Top 5 strategies for XRP crypto bots

- 1 Why use a bot to trade Ripple

- 2 Strategy 1: Trend scalping on XRP

- 3 Key features of trend scalping when working with a bot:

- 4 Strategy 2: XRP arbitrage between exchanges

- 5 Strategy 3: Trading with moving averages

- 6 Strategy 4: RSI + Price Action

- 7 Strategy 5: Grid Trading

- 8 How to implement these strategies with a trading bot

The XRP (Ripple) cryptocurrency has always been one of the most liquid on the crypto market, as well as one of the first cryptocurrencies in the world. That is why there are always opportunities for trading bots on this coin, regardless of the trading strategy and market sentiment.

Why use a bot to trade Ripple

Ripple (XRP) is one of the most liquid cryptocurrencies with high transaction speeds and active price fluctuations. These characteristics make Ripple an excellent asset for algorithmic trading. After all, trading bots allow you to automate the decision-making process, eliminate the human factor, and respond to market signals around the clock. Bots are most relevant for older coins such as XRP, where movements can be sharp and short-term. Therefore, using a trading bot allows you to execute trades faster, test strategies, and manage risks more effectively than with manual trading.

Strategy 1: Trend scalping on XRP

Trend scalping is one of the fastest and most active strategies for automated trading on Ripple (XRP), suitable for traders seeking to profit from short-term price movements. This strategy is based on the principle of opening multiple trades during a trading session in order to make a small profit from each price movement in the direction of the main trend.

The essence of the strategy is as follows: the trading bot tracks the current trend on the selected timeframe — usually minute (1m, 5m) or 15-minute charts.

Once the direction has been determined, the bot starts looking for signals to enter a position on short-term pullbacks. For example, in an uptrend, the bot will buy at local lows to close the trade with a small profit of a few points on an upward pullback.

Key features of trend scalping when working with a bot:

— Instant order execution

It is physically difficult for a person to keep up with price movements on small timeframes and with high XRP volatility. The bot, on the other hand, reacts instantly.

— Strict stop loss

Scalping requires clear risk management and compliance with all rules so that one unsuccessful trade does not overshadow a series of successful ones. The bot automatically sets a stop loss according to specified conditions (for example, 0.3% from entry) and does not remove it.

— Volume management

The trading bot adjusts the volume of trades depending on the size of the deposit, volatility, and the current situation of the account.

Strategy 2: XRP arbitrage between exchanges

Arbitrage is a strategy based on profiting from the difference in prices of the same asset on different trading platforms. In the case of Ripple (XRP), which is traded on most major exchanges, arbitrage is possible due to high liquidity and small but frequent discrepancies in quotes. A bot operating on an arbitrage strategy automatically tracks these price differences and instantly executes trades: buying XRP where it is cheaper and selling where it is more expensive.

Example: on one exchange, the XRP rate is $0.612, and on another, it is $0.619. A difference of $0.007 may seem insignificant, but with large volumes, it becomes a tangible profit. A trading bot connected to both exchanges via API instantly identifies arbitrage opportunities and executes trades without involving the trader in the process.

Strategy 3: Trading with moving averages

One of the most reliable and straightforward strategies for automated trading of Ripple (XRP) is trading with moving averages. It is based on the idea that the market often moves in a trend, and the intersection of various moving averages can serve as signals to open or close positions. A trading bot using this strategy analyzes the movement of XRP relative to the specified moving curves and automatically reacts to the emergence of a trend.

The basic version of the strategy uses two moving averages: one with a short period, for example, EMA 9, and the other with a long period, for example, EMA 50. When the short average crosses the long one from bottom to top, it is considered a buy signal. If the opposite happens, it is a sell signal. The bot can open a position immediately after the crossover or wait for confirmation in the form of a stable price consolidation above/below the average. All this helps to filter out false signals and work only in confirmed directions.

Ripple, as a highly liquid asset, lends itself well to technical analysis, and this is what makes moving averages effective. In trending areas, they allow you to capture strong movements without having to predict every fluctuation. The bot can also use adaptive parameters — for example, changing the moving average period depending on market volatility, increasing the flexibility and adaptability of the strategy.

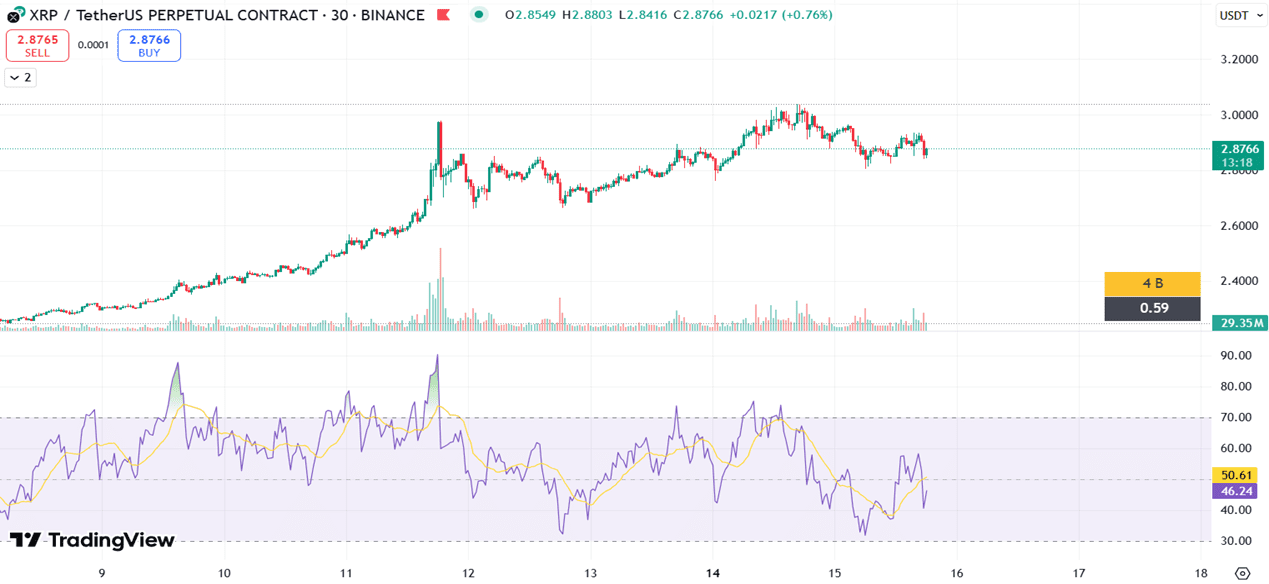

Strategy 4: RSI + Price Action

The RSI (Relative Strength Index) indicator provides signals for overbought or oversold XRP.

The bot analyzes RSI in combination with price action patterns — candlestick formations and support/resistance levels. For example, if the RSI shows oversold conditions and a candlestick reversal occurs from a strong level, the bot opens a long position. This is the most flexible approach, taking into account both indicator signals and price behavior.

Strategy 5: Grid Trading

Grid trading is ideal for XRP in a sideways market, when the price fluctuates within a given range.

The bot places buy and sell orders at specific intervals. With each purchase below and sale above, it locks in a small profit. If the price is stuck in a narrow range for a long time, the grid strategy can bring a stable income. The main thing in this strategy is to control the volume and not enter the market during high volatility without confirming the range boundaries.

How to implement these strategies with a trading bot

To apply any of the above strategies, you will need a trading bot with API support for the selected exchange, indicator settings, and logic for opening/closing trades. On the Veles Finance platform, you can run ready-made algorithms or customize your own.

All the user needs to do is set the parameters: asset (in our case, XRP), strategy type, limits, risks, and signal frequency. Once launched, the bot independently analyzes the market and trades according to the specified scenario. Thanks to automation, you can test several strategies simultaneously and quickly respond to changes in Ripple’s market dynamics.