Your Business’ Ultimate Guide to Form W-9 and B-Notice Compliance

- 1 What is Form W-9?

- 1.1 Who is Responsible for Requesting Form W-9?

- 1.2 When Should Businesses Request Form W-9?

- 1.3 What Happens if the Vendor Does Not Provide a Form W-9?

- 1.4 What if the Provided Vendor TIN is Incorrect or Invalid?

- 1.5 When Should I Stop Backup Withholding?

- 2 How to Avoid B-Notice and Stay Compliant?

- 2.1 Bottom Line

When it comes to financial transactions and tax compliance, businesses must navigate a complex web of regulations and requirements. One critical aspect of this process is obtaining accurate and up-to-date information from vendors and contractors. Form W-9 and B-Notice compliance play a vital role in ensuring that businesses fulfill their tax obligations and avoid penalties.

In this ultimate guide, we will delve into the details of Form W-9 and B-Notice requirements, outlining who is responsible for completing Form W-9, when it should be requested, what to do if a vendor fails to provide the form, and how to avoid B-notice issues and stay compliant.

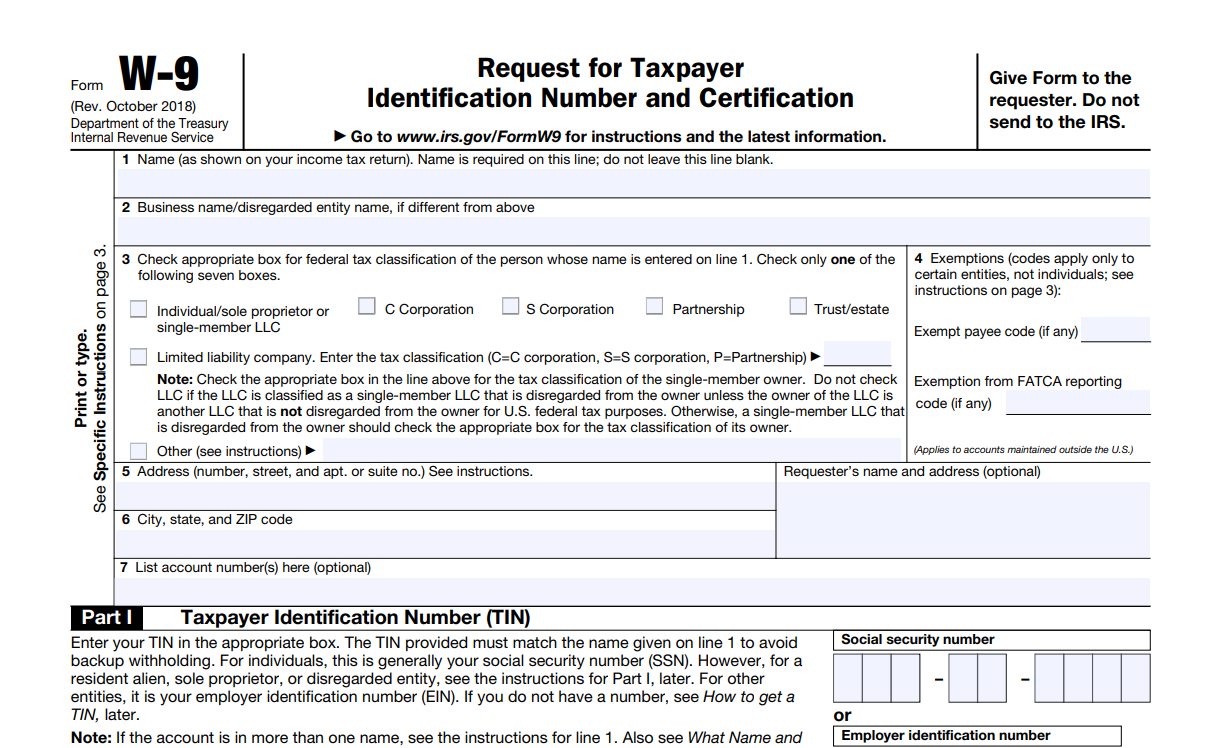

What is Form W-9?

W-9 Form, officially known as the Request for Taxpayer Identification Number and Certification, is a document issued by the Internal Revenue Service (IRS) in the United States. The purpose of Form W-9 is to collect information from vendors and contractors, primarily their taxpayer identification number (TIN) and legal name. This information is necessary for businesses to report payments made to vendors and contractors to the IRS.

Who is Responsible for Requesting Form W-9?

As a business, it is your responsibility to ensure that you have a collected Form W-9 from each vendor or contractor with whom you engage in certain business transactions. The IRS defines specific transactions that require the collection of Form W-9, including payments for services, rents, royalties, and other types of income.

When Should Businesses Request Form W-9?

The ideal time to request Form W-9 from a vendor or contractor is before making any payments to them. By collecting the form early on, you can ensure that you have the necessary information for accurate reporting to the IRS. It is best practice to request Form W-9 from vendors or contractors as soon as the business relationship is established or before the first payment is made.

What Happens if the Vendor Does Not Provide a Form W-9?

In situations where a vendor or contractor fails to provide a completed Form W-9, the business may be required to perform backup withholding. So what is Backup withholding?

Backup withholding is the process of withholding a portion of the vendor’s payment and remitting it to the IRS. The backup withholding rate is typically 24% of the payment amount. It is important to note that backup withholding is not a penalty but rather a means to ensure tax compliance.

What if the Provided Vendor TIN is Incorrect or Invalid?

In some cases, the TIN provided by a vendor or contractor on their Form W-9 may be incorrect or invalid. When the IRS identifies such discrepancies, they issue a B-Notice to the business. The B-notice includes a list of information on the 1099 Forms filed without TIN or where the name and TIN combination don’t match the IRS records. This notice informs payers that they may be responsible for backup withholding. There are two types of B-Notices CP2100 and CP2100A.

B-Notice CP2100: IRS will issue CP2100 if you file more than 50 information returns (1099 returns) that have errors. This notice informs the payer that the vendor’s TIN is incorrect, and the payer is responsible for backup withholding.

B-Notice CP2100A: IRS will issue CP2100A if you file less than 50 returns (1099 Forms) that have errors. There is no major difference between CP2100 and CP2100A in terms of information or instruction.

IRS issues the B notice CP2100 or CP2100A twice a year. The first B notice will be issued in October, and the second B notice generally will be issued in April of the following year.

When Should I Stop Backup Withholding?

Backup withholding should continue until the business receives a valid TIN from the vendor or contractor. Once a corrected Form W-9 is obtained, the business can cease backup withholding and report payments to the IRS using the accurate information provided.

How to Avoid B-Notice and Stay Compliant?

To avoid B-Notice issues and stay compliant with IRS regulations, businesses should follow these best practices:

- Request Form W-9 Promptly: As mentioned earlier, it is crucial to request Form W-9 from vendors or contractors before making any payments. Promptly collecting this information reduces the risk of compliance issues down the line.

- Validate TINs: Verify the accuracy of the TINs provided by vendors or contractors. The IRS provides online tools such as the TIN Matching System to validate TINs before reporting payments.

- Keep Accurate Records: Maintain comprehensive records of Form W-9s received, including the date of receipt and any subsequent updates or corrections. These records serve as proof of compliance in case of an audit.

- Respond to B-Notices Promptly: If your business receives a B-Notice from the IRS, act promptly and follow the instructions provided. Request a corrected Form W-9 from the vendor and submit the required response to the IRS within the specified timeframe.

Managing W-9 information and staying compliant with the IRS can be quite challenging, and this is where software like an online W-9 Manager or W-9 e-filer comes in handy. An online W-9 manager simplifies the process of collecting W-9 forms from vendors, contractors, and other payees. It provides a centralized platform for requesting, tracking, and managing W-9 forms electronically.

Some W-9 solutions offer TIN matching services to verify the accuracy of the TIN provided by payees. Cross-referencing the TIN with IRS records helps identify potential discrepancies and flags any mismatches before they lead to B-Notices.

Plus, when requesting Form W-9 online, you can securely store and retrieve W-9 forms and related documents whenever needed. This ensures easy access to accurate information, even during tax reporting or audits.

Bottom Line

Form W-9 and B-Notice compliance are critical for businesses to fulfill their tax obligations and avoid penalties. By understanding the requirements, responsibilities, and best practices associated with these forms, businesses can navigate the complexities of tax reporting successfully.

Promptly requesting and validating Form W-9, and responding to B-Notices in a timely manner, are crucial steps to ensure compliance and maintain strong vendor and contractor relationships. By using authorized e-file providers, businesses can streamline the W-9 collection process, verify TIN information, automate compliance checks, and avoid the potential consequences of B-Notices.