The Impact of Bitcoin Halving on the Market

- 1 How Does Halving Work?

- 2 History of Bitcoin Halvings

- 2.1 Halving in 2012

- 2.2 Halving in 2016

- 2.3 Halving in 2020

- 3 2024 Bitcoin Halving: Possible Scenarios

- 4 Conclusion

- 4.1 FAQs:

- 4.1.1 What is Bitcoin halving?

- 4.1.2 Why does Bitcoin halving occur?

- 4.1.3 How does Bitcoin halving affect miners?

- 4.1.4 What is the impact of Bitcoin halving on the price?

- 4.1.5 How many Bitcoin halvings have occurred?

- 4.1.6 When is the next Bitcoin halving expected?

- 4.1.7 What is the significance of Bitcoin halving for investors?

- 4.1.8 Should I invest in Bitcoin before the halving?

- 4.1.9 Can Bitcoin halving lead to price crashes?

- 4.1.10 What factors should I consider before investing in Bitcoin around halving?

- Bitcoin halving reduces the reward for miners, decreasing the rate of new Bitcoin issuance and making existing BTC more scarce.

- Historically, Bitcoin halvings have led to increased demand and higher prices for Bitcoin.

- The 2024 Bitcoin halving is expected to decrease the supply of new coins further, potentially impacting the price positively, but outcomes remain uncertain due to various market factors.

Bitcoin halving is a key event in the Bitcoin economy. A decrease in the number of new Bitcoins added to the circulation results in less Bitcoin inflation. This also means that miners receive fewer Bitcoins for their efforts, which can affect their profitability.

Reducing the supply of Bitcoin through halving can impact miners and the price of Bitcoin, but it can also result in an increased demand for existing Bitcoins, leading to a higher price. The limited availability of new Bitcoins in circulation makes the existing BTC more scarce, which can drive up their value.

In this article, we analyzed the impact of Bitcoin halving on the market.

How Does Halving Work?

Halving is a process built into the Bitcoin protocol to reduce the reward that miners receive for mining new blocks. The halving occurs every 210,000 blocks.

The miners’ rewards are cut in half. If they receive 50 BTC per block before halving, they get 25 BTC after halving. This is necessary to limit the total number of Bitcoins that can be put into circulation. Bitcoin issuance is capped at 21 million coins.

Halving is intended to combat inflation. As miners’ pay decreases, fewer new Bitcoins are issued. This keeps BTC scarce in the market and has a positive effect on price in terms of the law of supply and demand.

History of Bitcoin Halvings

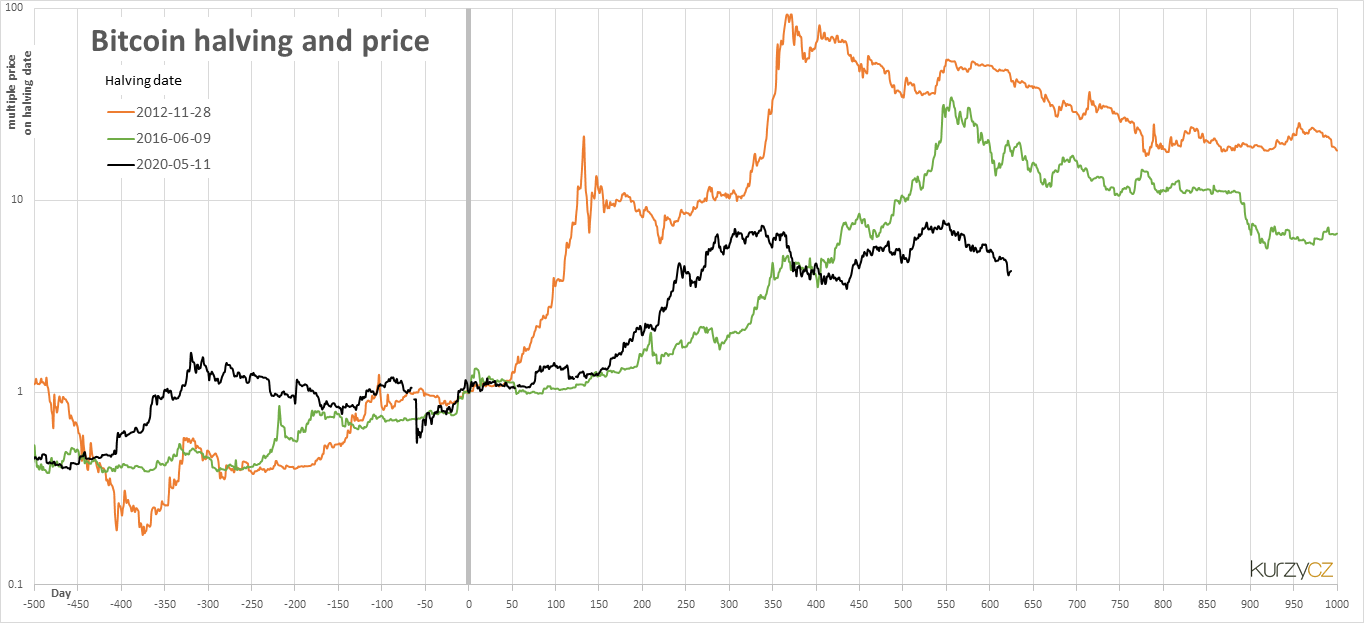

BTC halving has a global impact on the cryptocurrency market. There were already three Bitcoin halves in 2012, 2016, and 2020. Let us take a closer look at each of these epochal events for the crypto world, as well as the impact of halving on BTC price dynamics.

Halving in 2012

The first Bitcoin halving took place on November 28, 2012, on block number 210,000. At that time, miners’ reward for mining a block was 50 BTC. However, according to the rules laid out in the protocol, this was halved to 25 BTC.

This was an important milestone in the history of Bitcoin and the crypto industry as a whole. In 2012, Bitcoin had already begun to attract the attention of investors, and halving it marked the transition of cryptocurrency into a new phase of development.

From an economic perspective, the reduction in the issuance of new coins doubled the scarcity of Bitcoin in the market. This fuelled an explosive growth in its value after halving. While Bitcoin was worth around $12 before the first ‘halving’, a year later, by December 2013, its price had soared to a then-historic high of $1150.

Halving in 2016

Bitcoin’s second halving occurred on July 9, 2016, at a level of 420,000 blocks. According to the protocol rules, the reward for miners was halved again from 25 BTC to 12.5 BTC for each new block.

By this time, Bitcoin had firmly established itself as a leader in the crypto market, attracting the attention of major investors around the world. Therefore, it isn’t easy to overstate the significance of the 2016 halving of the industry.

Following the reduction in new coin issuances, the price of BTC resumed its upward trajectory. Despite some instability, Bitcoin broke through the $1000 mark at the beginning of 2017. By the end of the year, it had reached a new all-time high of almost $20,000 per BTC on December 18.

Halving in 2020

The third halving of Bitcoin in history, and the most recent to date, will take place on May 11, 2020, at the 630,000 block. According to the algorithm, the reward for miners was halved again to 6.25 BTC per block.

Bitcoin has firmly established its global popularity and leadership in the cryptocurrency market. Therefore, the 2020 halving was a truly significant event eagerly anticipated by investors and traders worldwide.

In just a few months, the price of BTC skyrocketed from $10,000 to an all-time high of $64,800 in April 2021. Although the price has been corrected due to China’s mining ban, its growth has continued.

It is important to note that halving the price of Bitcoin can have both positive and negative effects. Everything depends on the balance between supply and demand, geopolitical factors, news background, and the general state of the economy. Therefore, it is extremely difficult to make accurate predictions. However, most experts expect BTC price growth to continue over the long term.

2024 Bitcoin Halving: Possible Scenarios

2024 Bitcoin Halving is expected to occur sometime between April 8 and May 18, 2024. The exact date is known to be closer to the event when the blockchain approaches a height of 840,000 blocks.

As before, the reward for miners is reduced. While miners can obtain 6.25 BTC, after the event, they will only receive 3.125 BTC for each new block. This reduces the amount of Bitcoin put into circulation and could have a positive impact on its value.

One of the main reasons for the halving of the price is that the supply of new coins will decrease while the demand remains the same. In addition, some miners may start to reduce the sales of their Bitcoin holdings as their current mining revenues decrease. This supply shortage drives BTC prices higher.

The impending halving of Bitcoin by 2024 is already worrying for many investors and traders. A reasonable question arises: is it time to start buying BTC before the next block reward cut? After all, if historical parallels are anything to go by, the price spike will not be long in the future.

Usually, the tactic of accumulating Bitcoin before halving is logical. After the previous events, the BTC exchange rate went into a breakout, and crypto asset holders made a profit. On the other hand, no one guarantees that this will occur again. However, some analysts are pessimistic about this.

Alternative scenarios may also be possible. For example, most market participants may also start buying Bitcoin in anticipation of halving it. This could lead to overheating and subsequent sharp correction. Therefore, careful analysis of all risks is required before making decisions.

Conclusion

While it is difficult to predict the consequences of halving accurately, one thing is clear: whatever the future market dynamics, this process will have a significant long-term impact on the entire cryptocurrency market. For now, we can only guess how exactly halving Bitcoin 2024 will affect the price of the first cryptocurrency, so we should be careful about speculating on the 100% probability of anything, especially the price of Bitcoin.

We advise you to conduct your research on the market and assets before making investment decisions.

FAQs:

What is Bitcoin halving?

Bitcoin halving is a programmed event in the Bitcoin protocol where the reward for miners is cut in half approximately every four years.

Why does Bitcoin halving occur?

Bitcoin halving is designed to control inflation and ensure a limited supply of Bitcoin by reducing the rate at which new coins are created.

How does Bitcoin halving affect miners?

Bitcoin halving reduces the reward miners receive for validating transactions, potentially impacting their profitability.

What is the impact of Bitcoin halving on the price?

Bitcoin halving historically has led to increased demand and higher prices due to reduced supply and increased scarcity.

How many Bitcoin halvings have occurred?

As of 2024, there have been three Bitcoin halving events: in 2012, 2016, and 2020.

When is the next Bitcoin halving expected?

The next Bitcoin halving is expected to occur in 2024, approximately four years after the previous halving in 2020.

What is the significance of Bitcoin halving for investors?

Bitcoin halving is significant for investors as it affects the supply and demand dynamics, potentially influencing the price of Bitcoin.

Should I invest in Bitcoin before the halving?

Investment decisions should be made based on individual research and risk assessment. Bitcoin halving can impact the price, but outcomes are uncertain.

Can Bitcoin halving lead to price crashes?

While historically Bitcoin halving has resulted in price increases, it’s possible that market dynamics and other factors could lead to price corrections or crashes.

What factors should I consider before investing in Bitcoin around halving?

Factors to consider include market trends, geopolitical events, news background, and the general state of the economy, in addition to the impact of halving on supply and demand dynamics.