BaaS business model as a disruptive force in Traditional Banks’ Value Chains

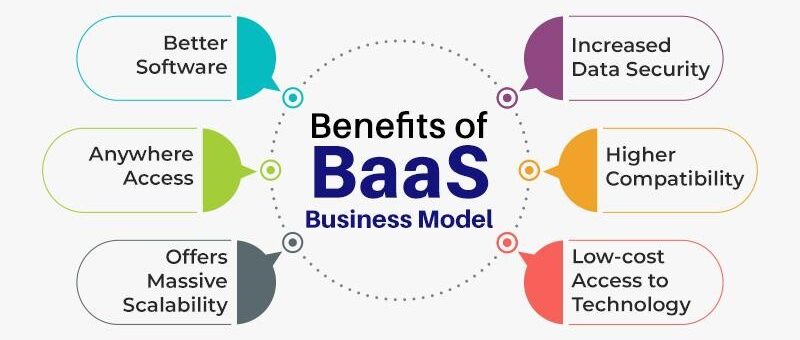

In the ever-evolving finance landscape, the Banking as a Service (BaaS) business model is highly required among other fintech development services. Would you like to know why? The answer is simple – it presents many advantages for traditional banks and other financial institutions. By embracing BaaS, these institutions can transform their operations, making them more transparent, cost-efficient, and user-friendly.

For those who have not yet explored this innovative approach, it’s crucial to delve into the potential costs, product offerings, and partnership opportunities. Additionally, developing a comprehensive strategy to adapt legacy operations to the BaaS space is essential. So, what exactly is BaaS, and is it a worthwhile investment? The Geniusee experts will answer these questions while providing insightful use cases to shed light on the subject.

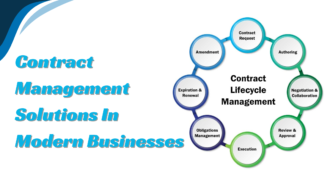

Banking as a Service (BaaS) is fully revolutionizing the traditional value chain, opening up new avenues for businesses across diverse industries to explore innovative banking products and opportunities they never thought possible.

BaaS business model in Traditional Banks’ Value Chains

According to a recent Deloitte white paper, the BaaS value chain consists of four fundamental components:

BaaS Platforms

These platforms offer essential services that were once exclusive to traditional banks but are now accessible to non-financial businesses. Through open banking APIs, companies can integrate banking products like bank accounts and operational tools provided by BaaS platforms.

BaaS Software

Using BaaS software, businesses can aggregate various services onto a single banking platform. This consolidation simplifies operations and enhances efficiency, enabling companies to offer a comprehensive suite of financial services to their customers.

Distribution Channels

BaaS platforms enable the effective distribution of financial and banking services through multiple customer channels. This means that companies beyond traditional banks, can now deliver banking offerings to their customers through user-friendly interfaces and tailored experiences.

BaaS Tools

These tools empower tech-savvy financial institutions, as well as companies unrelated to the financial sector, to review the customer experience. With embedded finance and other innovative features provided by BaaS, these entities can modernize their offerings and provide seamless banking services to their customers.

Banking as a Service (BaaS) is gaining immense popularity worldwide, driven by several influential factors that have reshaped the financial landscape. Let’s explore these factors together:

Changing Customer Needs

Today, customers seek hassle-free banking experiences through mobile applications. They prefer a one-stop solution where they can easily open accounts and access a wide range of financial services. BaaS projects fulfill this demand by offering user-friendly platforms, ensuring customers can conveniently manage their finances without switching between multiple apps.

Widespread Use of APIs

Traditional banks have embraced open banking APIs, allowing third-party agents to connect and interact with their systems. This integration has opened doors for non-financial companies to incorporate digital banking services into their own software solutions. For instance, embedding financial services within e-commerce websites has become increasingly popular.

Rising Popularity of Cloud Technologies

The adoption of cloud technologies is on the rise as companies recognize the benefits of scalability, resilience, and flexibility. By hosting applications in the cloud, trusted third-party distributors can securely access and integrate financial services into their solutions, providing enhanced offerings to their customers.

Fintech Industry Evolution

The fintech revolution has disrupted even the most conservative sectors, including banking. To keep up with digital transformation and changing customer demands, traditional banks are investing in technology, and becoming more tech-savvy. This empowers their partners to leverage BaaS services, such as embedded finance, resulting in improved experiences for end clients.

The Complexity of Banking Regulations

The banking industry is heavily regulated, making it challenging for new players to enter the market. However, the BaaS model has revolutionized the landscape, enabling fintech startups and other companies to offer services akin to traditional banks. This has blurred the lines between established financial institutions and emerging players, opening up new opportunities for collaboration.

In simpler terms, BaaS allows third-party companies to utilize banking services through a straightforward process:

Leading BaaS Platform Providers Making Banking More Accessible

Banking as a Service (BaaS) may be relatively new, but several institutions have already embraced this model and are offering a range of embedded finance services. Let’s take a closer look at some of the prominent BaaS platform providers:

Bancorp Bank

As a branchless bank, Bancorp Bank stands out for its digital-first approach. It offers a diverse range of financial products and services, including fintech solutions, institutional banking, commercial lending, and real estate bridge lending. The key is that Its comprehensive offerings cater to various customer needs.

Fidor Bank

Originating from Germany, Fidor Bank is a fintech company known for its custom operating system and cloud-based modular system. They provide services such as digital asset exchanges, brokers, institutional digital asset traders, and crypto marketplaces. Fidor Bank focuses on harnessing the potential of digital assets.

Solarisbank

Built from scratch, Solarisbank has developed a custom platform designed for seamless integration with partner networks, enabling faster time-to-market. Their simple open banking API documentation facilitates the smooth integration of their services into partners’ infrastructure. Solarisbank’s platform streamlines banking operations..

Galileo

Galileo is a technology company that operates an open and connected platform, offering a wide range of financial services across North and South America. Their platform empowers prominent fintech companies in North America, including Chime, KOHO, Robinhood, SoFi, and Varo. Additionally, Galileo collaborates with international powerhouses like Monzo, Paysafe, Revolut, and TransferWise.

Marqeta

Marqeta provides a comprehensive platform that enables its customers to build innovative products utilizing the services of their bank partners. As a fintech company specializing in payment services, Marqeta offers an array of new banking products, including Buy Now Pay Later (BNPL) solutions, lending services, expense management tools, and crypto cards. They have forged partnerships with prominent brands like Coinbase, Uber, and DoorDash.

It’s worth noting that BaaS is not limited to traditional banks alone; technology companies like Galileo and Marqeta also play a significant role in this space. While Galileo and Marqeta have been longstanding leaders in the BaaS sector, several startups are emerging with targeted and unique services, leveraging newer technologies.

Banking as a Service (BaaS) has opened up new possibilities by allowing third-party distributors to seamlessly integrate banking services, including embedded finance, into their platforms and applications. Both traditional and digital banks have recognized the potential of BaaS and are leveraging it to expand their client base and boost revenue. If you’re thinking about adopting the BaaS model and seeking a trusted technology provider, Geniusee is here to assist you and transform your challenges into new prospective opportunities.