10 Alternatives Of Personal Capital

- 1 Top 10 Alternatives to Personal Capital

- 1.1 Tiller Money

- 1.2 Mint

- 1.3 Banktivity

- 1.4 You Need a Budget (YNAB)

- 1.5 Google Sheets

- 1.6 Savology

- 1.7 PocketGuard

- 1.8 EveryDollar

- 1.9 Mvelopes

- 1.10 Simplifi by Quicken

Personal Capital is a website and wealth management system for managing personal assets. It is the most sophisticated and well-established way to keep track of money and organize personal finances. Users of the site can customize their financial management and investment tracking strategies. This website is based on the idea of a double-entry system and allows users to link their accounts.

With this site, you can easily look at your portfolio and figure out how much money you have. Also, the site has a retirement plan feature, so users can make plans for their retirement. Almost all of the tools and analyzers you need to check your finances are available on the website.

Features

- Manage your own property.

- Take charge of your finances.

- Personal finances should be organized.

- adapt intellectual strategies

- Keep track of your investments.

- Double-entry system

- Retirement plan feature

Top 10 Alternatives to Personal Capital

Here are some of the best alternatives to Personal Capital that you might want to try. Not all of these options are exactly the same, but many of them offer similar features and other ways to improve your financial health.

Tiller Money

Tiller Money is a website about money, business, commerce, the office, and online productivity. You can make spreadsheets on this site and fill them with all of your financial information. On this website, users can format their budgets for a year or a week and change the templates. This site has multiple budget categories that are easy to use. By combining their accounts with Yodlee, users of this website can link their financial accounts.

Mint

Mint is a free app that helps you plan how to spend your money. Every transaction, including income and expenses, is tracked and synchronized with your bank accounts. The platform was one of the first budgeting apps available, and it now has features like alerts, cash flow breakdowns, and budget pie charts. Mint will also have a dashboard that lets you see how much money you have, how much debt you have, and how much your investments are worth as a whole.

Banktivity

Banktivity is a personal finance and accounting website that helps you keep track of your money. This site helps users organise their finances in a systematic way. The website has a number of tools for managing money and organising finances. This site lets you keep track of your online bill payments and plan for your money in the future. Budgets can be created in addition to keeping track of bill payments and making plans.

You Need a Budget (YNAB)

You Need a Budget is like Mint, but it focuses more on helping you change how you spend your money. Every dollar you spend is assigned to a budget category under YNAB’s zero-based budgeting system. This lets you keep track of every penny and find out about costs you didn’t know about. YNAB helps you plan for the future and forecast your budget. It’s a great way to get you to start saving money and pay attention to your budget.

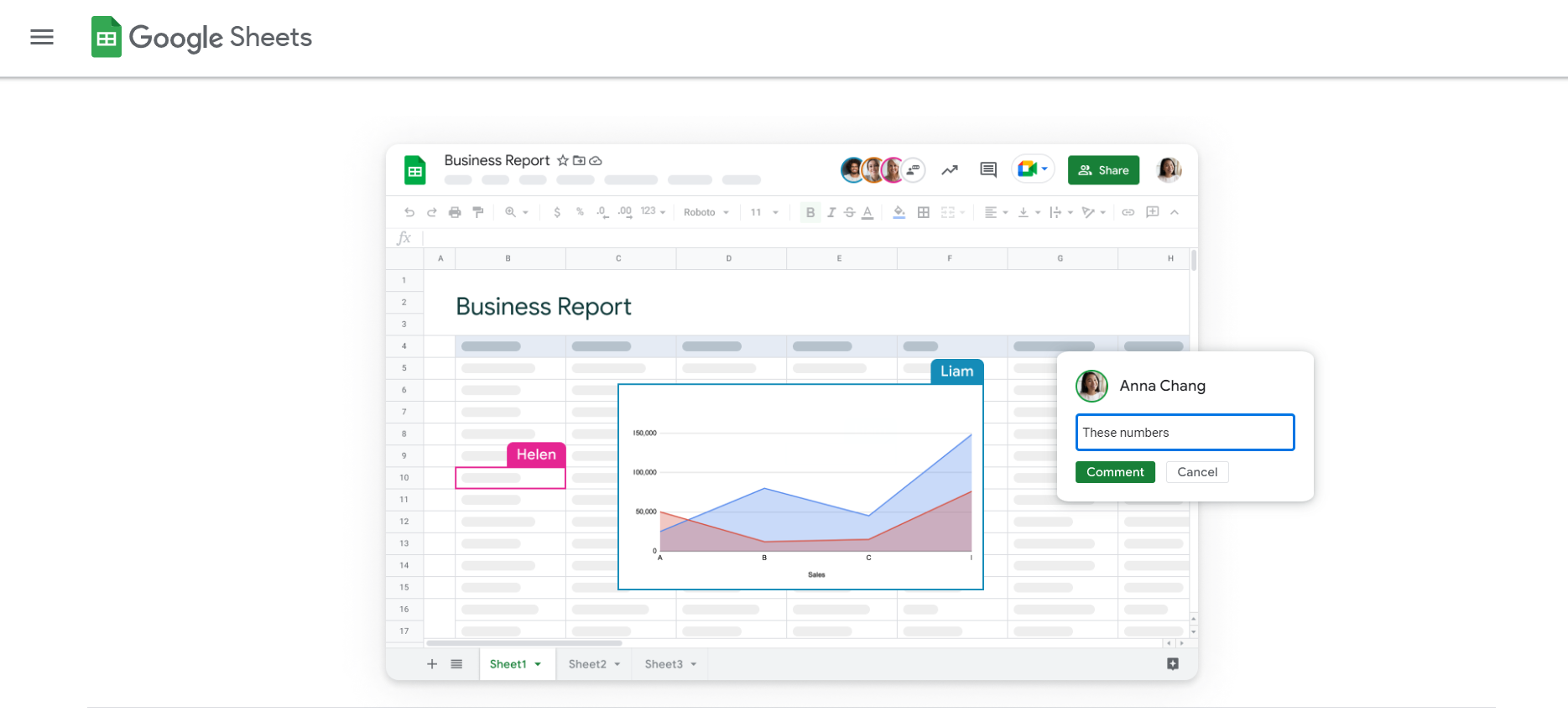

Google Sheets

Google LLC created the office and productivity app, Google Sheets. People can manage their finances with the help of this app’s multiple spreadsheets. You can create, edit, and design spreadsheets using this app however you like. With this app, you can make your data stand out with colorful graphs and charts.

Savology

Personal Capital is not the only alternative to Savology.It analyses your finances and then makes a personalised plan with steps you can take to reach your goals. Savology helps you keep track of your retirement, insurance payments, and other expenses by acting as both a budget and a plan. The platform will help you assess your strengths and weaknesses and encourage you to keep reviewing your “financial performance indicators.” The app has its own report card that grades you in different categories, so it’s easy to see where you need to improve. Savology is free and can give you a financial plan in five minutes.

PocketGuard

PocketGuard is a financial and budgeting app and tool made by PocketGuard, Inc. This app was created specifically for planning and managing finances. With the help of this site, you can increase your savings, manage your money, and reduce your spending. People can use this app to figure out how much money they have left over after spending their income. This app has a feature that automatically finds your bills and notifies you before they are due.

EveryDollar

Dave Ramsey’s EveryDollar is a tool that helps people make budgets and keep track of their money. The app uses the zero-based budgeting rule, which lets you keep track of every dollar you spend. The paid version of EveryDollar syncs your purchases with your bank account and even lets you call for help.EveryDollar will not keep track of your investments or help you plan for retirement, but it will help you improve your budgeting skills. The app has a free version and a paid version that costs $129 per year.

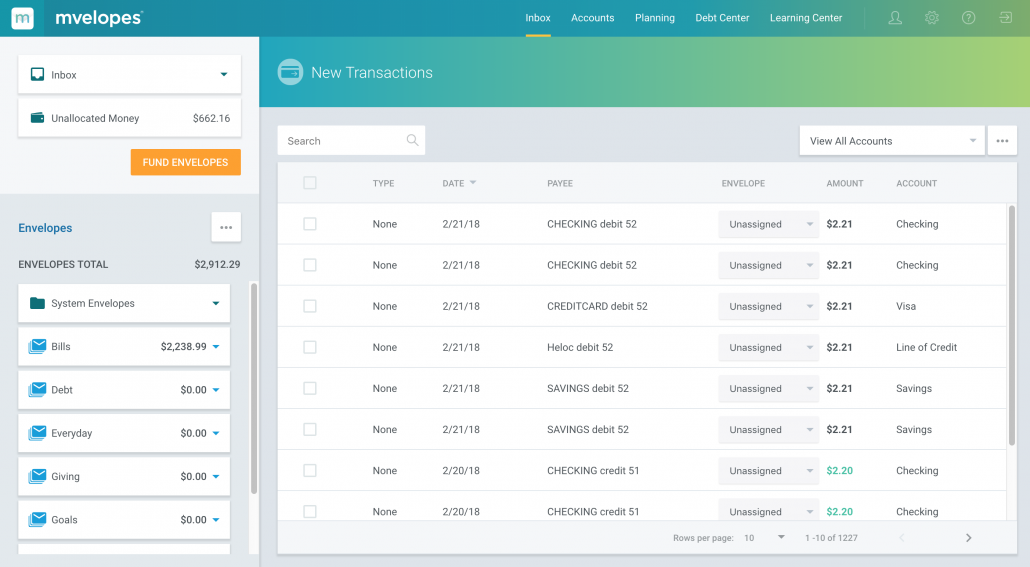

Mvelopes

When you first began using a cash-based budget, did you ever use actual envelopes? Mvelopes’s proposed solution employs virtual envelopes in place of paper ones. Mvelopes connects to your various bank accounts and gives you budgeting advice based on the information it gathers. Their software is aimed at people who are having trouble managing their finances or are already in debt, and they claim on their website that it can help users recoup as much as 10% of their income. Mvelopes provides a free trial for 60 days and three subscription plans with increasing functionality. Their entry-level plan costs $6 monthly, while their top-tier plan costs $19.99.

Simplifi by Quicken

With Simplifi by Quicken, you can access all of your financial information in one place. In this way, you can keep track of everything you owe, construct a budget, and establish individual financial objectives. By connecting to your various bank accounts, Simplifi makes it easy to spot trends in your income and expenditures.

You can keep tabs on your financial well-being with the use of Simplifi’s spending tracker and straightforward budgeting tools. The “Simplifi Dashboard” lets you see how close you are to reach your goals and shows you how much money is in your account for the next month. The service has a free trial period of 30 days and costs $3.99 per month or $39.99 per year.