Rocket Money Review: Easy-to-Use Budgeting App with Features

- 1 Rocket Money Review

- 1.1 PROS

- 1.2 CONS

- 1.3 What is Rocket Money, and how does it work?

- 1.4 Rocket Money Allows You To Visit All Accounts At One Place

- 1.5 Rocket Money Also Helps In Automate Saving

- 1.6 Rocket Money Is There To Track Credit Reports

- 1.7 What Are The Costs Of Rocket Money?

- 1.8 Rocket Money: Is It Trustworthy?

- 1.9 Is Rocket Money Safe?

- 1.10 Should I Choose Rocket Money?

- 2 FAQs

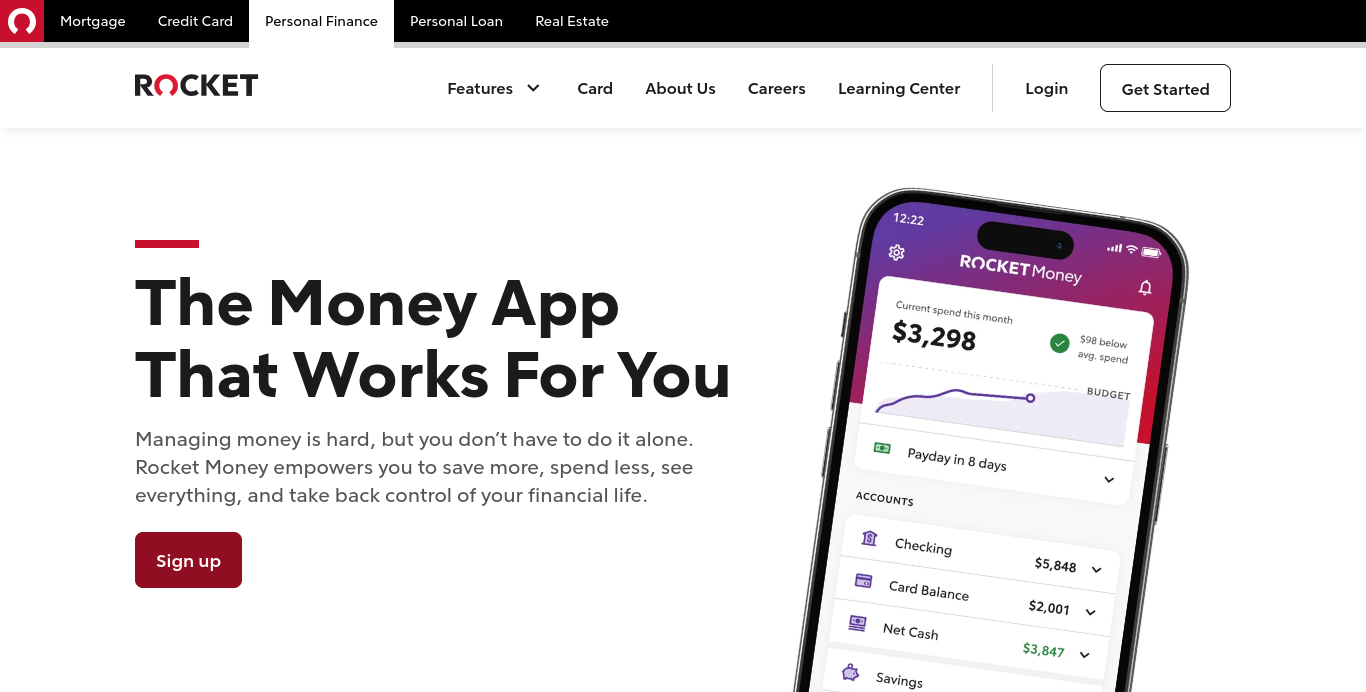

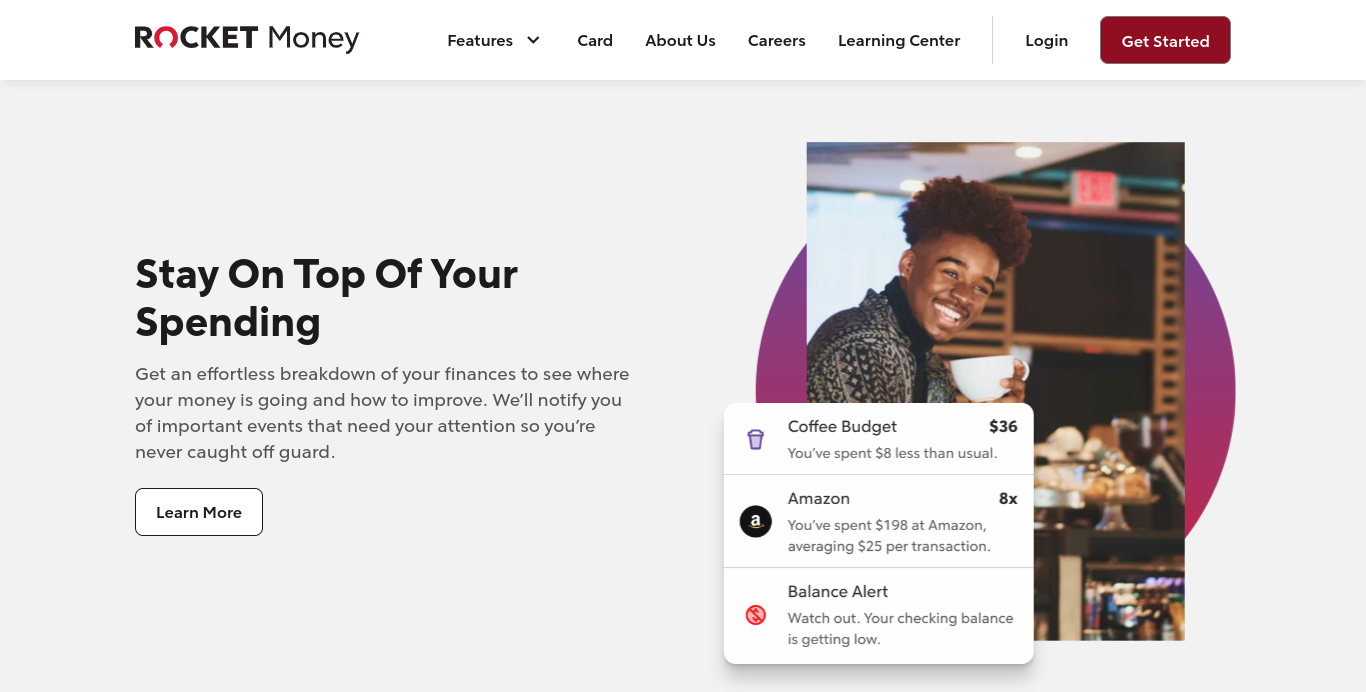

Rocket Money is a complete money management and budgeting program that improves financial health. To assist you choose, we’ll analyze the app’s features, usability, advantages, and downsides. Rocket Money centralizes checking, savings, credit card, and investment accounts for easy money management. The app is integrated securely and seamlessly through Plaid, a trusted third-party service many financial institutions use.

Rocket Money Review

PROS

- Bill management, transaction monitoring, and credit score

- Can reduce bills for you

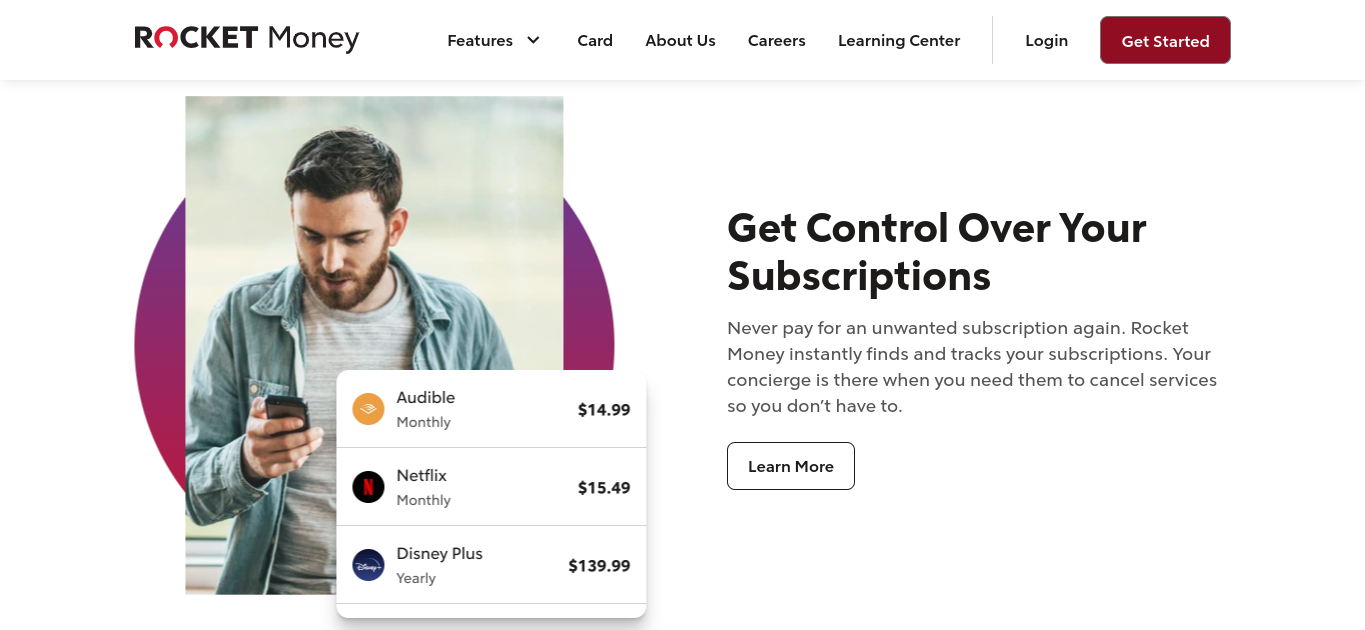

- Helps terminate unwanted subscriptions

- Great UI and navigation.

CONS

- All features demand a subscription.

- Some bank connection issues

- Poor investment tracking

What is Rocket Money, and how does it work?

Rocket Money consolidates all your financial accounts into one app for planning and money management.

All main accounts can be linked:

- Checking accounts

- Savings accounts

- Credit cards

- The investment accounts

Many financial institutions link through Plaid, a trusted third party. Rocket Money requires linking a checking account. Link your accounts to see all account balances on the app dashboard. Automatically identify and manually add recurring payments like invoices and subscriptions using the app. The Rocket Money app lets you define monthly budgets for various spending. Automatic savings employs AI to allocate savings based on spending behaviors to reduce overdraft risk.

Rocket Money Allows You To Visit All Accounts At One Place

The Rocket Money dashboard displays your account balances overall and individually. See current transactions, impending invoices, and “Left for spending.” Use the Spending tab to analyze your monthly spending. The app finds all your bills and recurring payments, making it easy to identify who and when to pay on the Recurring tab calendar.

Rocket Money Also Helps In Automate Saving

Setting your accounts to save automatically might enhance your savings without much effort. Rocket Money’s Autopilot allows you to select savings objectives and frequency. To avoid disrupting bills and other obligations, the sophisticated AI analyses your accounts to determine the optimal moment to save. An FDIC-insured savings account with NBKC Bank and Synapse partners holds funds. To take advantage of superior interest rates, periodically transfer your savings into a high-yield savings account if you use this service.

Rocket Money Is There To Track Credit Reports

Rocket Money helps you manage your credit scores and history, which are crucial to your money. Check your credit ratings and set up real-time notifications. Your three credit reports will also be available to ensure potential lenders see you at your best.

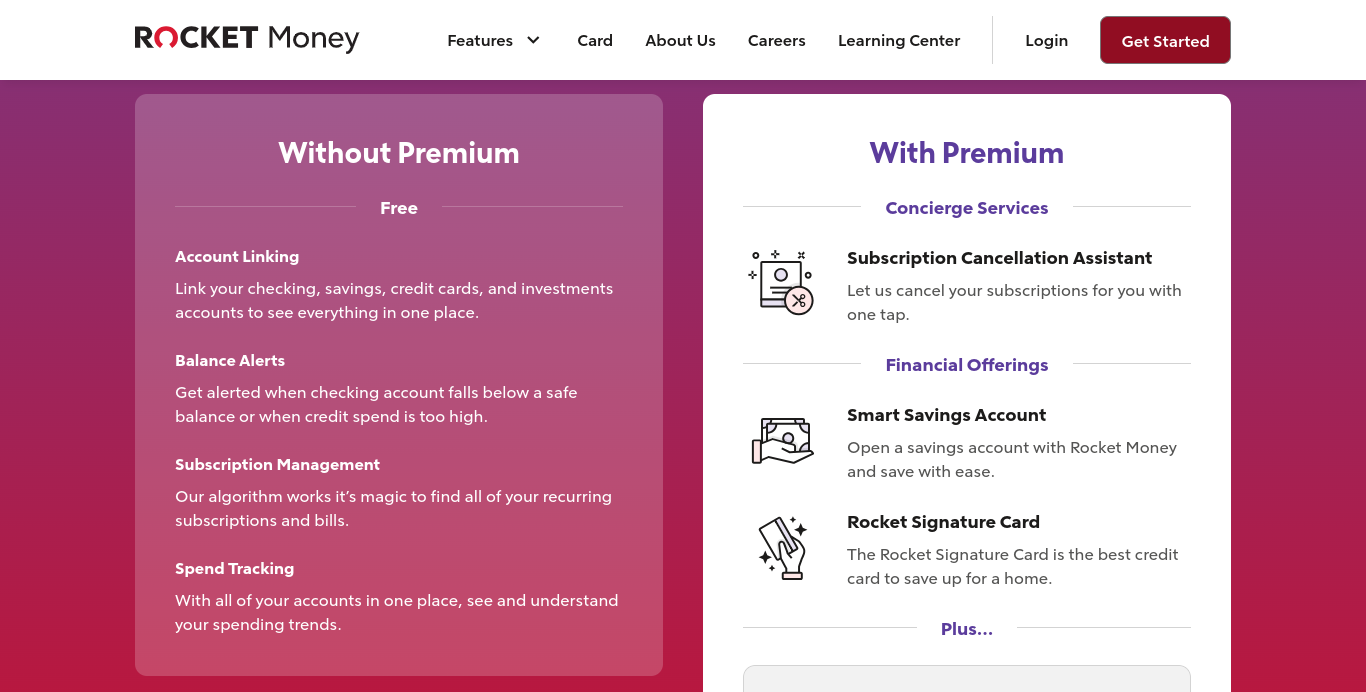

What Are The Costs Of Rocket Money?

Rocket Money app pricing is odd. Rocket Money lets you choose your pricing. (You read correctly.) If you don’t want to pay, use the free version. Despite its simplicity, account connection and budgeting are helpful.

There are several Premium membership options:

- Pay $36 annually, or $3 per month.

- Pay $48 annually, or $4 per month.

- Monthly payments range from $5 to $12.

What’s it, $5, $12, or somewhere in between? Your choice. Choose your rate. To clarify, Premium rates offer the same features and services. You’ll receive the same access for $36 a year as $5 or $12 a month. I don’t see why somebody would pay twice as much for the same service. I want Premium, but I am not sure if the perks are worth it. The seven-day free trial lets you try all Premium features. If you don’t want to pay, cancel before the trial ends.

Also Read- Tech Winks: Get real-time followers for your Instagram for free

Rocket Money: Is It Trustworthy?

The Better Business Bureau rates how corporations handle customer complaints and openness. Numerous consumer complaints earn Rocket Money a B rating. No previous public controversies have involved Rocket Money.

Is Rocket Money Safe?

Rocket Money does not store logins. They link your financial accounts utilizing Plaid, a trusted financial IT business. Your intelligent savings account is with an FDIC-insured U.S. bank. Your money may be safe at the bank. You should worry about Rocket Money stealing from you in plain sight. Why charge you 60% to save you money on your next payment when they only phone a firm and read a script? Highway robbery!

Should I Choose Rocket Money?

No, we disagree. Rocket Money’s free edition lacks valuable features. As mentioned, you can accomplish anything the premium version does for free or better elsewhere. User complaints have lowered Rocket Money’s Better Business Bureau rating to medium.6 Rocket Money’s bill negotiating service is their biggest issue. Users say they were arbitrarily charged for invoices they didn’t know were negotiated and kept being charged after canceling Rocket Money! That should be avoided.

FAQs

Is Rocket Money Real?

Rocket Money is a legitimate budgeting and money management tool. It consolidates bank accounts, monitors credit scores, and offers budgeting and savings capabilities.

Is Rocket Money’s Subscription Cancellation Effective?

Premium customers can use Rocket Money’s subscription cancellation feature to manage and cancel subscriptions. Users can test this functionality during the free trial.

Is Rocket Money’s Bill Negotiation Effective?

Rocket Money’s Bill Negotiation tool lets users lower mobile and cable bills. This is an additional service that costs a percentage of the expected first year’s savings if the negotiation is successful.

How Much Does Rocket Money Cost?

Rocket Money charges differently. The software is free to download and has basic functions. Subscriptions are needed for premium features. Users can pay $36 annually (equal to $3 per month) or $5–$12 per month. Features are the same across pricing tiers.