Comparing Leading Investment Management Platforms: Pros, Cons & Pricing

Investment management isn’t just about picking the right assets anymore. It’s also about picking the right tools to manage them. Spreadsheets don’t cut it when you’re tracking multiple portfolios, handling client reporting, and staying on top of regulations. That’s why more firms – both big and small – are rethinking their tech stack and fintech software.

There are dozens of platforms out there, each with its strengths and blind spots. Some focus on risk. Others go all-in on reporting. A few try to cover everything and end up doing some things better than others.

This breakdown covers well-known platforms, what they do well, where they fall short, and what you might expect to pay. And if you’re curious about how firms build their systems to fill in the gaps, this overview of investment software gives a solid starting point.

1. BlackRock Aladdin

Pros:

- Covers everything from risk modeling to compliance

- Ties in well with market data sources

- Used by some of the largest asset managers in the world

Cons:

- Steep learning curve – don’t expect to wing it

- Pricing? Let’s just say it’s not for lean teams

- It might be overkill unless you’re managing billions

Pricing: No public numbers, but contracts often run deep into six figures per year.

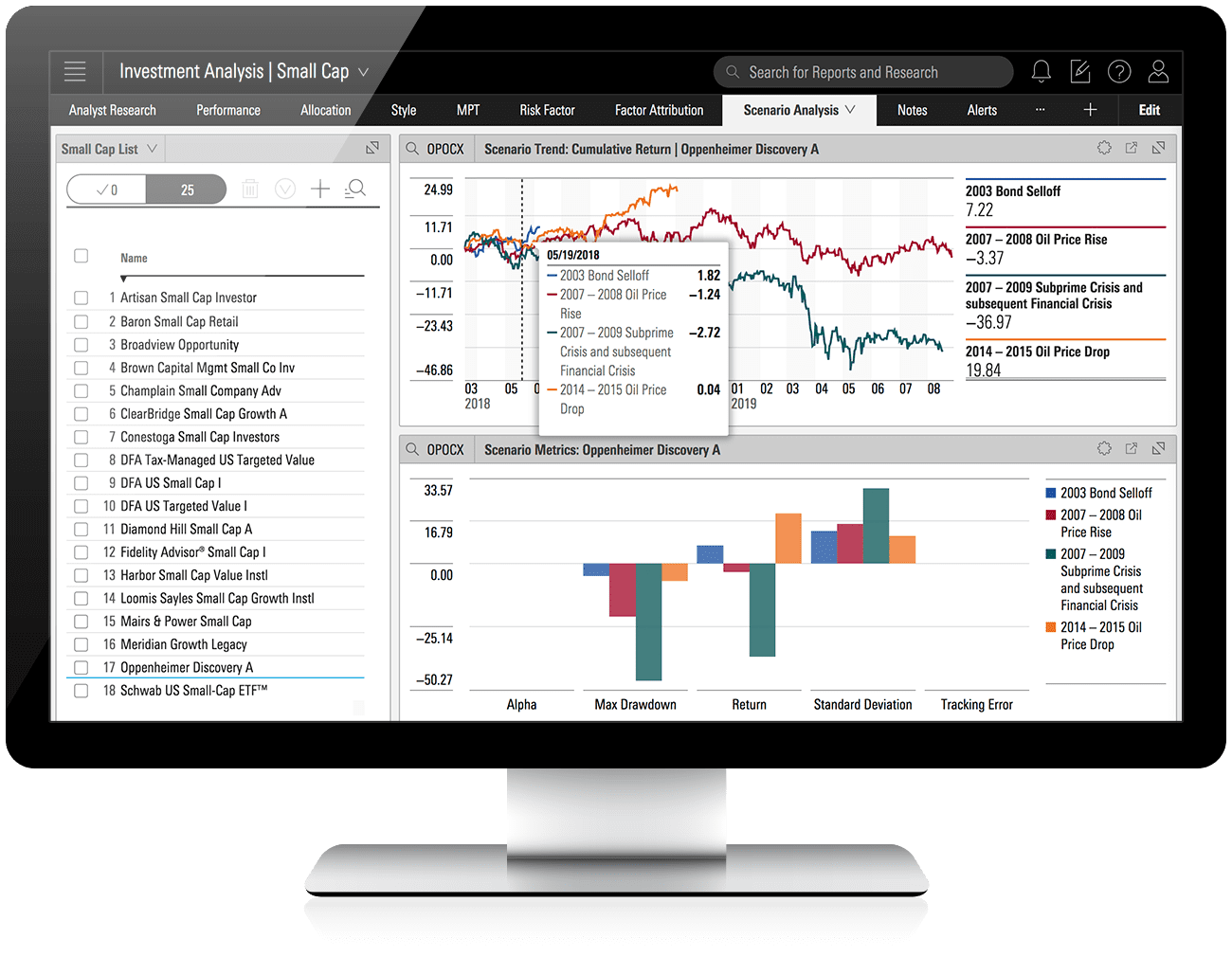

2. Morningstar Direct

Pros:

- Strong data and research capabilities

- Solid on benchmarking and performance reporting

- Integrates with Excel (yes, some still need it)

Cons:

- Not much help when it comes to trading

- It can get pricey for smaller firms

Pricing: Starts around $17,500 per user per year, depending on modules.

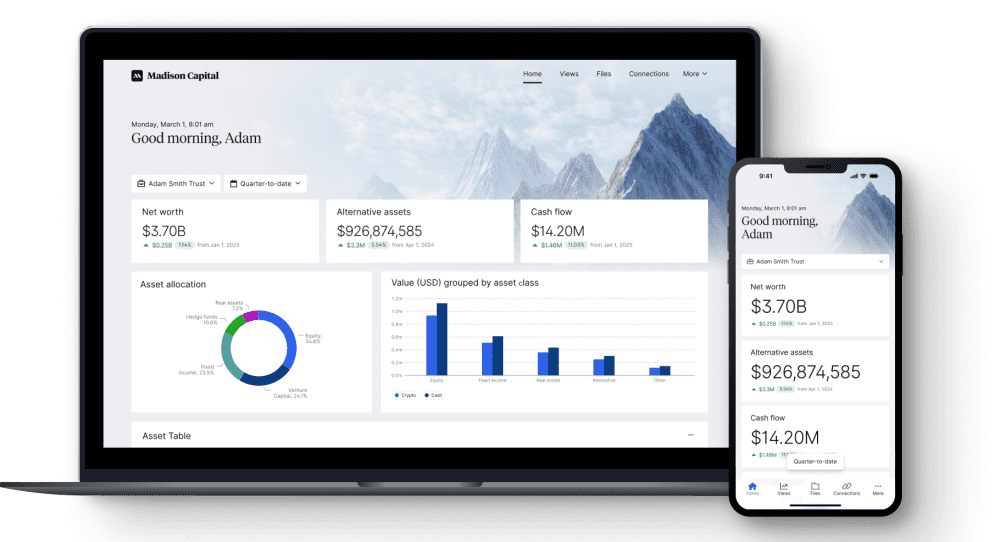

3. Addepar

Pros:

- Clean UI with real-time data visualization

- Works well for family offices, RIAs, and private banks

- Handles multi-asset class reporting pretty well

Cons:

- Doesn’t offer much in terms of trading tools

- May not scale smoothly for larger, complex operations

Pricing: Roughly $3,000/month to start. Costs grow with AUM and usage.

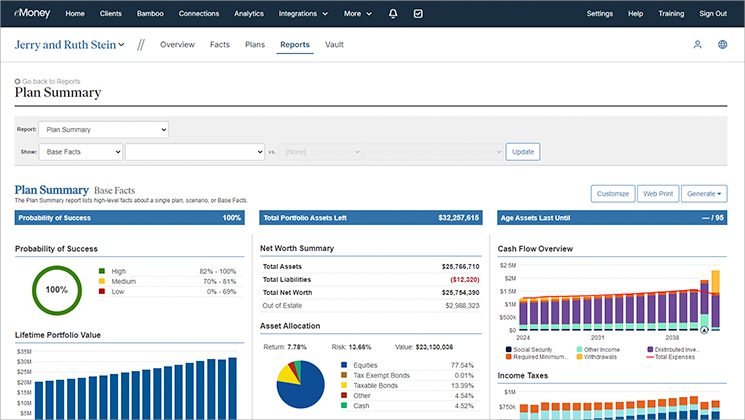

4. eMoney Advisor

Pros:

- Known for its financial planning capabilities

- Good client-facing portals

Integrates with major CRMs like Salesforce

Cons:

- More planner-friendly than portfolio-manager-friendly

- Reporting feels light for institutional workflows

Pricing: Somewhere between $3,600 and $10,000 a year, depending on what you use.

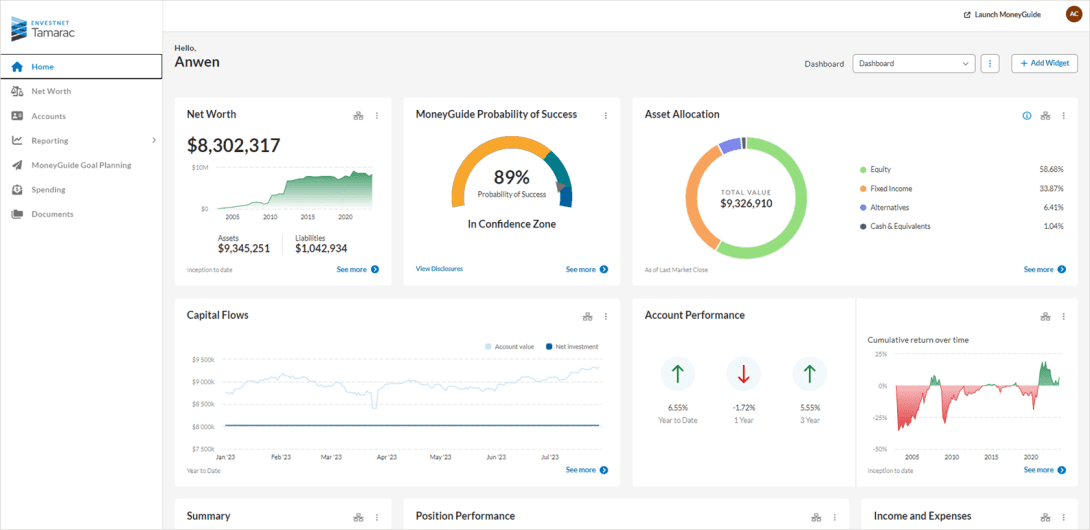

5. Tamarac by Envestnet

Pros:

- Popular among RIAs and wealth managers

- Combines rebalancing, trading, and reporting in one place

- Compliance tools are a nice bonus

Cons:

- Deeply tied into the Envestnet ecosystem

- Might not fit well for firms with global or more complex setups

Pricing: Starts around $10,000 annually for smaller firms. Goes up with AUM.

Pro Tip for Advanced Asset Management Firms

At some point, prebuilt platforms can start to feel like you’re forcing square pegs into round holes. Maybe the reports aren’t quite right. Maybe your workflows involve too much copy-pasting between tools. Or maybe you’ve got five vendors doing the job that one platform should’ve handled from day one.

That’s when some firms look at building their system. Not from scratch overnight – but starting with what they need most, then building around it. It’s not just about bells and whistles. It’s about making sure things work the way your team works.

S-PRO is one company that’s been behind the scenes of those builds. They’ve worked with asset managers, family offices, and fintech startups to create investment platforms that can handle scale, pull in external data, and stay compliant without constant workarounds. Their approach isn’t cookie-cutter.

Yes, custom platforms cost more upfront. But when you’re tired of stitching together tools that don’t talk to each other – or worse, constantly break – that cost starts to look more like an investment.

Final Thoughts

There’s no one-size-fits-all here. BlackRock Aladdin is powerful, but it’s not for everyone. Addepar hits a sweet spot for private wealth. Tamarac offers structure for RIAs.

If you’re still growing, start with a tool that’s solid on core features. If you’re managing more complexity – or hitting roadblocks with your current stack – it might be time to think beyond plug-and-play.

And if off-the-shelf software keeps falling short? Maybe it’s not the tech that needs to change, but the approach.