How to create a virtual Visa/MasterCard for online shopping without spending limits

- 1 What is a Virtual Card?

- 2 How to Choose a Virtual Card Provider:

- 2.1 Security:

- 2.2 Ease of Use:

- 2.3 Fees and Commissions:

- 3 Benefits of Using the PSTNET Service

- 4 Practical Advice on Using Virtual Cards

- 4.1 Safeguard Card Details:

- 4.2 Use Secure Connections:

- 4.3 Monitor Account Activity:

- 4.4 Exercise Caution Online:

- 4.5 Enable Two-Factor Authentication:

- 5 Conclusion

In today’s digital age, online shopping has become an integral part of everyday life for millions of consumers worldwide. With the rise of e-commerce platforms and digital payment solutions, the demand for secure and convenient payment methods has never been greater. Virtual cards have emerged as a preferred choice for online purchases, offering enhanced security features and unparalleled convenience. In this comprehensive guide, we explore the importance of virtual cards for secure online transactions and highlight the benefits of using the PSTNET service.

What is a Virtual Card?

Virtual cards, or virtual Visa/MasterCard cards, are digital representations of traditional payment cards. These cards have gained widespread popularity due to their ease of use and enhanced security features. Unlike physical cards, virtual cards exist solely in digital form and can be used for online purchases without needing a physical card. They offer numerous advantages over traditional payment methods, including improved security, flexibility, and convenience.

How to Choose a Virtual Card Provider:

When choosing a virtual card provider, it’s crucial to prioritize certain factors to ensure a seamless and secure experience.

Let’s delve into the details of what each aspect entails and why they are essential:

Security:

Security is paramount when selecting a virtual card provider. Look for providers that employ robust security measures, such as encryption protocols, multi-factor authentication, and fraud detection systems. These features help safeguard your personal and financial information from unauthorized access and fraud. Additionally, consider the provider’s track record in handling security breaches and their responsiveness in addressing any security concerns promptly.

Ease of Use:

The ease of use of a virtual card platform significantly impacts the overall user experience. Choose a provider that offers an intuitive and user-friendly interface, allowing you to navigate the platform quickly and manage your virtual cards efficiently. Features like streamlined registration processes, straightforward card activation procedures, and accessible account management tools contribute to a seamless user experience.

Fees and Commissions:

Assessing the fees and commissions associated with a virtual card provider is crucial to understanding the cost implications of using their services. Look for transparent fee structures that clearly outline any charges, including transaction fees, account maintenance fees, currency conversion fees, and withdrawal fees. Compare the fee schedules of different providers to ensure you’re getting the best value for your money. Additionally, consider any additional perks or benefits the provider offers, such as cashback rewards, discounts, or loyalty programs, which can offset some associated costs.

Benefits of Using the PSTNET Service

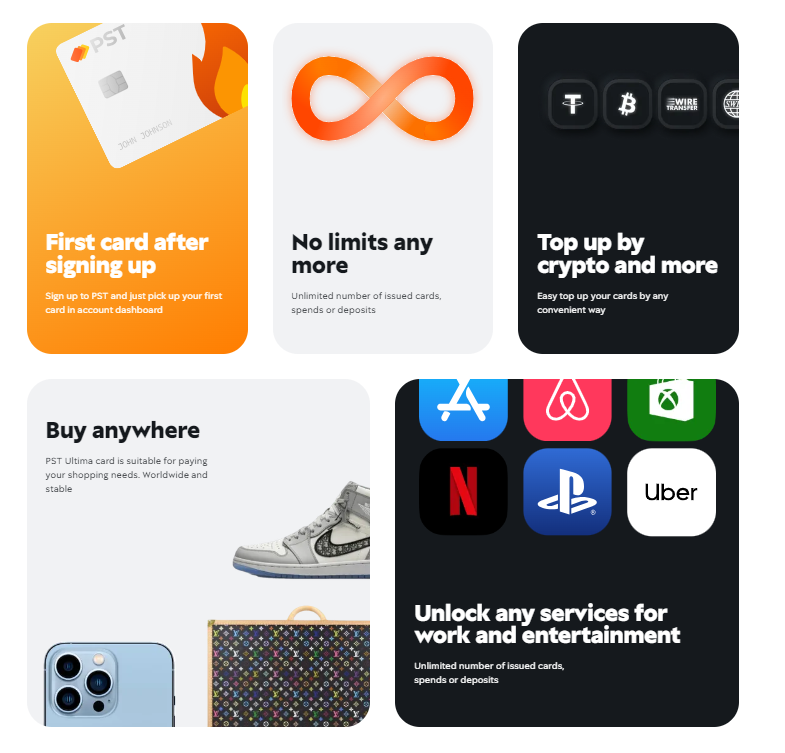

In today’s digital landscape, choosing a virtual card provider can significantly impact your online shopping and payment experiences. Among the options available, PSTNET stands out for its remarkable benefits and user-friendly features. One of its key advantages lies in the absence of limits on replenishment and expenses, ensuring uninterrupted transactions for users. PSTNET provides the best virtual cards for shopping without limits on expenditures. PSTNET offers a straightforward and expedited registration process, allowing users to access their accounts effortlessly.

What sets PSTNET apart is its diverse range of replenishment methods, including instant crypto top-up with various coins like USDT and BTC. Moreover, the platform boasts a responsive customer support system, available round-the-clock via Telegram bot, WhatsApp, and email, providing users with peace of mind and prompt assistance when needed. With features such as service notifications through the Telegram bot and robust two-factor authentication, PSTNET prioritizes security and convenience for users worldwide, making it a preferred choice for savvy online shoppers and digital payment enthusiasts.

Practical Advice on Using Virtual Cards

While virtual cards offer enhanced security features, users must adopt safe online shopping practices to protect their personal and financial information.

Here are some detailed practical tips to help you maximize security while shopping online:

Safeguard Card Details:

Keep your virtual card details confidential and avoid sharing them with anyone unnecessarily. Store your card information securely, preferably in an encrypted digital wallet or password-protected document. Avoid writing down your card details or sharing them over unsecured channels like email or social media.

Use Secure Connections:

Always use a secure and encrypted internet connection when making online transactions. Look for websites with HTTPS encryption in the URL, indicating a secure connection. Avoid conducting transactions over public Wi-Fi networks, as they may be vulnerable to hacking and interception.

Monitor Account Activity:

Review your virtual card account activity regularly to identify unauthorized or suspicious transactions. Set up transaction alerts or notifications to receive real-time updates on account activity. Report any unauthorized transactions to your virtual card provider immediately to prevent further unauthorized access.

Exercise Caution Online:

Exercise caution when sharing your virtual card information online. Avoid clicking on suspicious links or ads that may lead to phishing websites that steal your card details. Only enter your card information on trusted, reputable websites with secure payment gateways.

Enable Two-Factor Authentication:

Whenever possible, enabling two-factor authentication (2FA) enhances the security of your virtual card account. 2FA adds an extra layer of security by requiring users to provide a secondary verification form, such as a code sent to their mobile device and their password.

Implementing these practical tips can significantly reduce the risk of unauthorized access and fraudulent transactions when using virtual cards for online shopping. Stay vigilant and proactive in safeguarding your personal and financial information to enjoy a secure and worry-free online shopping experience.

Conclusion

In conclusion, virtual cards offer a secure, convenient, and flexible payment solution for today’s online shoppers. By choosing a reputable provider like PSTNET, consumers can enjoy various benefits, including unlimited replenishment, user-friendly interfaces, and global payment capabilities. PSTNET reviews confirm its commitment to security, convenience, and user satisfaction, making it a top recommendation for virtual card solutions. As online shopping continues to evolve, virtual cards remain a trusted choice for those seeking a seamless and hassle-free shopping experience.