The Best Personal Finance and Budgeting Apps for 2026

In 2026, managing your finances goes far beyond just checking your bank account. It’s about being able to see in real-time where your money is going, knowing your cash flow, handling debt, and planning for the future. Whether you’re replacing an app or trying personal finance management for the first time, a great budgeting app can make your finances easier to manage. Some of the best apps now offer a variety of advanced — if not downright elaborate — tools for everything from automating your budget to tracking your investment portfolio, allowing you to make the most informed financial decisions possible today.

We’ve tested all sorts of tools, but we think these are the best apps out there that help you track and manage your finances with ease, security, extra features, and depth where you need it. If you’re new to budgeting or are a more experienced user with complex financial needs, there’s a personal finance app here for everyone.

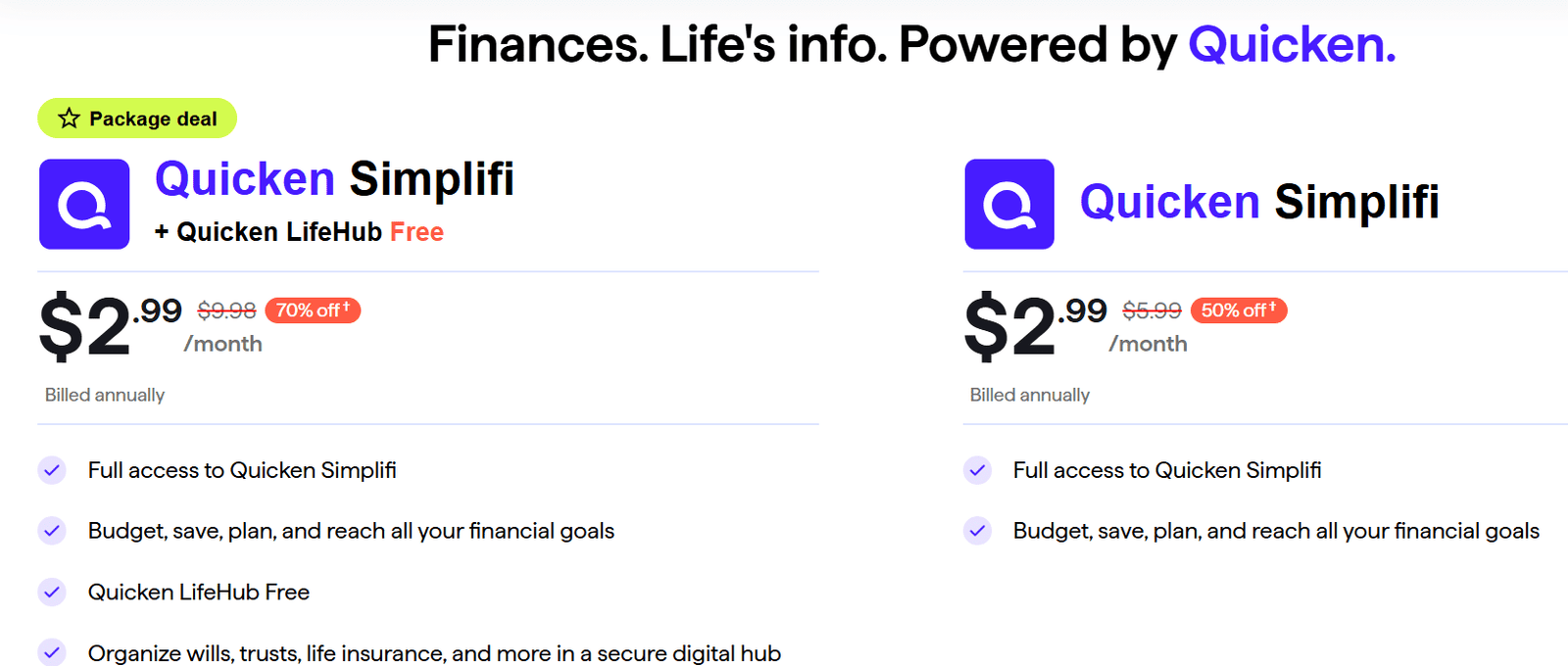

Best Overall: Simplifi by Quicken

Rating: 4.5/5

Rating: 4.5/5

Best For: Everyday budgeting and expense tracking

Pricing: Starts at $2.99/month

Simplifi offers an almost perfect blend of ease of use and powerful financial tools. Using a beautiful visual dashboard and intelligent automation, users can easily monitor their income, categorise expenses, and create savings goals. It easily links to multiple bank accounts and credit cards to see all your finances in one place. Simplifi’s reporting features enable you to drill down into your monthly spending patterns and long-term financial well-being. It’s suitable for people who wish to track every penny spent and make data-driven predictions, but who also need to avoid the learning curve of larger packages.

Pros:

- Excellent transaction categorisation

- Real-time syncing and alerts

- Visual budgeting goals and custom watchlists

Cons:

- Savings goals not tied to live bank balances

- Requires subscription

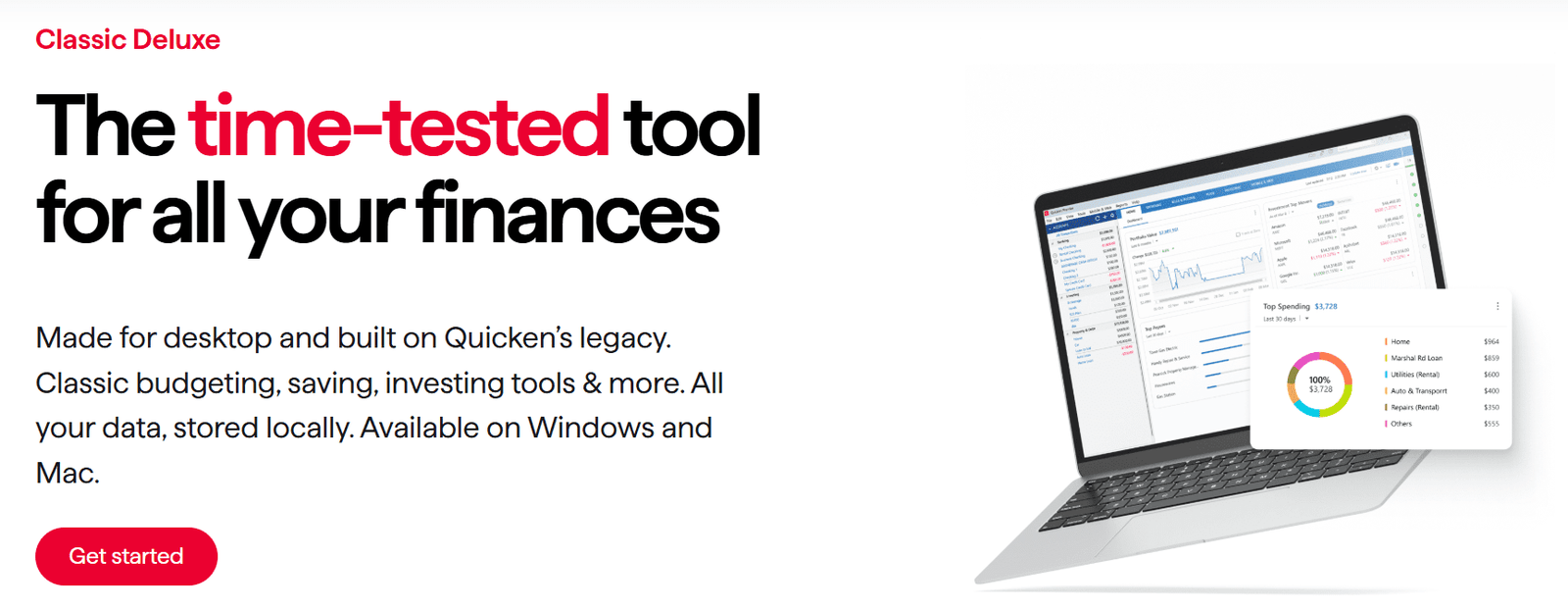

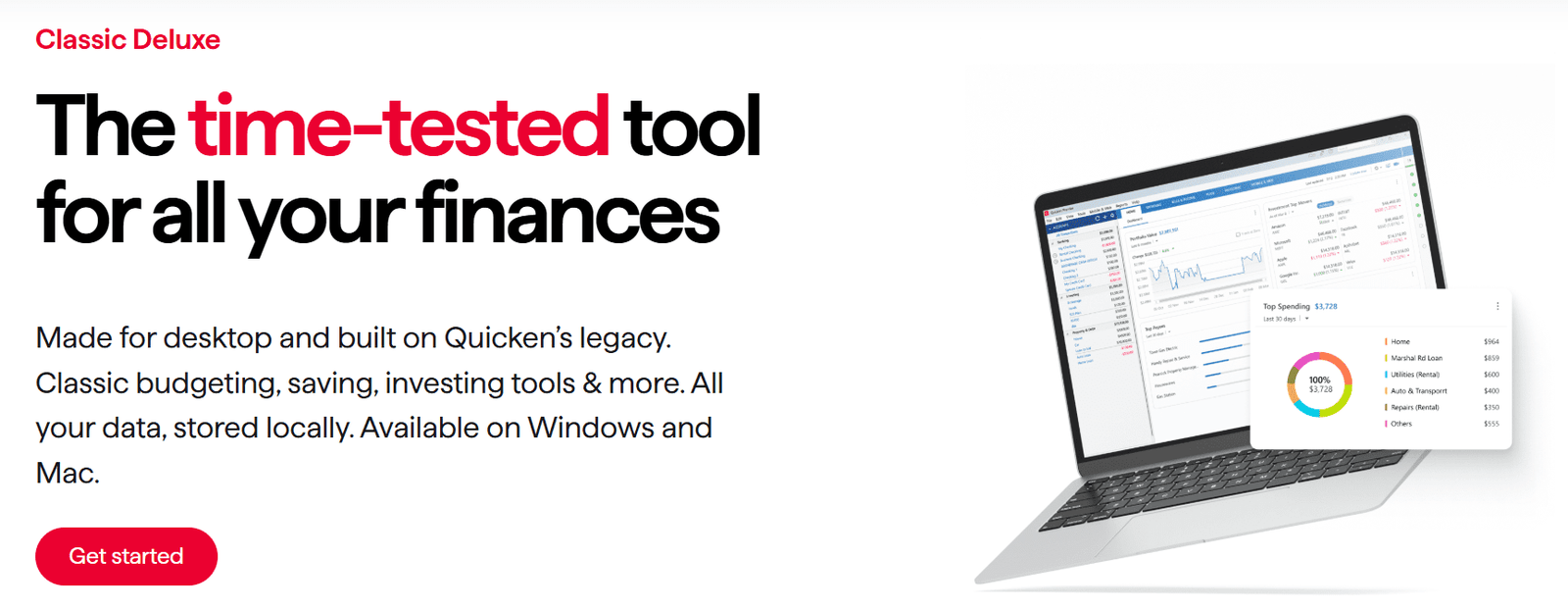

Best for Power Users: Quicken Classic

Rating: 4.5/5

Best For: Users who need comprehensive, desktop-based finance tracking

Pricing: Up to 50% off, starting at $2.99/month

Quicken Classic is back, with power under the hood, for those who want to take control of every aspect of their financial life. From budgeting to tracking investments, Quicken sets the gold standard in personal finance software. Its desktop interface does everything from mortgage tracking to tax prep. Its interface and lack of mobile option may feel a bit dated, but its feature set, particularly for those with slightly more complex financial lives, is on point.

Pros:

- Detailed transaction and investment tracking

- Strong reporting capabilities

- Suitable for long-term financial planning

Cons:

- Primarily desktop-based

- The interface can be overwhelming for beginners

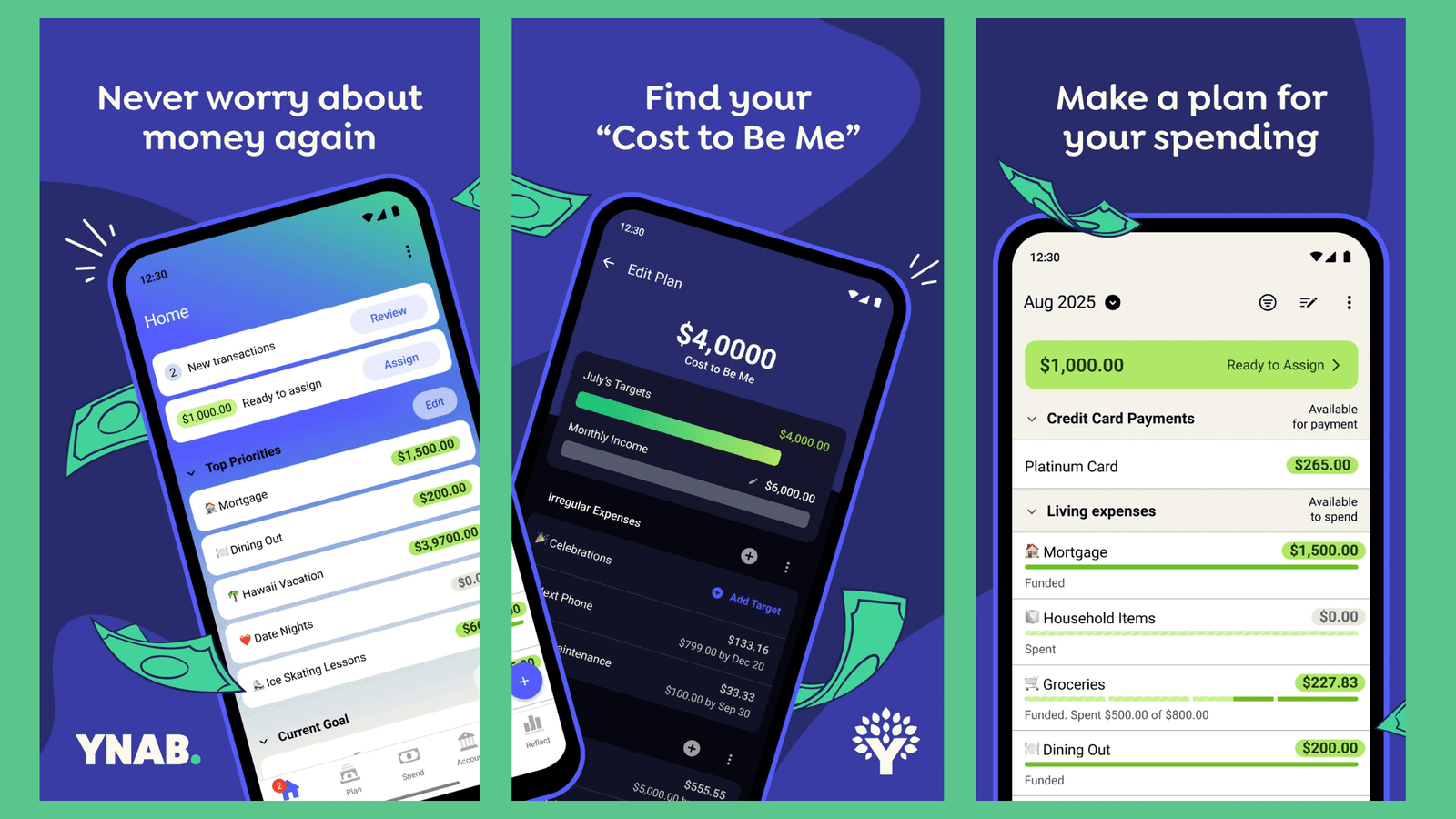

Best for New Budgeters: YNAB (You Need a Budget)

Rating: 4.0/5

Best For: Those looking to gain control over spending and build financial discipline

Pricing: $14.99/month

YNAB’s methodology is built on zero-based budgeting – give every dollar a job! It’s designed to rewire how its users think about money, with an emphasis on accountability and planning. Rather than following where cash has already gone, YNAB emphasises assigning income to future expenditures and saving goals. This app isn’t for everyone; you need to commit to learning its way of doing things, but if you do, then the result is a whole new perspective on budgeting. Its mobile and desktop editions sync in real-time and allow account sharing among members of the same household.

Pros:

- Powerful budgeting model

- Excellent educational resources

- Multiple-user access

Cons:

- No investment or credit score tools

- Steeper learning curve

Best Free App: NerdWallet

Rating: 4.0/5

Best For: Users looking for financial tracking and credit monitoring at no cost

Pricing: Free

NerdWallet offers a robust suite of free tools, including account linking, expense tracking, and credit score monitoring. It provides users with a window into their net worth, monthly spending, and cash flow, all without charging a subscription fee. It also includes a plethora of educational materials to help users trade more intelligently. But it’s missing some of the budgeting options and detailed transaction views that other apps offer behind paywalls.

Pros:

- Free to use

- Credit score tracking

- Financial product comparisons

Cons:

- Limited customisation

- Less robust reporting

Best for Debt Management: Rocket Money

Rating: 4.0/5

Best For: Managing subscriptions and reducing debt

Pricing: Starts at $48/year

Rocket Money (formerly Truebill) has built its business on helping you get a handle on your monthly bills and recurring subscriptions. It links up to your bank accounts, finds subscriptions you forgot you even signed up for, and even haggles to get your bill lowered for you. For those working to pay down debt, Rocket Money also provides tips on the progress of your credit score and savings goals. It has slick visuals and an easy-to-use interface, and appeals to users under financial stress.

Pros:

- Subscription tracking and cancellation tools

- Credit score and net worth tracking

- Clean, user-friendly interface

Cons:

- Premium features require payment

- Not ideal for investment tracking or in-depth reporting

Conclusion

It’s 2026, and the days of busting out the paper and pen or marathon Excel work sessions to tackle your finances are long gone. The top personal finance apps provide real-time tracking of transactions, in-depth reports, and insights into how you’re spending your money. If you want a clean, modern experience that strikes the right balance of features, Simplifi is the best. So if you’re a control freak when it comes to your financial life — investments, retirement, and taxes included — then Quicken Classic is the only way to go. On the other hand, YNAB is the best choice for people who are really looking to turn their budgeting habits on its head.

The best personal finance app for you is going to depend on your needs, whether that is getting out of debt, saving for a big purchase, planning for retirement, or simply getting a grip on your budget. The most important thing is to reliably use whichever tool seems to fit best with your lifestyle, because the right app can deliver the tremendous clarity, discipline, and peace of mind you need to achieve financial success with your own money.

Frequently Asked Questions (FAQs)

What is the best personal finance app for someone who has no idea how to budget?

YNAB is an excellent option for individuals starting from scratch who want to establish healthy financial habits. Its zero-based budgeting method imparts discipline and control.

Can I use these apps for my financial accounts?

Yes. These apps rely on bank-level encryption and utilise third-party services, such as Plaid, to securely connect with your financial institutions. Multi-factor authentication is also frequently used for added security.

What is an app that is 100% free but still useful?

NerdWallet is a good option for individuals who want to track their finances and monitor their credit score without incurring a subscription fee.

Can I invest through any of these apps?

Quicken Classic and Empower provide the most comprehensive investment tracking tools, while Simplifi is the least helpful in this regard.

What app is the best for reducing monthly costs?

This free app, Rocket Money, helps people save money by helping identify and cancel unnecessary subscriptions - great for paying off or consolidating debt, and reducing the budget.