How to Diversify Your Portfolio: How to Reduce Risk

- 1 Understanding the Power of Diversification

- 1.1 Evaluating Your Risk Tolerance

- 1.2 Allocating Assets Strategically

- 1.3 The Role of Bonds in Diversification

- 1.4 Exploring Equities: Large Cap vs. Small Cap

- 1.5 Unearthing the Potential of Real Estate

- 1.6 Don’t Overlook Alternative Investments

- 1.7 Staying Updated and Rebalancing

- 2 Conclusion

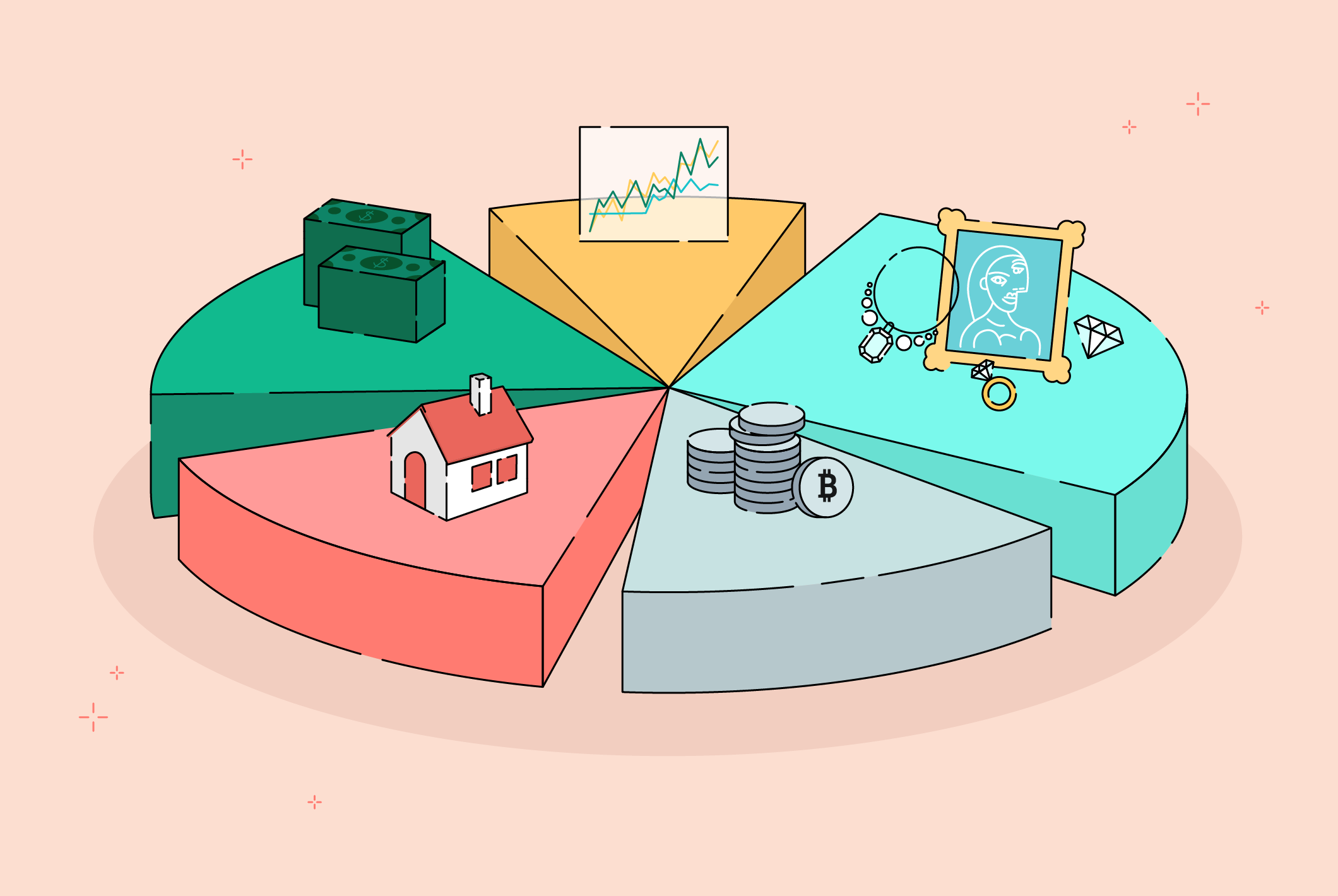

When it comes to investing, diversification is a fundamental strategy to reduce risk and maximize returns. By spreading your investments across different asset classes and industries, you can mitigate the impact of individual market fluctuations. In this article, we will explore the importance of diversification and provide actionable steps to help you build a well-balanced portfolio that stands strong against market volatility. To get started, consider exploring new investment opportunities with a reliable online trading platform like https://syntrocoin.com.

Understanding the Power of Diversification

Diversification is the art of not putting all your eggs in one basket. It is a risk management technique that can help protect your portfolio from major losses by having a variety of investments. By diversifying, investors can reduce the negative impact of a single underperforming investment on their overall portfolio. A diversified portfolio will typically include a mix of stocks, bonds, real estate, commodities, and other assets. This mix helps spread risk, ensuring that potential losses in one asset class may be offset by gains in another.

Evaluating Your Risk Tolerance

Before embarking on a diversification strategy, investors must evaluate their risk tolerance. Risk tolerance refers to an individual’s ability to withstand market fluctuations and potential losses. Assessing your risk tolerance will help determine the appropriate allocation of assets in your portfolio. If you have a higher risk tolerance, you might consider allocating a larger portion of your portfolio to equities or other higher-risk assets. On the other hand, if you prefer a conservative approach, a higher allocation to bonds and cash might be more suitable.

Allocating Assets Strategically

Once you understand your risk tolerance, it’s time to allocate your assets strategically. This involves deciding how much of your portfolio should be invested in each asset class. The goal is to create a mix that aligns with your financial goals and risk appetite. Historical data and asset correlations can be valuable tools in constructing a diversified portfolio. Keep in mind that asset allocation is not a one-time event; it requires periodic review and adjustments to maintain balance as market conditions change.

The Role of Bonds in Diversification

Bonds play a critical role in diversification as they are generally considered less volatile than stocks. During periods of market turbulence, bonds tend to provide stability to the overall portfolio. When stocks are experiencing a downturn, the income from bonds can help offset losses and provide a cushion. Government bonds, corporate bonds, and municipal bonds are common types of fixed-income securities that can be included in a diversified portfolio.

Exploring Equities: Large Cap vs. Small Cap

Equities, or stocks, are a core component of most investment portfolios. Within the equity asset class, there are large-cap and small-cap stocks, each with its own risk and return characteristics. Large-cap companies, typically established and stable, offer a sense of security. On the other hand, small-cap companies, often in a growth phase, can provide higher potential returns but come with increased risk. A well-diversified portfolio may include a mix of both large-cap and small-cap equities to balance risk and reward.

Unearthing the Potential of Real Estate

Real estate investment offers an excellent opportunity for diversification. Investing in properties, real estate investment trusts (REITs), or real estate crowdfunding can provide a steady income stream and potential for long-term capital appreciation. Real estate tends to have a low correlation with other asset classes, making it a valuable addition to a diversified portfolio.

Don’t Overlook Alternative Investments

In addition to traditional asset classes, alternative investments can be used to further diversify your portfolio. Alternative investments encompass a wide range of assets, including commodities, hedge funds, private equity, and venture capital. These investments can behave differently from traditional assets, providing unique benefits to your overall portfolio diversification.

Staying Updated and Rebalancing

Building a diversified portfolio is not a one-time activity. Market conditions change, and your financial goals may evolve over time. Regularly monitoring your portfolio’s performance and staying updated on market trends is crucial. Periodically rebalancing your portfolio—adjusting the asset allocation to maintain the desired mix—is essential to ensure that your investments align with your risk tolerance and financial objectives.

Conclusion

In conclusion, diversification is a fundamental aspect of successful investing. By strategically allocating your assets across different classes, you can reduce risk and increase the potential for long-term returns. To discover new investment opportunities and start diversifying your portfolio, consider exploring a reputable online trading platform. Remember to assess your risk tolerance, consider the role of bonds and equities, explore real estate and alternative investments, and consistently monitor and rebalance your portfolio. With a well-balanced and diversified approach, you can build a resilient portfolio that withstands market volatility and delivers steady growth over time.