Top 25 Personal Loan Apps

- 1 Why We Have Chosen These 25 Personal Loan Apps?

- 2 25 Best Personal Loan Apps:

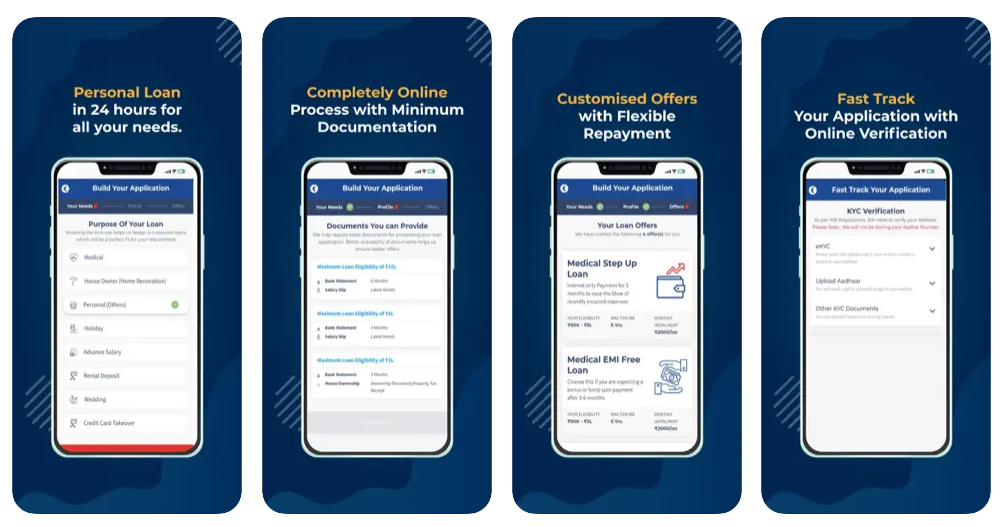

- 2.1 PaySense

- 2.2 LazyPay

- 2.3 Bajaj Finserv

- 2.4 IDFC FIRST Bank

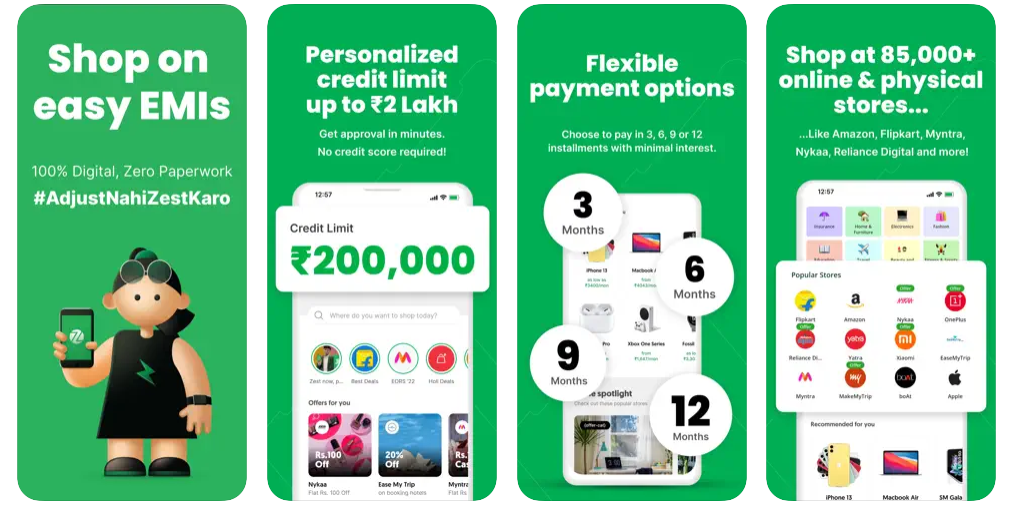

- 2.5 ZestMoney

- 2.6 Dhani

- 2.7 HomeCredit

- 2.8 CASHe

- 2.9 KreditBee

- 2.10 Fullerton India

- 2.11 Fibe

- 2.12 Nira

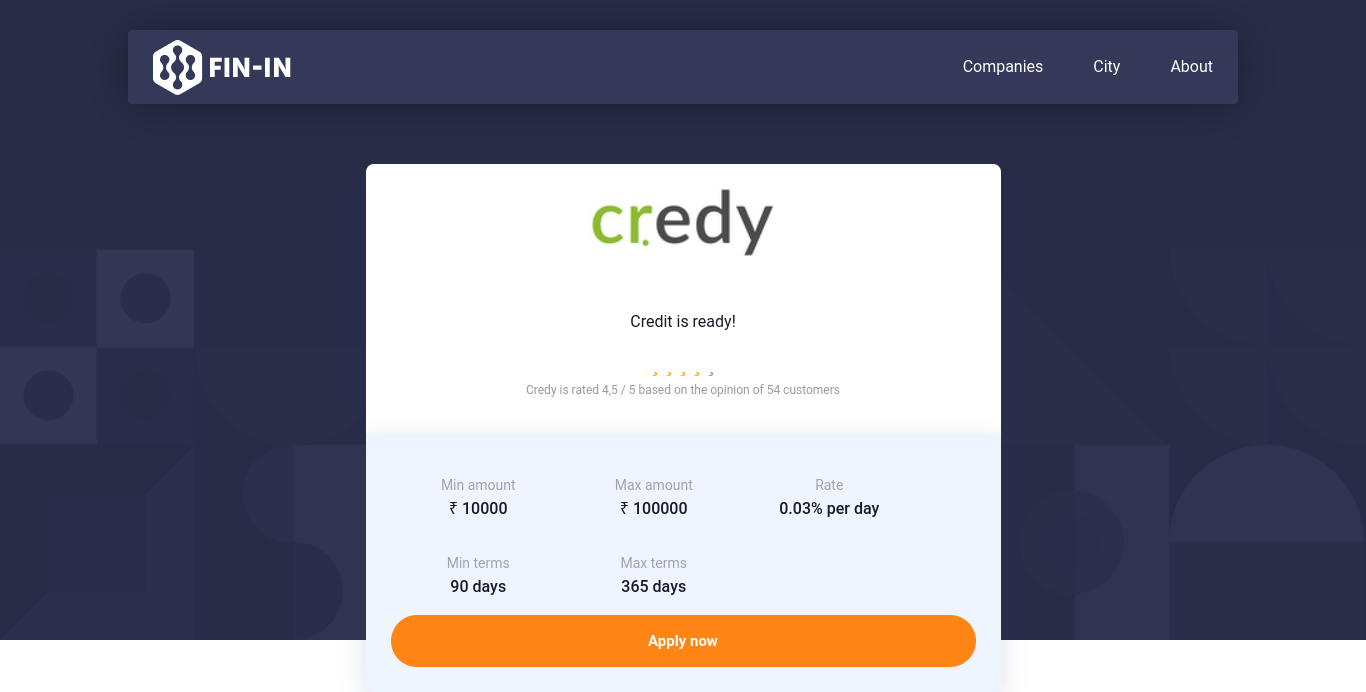

- 2.13 Credy

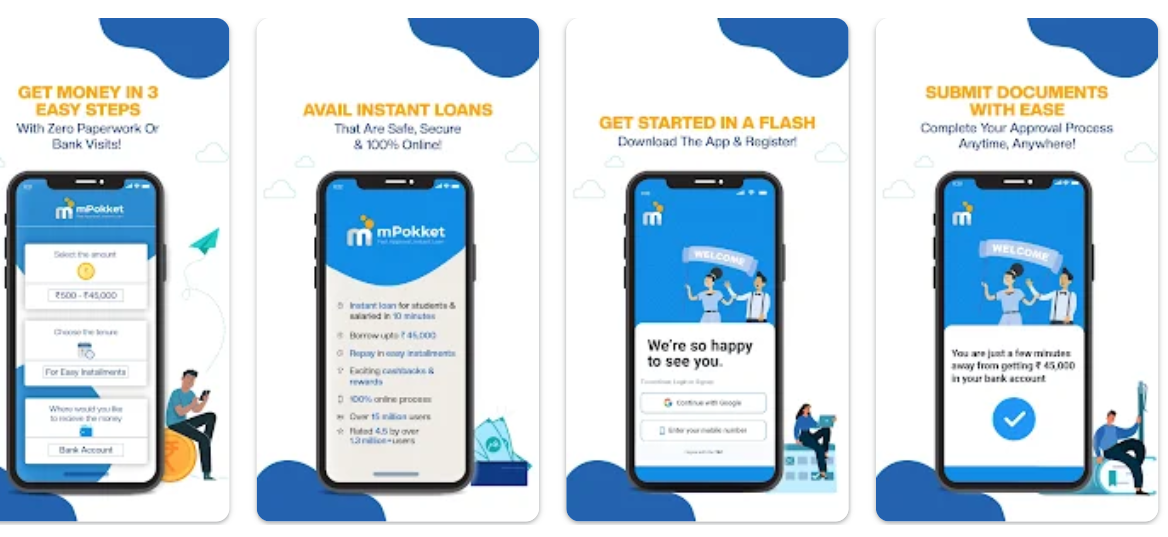

- 2.14 mPokket

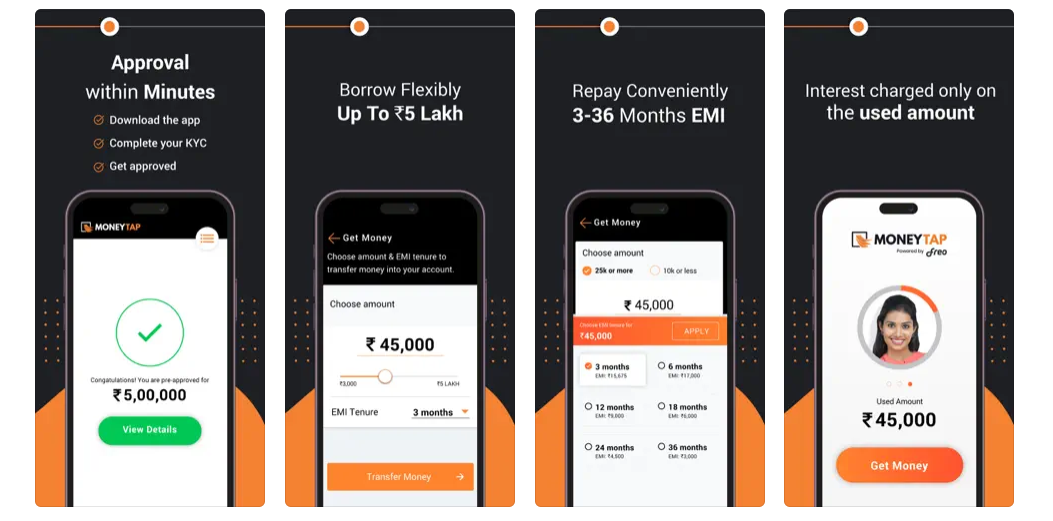

- 2.15 MoneyTap

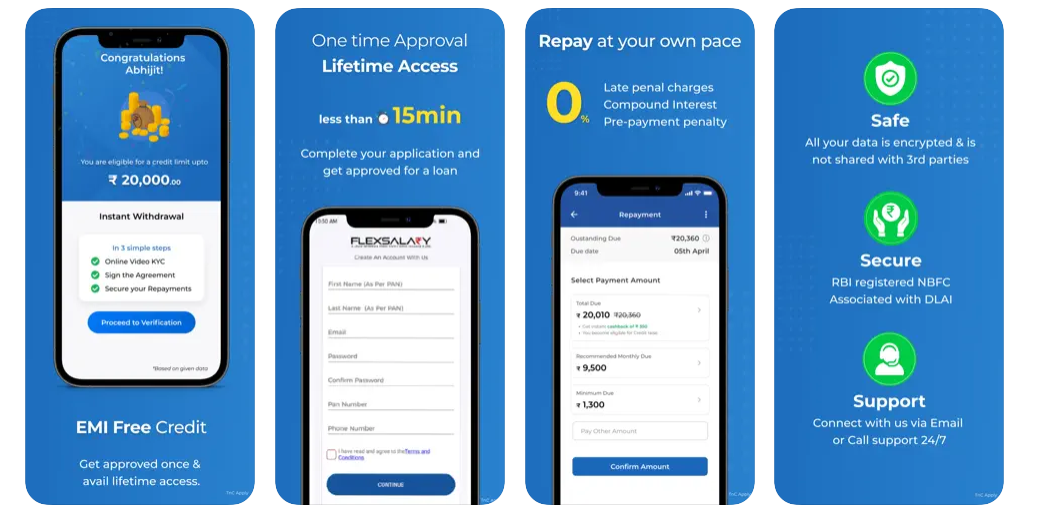

- 2.16 FlexSalary

- 2.17 MoneyView

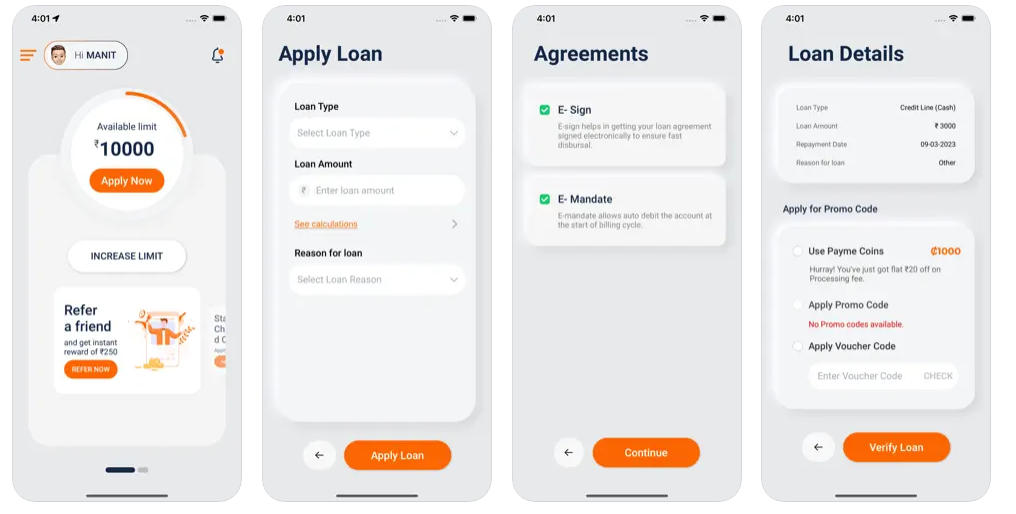

- 2.18 PayMe India

- 2.19 SmartCoin

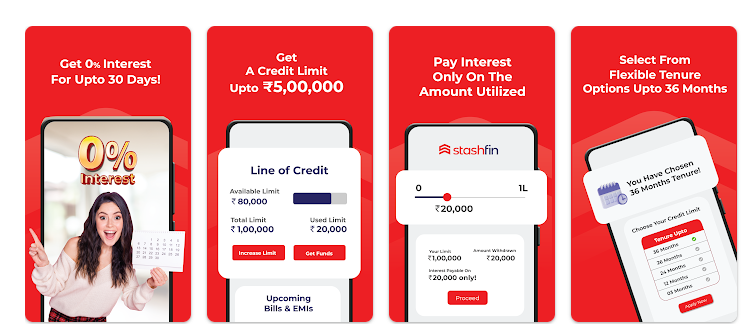

- 2.20 StashFin

- 2.21 LoanTap

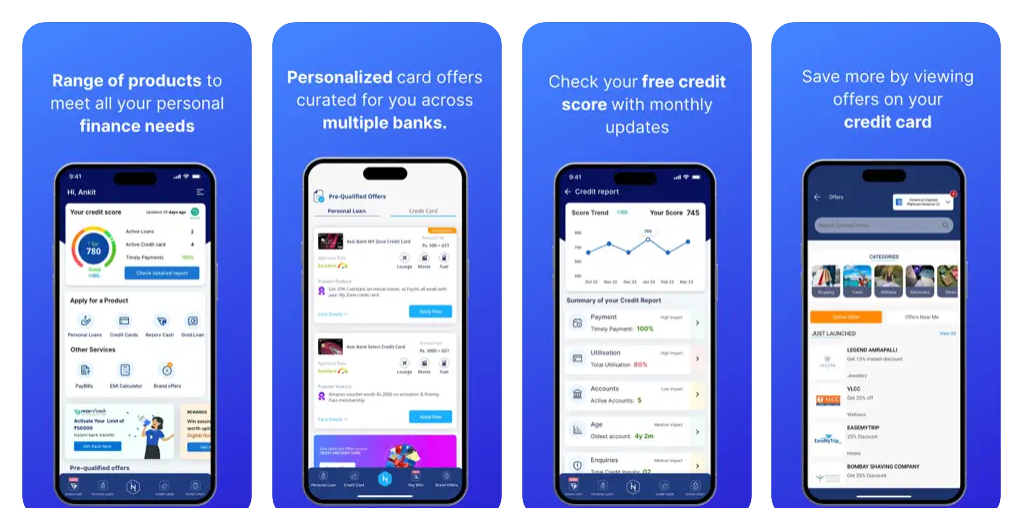

- 2.22 IndiaLends

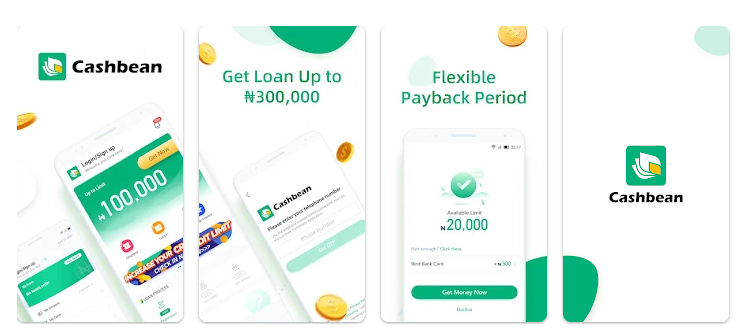

- 2.23 CashBean

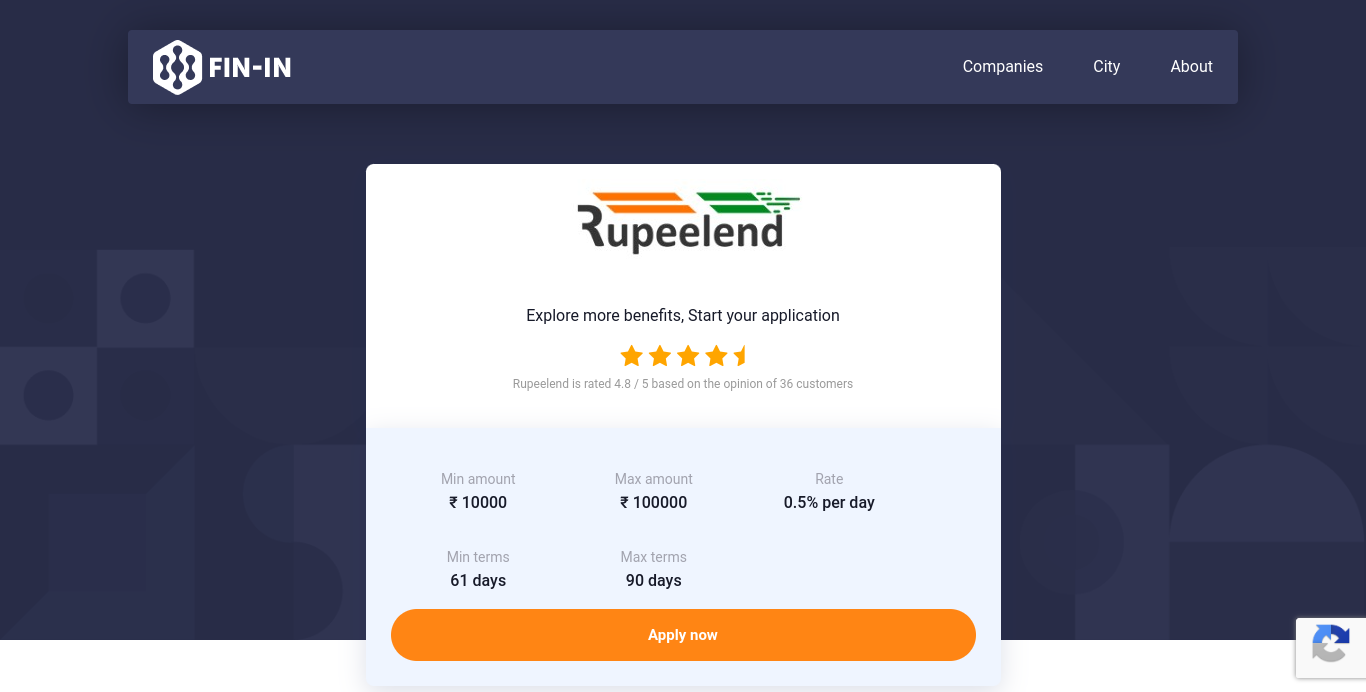

- 2.24 RupeeLend

- 2.25 AnyTimeLoan

- 3 Which One Is The Best Among These?

- 4 Methodology

Personal loans are useful for those with little ambition. They enable you to buy a desired product or handle financial difficulties without depleting your funds. Instant loan applications are great for personal loans today. They handle loans faster than banks and need less paperwork. Read on for Indian loan apps.

Why We Have Chosen These 25 Personal Loan Apps?

Our carefully selected 25 personal loan applications aim to provide consumers with a wide range of alternatives that value transparency, accessibility, and user-friendliness. To provide options for different financial requirements, we analyzed interest rates, loan periods, and application processes. We maintain a selection of secure and fast-approval applications to simplify lending and improve financial well-being. For those seeking easy and fast financial aid, these personal loan apps stand out because of their trustworthiness, convenience of use, and great user reviews.

25 Best Personal Loan Apps:

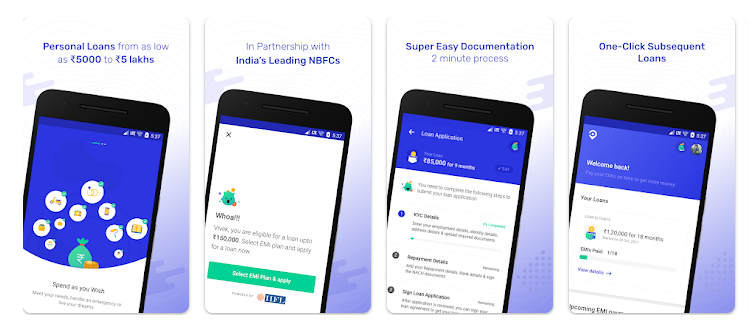

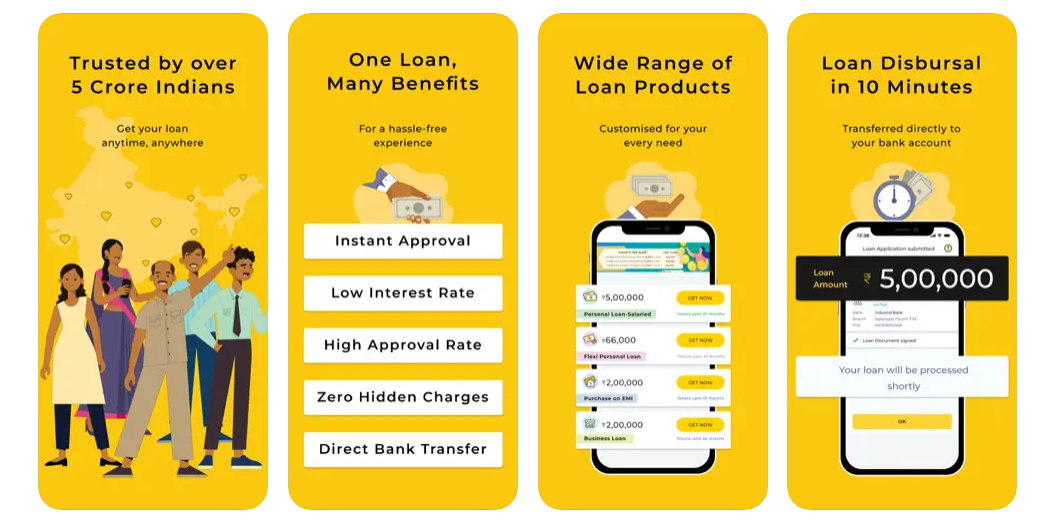

PaySense

Paid professionals and self-employed persons may apply for quick loans via PaySense, one of India’s top instant personal loan applications, and its website. The monthly minimum wage for a personal loan is ₹18,000. Additionally, the PaySense fast loan app allows self-employed persons earning ₹20,000 per month to borrow. The reliable loan app has a falling balance APR of 16% to 36%. PaySense fast personal loans may be used for house improvements, laptops, and marriage loans.

The Mumbai-based organization, founded by Sayali Karanjkar and Prashanth Ranganathan, disburses loans through RBI-registered NBFCs and banks, including Fullerton, IIFL, Credit Saison India, Northern Arc, and PayU Finance. PaySense raised $25.6 million in three rounds. You may get PaySense from Google Play. Simply check your loan eligibility and upload the paperwork after installation. PaySense’s EMI calculator makes calculating your monthly EMI easy, improving the user experience.

The win-win is that PaySense loans do not demand collateral or a good credit score.

- Year founded: 2015

- ₹5,000 Minimum Loan Amount

- Maximum Loan: ₹5,000,000

Required Documents:

- YC paperwork may include ID evidence (Aadhar/PAN/Voter ID), address proof (Aadhar/Utility Bills/Rental Agreement), income proof (bank statement), and a picture.

Standards for Eligibility:

- Indian resident

- Age 21-60

- PaySense serves 500+ Indian cities.

- Repayment Tenure: You can return your loan in 3–60 months.

Other Fees: Prepayment is 4% + 18% GST on the remaining principal. Failure to pay the EMI on the stipulated date incurs late payment costs of ₹500 + 18% GST (₹590).

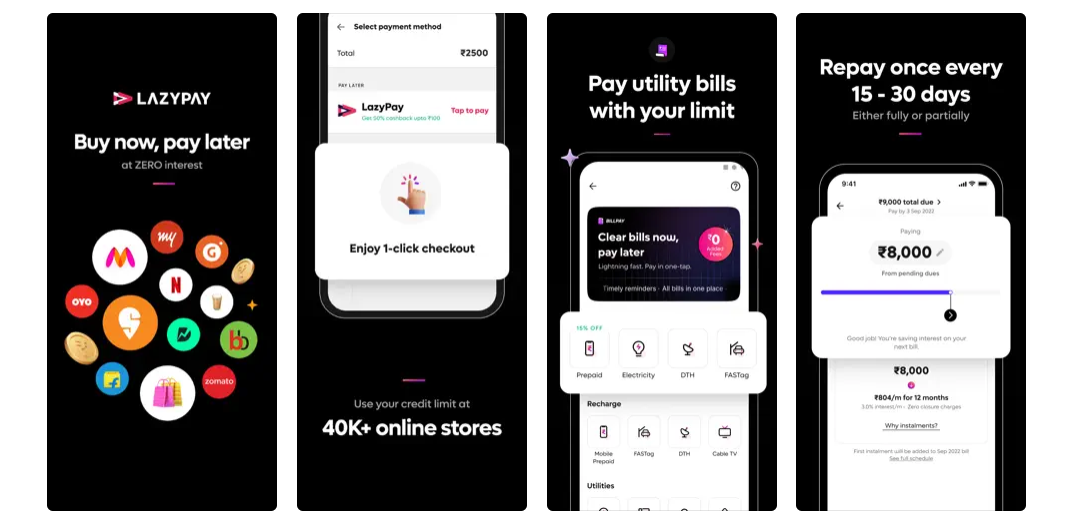

LazyPay

PayU, which acquired PaySense, powers LazyPay, one of the top finance applications in India that offers quick loans. It processes online loan applications quickly and securely. With the LazyPay App, your loan eligibility is determined by your phone number. LazyPay also offers a credit card with 1% cashback. Key LazyPay features include fast personal loans up to ₹1,000,000 with minimum paperwork and a simple digital process.

- Year founded: 2015

- ₹10,000 Minimum Loan Amount

- Maximum Loan: ₹1,000,000

Required Documents:

- ID proof (PAN Card) and address proof (Aadhar Card)

- Bank information for repayment setting

Standards for Eligibility:

- Indian resident

- Age 18 or older

- Minimum monthly income: INR 30,000

- Repayment Tenure: Personal loans can be repaid in 3–60 months.

The late fee of Rs. 17.7 (plus 18% GST) per day is imposed until the EMI is paid.

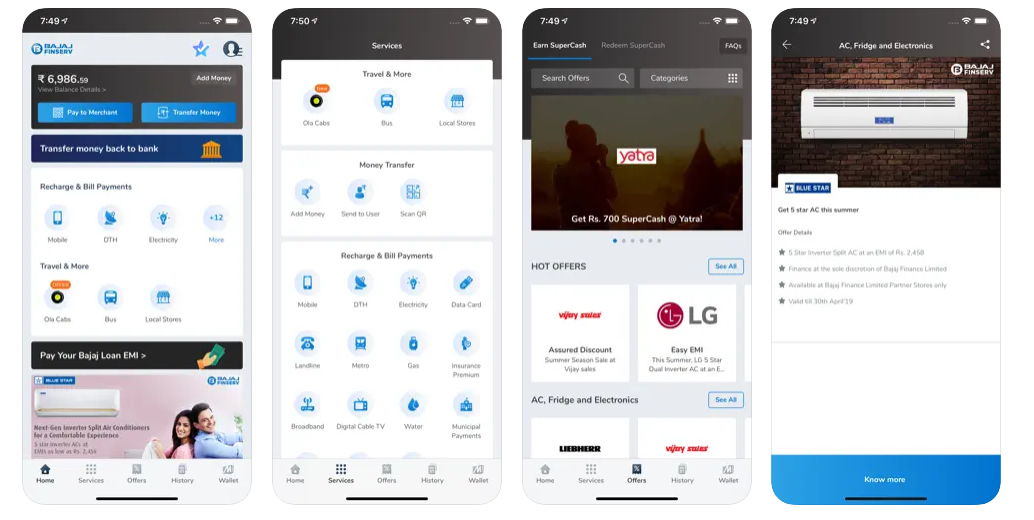

Bajaj Finserv

Personal finance giant Bajaj Finserv has been in the country for over a decade. Bajaj Finserv is one of India’s fastest-growing loan applications, with several options. Purchases and monthly obligations may be financed using their zero-interest EMI card and loan app. Bajaj Finserv offers personal loans up to ₹25 lakhs without collateral.

- Year founded: 2007

- ₹30,000 Minimum Loan Amount

- Loan Maximum: ₹25,000,000

Required Documents:

- Required documents: PAN card, passport, Aadhar card, driving license, voter ID, employee ID card, and 3 months of salary slips.

- Bank information for repayment setting

- Last three months’ bank statements

- Photos for passports

Standards for Eligibility:

- Residency in India is required.

- Age 21-80

- Minimum monthly income: INR 25,001

- CIBIL score of 685 or above

- Repayment maximum: 96 months

Other Fees: Loan processing fee up to 3.93% In case of repayment default, INR 700–INR 1,200 would be levied.

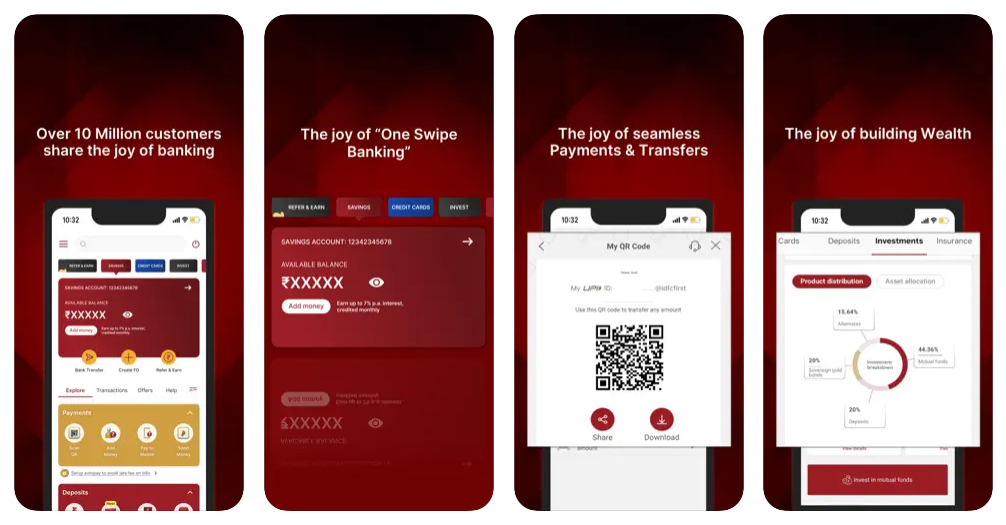

IDFC FIRST Bank

If you need a large loan to buy a car or two-wheeler, download and use this lending app. You may get your loan authorized in minutes with a straightforward process. Loan repayment is flexible, with affordable EMIs available over 1 to 5 years. Existing clients may view loan account data, statement details, outstanding balances, payment dates, and service requests.

- Year founded: 2018

- ₹20,000 Minimum Loan Amount

- Maximum Loan: ₹40,00,000.

Required Documents:

- PAN/Passport/Aadhar Card/Driving Licence/Voter’s ID: Last 3 months’ salary slips

- Last three months’ bank statements

Standards for Eligibility:

- Residency in India is required.

- Age 23-60

- Only salaried or self-employed people can get personal loans.

- Repayment Duration: 6–60 months

Other Fees: Processing fees might reach 3.5% of the loan amount.

ZestMoney

ZestMoney offers a quick way to get an instant loan. It does not need you to have a credit score. It takes just a few minutes to apply for a loan on the app. You can pay back your loan digitally in EMIs and earn a cashback of 100% on your EMIs.

- Founded in: 2015

- Minimum Loan Amount: ₹1,000

- Maximum Loan Amount: ₹10,00,000

Documents Required:

- PAN Card/Passport/ Aadhar Card/Driving License/Voter’s ID

- Bank details for repayment setup

Eligibility Criteria:

- Applicant must be a resident of India

- 18-65 years of age

- Repayment Tenure: 3 months to 36 months

Other Fees or Charges: No pre-closure fee is charged

Dhani

Indiabulls Ventures is the sponsor of this well-known Indian personal loan app. Apply for a personal loan with Dhani anytime, anywhere, and for any reason. Unsecured loans may be obtained quickly without collateral. For verification, download the app and provide your PAN, Aadhar number, and address. After verification, the loan amount is sent to the bank account in minutes, or three minutes, according to the app. You can repay the loan in –36 months.

- Indiabulls was founded in 2000; the app was launched in 2017.

- ₹1,000 Minimum Loan Amount

- Loan Maximum: ₹15,000,000

Required Documents:

- PAN/Passport/Aadhar Card/Driving Licence/Voter’s ID Bank information for repayment setup

- Last three months’ bank statements

Standards for Eligibility:

- Residency in India is required.

- Only for paid and self-employed persons aged 21–60.

- Repayment 3 months–2 years

Processing costs start at 3% of the loan amount.

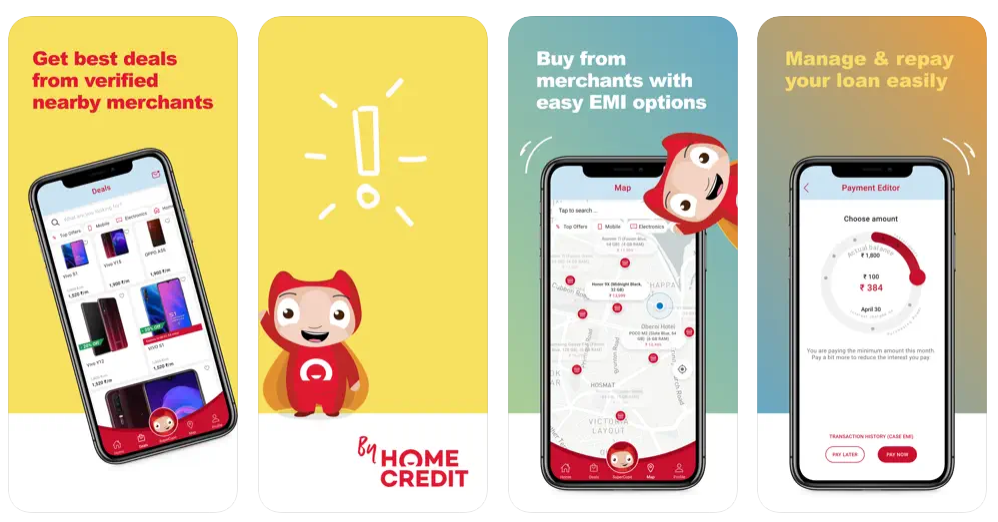

HomeCredit

One of India’s earliest money-lending applications. As part of the Home Credit Group, this firm operates in over 10 Asian and European nations. The lending app effortlessly provides the loan amount to aid you with financial issues like college loans or medical situations. You may borrow up to ₹2,40,000 and return it in simple EMIs over 6 to 51 months.

- Founded 2011

- ₹10,000 Minimum Loan Amount

- Maximum Loan: ₹2,40,000

Required Documents:

- Required documents: PAN/Form 60, passport/Aadhar card, driving license/voter ID, and bank information for payback.

Standards for Eligibility:

- Residency in India is required.

- Only for paid and self-employed persons aged 19–68.

- Repayment Duration: 12–48 months

Additional fees: Processing fees might reach 5%.

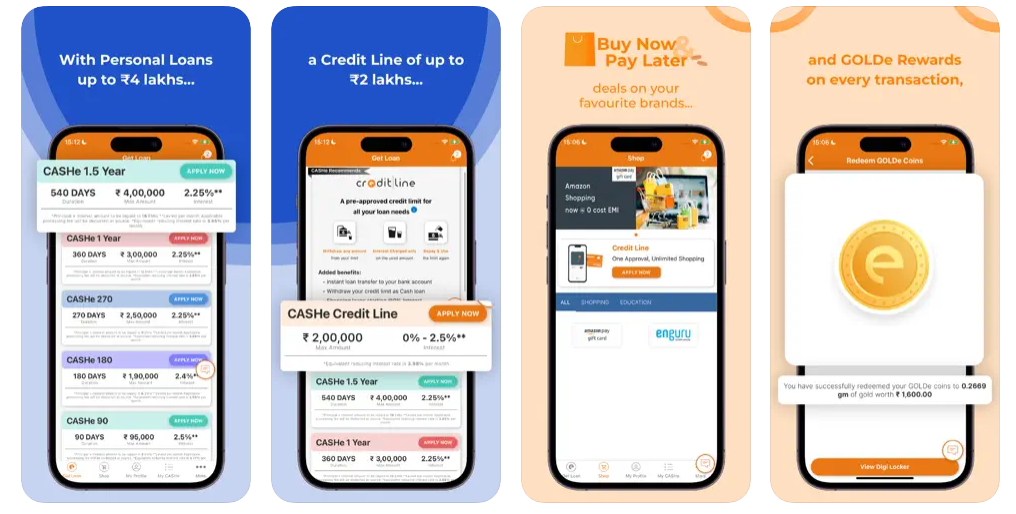

CASHe

CASHe helps get funding for medical or financial emergencies. Simply download the CASHe lending app on your phone. It’s on Google Play and the Apple Store. After uploading papers via the app, the loan amount is deposited into your account in minutes. You may also send loan funds to Paytm Wallet. CASHe uses a unique algorithm-based machine-learning platform to authorize loans based on an applicant’s social profile, merit, and earning potential.

- Year founded: 2016

- ₹7,000 Minimum Loan Amount

- Maximum Loan: ₹4,000,000

Required Documents:

- Required documents: PAN card, Aadhar card, passport, driving license, voter ID, and latest wage slip.

- The latest bank statement

Standards for Eligibility:

- Residency in India is required.

- 23-58 years old

- Minimum monthly income: INR 15,000.

- Repayment Duration: 3–18 months

Other costs: Processing fees are up to INR 1000, or 3% of the loan amount.

KreditBee

KreditBee is one of India’s top online lending applications for young professionals. Loan amounts range from ₹1000 to ₹2 lakh. Adults over 18 with a monthly income of ₹10,000 can apply for a loan using the app. The app handles everything, so no physical verification is needed. Verification and permission are required after submitting documents. After approval, the loan is deposited into your bank account. Young professionals seeking a loan for a phone, camera, or laptop love this app.

- Year founded: 2015

- ₹1,000 Minimum Loan Amount

- Maximum Loan: ₹2,000,000

Required Documents:

- Provide a PAN card, a passport or Aadhar card, a bank statement, and a photograph.

Standards for Eligibility:

- Residency in India is required.

- Age 21-50

- Minimum monthly income: INR 10,000

- Repayment Duration: 3–14 months

Other Fees: Processing fees might reach 6% of the loan amount.

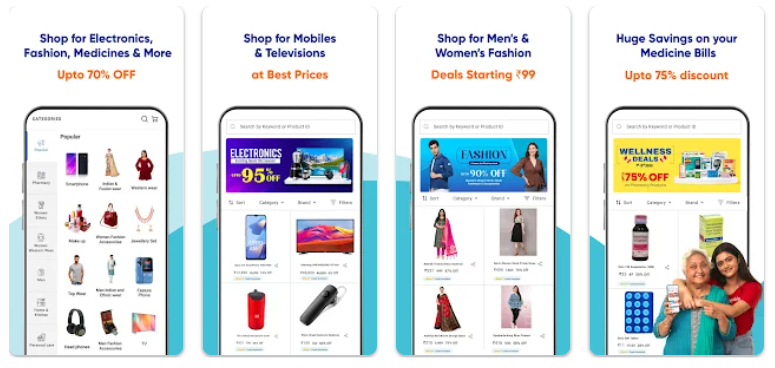

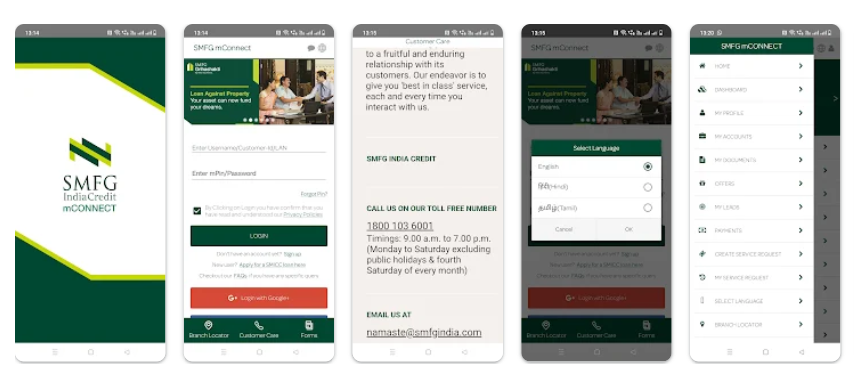

Fullerton India

Fullerton, India, makes it easy for self-employed and salaried professionals to get personal loans. Among the top online lending apps for freelancers, This online personal loan app promises a 30-minute loan disbursement after approval. The software requires only basic information for easy documentation. Your loan status may be dynamically tracked.

- Established in 1994; app launched in 2021

- ₹50,000 Minimum Loan Amount

- Loan Maximum: ₹25,000,000

Required Documents:

- PAN Card; – Passport/Aadhar Card; – Driving Licence/Voter’s ID; – Three months of salary slips

- Last three months’ bank statements

- Photos for passports

Standards for Eligibility:

- Residency in India is required.

- Age 21-65

- Minimum monthly income: INR 15,000.

- Repayment Duration: 60 months max.

Other fees: Processing fees might reach 7% of the loan amount.

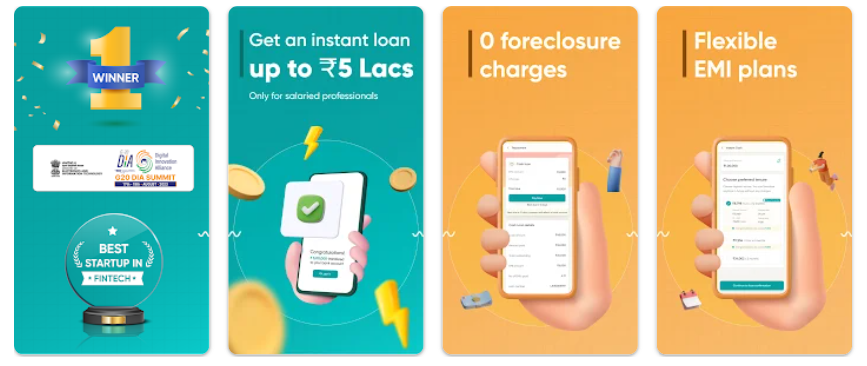

Fibe

Do you regularly run out of money mid-month? Are you anxious about paying bills for the remainder of the month? When payday is far off, the Fibe lending app helps. For salaried professionals, this app offers loans up to ₹5,00,000 for various reasons. The Pune fin-tech startup lets you repay the loan in 24 months with simple EMIs. Fibe, popular among youth, secured ₹100 crores in round B fundraising from Eight Roads Ventures and IDG Ventures India.

- Year founded: 2015

- ₹3,000 Minimum Loan Amount

- Maximum Loan: ₹5,000,000

Required Documents:

- PAN Card

- Passport/Aadhar/Driving Licence/Voter ID

- Recent 3-month salary slips

Standards for Eligibility:

- Residency in India is required.

- 21-55 years old

- Minimum monthly income: INR 15,000.

- Payment Period: 6–36 Months

Processing fees might reach 2% of the loan amount.

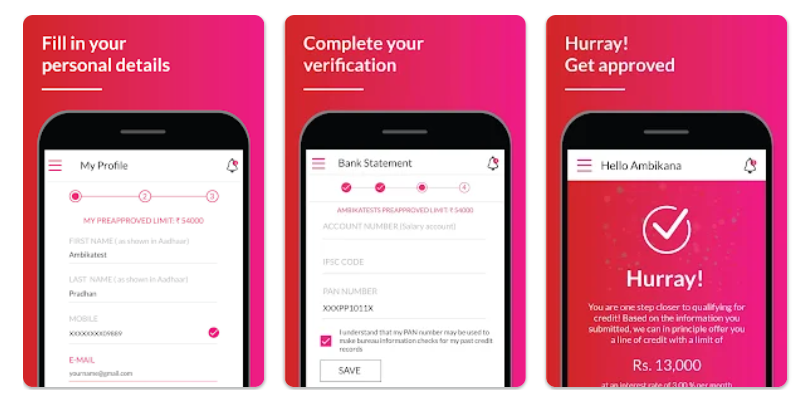

Nira

Nira is a top Indian loan app for unemployed people. Download the app to find out whether you qualify for a loan in 3 minutes. If loan eligibility is met, you will receive a $1,000,000 credit line. Get ₹5,000 or more at any moment and repay it in installments over 3 to 24 months. The best aspect is that you don’t need good credit to apply. If you need money fast, Nira is a fantastic choice. The app received $1 million in startup financing.

- Year founded: 2018

- ₹5,000 Minimum Loan Amount

- Maximum Loan: ₹1,000,000

Required Documents:

- PAN Card

- Passport/Aadhar/Driving Licence/Voter ID

- Recent 3-month salary slips

Standards for Eligibility:

- Residency in India is required.

- 21-55 years old

- Minimum monthly income: INR 15,000.

- Payment Period: 6–36 Months

Processing fees might reach 2% of the loan amount.

Credy

Credy, an excellent Indian rapid lending software, offers flexible loans for home furnishings, credit card payments, and more. It has no hidden fees and requires no collateral or guarantor to borrow. Download the app, complete the eligibility conditions, upload the required papers, and you’re ready to borrow from the app! The loan payback plan is variable because borrowers can pick a three- to 12-month term. They provide loans to salaried employees earning ₹15,000 in Bangalore, Chennai, Pune, Mumbai, and Hyderabad.

- Year founded: 2016

- ₹10,000 Minimum Loan Amount

- Maximum Loan: ₹1,000,000

Required Documents:

- PAN/Passport/Aadhar/Driving Licence/Voter ID

- Recent 3-month salary slips

- Previous loan closing certificate

Standards for Eligibility:

- Residency in India is required.

- Minimum age: 18 years old.

- Minimum monthly income: INR 20,000

- The applicant must live in Pune, Mumbai, Bangalore, Hyderabad, or Chennai.

Three to twelve months of repayment. Other fees: 3% of the loan amount plus GST is levied for processing.

mPokket

College students often run out of money. The founders of mPokket created special software to eliminate college student borrowing from pals. College students get pocket money via this personal loan app. Download the loan app, fill out the required information, and the money is sent to your bank account or Paytm Wallet if authorized. Initially granted for $500, the credit line increases with consistent usage and timely payments. The payback period is 2–4 months.

- Year founded: 2016

- ₹500 Minimum Loan Amount

- Maximum Loan: ₹30,000

Required Documents:

- PAN/Passport/Aadhar/Driving Licence/Voter ID

- Employment proof

- Recent 3-month salary slips

- Last three months’ bank statements

Standards for Eligibility:

- Residency in India is required.

- Minimum age: 18 years old

- Only for students and paid workers.

- Repayment Period: 61–90 Days

Processing fees range from INR 34 to INR 203 plus 18% GST.

MoneyTap

The “no-usage, no-interest” feature sets MoneyTap apart from other applications. This means you pay interest only on the money used. Simply download the app and upload the loan documentation. After acceptance, you have a credit line to use as needed. MoneyTap covers Bangalore, the NCR, Mumbai, Hyderabad, and other Indian cities through partnerships with prominent NBFCs. You must earn a minimum of ₹30,000 per month to qualify for a loan.

- Year founded: 2015

- ₹3,000 Minimum Loan Amount

- Maximum Loan: ₹5,000,000

Required Documents:

- PAN Card

- Adhar Card

- Last three months’ bank statements

- Photos for passports

Standards for Eligibility:

- Residency in India is required.

- Age 23–55

- Minimum monthly income: INR 20,000

- Two to three years to repay

Additional fees: loan processing fee up to 2% of the loan amount + GST.

FlexSalary

The Indian fast-lending app FlexSalary is aimed at salaried people. This Hyderabad-based online loan lending business helps salaried people in emergencies get cash quickly. FlexSalary offers rapid disbursals and 24/7 credit availability, in addition to a one-time approval process. Borrowers can choose the loan term and repayment amount. Borrowers have no set EMI with this innovative salary app. Sign up on the app, upload the relevant papers, and the loan is sent to your account upon approval.

- Year founded: 2016

- ₹4,000 Minimum Loan Amount

- Maximum Loan: ₹2,000,000

Required Documents:

- PAN Card

- Voter ID/Passport/Aadhar Card/Driving Licence

- Recent 3-month salary slips

- Bank information for repayment setting

Standards for Eligibility:

- Residency in India is required.

- Minimum age: 21

- Minimum monthly income: INR 8,000

- Work experience of at least 3 months is required.

Repayment Period: 10-36 Months

Other Fees: Loan processing costs up to INR 1,250.

MoneyView

If you need a lot of money for an emergency or other necessities, this is our top fast-lending app in India. Use this app to borrow ₹10,000 to ₹5 lakh and pay in affordable EMIs over 3 months to 5 years. The software makes the procedure simple and paperless. You obtain the loan amount when your paperwork is accepted. MoneyView has grown fast in recent years and is currently in various Indian cities.

- Year founded: 2014

- ₹10,000 Minimum Loan Amount

- Maximum Loan: ₹5,000,000

Required Documents:

- PAN/Passport/Aadhar/Driving Licence/Voter ID

- Recent 3-month salary slips

- Last three months’ bank statements

Standards for Eligibility:

- Residency in India is required.

- Age 21-57

- Minimum monthly income: INR 13,500

- There should be 600+ on CIBIL.

- Three to 60 months of repayment

Processing fees range from 2% to 8% of the loan amount.

PayMe India

PayMe, a fin-tech startup in Noida, Uttar Pradesh, provides short-term loans to corporate employees who need cash quickly. Their low-interest short-term cash, rapid payday, marriage, and advance salary loans enable salaried business personnel to fulfill their financial demands. A loan application is made fully through the app. Lending is fast and dependable. PayMe provides a timely and professional customer support service for new borrowers. Singaporean investors gave the firm $2 million.

- Year founded: 2016

- ₹2,000 Minimum Loan Amount

- Maximum Loan: ₹2,000,000

Required Documents:

- PAN/Passport/Aadhar/Driving Licence/Voter ID

- Recent 3-month salary slips

- Last three months’ bank statements

Standards for Eligibility:

- Residency in India is required.

- 21-58 years old

- Minimum monthly income: INR 15,000.

- Should have a CIBIL score of 650+

- Three to 24 months of repayment

Processing fees: none.

SmartCoin

This is a wonderful loan app for emergency cash or short-term loans. SmartCoin lends to salaried workers, stay-at-home parents, support staff, company owners, and others, unlike most other online lending apps. It’s simple to use the app and lending platform. Complete all paperwork online and get your application accepted in minutes. You can apply for a loan up to ₹1,000,000 after approval. SmartCoin has no wage requirement; therefore, anyone may apply for a loan.

- Year founded: 2015

- ₹4,000 Minimum Loan Amount

- Maximum Loan: ₹1,000,000

Required Documents:

- PAN/Passport/Aadhar/Driving Licence/Voter ID

- Recent 3-month salary slips

Standards for Eligibility:

- Residency in India is required.

- Aged 24-45

- Minimum monthly income: INR 20,000

- Two to nine months of repayment

Other fees: Processing is free.

StashFin

Experts in finance, banking, and technology formed StashFin. This digital loan app provides loans ranging from ₹1,000 to ₹5,000,000. Only electronic loan repayment is allowed. Loans last 3–36 months. There are no hidden fees with StashFin loans.

- Year founded: 2016

- ₹1,000 Minimum Loan Amount

- Maximum Loan: ₹5,000,000

Required Documents:

- PAN/Passport/Aadhar/Driving Licence/Voter ID

- Last three months’ bank statements

- Photos for passports

Standards for Eligibility:

- Residency in India is required

- Minimum age: 18 years old

- Minimum monthly income: INR 15,000.

- Repayment Period: 3–36 months

Processing fees are up to 10%.

LoanTap

One of the most popular fast loan applications in India LoanTap offers customized loans with the slogan “Bringing Dreams to Life.” They provide lifestyle, celebration, two-wheeler, home improvement, flexible personal, and cheaper payment loans. Simple documentation requires a few papers. Many repayment options are available, including expedited and bullet principal payback.

- Year founded: 2015

- Minimum Loan: ₹25,000

- Loan Cap: ₹10,000,000.

Required Documents:

- PAN Card Address Proof (Aadhar Card/Driving License/Voter’s ID)

- Recent 3-month salary slips

- Last six months’ bank statements

- Photos for passports

Standards for Eligibility:

- Residency in India is required.

- Minimum age: 21

- Minimum monthly income: INR 30,000

- Repayment Duration: 12–60 months

Other Fees: Processing fees might reach 2% of the loan amount.

IndiaLends

The low-interest cash loan app IndiaLends is one of India’s top lending platforms. Instant loans are available on the app. Uploading your PAN to the app lets you check your credit score and choose an immediate loan.

- Year founded: 2016

- N/A Minimum Loan Amount

- Max Loan: ₹50,000,000.

Required Documents:

- PAN/Passport/Aadhar/Driving License/Voter’s ID Form 16 or 3 years of income tax returns

- Recent 3-month salary slips

- Photos for passports

Standards for Eligibility:

- Residency in India is required.

- Age 18–65 and only for self-employed or salaried persons.

- Minimum monthly income: $20,000

- Should have a 750+ CIBIL score.

- Repayment Duration: 12–60 months

Other fees: 2%–5% of pre-closure expenditures.

CashBean

The CashBean lending app is mobile and web-based. This innovative product simplifies funding. They provide online loan applications on their tech-driven mobile app. Loans may be obtained in minutes without documentation. Applied, sanctioned, and disbursed loans are entirely digital.

- Year founded: 2018

- ₹1,500 Minimum Loan Amount

- Maximum Loan: ₹60,000

Required Documents:

- Required documents: PAN card, passport, Aadhar card, driving license, voter ID, and salary slips.

- Photos for passports

Standards for Eligibility:

- Residency in India is required.

- Age 18-56 Applicable only to paid or self-employed persons.

- Repayment Duration: 3–6 months

Other Fees: Processing fee between INR 90 and INR 2000 + GST, depending on the loaned amount.

RupeeLend

The RupeeLend lending app, part of Casinity, offers short-term loans. RupeeLend operates in most Indian cities, starting in Gurgaon. Loan disbursement is straightforward and quick using the app, reducing paperwork and phone calls. It knows that clients sometimes need a loan quickly. New clients get loans in two hours and returning customers in 10 minutes from RupeeLend. This makes it one of the fastest-growing lending applications nationwide. Its loan customization function lets consumers choose the loan amount easily. Additionally, you can foreclose the debt without penalty.

- Year founded: 2015

- ₹10,000 Minimum Loan Amount

- Maximum Loan: ₹1,000,000

Required Documents:

- Required documents: PAN card, passport, Aadhar card, driving license, voter ID, and salary slips.

- Photos for passports

Standards for Eligibility:

- Residency in India is required.

- Minimum age: 20 years old

- Be employed

- Minimum monthly income: INR 18,000.

- Repayment Duration: 1–60 days

There are no pre-payment fees. Not paying the EMI will cost INR 500.

AnyTimeLoan

If you’re not a paid worker worried about acquiring a loan, stop worrying! AnyTimeLoan may work for you. It connects salaried and self-employed people with lending partners for short-term loans. Their paperless approach requires only downloading the app and following the basic steps. The loan is sent to your bank account immediately after approval. K-12 school, personal, and business loans are available through the AnyTimeLoan lending app without collateral or a guarantor.

- Year founded: 2014

- N/A Minimum Loan Amount

- Maximum loan: ₹50,000,000

Required Documents:

- PAN/Passport/Aadhar Card/Driving License/Voter’s ID: Last 3 months’ salary slips

- Bank information for repayment setting

- Last six months’ bank statements

- Photos for passports

Standards for Eligibility:

- Residency in India is required.

- Age 18 or older

- Minimum monthly income: INR 18,000.

- Repayment: One day to three years.

Other fees: INR 750 processing fee or 1.5% of the loan amount, whichever is larger.

Which One Is The Best Among These?

Bajaj Finserv is a major financial organization owing to its dedication to client satisfaction and wide range of financial products at low prices. For fast and easy loan processing, the institution supports digital innovation and offers simple online platforms. Bajaj Finserv has been synonymous with trustworthy financial services by addressing the different demands of its clients and retaining its market leadership with a customer-centric approach, flexible repayment alternatives, and a solid reputation for reliability.

Methodology

Our rigorous selection of these 25 personal loan applications is inspired by a desire to provide reputable and various financial alternatives. We choose apps with transparency, usability, and client happiness. These possibilities include reasonable interest rates, flexible loan periods, and simplified application processes, providing a wide range of financial solutions. Our selection method prioritized security and trustworthiness to ensure consumers can trust these apps. Through a carefully selected collection, we strive to provide consumers with a selection of reliable personal loan solutions to simplify and improve borrowing.