A Comprehensive Guide to Torrid Credit Card – Login, Requirements, Reset, and Beyond

- 1 Torrid Credit Card: Who Should Get It?

- 2 Benefits Of Torrid Credit Card

- 3 Cons Of Torrid Credit Card

- 4 Torrid Credit Card Login Step To Step Process

- 4.1 LOGIN REQUIREMENTS:

- 4.2 LOGGING IN THROUGH WEBSITE

- 4.3 LOGGING THROUGH THE APPLICATION

- 4.4 LOGGING WITH THE HELP OF GOOGLE PLAY OR APPLE STORE

- 5 How do you reset the account password?

- 6 Top 3 Torrid Credit Card Alternatives

- 6.1 Chase Freedom Flex

- 6.2 Prime Visa

- 6.3 CardWells Fargo Active Cash

- 6.4 Is Torrid Credit Card Right for You?

- 7 FAQs

The Torrid Credit Card helps you save money on plus-size products. The card has no annual charge and offers 5% off Torrid purchases. It’s downhill after that. A store-branded credit card with a 35.24% variable APR on purchases and other fees will turn you away. Unlike other retail cards, it offers little benefits and just a rare coupon or special deal.

Torrid Credit Card: Who Should Get It?

The Torrid Credit Card* may appeal to frequent Torrid shoppers due to its 5% discount and unique promotions. The card’s high APR will offset the benefits if you typically carry a debt. Since the Torrid Credit Card* can only be used in-store, it could be better for infrequent shoppers. Consider a general rewards credit card if you seldom purchase at Torrid. Remember that consumers without the card may still benefit from Torrid Rewards with a free account. This may make consumers useless cardholders.

Benefits Of Torrid Credit Card

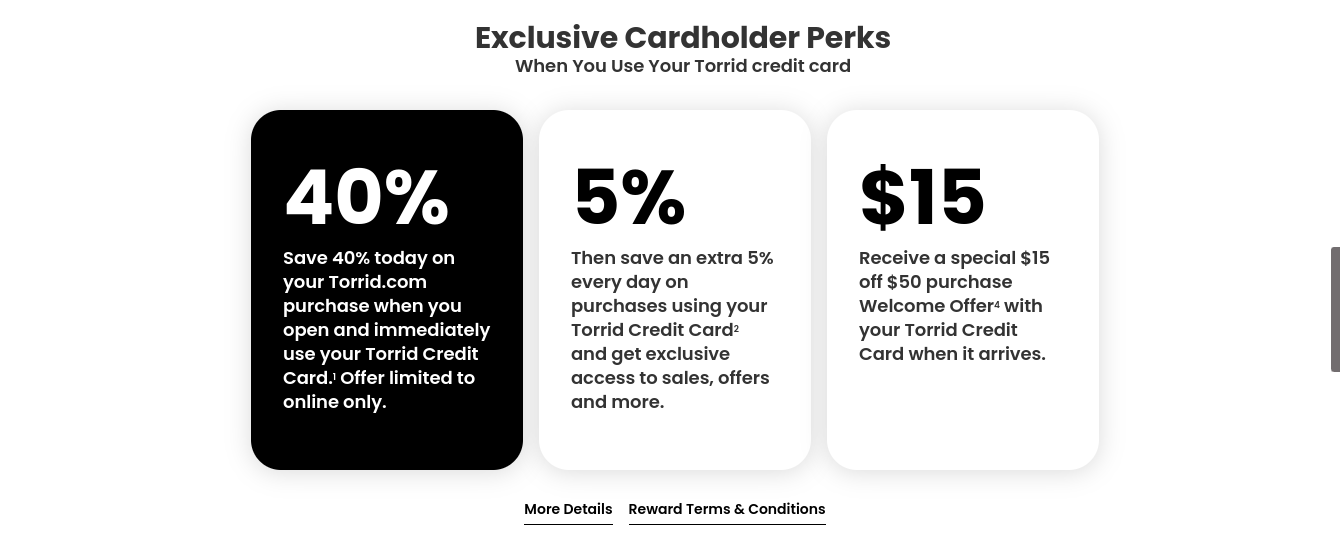

Welcome gift

The discount code must be used the day the card is accepted. Now is the moment to update your wardrobe. Those who have never bought at Torrid may obtain the 40% discount without a credit card by signing up for their campaign emails.

5% Off Torrid Items

The card offers 5% off Torrid retail and online purchases. This discount cannot be used with the 40% off sign-up offer. It is not valid with catalog/mailer coupons, boxstuffer codes, or sitewide promos.

Store loyalty program

The shop loyalty program comprises Insider, Loyalist, and VIP categories. Each tier offers more value perks like free delivery, refunds, and a birthday gift based on your point total. Clicking the store’s daily marketing email, sharing a product review online, sharing on Facebook or Pinterest, and shopping in-store or online get points.

Credit Reporting

You may enhance your credit with the three primary credit bureaus by making monthly, on-time payments to your Torrid Credit Card* account.

Cons Of Torrid Credit Card

The card is only valid in-store

The Torrid Credit Card is a closed loop and only valid at Torrid. This drastically restricts card rewards. If you seldom shop at Torrid, this card is not for you. A generic cashback or rewards card that allows you to earn anywhere, including Torrid, is superior.

High-interest rate

If you cannot pay your debt in full each month, purchases incur a 35.24% variable APR. This is more than other cards and poses a financial risk if you miss a payment. Interest expenses immediately surpass card savings.

Torrid Credit Card Login Step To Step Process

All Torrid clients may manage their accounts via Comenity Bank’s account center page. Customers can use account-level services after login.

LOGIN REQUIREMENTS:

Customers must verify the following before logging in. This information will help secure login and account protection.

- Customers must first create an online account and receive their username and password.

- Customers must use contemporary browsers like Google Chrome, Apple Safari, Mozilla Firefox, Opera, etc. Please update it to the current version.

- Official, up-to-date smartphone apps are required.

- Internet access must be constant.

- Secure and trustworthy devices must be used to access internet accounts. Personal smartphones, laptops, and tablets are recommended.

LOGGING IN THROUGH WEBSITE

- Visit the official Comenity Torrid account website.

- Link: https://d.comenity.net/ac/torrid/public/home

- No login form is initially available. Click Sign In under the menu to display the login form.

- Now, The login form appears.

- Enter your Torrid username and password and click Sign In. Your account dashboard will appear.

- Select Remember Me to store your username on your device. You’ll need your password next time you check-in.

LOGGING THROUGH THE APPLICATION

- Please visit the Torrid app page on their website.

- Customers will find Android and iOS app connections here.

- Click your device-compatible app link.

- The app opens on the Play Store or App Store.

- Click Install on the app page to download it to your phone.

LOGGING WITH THE HELP OF GOOGLE PLAY OR APPLE STORE

- Store applications let customers search the app directly.

- Launch Google Play or the App Store on your Android or Apple device.

- Use the shop app to find Torrid.

- A list of applications appears.

- Click the Torrid LLC app link.

- Click the Install link on the app page to download it to your smartphone

How do you reset the account password?

Customers who forget their username and password can regain their account. Customers may effortlessly restore accounts utilizing this feature. Check the procedures below to recover your account.

- Click Sign In on the Comenity Torrid website.

- Click Forgot username/password on the login form. It launches an online account recovery form.

- Please enter your credit card account number, zip code, and last four SSNs, and select Find My Account.

- Complete the registration form after verifying your account. Your Comenity account needs a unique username and secure password.

Top 3 Torrid Credit Card Alternatives

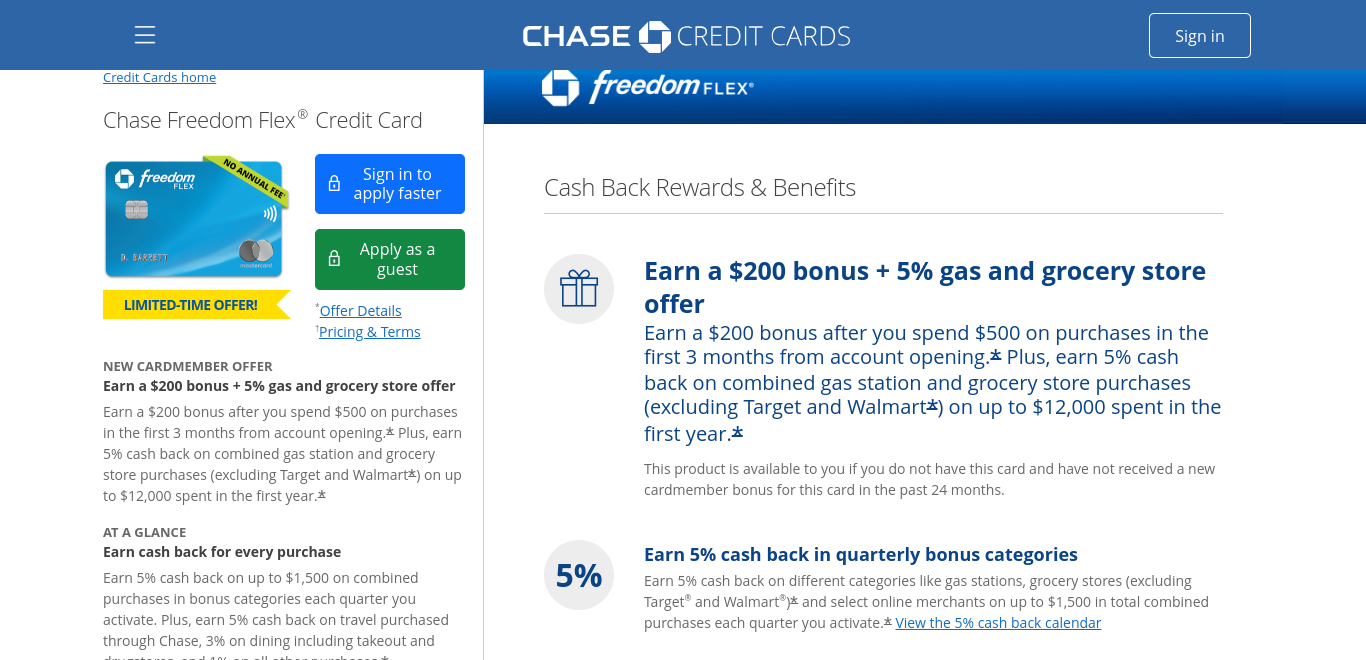

Chase Freedom Flex

Enjoy organizing purchases around bonus categories to maximize rewards? Grab the Chase Freedom Flex℠*. The card earns 5% cash back on up to $1,500 in quarterly rotating categories (needs activation), 5% on Chase Ultimate Rewards® travel, 3% on eating and drugstores, and 1% on all other transactions. These benefits are far higher than the Torrid card’s and may be used anywhere. It offers $200 after $500 in purchases in the first three months of account creation.

Plus, get 5% cash back on the petrol station and grocery shop purchases (excluding Target and Walmart) up to $12,000 in the first year. This plus a 0% initial APR on purchases and debt transfers for 15 months from account inception, then 20.49%–29.24% variable APR. Up to 5% (min. $5) of each balance transfer is charged. This makes the Freedom Flex superior to the Torrid card in practically every way. You can’t acquire this card if you’ve opened more than five credit cards in the prior 24 months due to Chase’s 5/24 restriction. This is a good pick if your Chase limit isn’t maxed out.

Prime Visa

Amazon Prime members will benefit significantly from the Prime Visa. A Prime membership gets 5% back on Amazon.com, Amazon Fresh, Whole Foods Market, and Chase Travel, 2% back at petrol stations, restaurants, and local transit and commuting (including ridesharing), and 1% back on other transactions. Amazon credit cards may be used anywhere Visa is accepted, unlike the store-branded Torrid Credit Card*.

The Amazon Plus Shop provides plus-size apparel and accessories for women, so it can accomplish what the Torrid card can but better. The shop card redemption possibilities are considerable. You may redeem points for Amazon.com, cash back, gift cards, and vacation. Torrid card prevents all that—19.49% to 27.49% variable APR. You need a $139 Amazon Prime Membership ($69 for students) to get the card.

CardWells Fargo Active Cash

The Wells Fargo Active Cash® Card is a fantastic cashback rewards card. This 2% cashback card has a welcome bonus, unlike the Citi Double Cash® Card or PayPal Cashback Mastercard®. Spend $500 in the first 3 months to earn $200 cash incentives. The card’s deductible-based mobile insurance makes it superior to the Torrid Card. Cardholders get 2% cash back. The Wells Fargo Active Cash® Card beats the Torrid Credit Card*. It gets points anywhere a Visa is accepted, including Torrid.

Is Torrid Credit Card Right for You?

The Torrid card is designed for longtime members. An exclusive 5% discount on purchases is accessible to cardholders. However, its APR is higher than usual and lacks an intro APR offer. Cashback credit cards with 0% initial APR, welcome bonuses, and other benefits may be better.

FAQs

How does the Torrid Credit Card work?

Torrid’s loyal customers get the Torrid Credit Card. Cardholders can earn points, get unique advantages, and get special financing at Torrid and its linked retailers. Apply online or in-store for the card and use its advantages after acceptance.

What are the Torrid Credit Card application requirements?

You must be 18 and have a U.S. mailing address to apply for a Torrid Credit Card. The application may request your social security number and other personal information to determine creditworthiness.

How do I access my Torrid Credit Card online?

Log in to your Torrid Credit Card account on the official website. Search for “Sign In” or “Log In” and enter your username and password to access your account dashboard, where you may modify your card, see statements, and more.