The Big 5 Forex Brokers

In the dynamic world of foreign exchange trading, choosing the right broker can make all the difference between success and failure.

With an overwhelming number of options to choose from, we’ve narrowed it down to the top five Forex brokers in the industry. These brokers are recognized for their robust platforms, exceptional customer service, competitive spreads, and a range of trading instruments.

Let’s delve deeper and explore what each of these market leaders has to offer.

What Does it Mean To Be a Forex Broker?

A Forex broker is a firm or an individual that facilitates the buying and selling of currencies in the foreign exchange market. They act as intermediaries between traders and the interbank market, where currency transactions take place.

Forex brokers provide traders with access to trading platforms, charts, technical indicators, news feeds, and other resources required for successful trading.Now let’s take a look at the top five Forex brokers in the market.

Forex.com

Forex.com is a globally recognized broker with over 20 years of experience in the industry. It offers traders access to over 300 markets, including currencies, commodities, and indices.

The platform boasts advanced charting tools and customizable trading options suitable for both novice and experienced traders. Moreover, Forex.com provides excellent customer support through various channels, including phone and live chat.

eToro

eToro is a popular broker known for its social trading platform, allowing traders to copy the trades of successful investors. If you ask why choose eToro, the answer would be its user-friendly interface, low fees, and access to a variety of markets.

The platform also offers educational resources and analysis tools to help traders make informed decisions. Additionally, eToro is regulated by top-tier financial authorities in Europe and Australia, providing clients with a sense of security for their investments.

IG

IG is a UK-based broker that has been in operation since 1974. It offers traders access to over 17,000 markets, making it one of the largest brokers in the world.

The platform provides traders with advanced charting tools, customizable trading options, and educational resources for beginner traders. It also offers competitive spreads and 24/7 customer support.

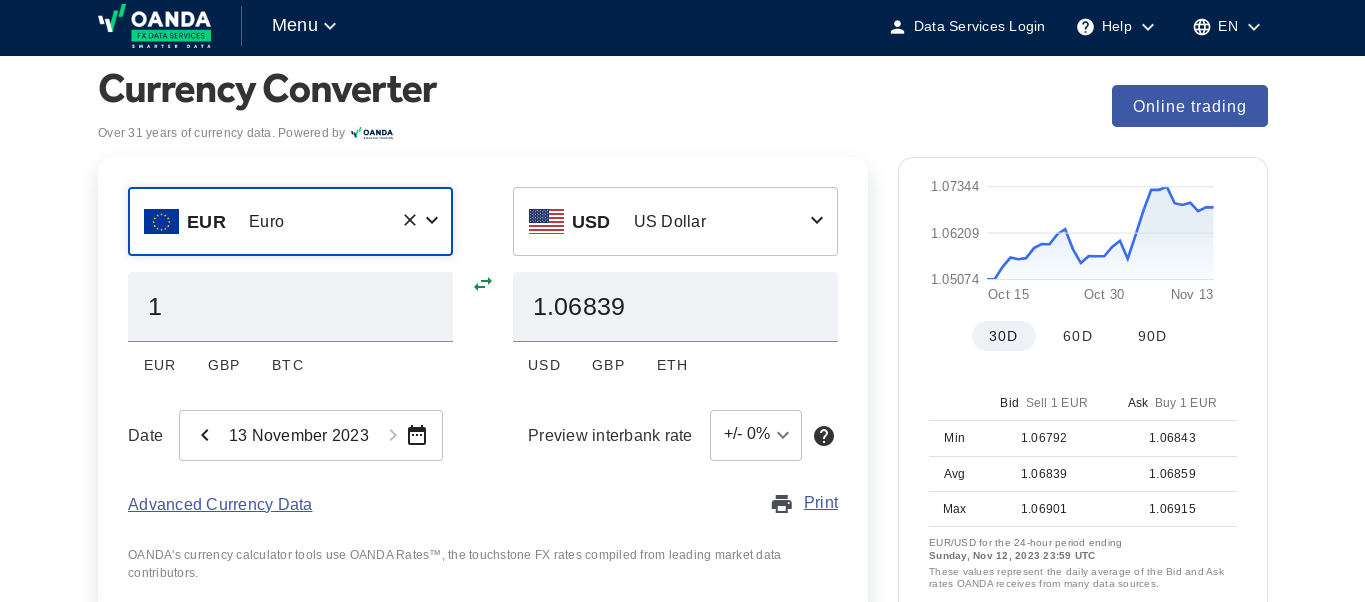

OANDA

OANDA has been in the Forex market for over two decades, making it one of the most trusted brokers in the industry.

It offers traders access to a wide range of instruments, including forex, commodities, crypto, bonds, and indices. The platform is known for its user-friendly interface and powerful analytical tools, making it an excellent choice for technical traders. OANDA also has 24/7 customer support available through live chat, email, and phone.

CMC Markets

With over 30 years of experience in the industry, CMC Markets is a well-established broker known for its competitive spreads and advanced trading platforms. It offers traders access to over 9,000 instruments and provides a wide range of educational resources for traders of all levels.

The platform also has excellent customer support available through various channels, including email, live chat, and phone. Additionally, CMC Markets is regulated by top-tier financial authorities, ensuring the safety of its clients’ funds.

Brokers vs. Trading Platforms

It is essential to understand the difference between a broker and a trading platform. While brokers act as intermediaries between traders and the market, trading platforms are software that allows traders to buy and sell assets. Brokers provide access to various markets, while trading platforms offer tools for analyzing market data, executing trades, and managing positions.

In some cases, brokers may have their trading platform, while in others, traders can choose from a list of supported platforms. However, it is crucial to ensure that the chosen broker and trading platform are reputable and regulated by trustworthy financial authorities. This ensures the safety of funds and fair-trading practices for all traders.

Choosing the Right Broker and Trading Platform

Choosing the right broker and trading platform is a crucial decision for any trader. Some factors to consider when making this choice include the broker’s reputation, trading fees and commissions, available markets and instruments, customer support, and the user-friendliness of the platform.

Traders should also research the broker’s regulatory status and check for any negative reviews or red flags before opening an account.Additionally, testing out demo accounts and comparing different brokers can help traders make an informed decision.

Conclusion

In conclusion, both brokers and trading platforms play essential roles in the trading process, and it is crucial to choose reputable and regulated providers. With excellent customer support available through various channels, traders can ensure a smooth trading experience.

By considering the factors mentioned above, traders can choose the right broker and platform that best suits their trading needs and preferences. So, it is imperative to do thorough research before making any decisions and to constantly review and assess the chosen broker and platform for optimal trading performance.