Trading Experts’ Picks For 2023: The Best Forex Brokers in Bangladesh

Choosing the right broker is crucial for trading in financial markets because your money, profit, and opportunities depend on it. So, it’s important to thoroughly check a company before starting to work with it. Experts at Traders Union have made this task easier for you. They have prepared a review and compared the best brokers in Bangladesh for 2023.

Is Forex Trading Legal in Bangladesh?

Yes, Forex trading is allowed in Bangladesh and is regulated by the Bangladesh Securities and Exchange Commission (BSEC). BSEC makes sure that Forex trading companies in Bangladesh are safe and transparent. It has rules to protect investors, encourage fair trading, and maintain the financial markets’ integrity. For example, people in Bangladesh can only trade with brokers licensed by BSEC, and there are limits on how much money can be moved in and out of the country for Forex trading. Both brokers and traders must follow BSEC rules and be aware of the risks involved in Forex trading.

Best Forex Brokers in Bangladesh for 2023: An Insight by TU Analysts

The success of your Forex trading journey largely depends on the broker you choose. Analysts at Traders Union have carefully reviewed and compiled a list of the top online brokers in Bangladesh for 2023.

Here are two top companies that hold leading positions in the ranking:

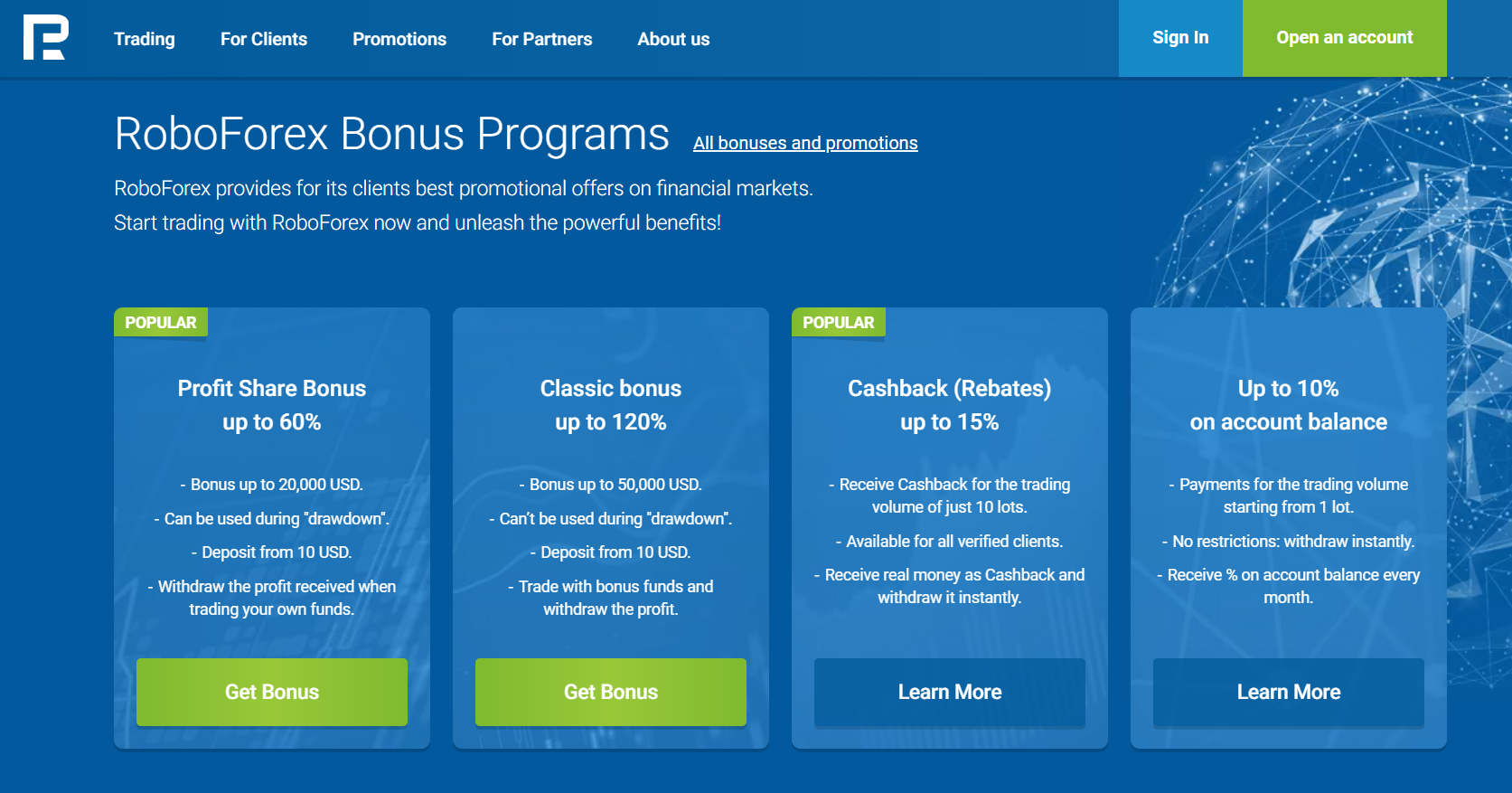

RoboForex:

RoboForex stands out for its robust bonus programs, offering a $30 Welcome Bonus for deposits of $10 or more, along with a potential 120% classic bonus on initial and subsequent deposits. The broker provides bonuses ranging from 5% to 15% cash back based on trading volume, and an additional 10% extra funds for more than 1,000 trades. The minimum deposit varies from $10 on most accounts to $100 for R StocksTrader and CopyFx. The company offers a range of trading applications, including MetaTrader 4, MetaTrader 5, CTrader, and R StocksTrader, alongside a web terminal. Leverage spans from 1:300 to 1:500, depending on account type and regulatory requirements. Additionally, the broker features a multilingual support system available around the clock.

eToro:

eToro provides a comprehensive platform for investors to engage with over 3,000 stock assets, and notably, some can be traded without incurring fees. The minimum deposit and available leverage are contingent upon a trader’s registered country. The versatility of trading on eToro extends to both mobile applications and web platforms across diverse devices. Deposits and withdrawals are facilitated through debit/credit cards, bank transfers, and electronic payment systems. This broker caters to margin trading enthusiasts, along with a range of bonuses and partner incentives to enhance the trading experience.

Among other reputable companies highlighted by financial experts are ETrade, CapTrader, Robinhood, SpeedTrader, Easy Equities, and others.

Remember to choose a broker that aligns with your trading needs and safeguard your investment wisely!

Selecting the Right Forex Broker in Bangladesh: A Guide by TU

Choosing the right Forex broker is crucial for success in the trading world. Traders Union experts have put together a guide to help you select a broker that is safe, transparent, and suits your trading needs in Bangladesh. Below are the key factors you should consider in your decision-making process.

- Regulatory Compliance: Ensure that the broker is regulated by the Bangladesh Securities and Exchange Commission (BSEC). This ensures safety and transparency.

- User-Friendly Trading Platforms: Opt for a broker that provides reliable trading platforms that are accessible on desktop, web, and mobile.

- Reputation: Check online reviews and feedback from other traders to assess the broker’s reputation.

- Trading Conditions: Compare the broker’s spreads, commissions, execution times, and account types.

- Mobile Trading App: Make sure the broker offers a dependable and user-friendly mobile trading app.

Conclusion

Choosing the right Forex broker is very important for your success in trading. TU has helped by listing the top brokers in Bangladesh for 2023 and giving you a guide on what to consider when choosing a broker. Remember to check if the broker is regulated by the BSEC, read online reviews, compare trading conditions, and make sure they have a good mobile trading app. This will help you choose a broker that is safe, transparent, and suits your trading needs.