Rural-focused technology-driven financial services provider Roinet Solution serves the underserved

- 1 What is The Origin of the Roinet?

- 2 Top Factors Of Roinet:

- 2.1 Cost-effective Financial Services Of Roinet

- 2.2 Strategic Partnerships and Investor Support

- 2.3 Product diversification and continuous innovation

- 2.4 Roinet Focuses on The Customers

- 3 Successes and Changes Of Roinet

- 4 Roinet Journey So Far

- 5 Visionary Goals and Technology

- 5.1 Accessibility via technology

- 5.2 Customer-focused and cost-effective

- 5.3 Industry Influence and Advisory Skills

- 5.4 Community Impact and Empowerment

- 5.5 Technology Investments for the Future

- 6 Conclusion

In Short

- The complete financial services offered by Roinet Solution are unique for rural areas.

- The organization deliberately integrates technology to connect rural communities to formal banking services.

- Robinet Solution provides affordable financial services to rural areas, recognizing their economic problems.

With its wide and diversified geography, India has 700 million rural residents. The government has done well to give every eligible person a bank account, but offering accessible financial services is difficult. In 2012, rural-focused, technology-driven financial services business Roinet Solution was founded to close this gap. This article covers Roinet’s path, unique services, and revolutionary influence on the disadvantaged.

What is The Origin of the Roinet?

Roinet Solution was born in rural India’s changing financial services scene. Insurance, savings, and mutual funds were poorly distributed and penetrated in rural areas despite increased bank account deposits. Roinet was founded to turn Customer Service Points (CSP) into full financial service hubs for the unbanked, seeing the tremendous potential in this neglected sector.

Infrastructure and Reach Of Roinet

A strong technical foundation makes Roinet a valued partner for six national banks. The organization serves approximately two million clients in 22 states, 520 districts, and 30,000 service locations. Roinet has helped rural financial inclusion by facilitating $1 billion in transactions.

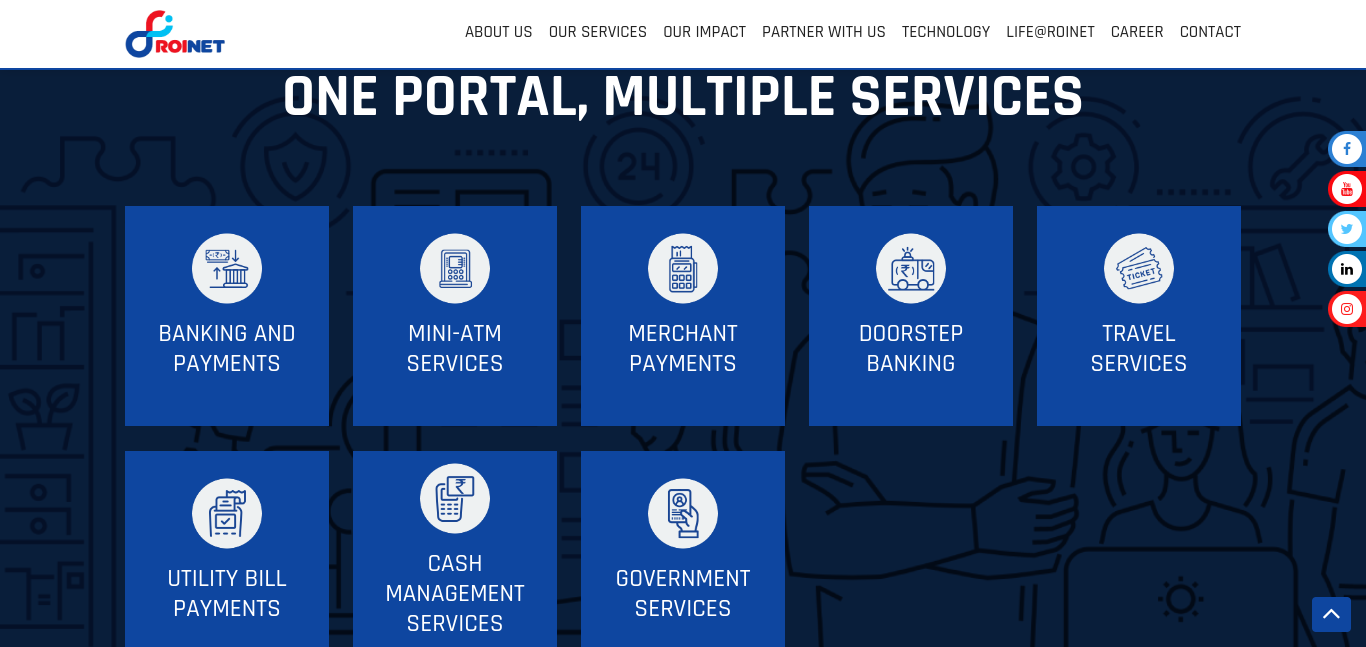

Understanding The’X’ Factor Of Roinet

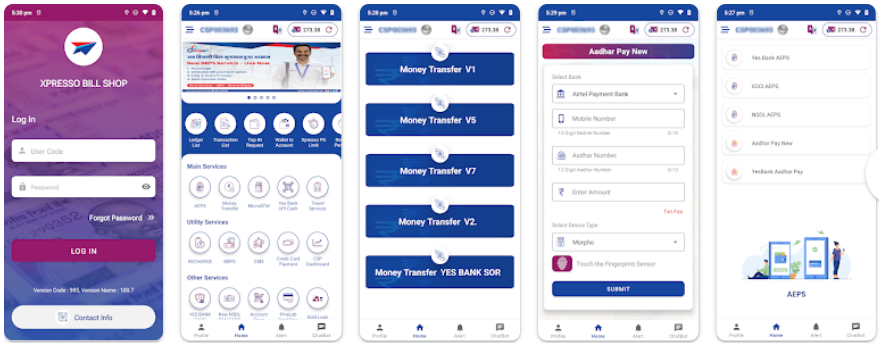

Digital, paperless, and seamless service points set Roinet Solution apart from traditional banking. Roinet stands apart with insurance, PAN card, recharge, tickets, and other life-enriching services. Based on Aadhaar, the authentication procedure is secure and eliminates fraud. Roinet’s in-house technology platform is carefully tested and certified for network security, demonstrating its security commitment.

Top Factors Of Roinet:

Cost-effective Financial Services Of Roinet

Roinet offers free money deposit and withdrawal services to rural residents because of their economic problems. Offering various low-cost financial services supports the company’s objective to increase transaction volumes per client. It promotes financial inclusion and economic empowerment for the underserved.

Strategic Partnerships and Investor Support

Roinet Solution’s strategic collaborations with six major banks solidify its reputation in the financial services industry. These partnerships boost the company’s credibility and make integrating its services into the financial ecosystem easier. Roinet’s well-funded position, backed by a Singaporean investment group, supports its aggressive development goals. Investor funding validates Roinet’s concept and enables major technological, infrastructure, and human expenditures.

Product diversification and continuous innovation

Innovation and product variety are crucial to Roinet Solution’s growth strategy. Over the past two years, the firm has grown from a banking service provider to a full financial services supplier. Our agility and drive to remain ahead of industry changes make Roinet a dynamic fintech company. The vow to provide at least one new service each quarter shows a commitment to staying ahead of financial technology, addressing client requirements, and staying relevant.

Roinet Focuses on The Customers

Roinet’s thorough Customer Service Partner onboarding is a crucial success factor. By having partners from the same communities as their consumers, Roinet improves communication through shared language and dialect. This creates confidence and gives rural consumers access to a wide range of services like typical bank locations. Roinet’s technology-driven CSPs serve rural people from early morning to late evening, including bank holidays.

Successes and Changes Of Roinet

Roinet Solution has achieved greatness and changed. A scalable and agile in-house technological platform gives the organization a competitive edge in meeting changing client demands. Roinet has grown revenue and CSPs multifold in the previous two years from a pure-play banking service provider to a complete financial service provider. The 110-person IT, Telecom, and FMCG professionals team has helped Roinet succeed. With over two decades of expertise, the management team prioritizes customer-centricity to improve stakeholders’ quality of life. Mr AP Hota was the chief architect of new payment interfaces at the National Payment Corporation of India. He now advises the firm.

Roinet Journey So Far

The road has been rewarding with highs and lows. ROINET’s in-house technology platform provides scalability and agility to meet changing customer needs quickly, giving it a competitive edge. The company went from pure play banking to financial services in two years. Revenue and CSP have grown multifold year for the organization. The 110-person ROINET team is vital. The executive team includes experienced IT, telecom, and FMCG leaders with over 20 years of expertise. The team’s only mission is to improve stakeholders’ quality of life. Thus, client-centricity dominates how team members think, behave, and comprehend the world. The company promotes hard work and partying. It gives them decision-making power, training, and rewards. While leading the National Payment Corporation of India, Mr. AP Hota designed new payment interfaces. ROINET is lucky to have him as an advisor.

Visionary Goals and Technology

Roinet Solution plans to expand to all addressable Indian districts by March 2020. To reach every targeted district in the country, Roinet is aggressively increasing its sales and distribution teams in untapped regions. Technology and customer support infrastructure are heavily invested in improving user experience. The complete financial services offered by Roinet Solution are unique for rural areas. Remote residents’ specific demands and problems have led the corporation to turn its Customer Service Points (CSPs) into one-stop shops. Roinet offers digital, paperless, and seamless banking services beyond deposits and withdrawals. Insurance, PAN card services, recharges, tickets, and more improve life. By meeting varied financial demands, Roinet provides rural clients access to many services like metropolitan customers.

Accessibility via technology

A strong technical platform drives Roinet’s success. The organization deliberately integrates technology to connect rural communities to formal banking services. Aadhaar authentication increases transaction security and confidence for rural customers. Our in-house technological platform offers network security, scalability, and agility. Roinet’s technology backbone allows it to function from early morning to late evening, including on bank holidays, making financial services convenient for rural populations. Roinet overcame geographical obstacles and enabled $1 billion in transactions using technology.

Customer-focused and cost-effective

Roinet Solution provides affordable financial services to rural areas, recognizing their economic problems. Zero-cost banking services like deposits and withdrawals boost financial inclusion. The firm offers several low-cost options to increase transaction volumes per client. Roinet meticulously onboards Customer Service Partners (CSPs) from the same communities as its clients, demonstrating its customer-centric approach. This grassroots link improves communication through a common language and dialect, establishing trust and community. This customer-centric approach allows Roinet to provide rural consumers with a wide range of services like typical bank locations.

Industry Influence and Advisory Skills

Mr. AP Hota, the National Payment Corporation of India’s lead architect of contemporary payment interfaces, advises Roinet Solution. His contribution strengthens the company’s commitment to contemporary payment system standards and offers industry expertise. Influencers help Roinet make strategic decisions and keep its services at the forefront of the market.

Community Impact and Empowerment

Roinet Solution improves stakeholders’ lives beyond financial services. The company’s community impact and empowerment programs demonstrate social responsibility. By empowering local Customer Service Partners and promoting rural economic activity, Roinet goes beyond financial services to spur good change. The company’s efforts support social and economic growth, improving its communities.

Technology Investments for the Future

Robinet Solution anticipates major technology advances. The company’s planned investments in AI and Data Analytics demonstrate its dedication to consumer knowledge. These technologies will let Roinet customize products, anticipate demands, and improve user experience. Roinet is presenting itself as a pioneer in rural financial services and a future-ready participant in fintech by adopting cutting-edge technology.

Conclusion

Roinet Solution pioneered using technology to assist rural India’s financial requirements. Through innovation, accessibility, and a customer-centric approach, Roinet has filled a critical vacuum in financial services and empowered millions economically. As the firm plans its future, it might become a beacon of financial inclusion, opening up new opportunities for rural India. Roinet Solution shows how technology can empower and include society.

Frequently Asked Questions

What is the company profile of Roinet?

Gurugram-based ROINET Solution Private Limited was created in 2012. It operates in ‘Finance & Insurance’ (ISIC: K). Financial services—insurance, reinsurance, pension funds, and support—are included in this industry.

Rating of Roinet?

ROI NET Solution’s total rating is 4.4, with company culture at 4.3. Career development scores the lowest at 3.7. Review ROI NET Solution’s job profiles, departments, and locations to experience working there.

What is Team Roinet?

We provide a wide range of financial and non-financial services to India’s last-mile underserved as a rural technology firm. Our Gurugram-based organization has eight years of expertise in this industry.