Is SGX:C6L (Singapore Airlines) Still a Good Buy in 2026?

- 1 Recent Scores and Stock Performance

- 1.1 What is Singapore Airlines (SGX: C6L)?

- 1.2 Is Singapore Airlines (SGX: C6L) Still Cheap?

- 1.3 Is SGX: C6L Growing?

- 1.3.1 Here’s why:

- 1.4 What does it mean for Shareholders?

- 1.5 What This Means for Would-Be Investors

- 1.6 Comparative Table: SGX: C6L vs Peers (Simplified)

- 1.7 Key Considerations Before Buying SGX: C6L

- 1.8 Is SGX: C6L a Long-Term Buy?

- 1.9 Final Judgment: Buy, Hold, or Wait?

- 2 Bottom Line

Singapore Airlines Limited (SGX: C6L) is a premium carrier with a prominent regional presence. In the last several months, the shares of SGX: C6L rose by double digits, which was quite a feat, taking into consideration the renewed market interest. But the big question is whether Singapore Airlines is still a buy in 2026?

Let’s take a look at the valuation, growth prospects, and investment thesis for SGX: C6L.

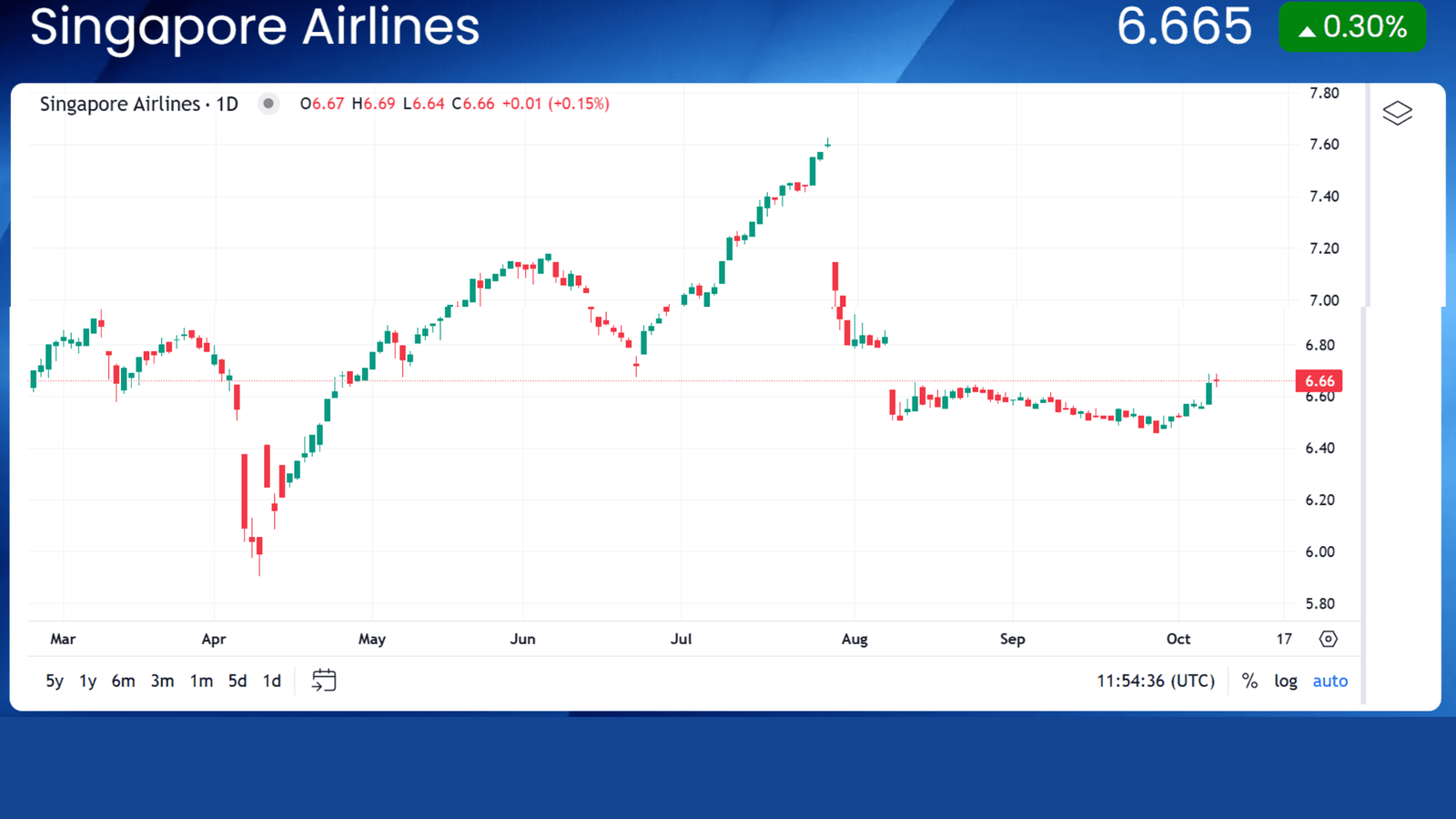

Recent Scores and Stock Performance

- Share price has been up more than 10% last few months

- Trading just under the industry average PE ratio (8.86x vs 10.1x)

- Low market beta (low volatility in the market), good stock price, and Good bump/risk ratio.

While investors may like the gains, there are still highs for Twitter that haven’t been reached for the year. That would imply there is still room for short-term gains, but what about in the long term?

What is Singapore Airlines (SGX: C6L)?

Singapore Airlines Limited (SGX: C6L) operates as the flag carrier for Singapore and is the world’s most awarded airline for more than 60 years, with a commitment to service and innovation. With the stock code C6L on the Singapore Exchange, the Group has an international network spanning across Asia, Europe, and North America.

It operates full-service passenger and cargo flights through Singapore Airlines and its regional and budget units, including Scoot. Supported by the government of Singapore, it has a sound financial footing. The reputation of the safety and quality of the airline and recognition of its world-class yet personalized customer service are vital for its place in the global aviation industry.

Is Singapore Airlines (SGX: C6L) Still Cheap?

Valuation is a crucial part of any investment decision. So is Singapore Airlines undervalued? Not exactly. While the stock is trading below the industry’s average PE ratio, the difference isn’t significant. At 8.86x compared to an industry average of 10.1x, it suggests the stock is priced fairly. It may not be a bargain, but it’s not overvalued either.

Here’s what the current PE ratio indicates:

- You’re paying a slightly lower price for each dollar of earnings compared to peers.

- It offers reasonable value, not expensive, not dirt cheap.

However, the company’s low beta signals less volatility. That means SGX: C6L won’t swing drastically with the market, making it a stable—but possibly less opportunistic-buy.

Is SGX: C6L Growing?

That is what typically drives the decisions to invest. But the picture with Singapore Airlines is a bit more nuanced.

Here’s why:

- Analysts expect earnings growth to be negative in the upcoming years.

- Recovery remains at risk from economic and travel uncertainties.

- Operational expenses could increase due to global inflation and higher fuel costs.

These indicators show that the airline industry’s recovery after COVID is losing momentum. For investors hoping for growth, the short to medium term could be disappointing.

What does it mean for Shareholders?

If you already own SGX: C6L, you may want to know:

- The stock isn’t massively undervalued, so the upside potential here is not rapid.

- The negative growth prediction implies risk.

- If you’re risk-averse, you might want to rebalance your portfolio.

But if you’re holding for the long term and have faith in the eventual recovery of the aviation sector, SGX: C6L can still be a core defensive play.

What This Means for Would-Be Investors

Thinking of buying SGX: C6L? Timing is everything. At present, it is not trading at a big enough discount to justify rushing in with a purchase. Here’s why:

- No serious mispricing to exploit.

- The growth picture is also weak, which adds to the risk.

If you’re a value investor, smack the stock on your watchlist. Wait for a pullback, especially if the price falls well below the industry averageP/P/EE ratio. That’s when it could be a real bargain.

Comparative Table: SGX: C6L vs Peers (Simplified)

| Metric | SGX: C6L | Industry Average |

| PE Ratio | 8.86x | 10.1x |

| Beta (Volatility) | Low | Medium |

| Earnings Forecast (3 yrs) | Negative | Positive |

| Share Price Stability | High | Variable |

Key Considerations Before Buying SGX: C6L

Pros:

- A bit undervalued per P/E ratio

- Adhesive price action on low beta

- Strong brand and international presence

- State support and government backing

Cons:

- Forecasted earnings decline

- Soft near-term growth prospects

- Increased costs of fuel and risk of operation

- Market recovery uncertainty

Is SGX: C6L a Long-Term Buy?

If you are an investor with a long-term view, there might be something that is still attractive about Singapore Airlines, such as:

- Solid balance sheet and cash flow provisions

- Brand value and customer loyalty

- Backed by the Singapore government

- For a short-term trader, the fall in near-term earnings and the absence of an undervaluation also imply that you can do better elsewhere.

The best bet is to track the stock and wait for a substantial pullback or change in growth outlook to enter.

Final Judgment: Buy, Hold, or Wait?

Current investors: If there’s a slowdown, then not just funky stocks will get hit: Consider just holding if you have a sufficiently long-term perspective, but calibrate how much risk you are taking in your portfolio. SGX: C6L is priced right, but it’s not a screaming buy. The stock’s upside depends on the industry’s return to pre-pandemic levels — and that’s likely to take longer than the market expects.

Bottom Line

Singapore Airlines (SGX: C6L) is a premium brand in a tough market. The stock is stable and slightly undervalued, but not a bargain. Growth looks limited in the near term. Long-term investors with patience may consider holding or waiting for a better entry point.

Tip: Watch SGX: C6L’s earnings reports and industry trends. These will be key indicators for future stock movement.

FAQs

Is SGX: C6L undervalued right now?

Not significantly. It has a PE ratio just a hair under the industry average, which indicates it’s fairly priced.

Will the stock of Singapore Airlines increase in the next few months?

Analysts anticipate negative earnings growth in the coming years, so near-term growth appears unlikely.

Is it a safe investment?

The low beta, less volatile compared to many stocks, provides a margin of safety, but not a negative outlook.

When is the right time to purchase SGX: C6L?

Buy if stock price drops well below its industry’s PE, or there’s a good change in earnings outlook.

What are the risks of investing in Singapore Airlines?

Key risks are increased operating costs, geopolitical tensions and unpredictable world travel demand.