High-risk Merchant Account High-riskpay.com: All You Need To Know About It

- 1 What Is High-risk Merchant Account High-riskpay.com?

- 1.1 What are high-risk merchant accounts? High-riskpay.com payment processors?

- 1.2 Why Are High-Risk Pay.com Accounts Necessary for Merchants?

- 1.3 How To Open High-risk Merchant Account High-riskpay.com?

- 1.4 Is High-risk Merchant Account High-riskpay.com Required?

- 1.5 High-risk Merchant Account High-riskpay.com Applications: What Documents Are Required?

- 2 Final Note

- 3 FAQs

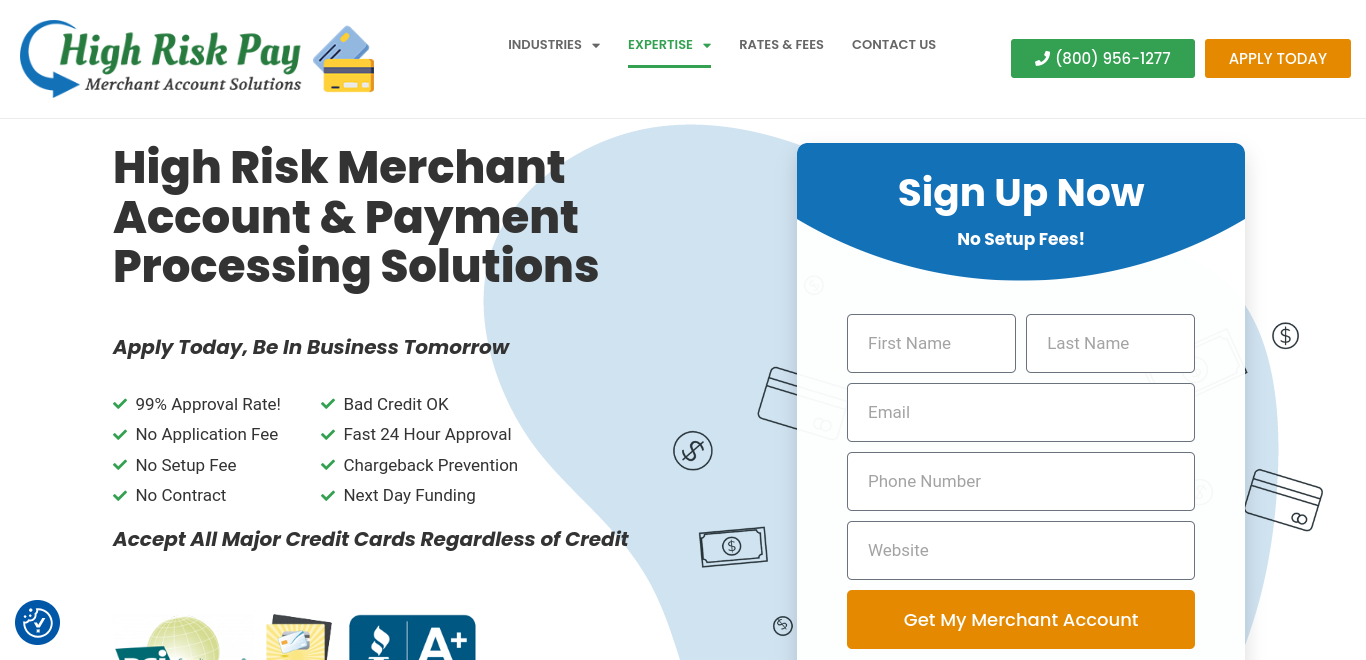

Do you know? High-risk industry business owners may need help locating a dependable payment processor. Highriskpay.com is a leading high-risk merchant account service that allows you to securely and efficiently accept credit cards, debit cards, e-checks, and other payment methods. This article introduces highriskpay.com. Read on to learn about high-risk merchants at highriskpay.com.

What Is High-risk Merchant Account High-riskpay.com?

To take debit and credit card payments, “high-risk” businesses need merchant accounts. High-risk businesses have more chargebacks, fraud, and other issues. However, no central authority or framework in the payments industry establishes business risk indicators. Instead, each bank and payment processor has its criteria. Some payment solution providers advertise that they don’t serve particular sectors. Others need specific business details to assess risk, which can affect their application acceptance. It all depends on a payment processor’s criteria and risk management approach.

What are high-risk merchant accounts? High-riskpay.com payment processors?

High-risk payment processors execute transactions for merchants in high-risk businesses such as adult entertainment, online gaming, and debt relief. Due to their high fraud and chargeback risk, traditional banks and payment processors rarely grant merchant accounts to these companies. High-risk payment processors help merchants reduce business risks by offering fraud prevention, chargeback management, and multi-currency support. They also accept higher risk and have more flexible underwriting requirements, making it easier for high-risk merchants to get a merchant account and start processing payments.

However, high-risk payment processors demand more outstanding fees and have stricter contract terms than ordinary processors. The risk associated with processing payments for merchants deemed high-risk is heightened. Merchants must carefully assess their high-risk payment processor contracts, reputation, and track record. This will ensure the business works with a trustworthy provider that manages risk and streamlines payments.

Why Are High-Risk Pay.com Accounts Necessary for Merchants?

Advantages of high-risk merchant accounts:

- Processing payments is one of the services offered by a high-risk merchant account. High-risk enterprises can accept credit and debit cards.

- Payment processors may close accounts for high-risk businesses, but this account decreases the risk.

- Merchant accounts with high risk have more restrictions. High-risk enterprises can make more transactions with it than with standard merchant accounts.

- High-risk merchant accounts may benefit from bespoke fraud prevention services to reduce fraud and chargebacks.

How To Open High-risk Merchant Account High-riskpay.com?

Chargebacks and fraud are more likely for high-risk retailers. Highriskpay.com processes payments for high-risk merchants. High-risk Merchant Account High-riskpay.com works like this.

- Merchants submit business information to high-risk merchant accounts at high-riskpay.com.

- Highriskpay.com evaluates merchant risk and applications.

- If authorised, the merchant receives a credit card merchant account.

- Merchants accept customer payments after integrating the payment solution into their website or payment procedure.

- Highriskpay.com handles transaction processing, security, and fraud monitoring.

- Merchant accounts get transaction funds.

- High-risk merchants may pay more and have more rigid processing rules.

Is High-risk Merchant Account High-riskpay.com Required?

Merchants in high-risk businesses may face chargebacks and fraud accusations. Highriskpay.com and other high-risk payments offer high-risk merchant accounts. Online gambling, adult entertainment, travel agencies, and some e-commerce are high-risk. Due to chargebacks and fraud, high-risk firms may have trouble getting a merchant account with their bank or payment processor. High-risk pay.com merchants may need help collecting customer payments, restricting their growth and success.

High-risk Merchant Account High-riskpay.com Applications: What Documents Are Required?

High-risk merchant highriskpay.com accounts require the following documents:

- Valid driving licence

- Insurance proof

- ATM/drive-through PIN—a secret answer.

- These should not include name, address, or SSN.

- If there is only one owner, this clause can be waived.

- Business Registration Information: Includes:

- Articles of incorporation

- Contracts of partnership

- Limited liability company articles

- Documents proving the firm is operating, and you can perform financial transactions

Final Note

High-risk Merchant Account High-riskpay.com offers trustworthy and cheap high-risk merchant accounts. Businesses considered high-risk by banks and other financial institutions can get merchant accounts and payment processing from Highriskpay.com. Visit highriskpay.com today to sign up for a free account and see how it may help your high-risk business prosper. Ask their 24/7 customer care team for help. Highriskpay.com is the best high-risk merchant account provider.

FAQs

What is a High-risk Merchant Account High-riskpay.com?

High-risk merchant accounts are for high-risk enterprises. These businesses will likely experience chargebacks, fraud, and other financial risks. Such accounts must accept credit and debit cards for high-risk enterprises.

What industries are high-risk?

Specific sectors are high-risk due to their nature. CBD goods, e-cigarettes, vape items, stun guns, credit repair, multi-level marketing, adult products/services, pawnshops, dietary supplements, SEO services, and tech assistance are examples.

Who classifies high-risk businesses?

No one authority classifies businesses as high-risk. Each payment processor and bank establishes its requirements based on internal risk management. Providers evaluate organisations based on specific information to determine risk.

What makes merchant accounts risky?

Being a new business, having weak credit, working in contentious or highly regulated areas, relying substantially on overseas sales, and having previous payment processor MATCH list placements make a business high-risk.