Sologenic (SOLO) Price Analysis: Assessing Market Trends and Potential

Cryptocurrency has ushered in a revolutionary era in the realm of financial assets, reshaping conventional markets and capturing the global investment community’s fervent interest. Amidst the diverse array of available cryptocurrencies, Sologenic (SOLO) has stood out prominently, drawing considerable attention due to its innovative approach and the substantial growth prospects it presents. In the forthcoming sections of this article, we will embark on an extensive analysis of Sologenic’s price dynamics, delving into intricate market trends, identifying potential catalysts, and offering a comprehensive perspective on the overall trajectory of this exceptionally promising digital asset. Noteworthy within the cryptocurrency landscape is the profound influence that has left an indelible mark on the sector, further underscoring the transformative nature of digital financial systems. If you’re interested in Bitcoin, it’s essential to know the reasons behind the growing number of Bitcoin investors lately.

Understanding Sologenic (SOLO)

Sologenic (SOLO) is a decentralized finance (DeFi) ecosystem built on the XRP Ledger, leveraging the power of blockchain technology to bridge traditional financial markets with the world of cryptocurrencies. Created by CoinField, Sologenic aims to disrupt the traditional stock market by enabling investors to tokenize real-world assets, such as stocks and ETFs, and trade them on various blockchain networks.

One of the unique features of Sologenic is its innovative mechanism of “Solo Coins” or “SOLO tokens.” These tokens represent ownership of real-world assets and provide users with exposure to traditional financial markets without the need to go through traditional brokers or face lengthy settlement periods.

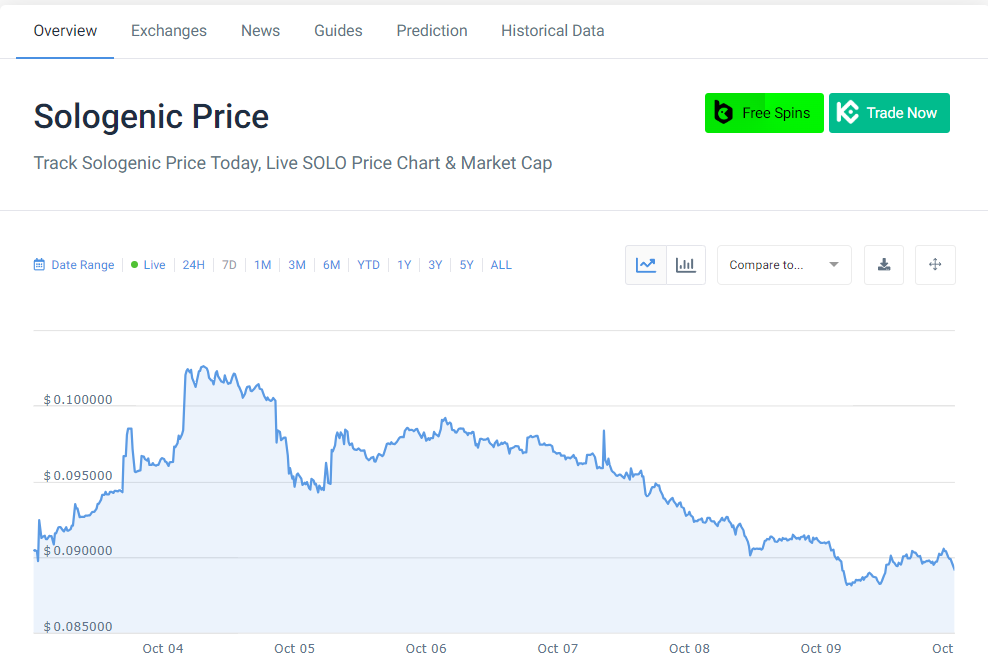

Price History and Performance

To understand the potential of Sologenic, let’s take a closer look at its price history and performance since its inception. Please note that past performance is not indicative of future results, and investing in cryptocurrencies carries inherent risks.

Since its launch, Sologenic has experienced both ups and downs. Like most cryptocurrencies, it faced market volatility, but it has also demonstrated resilience and potential for growth. As the global interest in decentralized finance increases, Sologenic’s unique offering could position it for substantial long-term gains.

Factors Influencing Sologenic’s Price

Several factors can influence the price movements of Sologenic, and it’s essential for investors to keep a close eye on these variables when assessing the cryptocurrency’s potential.

Market Sentiment

Market sentiment plays a significant role in the valuation of any cryptocurrency. Positive developments, partnerships, and news can boost investor confidence, leading to an increase in demand for Sologenic. Conversely, negative news or regulatory concerns may lead to short-term price declines.

Adoption and Use Cases

The widespread adoption of Sologenic in various industries and sectors can have a significant impact on its price. As more businesses integrate Sologenic’s technology into their operations, it could drive demand for the underlying SOLO tokens.

Technological Developments

The continuous improvement of the Sologenic ecosystem and the underlying XRP Ledger can positively influence the price of SOLO tokens. Technological advancements, such as faster transaction times and enhanced security, can attract more investors to the platform.

Market Liquidity

Market liquidity refers to the ease with which an asset can be bought or sold without significantly impacting its price. Higher liquidity levels for Sologenic can attract institutional investors and traders, further contributing to its price stability.

Regulatory Environment

The regulatory landscape for cryptocurrencies is continuously evolving. Clarity and favorable regulations can enhance investor confidence, potentially leading to increased demand for Sologenic tokens.

Overall Market Conditions

Cryptocurrencies, including Sologenic, are not immune to broader market trends. Major market movements in the crypto space can influence the price of SOLO tokens.

Future Potential and Growth Prospects

As the cryptocurrency space evolves, Sologenic’s innovative concept of bridging traditional financial markets with cryptocurrencies positions it for substantial growth. By offering tokenized assets, Sologenic provides investors with a unique opportunity to diversify their portfolios and access previously inaccessible markets.

The growth prospects for Sologenic are also influenced by the broader adoption of decentralized finance. As DeFi continues to gain traction, more investors might turn to Sologenic as a viable investment option.

Risk Factors to Consider

While Sologenic presents exciting prospects, potential investors must also be aware of the risks associated with cryptocurrency investments. Some key risk factors to consider include:

- Market Volatility: Cryptocurrencies are known for their price volatility, and Sologenic is no exception. Investors should be prepared for rapid price fluctuations.

- Regulatory Changes: The regulatory environment for cryptocurrencies is evolving, and changes in regulations can impact Sologenic’s operations and value.

- Technology Risks: While blockchain technology is robust, it is not immune to technical glitches or security breaches.

- Liquidity Concerns: Sologenic’s liquidity may vary, and this can affect the ease of buying or selling SOLO tokens.

Conclusion

In conclusion, Sologenic (SOLO) holds great promise as a disruptive force in the world of decentralized finance. Its unique approach to tokenizing real-world assets and bridging traditional financial markets with cryptocurrencies sets it apart from many other digital assets. As with any investment, it’s crucial for individuals to conduct thorough research and consider their risk tolerance before investing in Sologenic or any other cryptocurrency. While the future looks promising for Sologenic, the market remains unpredictable, and prudent investment decisions should be made with careful consideration of all factors involved.