Online Health Insurance Enrollment: Steps to a Healthier Future

- 1 Step 1: Research Your Options

- 1.1 Customized Coverage

- 1.2 Cost-Efficiency

- 1.3 In-Network Providers

- 1.4 Prescription Coverage

- 1.5 Types of Health Insurance Plans

- 2 Step 2: Gather Necessary Information

- 2.1 Personal Information

- 2.2 Financial Information

- 2.3 Healthcare Information

- 2.4 Life Changes and Family Information

- 2.5 Immigration and Citizenship Status

- 2.6 Employer Information

- 2.7 Document Your Preferences and Priorities

- 3 Step 3: Review Your Policy

- 3.1 Understanding Coverage

- 3.2 Financial Preparedness

- 3.3 Network Details

- 3.4 Benefits and Exclusions

- 3.5 Policy Changes

- 3.6 What to Focus on During the Policy Review

- 3.6.1 Coverage Details

- 3.6.2 Network Providers

- 3.6.3 Cost Sharing

- 3.6.4 Premiums

- 3.6.5 Prescription Drug Coverage

- 3.6.6 Coverage Period

- 3.6.7 Preventive Services

- 3.6.8 Emergency Care

- 3.6.9 Appeals and Grievances

- 3.6.10 Contact Information

- 4 Step 4: Stay Informed and Updated

- 4.1 Policy Changes

- 4.2 Eligibility Changes

- 4.3 New Benefits

- 4.4 Life Events

- 4.5 Legislative Changes

- 4.6 How to Stay Informed and Updated

- 4.6.1 Read Communication from Insurer

- 4.6.2 Access Online Portals

- 4.6.3 Review Policy Annually

- 4.6.4 Stay Informed About Eligibility

- 4.6.5 Stay Current on Healthcare Laws

- 4.6.6 Seek Assistance

- 4.6.7 Attend Educational Seminars

- 4.6.8 Utilize Preventive Services

- 4.6.9 Maintain Records

- 4.6.10 Regularly Check Network Providers

- 4.6.11 Consider Life Events

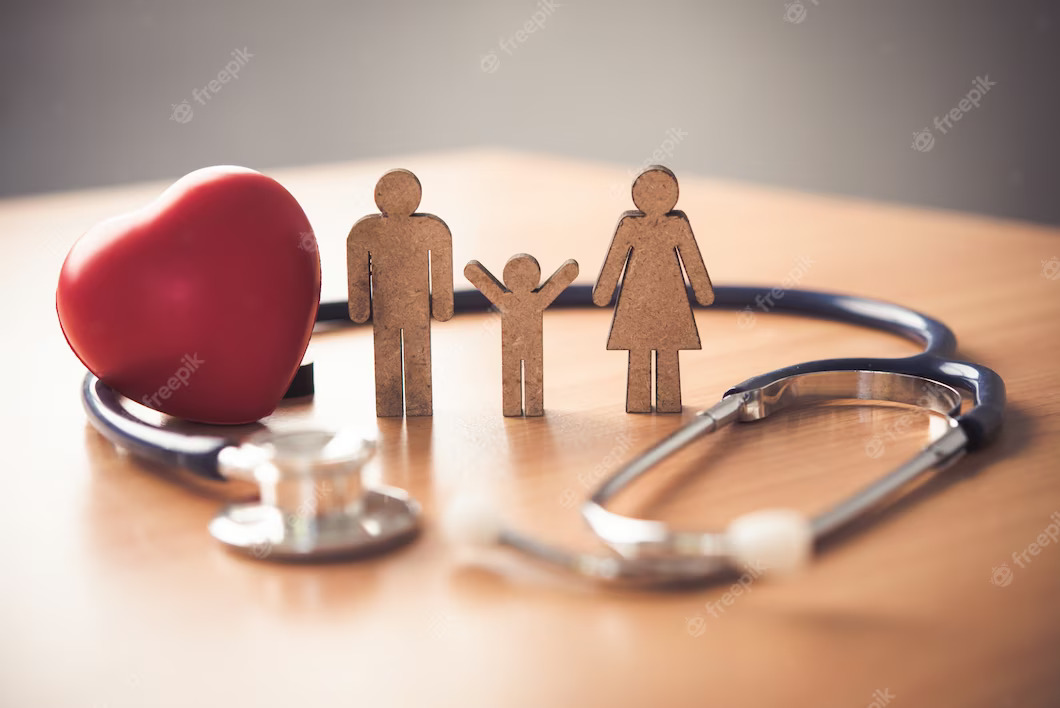

Securing health insurance is a critical step toward ensuring your well-being and financial security. In recent years, the process has become more accessible and convenient, thanks to the transition to online enrollment.

The online health insurance enrollment process has revolutionized how individuals and families access vital healthcare coverage. It offers the convenience of researching, comparing, and selecting insurance plans from the comfort of your own home. Moreover, the transparency of online platforms allows you to make informed decisions by easily comparing coverage options, premiums, and deductibles. This will provide valuable insights into navigating the online health insurance enrollment process, ensuring that you have the tools and knowledge needed to make the right choices for your specific healthcare needs and financial situation.

Step 1: Research Your Options

Research is your best friend when it comes to finding the correct health insurance coverage. Investigate the various components of health insurance plans to make an informed decision that fits your healthcare needs and financial position.

Customized Coverage

One of the key reasons for conducting thorough research is to tailor your coverage. In terms of what they provide, health insurance plans differ greatly. Some plans offer complete coverage with a large network of doctors, while others are less expensive but have limitations. You can select a plan that meets your individual health needs and preferences by examining your options. If you have specific medical issues that necessitate specialized care, you can narrow your search to plans that have those experts in your network.

Cost-Efficiency

Health insurance isn’t just about getting coverage; it’s about getting value for your money. Research helps you compare the costs associated with different plans. This includes looking at monthly premiums, deductibles, and out-of-pocket expenses like copayments and coinsurance. By carefully assessing these costs, you can identify a plan that not only suits your healthcare requirements but also aligns with your budget. For some individuals, paying slightly higher premiums might be worthwhile if it results in lower out-of-pocket expenses when seeking medical care.

In-Network Providers

Whether you have healthcare providers you trust or desire to continue seeing, making sure they are in-network is critical. In-network providers have negotiated reduced prices with your insurance company, which equals cheaper costs for you. Using out-of-network providers, on the other hand, can result in higher out-of-pocket payments. As a result, ensuring that your chosen doctors, specialists, and hospitals are part of a plan’s network can help you save money while also giving you peace of mind about the quality of treatment you’ll receive.

Prescription Coverage

If you rely on prescription medications, researching plans should include a thorough examination of their prescription drug coverage. Each plan maintains a list of covered medications, known as a formulary. It’s essential to check if your required medications are included in the formulary and understand the associated costs. Some plans may require you to pay a flat copayment for each prescription, while others might use coinsurance, which means you’ll pay a percentage of the medication’s cost. By considering your medication needs and comparing plans, you can select one that offers the most cost-effective prescription coverage.

Types of Health Insurance Plans

Understanding the many types of health insurance plans is also an important component of the research process. Each type of plan has its own set of rules and features. HMOs are often less expensive, but you must choose a primary care physician and acquire referrals to see specialists. Preferred Provider Organizations (PPOs) allow you to see specialists without a reference while charging higher premiums. High-deductible health plans (HDHPs) offer lower premiums but higher deductibles and can be paired with Health Savings Accounts (HSAs). Exclusive Provider Organizations and Point of Service Plans combine HMOs with PPOs. Understanding the various types of plans enables you to reduce your selections based on your healthcare preferences.

Step 2: Gather Necessary Information

Before you embark on the journey of enrolling in health insurance online, it’s essential to gather all the necessary information. This step ensures a smoother and more efficient enrollment process and helps you make informed decisions about your coverage.

Here’s a deeper look at what information you should gather and why it’s crucial:

Personal Information

Gather all of your personal information, including your full name, birth date, Social Security number, and contact information (address, phone number, and email). This information is critical for confirming your identification and ensuring that your policy is issued correctly. Accuracy is critical since any errors can cause enrollment and claims processing delays.

Financial Information

Prepare your financial information, including your annual income, tax filing status, and details about any current health insurance plans or coverage you may have. This data is crucial for determining your eligibility for subsidies, premium tax credits, or cost-sharing reductions. Providing accurate financial information can help you access financial assistance that makes health insurance more affordable.

Healthcare Information

Compile relevant healthcare information, such as a list of current doctors, specialists, and healthcare providers you visit regularly. Additionally, document any prescription medications you currently take, including the names, dosages, and frequency. This information is essential for selecting a health insurance plan that covers your preferred providers and medications. Ensuring that your doctors are in-network can save you money, and understanding the prescription drug coverage helps you estimate your medication costs.

Life Changes and Family Information

If you have dependents or family members who will be covered under the same policy, gather their personal information. Be prepared to document any significant life changes that have occurred or are anticipated in the near future, such as marriages, births, or adoptions. Life changes can impact your eligibility for certain plans or financial assistance, so keeping this information up to date is essential.

Immigration and Citizenship Status

If applicable, be ready to provide information about your immigration and citizenship status. This includes details about your citizenship or immigration status and any relevant documentation, such as green cards or visas. Accurate information in this area is crucial for determining your eligibility for specific health insurance programs and subsidies.

Employer Information

If you’re offered health insurance through your employer or have access to other group health coverage, gather information about your employer’s plan, including the plan name and any provided documentation. This information is crucial for assessing whether you meet the minimum essential coverage requirements and how your employer-based coverage may impact your eligibility for subsidies or tax credits.

Document Your Preferences and Priorities

Think about your healthcare preferences and priorities. Consider factors such as the type of coverage you desire, your preferred doctors and healthcare facilities, and your budget for monthly premiums and out-of-pocket costs. Documenting your preferences and priorities helps you stay focused on selecting a plan that aligns with your healthcare goals.

Step 3: Review Your Policy

Reviewing your health insurance policy is a crucial step in the process of obtaining coverage. It ensures that you fully understand the terms, benefits, and responsibilities associated with your chosen plan. Here’s an in-depth exploration of why this step is essential and what you should focus on during the policy review:

Understanding Coverage

Reviewing your policy allows you to understand what is covered and what is not. This clarity helps you make informed decisions about when and how to use your health insurance.

Financial Preparedness

By examining your policy, you can anticipate your financial responsibilities, including premiums, deductibles, copayments, and coinsurance. This understanding helps you budget for healthcare expenses.

Network Details

You can verify the network of healthcare providers, doctors, and hospitals that are in-network under your plan. Staying in-network typically results in lower out-of-pocket costs.

Benefits and Exclusions

Learn about the exact benefits that your plan provides, such as preventive care, hospitalization, prescription medicines, and maternity services. Take note of any exclusions or restrictions that may apply.

Policy Changes

Insurers may make changes to policies from year to year. Reviewing your policy ensures you’re aware of any modifications that may affect your coverage or costs.

What to Focus on During the Policy Review

Coverage Details

Carefully read through the policy document to understand the scope of coverage. Pay attention to the specific medical services and treatments covered, as well as any limitations or exclusions. For example, some policies may exclude certain elective procedures or experimental treatments.

Network Providers

Verify that your preferred healthcare providers, including doctors, specialists, and hospitals, are in-network. Using in-network providers typically results in lower out-of-pocket costs.

Cost Sharing

Understand the cost-sharing structure of your policy, including deductibles, copayments, and coinsurance. Determine when and how you’ll be responsible for these expenses and calculate potential out-of-pocket costs.

Premiums

Confirm the monthly premium amount and the due date for payments. Ensure that you’re aware of the payment method and schedule. Timely premium payments are essential to maintain your coverage.

Prescription Drug Coverage

If you require a prescription, review the policy’s formulary to check if your medications are covered. Understand the cost-sharing for prescription drugs, such as copayments or coinsurance.

Coverage Period

Determine the coverage period of your policy. Many health insurance plans operate on an annual basis, and the terms may change at the start of each new year.

Preventive Services

Take note of any preventive services that are covered at no cost to you. Many health plans are required to provide free preventive services, such as vaccinations and screenings, as mandated by the Affordable Care Act (ACA).

Emergency Care

Understand the policy’s coverage for emergency care. Know the procedure for seeking emergency medical treatment, even if it’s out of network, as emergencies can happen unexpectedly.

Appeals and Grievances

Familiarize yourself with the process for appealing claim denials or filing grievances with your insurer. Knowing your rights and how to address issues can be invaluable if you encounter problems with your coverage.

Contact Information

Keep a record of the insurer’s contact information, including customer service numbers and the process for reporting changes to your personal information or life events.

Step 4: Stay Informed and Updated

Staying informed and updated is an ongoing and essential aspect of managing your health insurance coverage effectively. It ensures that you remain aware of changes, new benefits, and any adjustments that may impact your policy. Here’s an in-depth exploration of why this step is crucial and how to stay informed and updated about your health insurance:

Importance of Staying Informed and Updated

Policy Changes

Health insurance policies can change from year to year. Updates may include alterations to coverage, premium amounts, deductibles, and copayments. Staying informed helps you adapt to these changes and make necessary adjustments to your healthcare planning.

Eligibility Changes

Your eligibility for certain benefits or subsidies may change due to alterations in your income, household size, or life circumstances. Staying updated ensures that you are aware of your eligibility status and can access available assistance programs.

New Benefits

Insurers may introduce new benefits, services, or discounts over time. Staying informed allows you to take advantage of these offerings, such as wellness programs, telemedicine services, or preventive care initiatives.

Life Events

Significant life events, like marriage, childbirth, or job changes, can impact your health insurance needs. Staying updated ensures that you review and modify your coverage when necessary to reflect these changes.

Legislative Changes

Healthcare laws and regulations can evolve, potentially affecting your health insurance options and requirements. Staying informed about legislative changes helps you remain compliant and informed about your rights and obligations.

How to Stay Informed and Updated

Read Communication from Insurer

Regularly review and read communications from your health insurance provider. This includes emails, letters, policy documents, and any updates sent to you. Pay attention to important notices and announcements.

Access Online Portals

Many insurers provide online portals or mobile apps through which you can obtain policy information, claims information, and updates. Use these resources to remain up-to-date on your coverage.

Review Policy Annually

Conduct an annual policy review to ensure that your coverage is still appropriate for your current healthcare demands and financial circumstances. During the open enrollment period, make any necessary changes.

Stay Informed About Eligibility

Be aware of any changes in your eligibility for subsidies, premium tax credits, or government assistance programs. Life events such as marriage, divorce, or changes in income can impact your eligibility.

Stay Current on Healthcare Laws

Stay informed about changes in healthcare laws and regulations, especially those that affect health insurance. Resources from government agencies, consumer advocacy groups, and reputable news sources can provide updates.

Seek Assistance

If you have questions or need guidance regarding your health insurance, don’t hesitate to contact your insurer’s customer service or seek assistance from a licensed insurance agent or counselor. They can provide clarity on policy details and changes.

Attend Educational Seminars

Some insurers or healthcare organizations offer educational seminars or webinars on health insurance topics. Attending these sessions can enhance your knowledge and keep you updated on industry trends.

Utilize Preventive Services

Take advantage of preventive services covered by your plan, such as screenings and vaccinations. These services not only promote your health but also help you stay connected with your healthcare provider.

Maintain Records

Keep records of your insurance-related documents, including policy summaries, explanation of benefits (EOB) statements, and correspondence with your insurer. These records can be valuable for reference.

Regularly Check Network Providers

Verify that your preferred healthcare providers remain in-network. Changes in network participation can affect your out-of-pocket costs, so it’s essential to stay updated.

Consider Life Events

When significant life events occur, such as marriage, divorce, or the birth of a child, consider how these events may impact your health insurance needs. Update your coverage as necessary to reflect your changing circumstances.

Take Charge of Your Future: Enroll in Online Health Insurance Today for a Healthier Tomorrow!

Online health insurance enrollment is a gateway to a healthier future. It streamlines the process, making it easier to access essential coverage and financial assistance. By following these steps, you can secure the right health insurance plan for your needs and take proactive steps toward better health and financial security. Don’t delay; at www.azay.co.th/, explore your options and embark on the path to a healthier, more secure future today. Your well-being is worth the effort.