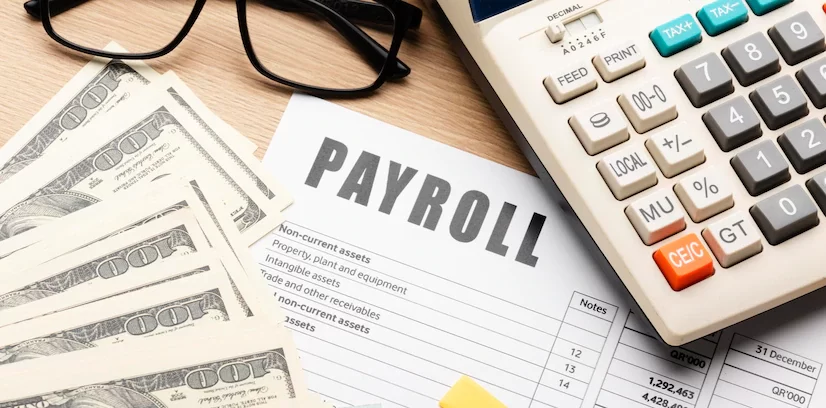

Importance of a Strong Payroll System

Navigating the challenges of being a small business owner can often feel overwhelming, especially when juggling multiple responsibilities, from overseeing the sales team’s performance to managing back-office operations. However, it doesn’t have to be that way. Strategic delegation and informed decision-making can significantly enhance your company’s performance and grant you more freedom to focus on essential tasks. A prime example of this is utilizing payroll management solutions, a well-established practice that effectively alleviates the burden of payroll administration.

By entrusting this critical function to a reputable payroll management service, you can ensure precise and punctual processing of employee salaries, tax deductions, and other payroll-related obligations. This empowers you to concentrate on core business operations and strategic decision-making, ultimately driving improved efficiency and productivity across the organization.

You can handle the payroll or assign it to a trusted confidante, accountant, or bookkeeper. But using accounting software has several benefits regardless of who is in charge of payroll accounting. Payroll is one of a company’s trickiest and most confusing areas, but it’s also one of the most important. It’s simple to undervalue the value of a well-operating payroll system, particularly when mired in day-to-day operations or the hustle and bustle of sales and delivery.

What Is Payroll System?

The process of figuring out how much money you owe each worker or agency based on the number of hours they put in is known as payroll. This includes taxes, perks, holiday pay, paid sick days, etc. Companies can better manage their money, reduce errors, and provide precise information regarding employee remuneration by using a well-managed payroll system that includes an hourly paycheck calculator.

A payroll process normally consists of two key parts: accounting and human resources. Employee relations are handled by human resources, including hiring, firing, training, scheduling, pay, benefits, etc. Every financial transaction involving your staff, such as wages, deductions, and withholding tax, must be recorded in your books thanks to the accountancy component of payroll.

Benefits of Payroll System:

The following are the benefits of using a payroll system:

Avoid Mistakes:

Payroll system mistakes can be a nightmare. But one of the great benefits of adopting payroll software is that it lessens the possibility that these expensive mistakes would happen. If you make a mistake and don’t consider your employees, it might lower morale and, in the worst-case scenario, get you and your business into legal trouble.

If you overpay your employees, you risk leaving your business with insufficient working capital and creating a logistical nightmare for collection. With payroll software, you can dramatically lower the possibility of human error and ensure that your employees are paid exactly what they are due.

Time-saving:

Payroll administrators probably do not expect to be paid every month. Payroll is not exactly what we would call an enjoyable job, but it is necessary. By adopting payroll software, you can simplify their tasks and spare them a tonne of time that could be better spent elsewhere in the business.

Payroll software enables you to focus more on expanding your company and less on handling your employees’ wages. Managing each firm independently can take a lot of time if you have many enterprises.

You Can Use Payroll Software Too:

Moreover, Payroll software has several benefits over manual processing, which is why many organizations prefer to utilize it.

- Calculate payroll deductions and calculations more quickly.

- Payroll software stores information in a safe, easily accessible system.

- It lessens the compliance load.

- Eliminate the need to comprehend intricate tax regulations.

Data Protection:

Your data must be secure, and your salary information is very crucial. Personal information in payroll files, such as postal addresses, birth dates, social security numbers, bank account details, etc., must be protected.

Using top-notch payroll software, you can ensure that this data is securely guarded and cannot be read by anybody outside of your company. Moreover, because your data is stored safely in a secure cloud environment, hackers cannot access it. Thus, Your data is shielded against theft, loss, and harm.

You Can Make Your Payroll System Easy By Using Payroll Software:

Most of the discomfort associated with this process is eliminated by payroll software, such as Netchex. You may rapidly create reports illustrating how much each employee has made, how much income tax has to be withheld, and how much the overall payroll expenses will be by just entering the employees’ names, addresses, and tax information.

However, quality is the key here. Always rely on a top-ranked payroll tool as it will streamline the entire process. Make sure it supports 401k paycheck calculator so that you will have no trouble finalizing the payroll of your employees while ensuring compliance.