All About : UPI Stack In Payment Gateway

Unified Payments Interface (UPI) is a revolutionary innovation in the Indian digital payment industry. It is a system that enables instant and seamless money transfer between any two bank accounts using a smartphone. UPI has transformed the way people pay and get paid online, by eliminating the need for multiple apps, cards, wallets, or net banking credentials.

UPI Stack In Payment Gateway

UPI Stack

But what makes UPI possible and powerful is the UPI stack, which is a set of APIs and protocols that enable interoperability between different payment service providers (PSPs), banks, and front-end applications. The UPI stack consists of four layers:

- Application layer: This is the layer where the user interacts with the payment app, such as Google Pay, PhonePe, BHIM, or any other UPI-enabled app. The app provides a user interface to initiate and authorize payments using a virtual payment address (VPA), which is a unique identifier linked to a bank account.

- PSP layer: This is the layer where the payment app communicates with the PSP, which is an entity that facilitates the payment process and acts as an intermediary between the app and the bank. The PSP validates the VPA, generates a collect request or a push payment request, and routes it to the appropriate bank.

- NPCI layer: This is the layer where the National Payments Corporation of India (NPCI), which is the umbrella organization for retail payments in India, operates the UPI platform and provides the core infrastructure and network for UPI transactions. The NPCI layer handles the settlement, reconciliation, dispute resolution, and fraud prevention for UPI payments.

- Bank layer: This is the layer where the bank of the payer and the payee are involved in debiting and crediting the respective accounts based on the UPI transaction. The bank layer also verifies the identity and balance of the customers and sends confirmation messages to the PSP and NPCI.

Also Read: How Can You Use UPI For Transferring Your Money?

Benefits Of UPI Stack In Payment Gateway

The UPI stack is important for payment gateway because it offers several benefits for both merchants and customers, such as:

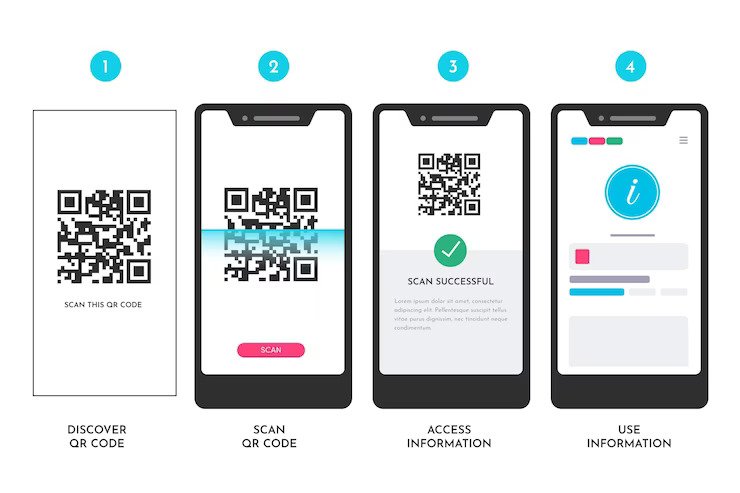

- Simplicity: The UPI stack simplifies the online payment process by reducing the friction and complexity involved in entering card details, OTPs, passwords, etc. The user only needs to enter their VPA or scan a QR code to make or receive payments.

- Speed: The UPI stack enables real-time and instant payments that are settled within seconds. The user does not have to wait for long confirmation messages or face delays due to network issues or server downtime.

- Security: The UPI stack ensures security and privacy of the transactions by using encryption, authentication, and tokenization techniques. The user does not have to share their bank account details or card information with anyone. The user also has control over their transactions by setting limits and choosing which apps to use.

- Cost-effectiveness: The UPI stack reduces the cost of online payments by eliminating intermediaries and transaction fees. The user does not have to pay any charges for using UPI services. The merchant also benefits from lower operational costs and higher conversion rates.

- Inclusiveness: The UPI stack enables financial inclusion and empowerment by reaching out to millions of unbanked and underbanked customers who can now access digital payments using their smartphones. The user does not need to have a minimum balance or a credit history to use UPI services.

Also Read: The Significance Of Digital Marketing For Payment Solution Companies

Conclusion

The UPI stack is a game-changer for payment gateway because it provides a unified, scalable, and interoperable platform for online payments that can cater to diverse use cases and customer segments.

The UPI stack has also paved the way for innovation and collaboration among various stakeholders in the digital payment ecosystem, such as banks, fintech companies, e-commerce platforms, government agencies, etc. The UPI stack is not only important but also indispensable for the payment gateway in India. It is a testament to India’s vision and leadership in building a digital economy that is inclusive, efficient, and secure.