Smart Trading Strategies: How to Leverage SDEX’s Capabilities

- 1 Understanding SDEX: The Future of Trading

- 2 Smart Trading Strategies on SDEX

- 2.1 Thorough Research and Analysis

- 2.2 Risk Management is Key

- 2.3 Utilize Stop-Loss Orders

- 2.4 Leverage Technical Analysis Tools

- 2.5 Practice Patience and Discipline

- 3 Leveraging SDEX’s Capabilities for Success

- 3.1 Fast and Low-Cost Transactions

- 3.2 Arbitrage Opportunities

- 3.3 Liquidity Provision

- 3.4 Token Staking and Governance

- 4 Conclusion

The landscape of financial market trading has undergone a remarkable transformation, driven by technological advancements that have reshaped the methods of asset buying and selling. In the contemporary digital era, traders are presented with a diverse array of platforms and exchanges, each offering a spectrum of features and functionalities. In this context, the Smart Decentralized Exchange (SDEX) assumes a pivotal role in delving into intelligent trading tactics and harnessing the full potential of SDEX’s capabilities to secure a distinct competitive advantage within the market. When it comes to entering the crypto market, choosing a trustworthy exchange like Immediate Edge is critical for seamless cryptocurrency buying and trading.

Understanding SDEX: The Future of Trading

What is SDEX?

SDEX, also known as Smart Decentralized Exchange, is a cutting-edge platform built on blockchain technology. Unlike traditional centralized exchanges, SDEX operates in a decentralized manner, which means it eliminates the need for intermediaries. This decentralized structure offers several advantages, such as enhanced security, transparency, and control over funds.

Key Features of SDEX

- Smart Contracts: SDEX leverages smart contracts, which are self-executing contracts with predefined conditions. These contracts enable automated transactions without the need for intermediaries, ensuring a trustless and efficient trading environment.

- Decentralization: SDEX operates on a peer-to-peer network of nodes, removing the risk of a single point of failure. Decentralization enhances the platform’s resilience and ensures continuous availability.

- Security: Blockchain technology underpins SDEX, providing robust security mechanisms to safeguard user assets and data. The immutability of blockchain prevents unauthorized alterations and ensures the integrity of trading records.

- Anonymity: SDEX respects user privacy by allowing traders to conduct transactions without revealing their identities. This anonymity fosters a level playing field for all participants.

- Global Access: Being decentralized, SDEX is accessible to anyone with an internet connection, facilitating global participation in the financial markets.

Smart Trading Strategies on SDEX

Thorough Research and Analysis

Before delving into the world of trading on SDEX, it is crucial to conduct comprehensive research and analysis. Familiarize yourself with the assets you are interested in trading, study market trends, and identify potential entry and exit points based on technical indicators. Keeping a close eye on the news and developments in the cryptocurrency and blockchain space can also provide valuable insights for your trading decisions.

Risk Management is Key

Trading always involves an element of risk, and it’s essential to manage it prudently. One of the golden rules of trading is never to invest more than you can afford to lose. Diversifying your portfolio across different assets can mitigate risk and safeguard your investments from excessive volatility.

Utilize Stop-Loss Orders

SDEX supports the use of stop-loss orders, which automatically trigger a sell order when the asset’s price reaches a predefined level. These orders help minimize potential losses during market downturns and are invaluable tools for risk management.

Leverage Technical Analysis Tools

SDEX provides various technical analysis tools to assist traders in making informed decisions. Utilize features such as candlestick charts, moving averages, and RSI (Relative Strength Index) to identify patterns and trends in asset prices.

Practice Patience and Discipline

Trading on SDEX, or any other platform, requires patience and discipline. Avoid succumbing to impulsive decisions driven by emotions. Stick to your trading strategy and be prepared to adapt it based on changing market conditions.

Leveraging SDEX’s Capabilities for Success

Fast and Low-Cost Transactions

SDEX boasts rapid transaction speeds and relatively low fees compared to traditional financial systems. As a trader, you can leverage these capabilities to execute quick trades and minimize transaction costs, ultimately boosting your overall profitability.

Arbitrage Opportunities

The decentralized nature of SDEX often leads to slight discrepancies in asset prices across different exchanges. Savvy traders can take advantage of these arbitrage opportunities by buying assets at a lower price on one exchange and selling them at a higher price on another, pocketing the price difference as profit.

Liquidity Provision

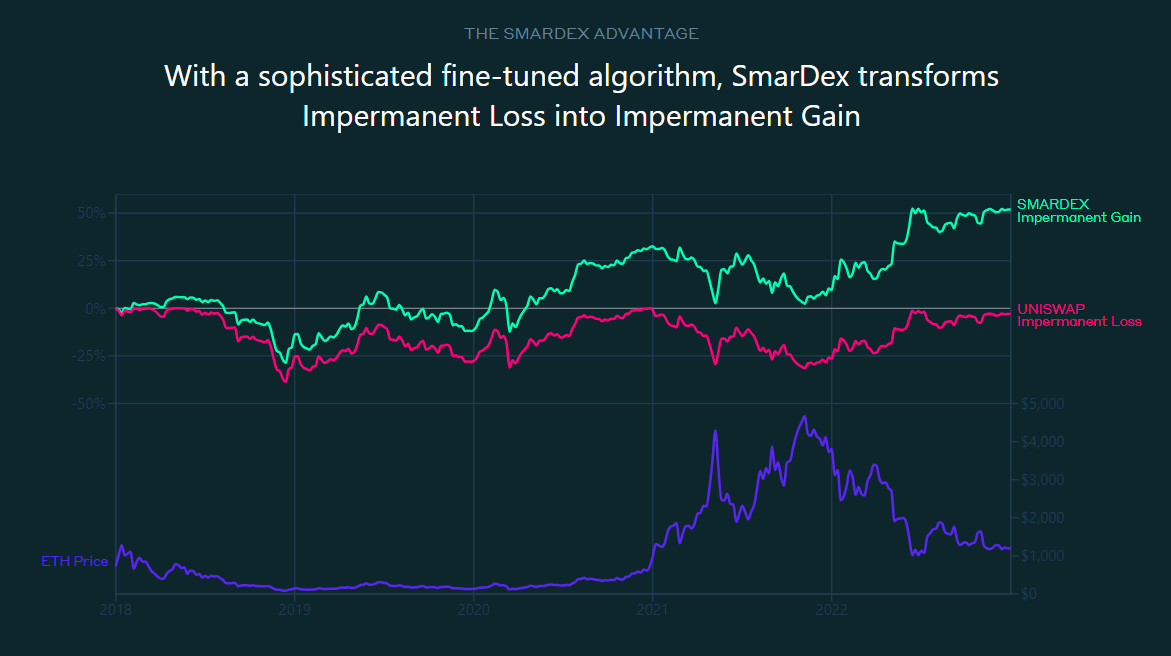

SDEX relies on liquidity providers to facilitate smooth trading operations. As a liquidity provider, you can earn rewards for providing liquidity to the exchange. This strategy allows you to earn passive income while supporting the platform’s liquidity requirements.

Token Staking and Governance

SDEX may offer native tokens that users can stake to participate in the platform’s governance or earn rewards. By staking tokens, traders contribute to the platform’s security and governance decisions while being eligible for potential incentives.

Conclusion

As the financial landscape continues to evolve, SDEX stands out as a powerful and forward-thinking platform for traders seeking a decentralized and secure trading experience. By employing smart trading strategies and leveraging SDEX’s unique capabilities, traders can stay ahead of the curve and unlock new opportunities in the exciting world of cryptocurrency trading.