Why LinkPay Virtual Cards are Your Best Choice in 2025: Secure Online Transactions

- 1 Understanding Virtual Cards

- 2 Introducing LinkPay Virtual Cards

- 2.1 Enhanced Security:

- 2.2 Two-Factor Authentication:

- 2.3 Transaction Limits and Spending Controls:

- 2.4 Convenience and Flexibility

- 2.5 Cost-Effectiveness and Budget Control

- 2.6 Streamlined Online Shopping Experience

- 3 LinkPay Virtual Cards vs. Traditional Payment Methods

- 4 Conclusion

With the increasing prevalence of cyber threats, we must adopt secure payment methods that protect our sensitive data from unauthorized access. This is where virtual cards come into play, revolutionizing how we make online purchases. Among the leading virtual card providers, LinkPay is the best choice for secure online transactions in 2025.

Understanding Virtual Cards

Before we delve into why LinkPay virtual cards are the superior choice, let’s first understand what virtual cards are and how they work. Virtual cards are digital payment instruments that function similarly to physical credit or debit cards but without the tangible form. Virtual cards are generated electronically instead of physically and can be used for online transactions. They are typically linked to your primary bank account or credit card, providing a secure layer of separation between your financial details and online merchants. I

Virtual cards generate a unique card number, expiration date, and security code for each transaction. These details are typically valid for a limited time or single use, adding an extra layer of security against fraud and unauthorized usage. The primary advantage of virtual cards is their enhanced security compared to traditional physical cards.

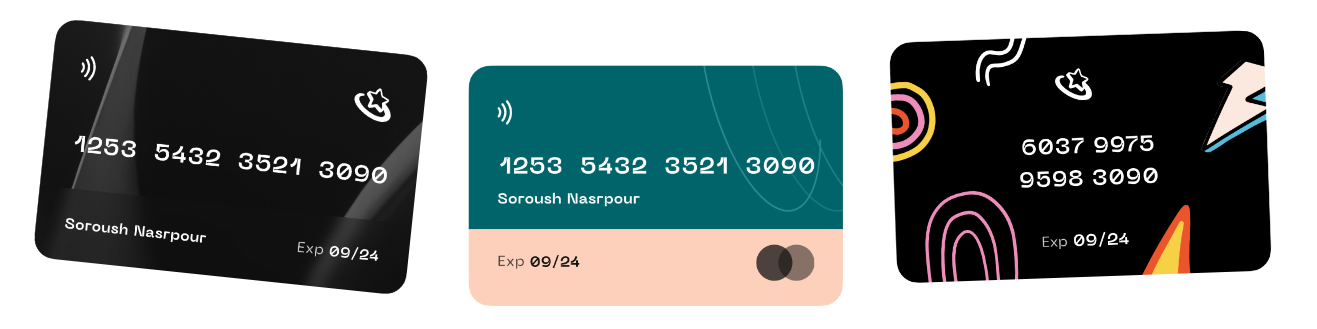

Introducing LinkPay Virtual Cards

Among the various virtual card providers, LinkPay has emerged as a leading player in the market, offering a range of features and benefits that make it the best choice for secure online transactions. LinkPay is a user-friendly platform that allows individuals and businesses to generate virtual cards quickly and easily. Let’s explore some of the key features and benefits of LinkPay virtual cards:

Enhanced Security:

LinkPay virtual cards incorporate advanced security measures to safeguard online transactions. The platform utilizes tokenization technology, which replaces sensitive card information with unique tokens. This ensures your data remains secure even if hackers intercept it, significantly reducing the risk of compromised financial details during online transactions.

Two-Factor Authentication:

LinkPay takes security a step further by implementing two-factor authentication. In addition to entering your virtual card details, you must provide a secondary verification, such as a One-Time Password (OTP) sent to your registered mobile number or email address. This additional layer of authentication offers robust protection against unauthorized usage and ensures that only you can authorize transactions.

Transaction Limits and Spending Controls:

With LinkPay virtual cards, you have complete control over your spending. The platform allows you to set transaction limits and spending controls, enabling you to define the maximum amount that can be charged to your virtual card within a specified time frame. This feature is handy for budgeting and preventing overspending, giving you peace of mind and financial control.

Convenience and Flexibility

In addition to the enhanced security features, LinkPay virtual cards offer unparalleled convenience and flexibility. Setting up and accessing your virtual cards is a breeze, making it a seamless experience for users of all technical levels. LinkPay’s platform is compatible with various devices and operating systems, whether you’re using a computer, smartphone, or tablet.

LinkPay virtual cards can be used across various platforms and merchants, making them a versatile payment option for all your online shopping needs. They are widely accepted, whether purchasing products from e-commerce giants or making payments on smaller online stores. This flexibility eliminates the hassle of carrying multiple physical cards or worrying about compatibility issues.

Cost-Effectiveness and Budget Control

In addition to the convenience and flexibility, LinkPay virtual cards offer cost-effectiveness and budget control. Unlike traditional credit or debit cards, which often have annual fees or hidden charges, LinkPay virtual cards have no additional costs. This means you can enjoy the benefits of secure online transactions without worrying about unexpected fees.

Moreover, LinkPay provides tools and features to help you track your expenses and manage your budget effectively. By monitoring your spending habits, you can gain insights into your financial behavior and make informed decisions about your expenses. By setting customizable spending limits on your virtual cards, you can stay within your budget and avoid overspending, promoting financial discipline and control.

Streamlined Online Shopping Experience

LinkPay virtual cards are designed to provide a seamless and streamlined online shopping experience. The platform integrates smoothly with various e-commerce platforms, allowing you to purchase with just a few clicks. The autofill feature saves you time and effort by automatically populating your virtual card details during checkout, eliminating the need for manual data entry.

Furthermore, LinkPay virtual cards offer robust protection against fraud and unauthorized charges. With each transaction generating unique card details, the risk of your information being compromised is significantly reduced. In the event of any suspicious activity, you can easily block or deactivate your virtual card, ensuring that your finances remain secure.

LinkPay Virtual Cards vs. Traditional Payment Methods

Several advantages become evident when comparing LinkPay virtual cards to traditional payment methods such as credit cards, debit cards, or bank transfers. Unlike credit or debit cards that expose your primary account details during online transactions, virtual cards provide an additional layer of security by keeping your sensitive information separate. This separation minimizes the risk of your primary financial accounts being compromised in case of a data breach.

Moreover, virtual cards offer superior security compared to bank transfers, where your account details are often shared directly with the recipient. With LinkPay virtual cards, the transaction is conducted securely through the platform, minimizing the possibility of interception or unauthorized access to your financial information.

Virtual cards also serve as a convenient alternative to cash payments. Carrying cash can be inconvenient and risky in an increasingly digital world. Virtual cards allow you to make payments without needing physical currency, ensuring a hassle-free and secure transaction experience.

Conclusion

LinkPay virtual cards offer the best choice for secure online transactions in 2024. With advanced security measures such as tokenization and two-factor authentication, LinkPay ensures that your financial information remains secure during online purchases. Their convenience, flexibility, and cost-effectiveness make them a preferred payment option for individuals and businesses alike.

Make an intelligent choice and adopt LinkPay virtual cards for your online transactions. Experience the peace of mind that comes with secure and hassle-free payments. Say goodbye to worries about fraud and unauthorized charges and embrace a new era of safe online shopping.