- 0.1 Figure out how much money you need

- 0.2 Check your credit score

- 0.3 Compare rates

- 0.4 Complete the application

- 0.5 Wait for approval

- 0.6 Sign the loan agreement

- 0.7 Start enjoying your vacation

Summer is a great time to take a vacation, but if you’re like most people, you may not have the money saved up to cover the cost. If that’s the case, you may be considering taking out a personal loan.

Applying for a personal loan online is a quick and easy process, and can get you the money you need in just a few days. Here are a few tips on how to apply for a personal loan online:

Figure out how much money you need

When applying for a personal loan, it’s important to figure out how much money you need. This will help you determine the right loan amount and term.

Check your credit score

Your credit score is one of the most important factors lenders consider when deciding whether to approve your loan. Make sure to check your credit score before applying so you know where you stand.

Compare rates

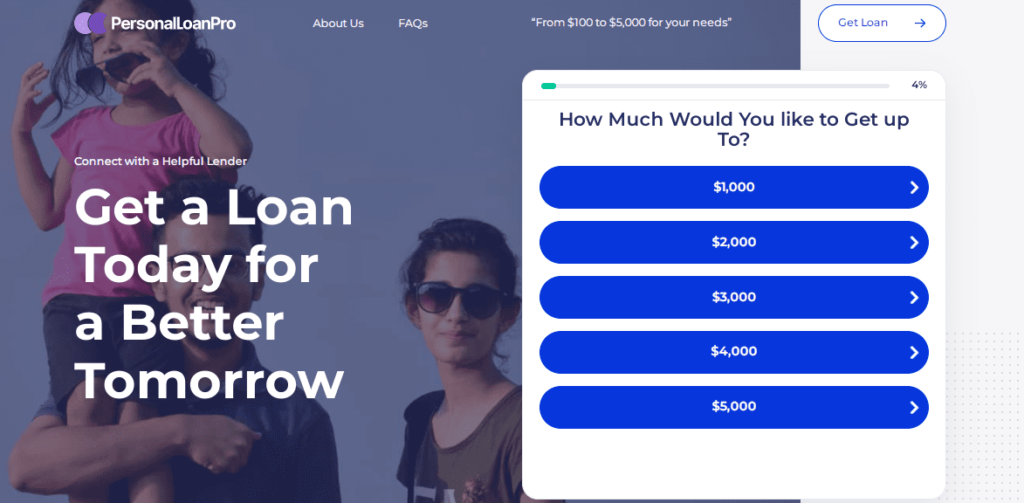

Not all personal loans are created equal. You can compare rates from different lenders at PersonalLoanPro official website to find the best deal of online personal loans.

Complete the application

Once you’ve gathered the information you need, complete the online application. Be sure to provide accurate information and answer all questions honestly.

Wait for approval

Once you submit your application, it will be reviewed by the lender. If approved, you’ll receive a loan offer.

Sign the loan agreement

Once you accept the loan offer, you’ll need to sign the loan agreement. This will finalize the loan agreement and provide the funds to cover your expenses.

Start enjoying your vacation

Now that you have the money you need, you can relax and enjoy your summer vacation.

If you’re considering taking out a personal loan, be sure to follow these tips to make the process easy and stress-free. Getting a personal loan online with the help of Personal Loan Pro is a quick and easy way to get the money you need, so you can enjoy your summer vacation without worrying about the cost.

Are Online Personal Loans Available To Everyone?

There is no doubt that online personal loans are becoming increasingly popular. But are they available to everyone? The answer to this question depends on a number of factors, including your credit score and the lender you choose.

If you have a good credit score, you should be able to find a lender that is willing to offer you a personal loan. However, if you have a poor credit score, your options will be more limited. In fact, you may not be able to find a lender that is willing to offer you a loan at all.

It is important to remember that the interest rate you pay on an online personal loan will be affected by your credit score. The higher your credit score, the lower the interest rate you will likely pay.

So, are online personal loans available to everyone? The answer is no, but they are available to most people. If you have a good credit score, you should be able to find a lender that is willing to offer you a loan. If you have a poor credit score, your options will be more limited. But you can learn more about online personal loans and find a lender willing to offer personal loans for a bad credit score.

What Is The Importance Of Getting Personal Loans Online?

One of the biggest decisions you’ll have to make is whether to get a loan from a bank or credit union, or whether to get a personal loan online.

There are a lot of benefits to getting a personal loan online.

- For one, you can often get a loan faster than you can through a bank or credit union.

- Online lenders also tend to have lower interest rates

- They’re more likely to offer you a loan if you have a less-than-perfect credit score.

- Another big benefit of getting a personal loan online is that you can shop around or can compare rates at Personal Loan Pro for the best rate. By comparison, when you go through a bank or credit union, you’re typically limited to the loans they offer.

So, if you’re thinking about getting a personal loan, it’s worth considering getting one online. You’ll likely get a better interest rate, and you’ll have more flexibility in terms of the loans you can apply for.

Other Alternatives Of Online Personal Loans

Online personal loans are becoming a popular way for people to get the money they need for a variety of reasons. But what if you don’t want to, or can’t, get a loan from a bank or other lending institution?

Loan From A Family Member Or Friend

One option is to get a loan from a family member or friend. This can be a risky move, as you could wind up in a lot of debt if you can’t pay it back. But if you have a good relationship with the person you’re borrowing from, and you can come up with a repayment plan that works for both of you, it can be a good option.

Peer-To-Peer Lending Site

Another option is to use a peer-to-peer lending site. These sites allow you to borrow money from individual investors. This can be a good option if you have a good credit score, as you’ll likely get a lower interest rate than you would from a bank.

Credit Card Cash Advance

You could also try a credit card cash advance. This is a good option if you need a small amount of money quickly. However, you’ll likely have to pay a higher interest rate on the cash advance than you would on a traditional loan.

Personal Loan From A Private Company

Finally, you could try a personal loan from a private company. These loans can be a good option if you have bad credit, as you may be able to get a loan with a higher interest rate than you would from a bank. However, be sure to read the terms and conditions carefully before you apply, as some of these loans can have high fees and penalties.

No matter which option you choose, be sure to do your research and compare interest rates and fees at Personal Loan Pro before you apply. By thinking outside the box, you can find the perfect personal loan for your needs.