What Are Personal Loans

Personal loans are a type of loan that can be used for various purposes. Whether you need to consolidate debt, finance a large purchase, or cover unexpected expenses, a personal loan can be a great option.

Personal loans are typically unsecured, which means they are not backed by collateral. This can make them a bit more expensive than secured loans, but they can also be more accessible to qualify.

When you take out a personal loan, you typically agree to repay it with interest over a set period. The interest rate on a personal loan will depend on several factors, including your credit score and the length of the loan.

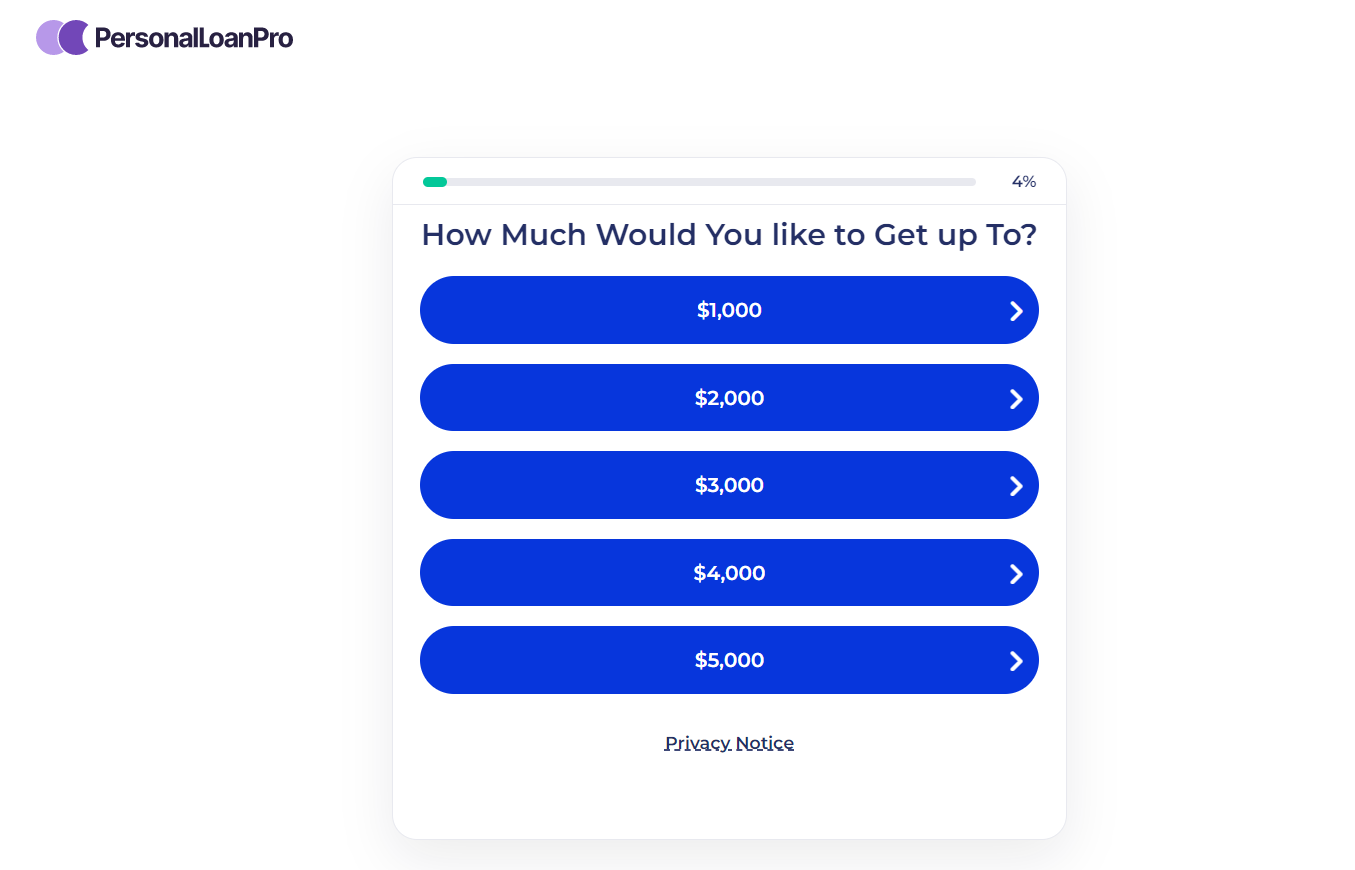

If you are considering a personal loan, comparing offers from multiple lenders is essential to ensure you are getting the best deal possible. The online loan broker Personal Loan Pro can help save you time when selecting a suitable lender for personal loans via its extensive lender database; look here to find the right lender for personal loans.

How Do Personal Loans Work?

You might wonder how they work if you’re considering taking out a personal loan. Personal loans are a popular way to finance big-ticket purchases or consolidate debt, but they can also be used for minor expenses.

Personal loans are typically unsecured, which means they’re not backed by collateral like a home or car. That means they’re riskier for lenders, which usually translates to higher interest rates. But it also means they’re easier to qualify for since you don’t need to put up any assets as collateral. Check at the site of Personal Loan Pro and get the application form for personal loans to cover your expenditures.

Generally, personal loans have fixed interest rates, which means the rate won’t change over the life of the loan. That can make it easier to budget since you’ll always know exactly how much your monthly payment will be.

Personal loans are typically repaid in monthly instalments, and you may be able to choose a repayment schedule that fits your needs. Some loans may even offer the flexibility to make extra payments or pay off the loan early without penalty.

So, how do personal loans work? It depends on the loan you choose and your circumstances. However, in general, personal loans can be a convenient and affordable way to finance various expenses.

How to Choose A Suitable Personal Loan?

A personal loan can be a great way to get the financial help you need. But how can you make sure that you get the best deal possible?

Here are a few tips to help you get the most out of a personal loan from brokers like Personal Loan Pro:

Shop around

Before committing to a personal loan, it is essential to compare rates and terms from multiple lenders. This will ensure you’re getting the best deal possible.

Know your credit score.

Your credit score is one factor that lenders consider when determining the terms of your loan. So, knowing your score before applying for a loan is essential.

Consider your options

Various types of personal loans are available, so it’s essential to consider all your options before applying for one. For example, you may want to consider a secured loan if you have collateral to put up as security.

Read the fine print

Before you sign on the dotted line, read and understand the terms of your loan. This way, you’ll know exactly what you’re getting into, and there won’t be any surprises.

A personal loan can be a great way to get the financial help you need. But by following these tips, you can be sure you’re getting the best deal possible.

What Are the Advantages of Personal Loans?

Personal loans are often seen as the best option for borrowing money. They offer various advantages that can make them the right choice for many people.

One of the most significant advantages of personal loans is that they can be used for almost anything. Whether you need to consolidate debt, finance a home improvement project or cover unexpected expenses, a personal loan can be a flexible and affordable option.

Another advantage of personal loans is that they tend to have lower interest rates than others. This can save you money over the loan’s life, making it easier to keep up with your monthly payments.

Finally, personal loans can give you the peace of mind of knowing that you have the money you need when you need it. Whether dealing with a financial emergency or planning a significant purchase, a personal loan can give you the security and flexibility you need.