What Assets Are Included in a Family Law Property Settlement?

- 0.1 What is a Property Settlement Under Australian Family Law?

- 0.1.1 Legal Basis

- 0.1.2 Who Can Apply

- 0.1.3 Typical Outcomes

- 0.2 Types of Assets Commonly Included

- 0.3 Real Property

- 0.3.1 Bank Accounts and Cash Holdings

- 0.3.2 Superannuation

- 0.4 Business Interests and Shares

- 0.4.1 Personal Property

- 0.4.2 Debts and Liabilities

- 0.5 Assets Commonly Contested or Overlooked

- 0.6 Trusts and Company Structures

- 0.6.1 Offshore Assets and Hidden Funds

- 0.6.2 Intermingled Inheritances and Gifts

- 0.6.3 Superannuation Complexities

- 0.7 Valuation and Evidence

- 0.7.1 Valuation Methods

- 0.7.2 Documents to Gather

- 0.7.3 Role of Experts

- 0.8 How Assets Are Divided in Practice

- 0.9 Practical Steps to Prepare for Settlement

- 1 Conclusion

- Property settlements include all assets and liabilities, regardless of ownership or when they were acquired.

- Superannuation is treated as property and can be split between parties

- Business interests, trusts, and overseas assets must be properly disclosed and valued

- Both financial and non-financial contributions are considered when dividing assets

- Time limits apply: 12 months after divorce finalisation for married couples and 2 years after separation for de facto relationships

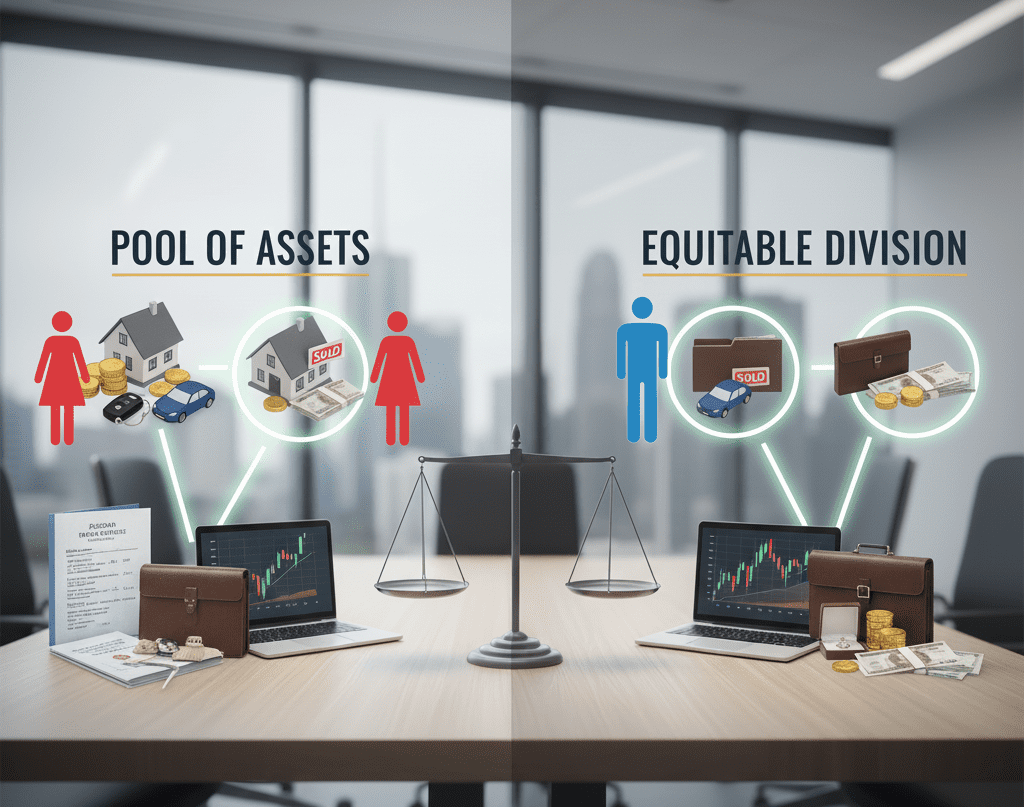

Going through a separation can be challenging, especially when it comes to dividing assets. Understanding which possessions and financial interests form part of your property settlement is a critical first step toward achieving a fair outcome. When faced with property division matters, seeking advice from property settlement lawyers in Brisbane can help clarify your rights and obligations under Australian law.

What is a Property Settlement Under Australian Family Law?

Legal Basis

The Family Law Act 1975 provides the framework for how property is divided after a relationship breakdown. The court follows a four-step approach: identifying and valuing all assets and liabilities, assessing contributions made by each party, considering future needs factors, and determining whether the proposed division is just and equitable.

Who Can Apply

Both married couples and de facto partners (including same-sex couples) can apply for property settlement. Married couples must apply within 12 months of divorce finalisation, while de facto partners have 2 years from the date of separation to commence proceedings.

Typical Outcomes

Most property matters are resolved through consent orders (agreements approved by the court) or binding financial agreements without going to trial. When parties cannot agree, the court will make orders based on the factors outlined in the Family Law Act.

Types of Assets Commonly Included

Real Property

The family home is typically the largest asset in most settlements, along with any investment properties or land holdings. Both the equity (market value minus mortgage) and any related debts are considered part of the property pool.

Bank Accounts and Cash Holdings

All financial accounts – joint or individually held – form part of the property pool. This includes everyday transaction accounts, savings accounts, term deposits, and cash holdings.

Superannuation

Super is treated as property under family law, though it exists in a separate category from other assets. It can be split between parties or offset against other assets depending on circumstances. Special valuation rules apply, particularly for defined benefit funds.

Business Interests and Shares

Ownership interests in businesses (sole trader operations, partnerships, companies), shares, investments, and intellectual property rights all form part of the property pool. Business valuation often requires expert assessment to determine fair market value.

Personal Property

Vehicles, furniture, jewellery, artwork, collections, and other household items are included. While some items may have significant financial value requiring formal valuation, many personal possessions are divided by agreement based on sentiment or practicality.

Debts and Liabilities

All debts are considered when calculating the net asset pool, including mortgages, personal loans, credit cards, tax liabilities, and family loans. The court generally takes the approach that debts incurred jointly are joint responsibilities.

“Property settlements require full financial disclosure from both parties – attempting to hide assets can result in serious consequences, including costs orders and potential criminal charges.” – Avokah Lega.l

Assets Commonly Contested or Overlooked

Trusts and Company Structures

Family trusts and corporate entities can complicate property settlements. The court looks beyond legal ownership to examine control and benefit. Trust assets may be included if a party effectively controls the trust or is a beneficiary.

Offshore Assets and Hidden Funds

Assets held internationally must be disclosed and valued. Both parties have a duty of full and frank disclosure. Red flags for hidden assets include unexplained cash withdrawals, sudden business downturns, or transfers to third parties.

Intermingled Inheritances and Gifts

Inheritances and gifts received before or during the relationship are generally included in the asset pool. However, the court may give weight to this contribution when considering how assets should be divided, especially for recent inheritances.

Superannuation Complexities

Superannuation splitting involves technical, legal, and financial considerations. The value date, required documentation (such as actuarial certificates for some funds), and implementation of splits all require careful handling.

Valuation and Evidence

Valuation Methods

Assets are generally valued at current market value as at the date of settlement. Parties may agree on values or require formal valuations from qualified experts for significant or complex assets.

Documents to Gather

Useful documents include property titles, loan statements, bank statements, tax returns, business financial records, superannuation statements, and vehicle registrations. These provide evidence of ownership, value, and financial history.

Role of Experts

Expert valuers often assist with complex assets. Forensic accountants may trace financial transactions, property valuers assess real estate, business valuers determine company worth, and actuaries value complex superannuation interests.

How Assets Are Divided in Practice

Step-by-Step Assessment

The court follows a methodical approach: identifying and valuing all assets and liabilities, assessing contributions (both financial and non-financial), considering future needs factors, and determining if the outcome is just and equitable.

Contributions Considered

The court weighs direct financial contributions (income, property brought into the relationship), indirect financial contributions (gifts from family), and non-financial contributions (homemaking, parenting, and property improvements).

Consideration of Future Needs

Factors affecting future economic circumstances include age, health, income capacity, care of children, and financial resources. These may justify an adjustment to recognise practical realities facing each party after separation.

Practical Steps to Prepare for Settlement

When preparing for property settlement, gather all financial documents, consider obtaining professional valuations for significant assets, and explore mediation before litigation. Be prepared to disclose all financial information honestly and completely.

The court takes a dim view of parties who attempt to hide assets or undervalue their holdings. Consequences can include adverse findings, unfavourable property divisions, and potential legal penalties.

In cases involving complex asset structures or high-conflict situations, early legal advice is particularly valuable. Professional guidance helps protect your interests and ensures all relevant assets are properly considered.

Conclusion

Property settlements involve identifying, valuing, and fairly dividing all assets and liabilities accumulated during and sometimes before a relationship. From the family home to superannuation, business interests, and personal belongings, a thorough assessment creates the foundation for fair outcomes.

For those facing separation, gathering financial documentation and seeking professional guidance are practical first steps. Avokah Legal recommends focusing on cooperative approaches where possible, as negotiated settlements typically save time, money, and emotional strain compared to lengthy court battles.

Remember that each relationship involves unique financial circumstances, and family law provides flexibility to address individual situations rather than imposing a one-size-fits-all formula.