Is Rocket Money Safe? Points To Know Before Signing Up

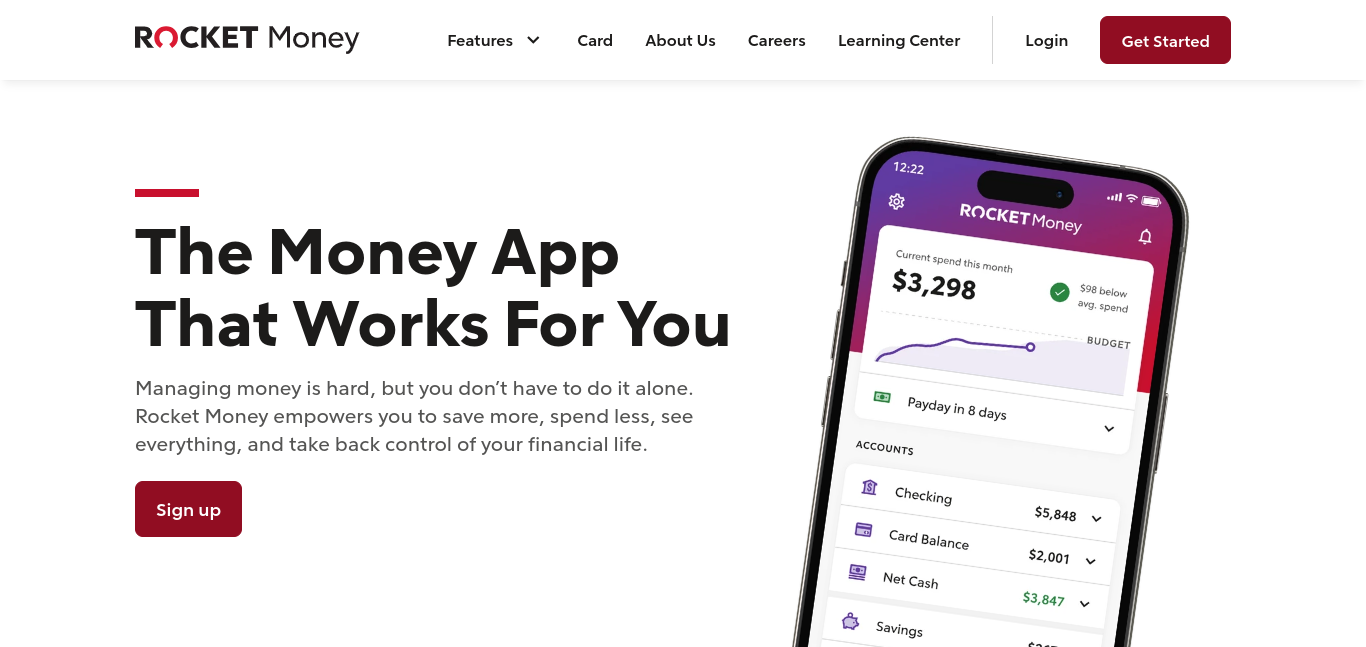

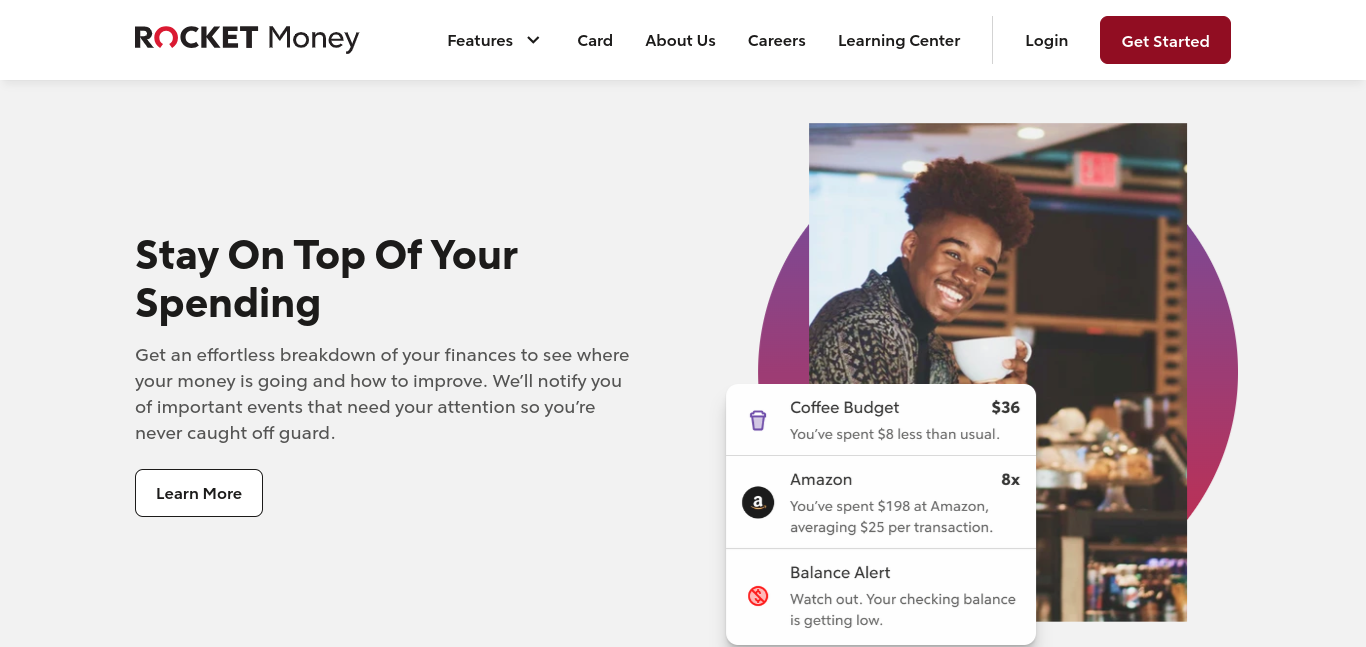

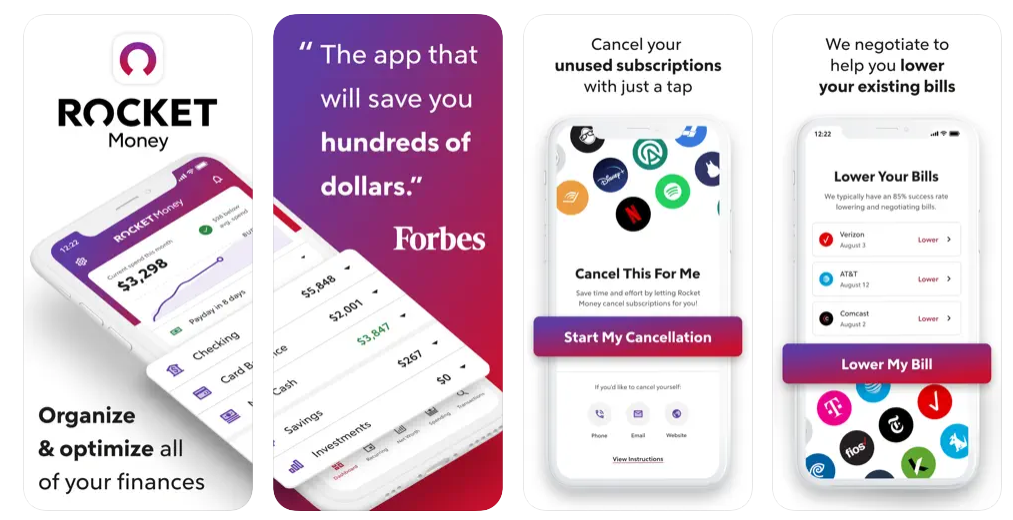

Rocket Money, formerly known as Truebill, is a financial app that aims to help users take control of their finances. With features like bill negotiations, subscription cancellation, budgeting tools, and more, Rocket Money makes big claims about saving you money effortlessly.

But is Rocket Money safe to use? Security is a valid concern as with any financial app that links to your personal accounts. This guide will walk through how Rocket Money works, its safety features, pros and cons, and commonly asked questions to help determine if Rocket Money is secure for managing your finances.

Some key features of Rocket Money:

| Item | Details |

| Account Linking | Link checking, savings, investment, and debt accounts to see your finances in one place |

| Budgeting Tools | Set monthly spending goals and track expenses against your budget |

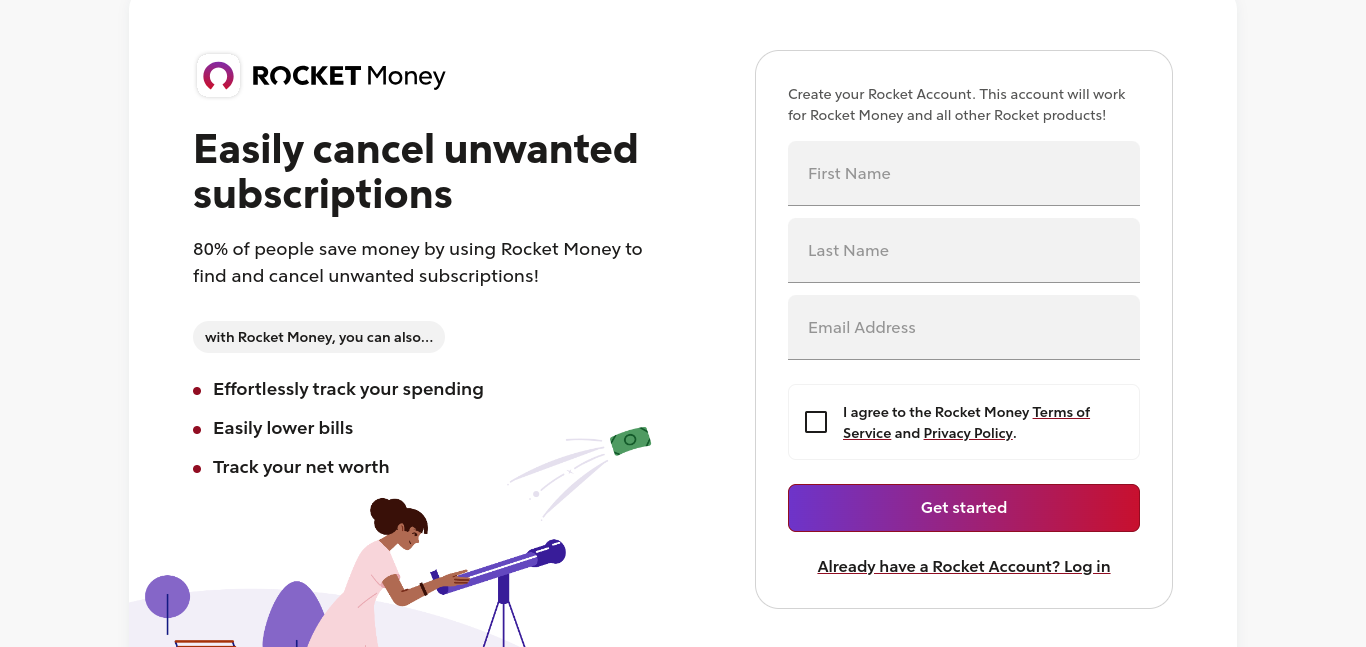

| Subscription Management | Identify recurring subscriptions and cancel unwanted ones |

| Cost | Free account option or premium subscription ($48-$144/yr) |

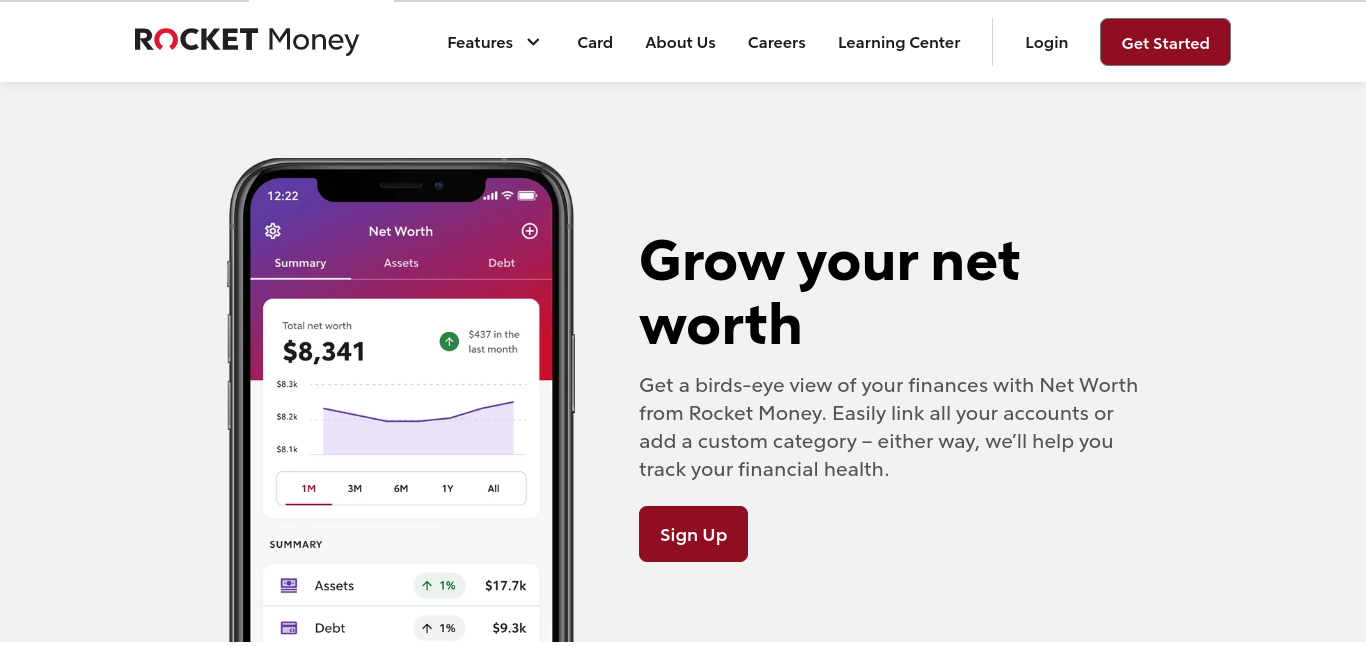

| Net Worth Tracking | Calculate your total assets minus liabilities |

| Bill Negotiations | Rocket Money will attempt to negotiate bills on your behalf to save money, for an added fee |

| Platforms | Android and iOS mobile apps |

| Account Linking | Connects over 18,000 banks and supports investment accounts |

| Bill Negotiation | Charges 30-60% of 1-year savings |

| Data Access | Read-only account access via Plaid |

| Availability | U.S. only |

Is Rocket Money Safe to Use?

When asking if Rocket Money is safe, there are a few key factors to consider:

- Data security: Rocket Money uses bank-level AES-256 data encryption and secure tokenization via Plaid to keep your linked financial credentials and transaction data safe. Employees can’t see your login credentials.

- Savings accounts: Smart Savings accounts provided by Rocket Money are FDIC-insured for up to $250,000 per account.

- Limited access: Rocket Money secures read-only access, meaning the app can only view transaction details and account balances. It cannot move money between accounts or make payments on your behalf.

- Reputation: Rocket Money currently maintains a B rating on the Better Business Bureau, with most complaints related to customer service issues rather than data breaches or fraud.

Rocket Money utilizes proper financial app security measures like data encryption, read-only access to linked accounts, and regulatory compliance. While no system is completely bulletproof when providing account access, Rocket Money checks the right security boxes.

What happened to Truebill?

Does anyone remember a subscription-canceling company? Maybe Truebill? Instagram advertising was everywhere! 2021 Rocket Money acquired Truebill, which became Rocket Money in August 2022. Rocket Money provides more features than Truebill, but subscription cancellation is still their main draw.

Step-by-Step Guide to Using Rocket Money

Signing up for Rocket Money is simple.

To test it out, just follow these steps:

- Download the app for iOS or Android

- Create a Rocket Money account with your email and password

- Link financial accounts when prompted

- Review linked accounts and transactions

- Set a monthly budget for spending (optional)

- Identify subscriptions to cancel (optional)

- Enable bill negotiations as desired

Be sure to update linked accounts or budget settings anytime you add or close an account. You can also contact Rocket Money’s support team via in-app chat or email if any questions arise.

What Is Rocket Money Price?

The Rocket Money app is free, but premium features cost $4–5 a month (billed as $48–60 yearly) or $6–12 monthly. The range—why? They use a misleading “pay what you think is fair” scale. Oddly, someone who pays $48 a year gets the same benefits as someone who pays $144. Make sense!

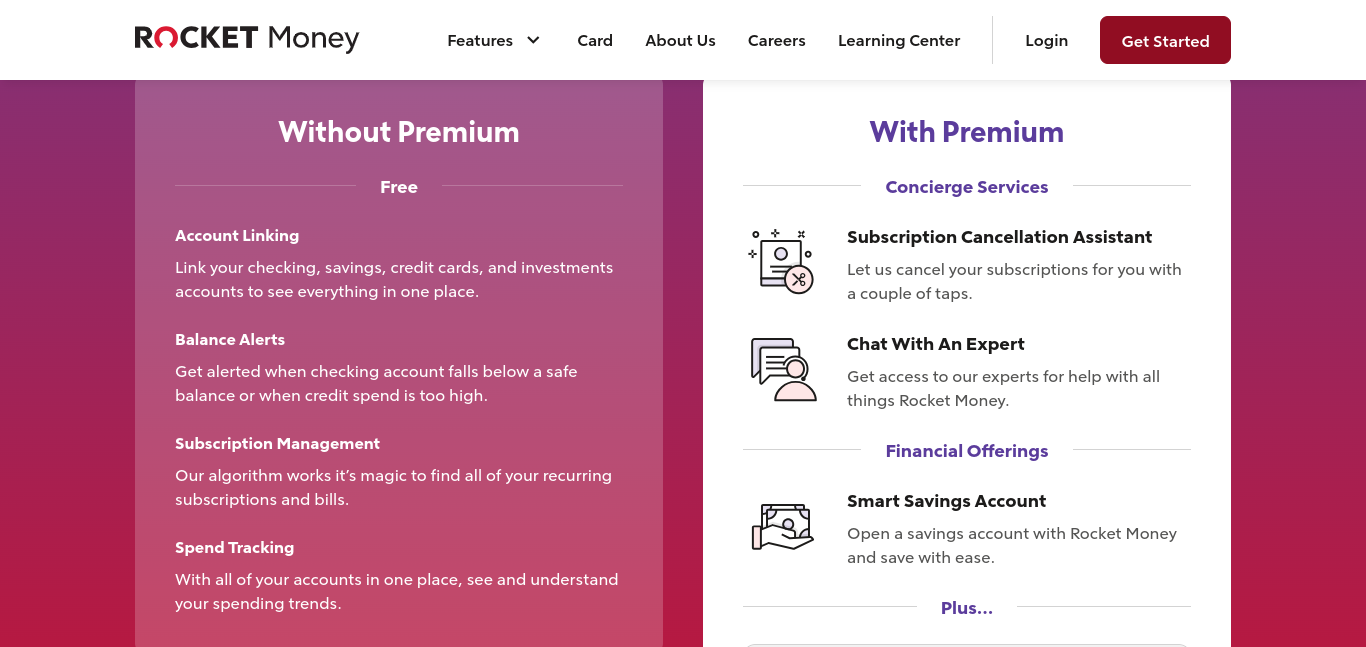

Rocket Money free includes:

- Account linking

- Balance warns

- Manage subscriptions

- Tracking spending

Rocket Money Premium includes:

- Subscription cancellation concierge

- Bill negotiation (but you must pay 30–60% of what they save you on top of your subscription)

- Premium budgeting (custom categories, limitless budgets)

- Net worth tracking

- Credit score monitoring

- Savings account smart

- Super chat support

Rocket Money premium is available to Rocket Visa Signature Card applicants. A Rocket Mortgage mortgage eliminates the card’s $95 annual fee.5 Rocket will earn money from you with their loan products if they can’t make money with their app.

Is Rocket Money Safe?

Rocket Money does not store logins. They link your financial accounts utilizing Plaid, a reputable financial IT business. Your smart savings account is with an FDIC-insured U.S. bank. Your money may be secure at the bank. You should worry about Rocket Money stealing from you in plain sight. Why charge you 60% to save you money on your next payment when they only phone a firm and read a script? Highway robbery!

Rocket Money: Worth It?

No, we disagree. Rocket Money’s free edition lacks useful features. As mentioned, you can accomplish whatever the premium version does for free or better elsewhere. User complaints have lowered Rocket Money’s Better Business Bureau rating to medium.6 Rocket Money’s bill negotiating service is their biggest issue. Users allege they were arbitrarily charged for invoices they didn’t know were negotiated and kept being charged after canceling Rocket Money! That should be avoided.

Pros and Cons of Using Rocket Money

| Pros | Cons |

| Identifies forgotten subscriptions to save money on unwanted bills | Must pay added fees for premium features and negotiated savings |

| Negotiates bills and subscriptions to lower costs | Budgeting tools offer limited customization options |

| Offers free basic budgeting and net worth tracking | Privacy concerns over sharing financial data |

| Secures accounts with bank-level encryption |

Conclusion

Rocket Money can provide helpful insights into cleaning up tangled finances. Key perks include identifying forgotten subscriptions, accessing read-only views of all your accounts, and potentially negotiating lower rates by leveraging bulk savings. However, the service isn’t free and you must decide if the subscription cost suits your needs. Rocket Money also doesn’t offer the most robust budgeting capabilities compared to dedicated personal finance apps. If you opt to try Rocket Money, rest assured they have proper security protections to keep your data safe while using their platform. But as with any financial service, read the fine print to know exactly what you agree to.

FAQs

Is Rocket Money free to use?

The core app is free, but advanced features require a paid premium subscription.

What happens when Rocket Money negotiates my bills?

They secure lower rates on your behalf, but charge 30-60% of the 1-year savings as their fee.

Is my data safe with Rocket Money?

Yes, they use bank-level security measures like encryption and read-only account access.

Can I cancel Rocket Money whenever I want?

Yes, you can cancel anytime but may still be charged negotiation fees per your agreement.

What banks and accounts does Rocket Money support?

They connect with over 18,000 banks and support investment and loan accounts.