Signaling Changes in Bitcoin’s Momentum with the TRIX Indicator

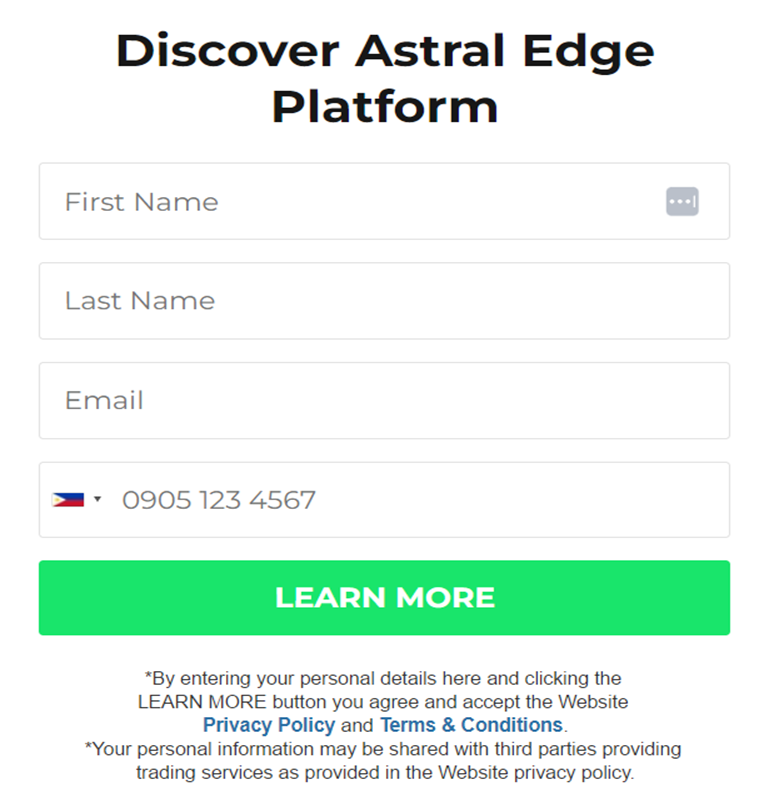

Cryptocurrency markets, especially Bitcoin, have garnered significant attention from investors and traders around the world. Successful trading and investing in Bitcoin require a deep understanding of market trends and indicators. One such powerful tool is the TRIX indicator, which plays a pivotal role in detecting momentum changes in Bitcoin’s price movement. Click the image below to start Bitcoin trading.

Understanding the TRIX Indicator

The TRIX (Triple Exponential Average) indicator is a technical analysis tool designed to filter out market noise and identify trends more effectively. It achieves this by calculating the percentage change of a triple exponentially smoothed moving average. The indicator is unique in that it provides insights into not only the direction of the trend but also the momentum behind it.

Calculating the TRIX

To calculate the TRIX, we first compute the Exponential Moving Average (EMA) of a given price series over a specific period, usually 14 days. Then, we calculate the percentage change between each successive EMA value and smooth these percentage changes using another EMA. The result is the TRIX line, which oscillates around a zero line, representing its signal line.

Detecting Momentum Changes in Bitcoin

Bitcoin’s price is known for its high volatility, making it crucial for traders and investors to identify momentum shifts accurately. The TRIX indicator can serve as a reliable tool for this purpose. Here’s how:

Convergence and Divergence

When the TRIX line crosses above the signal line, it suggests a bullish momentum, indicating potential buying opportunities. Conversely, when the TRIX line crosses below the signal line, it indicates bearish momentum and could signal a time to consider selling or shorting Bitcoin.

Zero Line Crossovers

The TRIX’s interaction with the zero line is equally important. Crossing above the zero line indicates positive momentum, while crossing below signifies negative momentum. These crossovers can provide early signals of potential trend changes in Bitcoin’s price movement.

Utilizing the TRIX Indicator Effectively

While the TRIX indicator is a valuable tool, it’s essential to use it in conjunction with other technical analysis methods and indicators. No single indicator can provide foolproof predictions of market movements. Here are some tips for using the TRIX indicator effectively:

Confirm with Volume

Confirm TRIX signals with trading volume. Sudden price movements accompanied by significant trading volume lend more credibility to the momentum shift indicated by the TRIX.

Multiple Timeframes

The TRIX signal’s interpretation can vary significantly when applied to short-term and long-term charts. When examining short-term fluctuations, the TRIX signal may react more swiftly to minor price movements, aiding in the identification of rapid shifts in momentum. On the other hand, when observed on long-term charts, the TRIX signal tends to filter out short-term noise, highlighting the broader trends and sustained shifts in Bitcoin’s momentum over extended periods. Integrating TRIX signals from different timeframes into the analysis thus offers a comprehensive and holistic understanding of Bitcoin’s evolving price dynamics, enabling more informed investment and trading decisions.

Risk Management

The TRIX indicator, like any tool used in trading, should be approached with a comprehensive understanding of its risks. While it can offer valuable insights, it’s crucial not to exclusively rely on its signals for decision-making. Traders are encouraged to diversify their analysis and consider other indicators, fundamental factors, and market trends before executing trades.

To mitigate potential losses, implementing sound risk management strategies is imperative. One effective approach is to incorporate stop-loss orders, which automatically trigger the sale of an asset if its price reaches a predetermined level. This proactive measure helps traders limit losses and protect their investments. By combining the TRIX indicator with a well-rounded trading approach and disciplined risk management, traders can make more informed decisions and navigate the complex landscape of financial markets with greater confidence.

Conclusion

In the fast-paced world of cryptocurrency trading, accurate and timely information is essential for making informed decisions. The TRIX indicator’s ability to detect momentum changes in Bitcoin’s price movement can provide traders and investors with a valuable edge. By understanding how the TRIX works, interpreting its signals, and combining it with other analysis methods, you can enhance your ability to navigate the exciting but volatile landscape of Bitcoin trading.