Top 10 Earnin App Alternatives

- 1 How Earnin Works?

- 2 10 Best Alternatives of Earnin App

- 2.1 Possible Finance

- 2.2 SpeedyCash

- 2.3 PayActiv

- 2.4 FlexWage

- 2.5 Chime

- 2.6 Branch

- 2.7 DailyPay

- 2.8 Even

- 2.9 Vola Finance

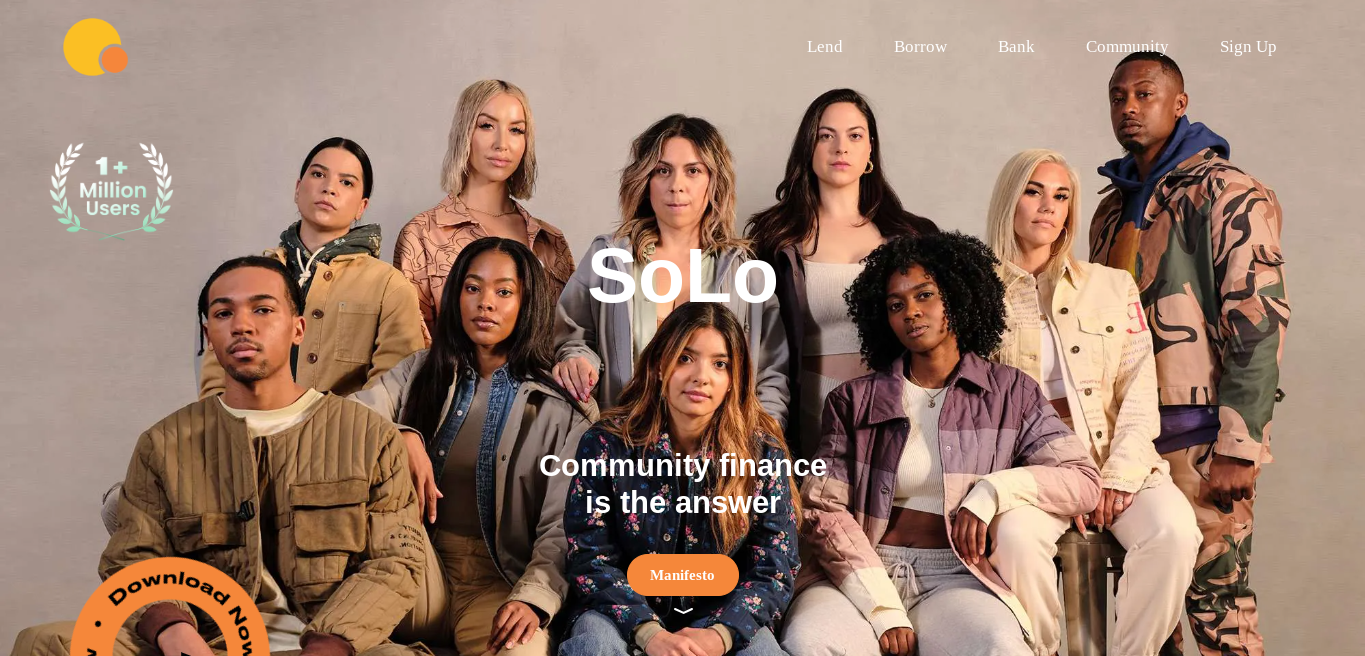

- 2.10 SoLo Funds

Earnin pays you now and lets you withdraw up to $100 daily without fees or interest. Earnin has no monthly fees or interest. Pay what you like to support the service. This is a significant difference from the American financial system. Earnin doesn’t work with Chime or Varo due to connectivity concerns. Cash advance apps like Earnin that integrate with these new digital banks may be better.

How Earnin Works?

Before discussing the top Earnin alternatives, let’s examine the app’s features:

- Cash Out: Get $500 per pay period before payday.

- Balance Shield warnings for low bank account balances: The Cash Out option can fund your bank account.

- Win money: With a ticket for every $10 you put into a free FDIC-insured account.

- Earnin Express: Deposit your paycheck two days earlier than your checking account.

No service on this platform charges interest or fees. Leave optional tips to cover running costs. Your $100 cash advance limit is initial. This threshold can be raised once you have a continuous income history and perform a minimum amount of monthly activities (debit card transactions, minimum deposit levels, etc.). Similar regulations on other platforms gradually increase advance limits.

10 Best Alternatives of Earnin App

Possible Finance

Possible Finance works like MoneyLion. Loan terms and conditions differ. Possible Finance offers $500 short-term loans for up to 8 weeks. It reports to major credit agencies to increase your credit score afterwards. Possible Finance’s 150%–200% APR is slightly lower than payday loan and overdraft rates.

SpeedyCash

Speedy Cash is Earnin’s most flexible option because it offers multiple loan types. Installment loans up to $ 5,000 first. Second, a title loan lets you borrow $100–$25000 with your car. Speedy Cash also offers payday and credit line loans online. Speedy Cash has higher interest rates but is the best app for loan flexibility.

PayActiv

PayActiv is another cash advance software that lets workers see their earnings before payday. In addition, PayActiv educates consumers on handling finances efficiently through financial counselling. PayActiv lets you pay bills and get prescription discounts. Additionally, it offers a debit card for fast withdrawals. However, transferring funds may cost $5.

FlexWage

FlexWage is a great Earnin alternative for workers who want instant pay. Payroll debit cards are available from FlexWage for employees without bank accounts who get paper checks. All these services cost $5. FlexWage services are worth investigating, especially if you qualify for their debit card.

Chime

Chime operates diligently like Earnin and Dave. It lets you get paid two days early. Though slightly different, Chime works differently. Signing up for the app gets you a Visa Debit Card and a spending account. Set up a Chime savings account to save money. Chime is not a monthly member. Interchange fees from Visa Debit Card use generate revenue. Additionally, non-Chime ATMs charge about $2.5 for cash withdrawals.

Branch

Hourly workers cannot apply for loans on most apps like Earnin. The branch helps hourly workers, who are most sensitive to cash flow issues, achieve financial stability. It charges no membership fees or loan interest. It also serves clients without credit checks. The employee receives the Cash three business days after applying. For a nominal fee, you can get Cash fast.

DailyPay

DailyPay, like Earnin, uses a similar model but is less popular. DailyPay helps firms provide employees with cash advances until their next payday. The software lets users connect their bank accounts and set daily working hours. As working hours rise, the user can use the balance to earn advance cash for $1.25.

Even

Even unlike Earnin, it is a complete financial planning app. Anyone looking to improve their finances should try it. Instead of waiting for your paycheck, Even gives you quick access to your earnings. To avoid the debt cycle, it offers financial management capabilities to organise your finances and plan your monthly budgets. The downside of this software is that only your employer can utilise it.

Vola Finance

Vola Finance pays up to $300 for a $4.99 monthly subscription. Other than this, money transfers require no tips or fees. Vola Finance uses the Vola Score, a scoring system that lowers membership costs and increases advances. This service is best for frequent borrowers.

SoLo Funds

A unique peer-to-peer lending app is SoLo Funds. Which implies you borrow money from people rather than banks. Loans range from $50 to $1000. This app lets users lend money to make extra money, which is unusual. The programme allows you to pay back loans with gratuities, so you don’t pay interest.