The Dilemma of Doctors as Debt Collectors: Ethical Implications, Challenges, and Solutions

- 1 What Ethical Implications Do Healthcare Providers Have?

- 2 What Challenges Do Healthcare Providers Face While Recovering Bad Debts?

- 2.1 Balancing Empathy and Economic Stability

- 2.2 Lack of Standardized Policies:

- 2.3 Socioeconomic Differences:

- 3 How Are Medical Professionals Trying To Recover Outstanding Balance?

- 3.1 In-House Collection Efforts:

- 3.2 Third-Party Debt Collection Agencies:

- 3.3 Legal Actions:

- 3.4 What’s The Impact Of Bad Debt Recovery On Medical Practices?

- 3.5 Financial Strains

- 3.6 Increased Administrative Burden

- 3.7 Limited Resources for Patient Care

- 3.8 Strained Patient-Provider Relationships

- 3.9 Solutions:

- 3.10 Offer Flexible Payment Plans:

- 4 Use Automated Bad Debt Recovery System:

- 4.1 Conclusion:

Purpose: To highlight and discuss the ethical considerations and challenges that arise when medical professionals are required to take on the role of debt collectors and promote Credee as an effective and efficient means to address the challenges faced by healthcare providers.

Did you know around 100 million adults in the United States owe at least $195 billion in medical debt?

This staggering figure emphasizes a significant issue in the American healthcare system–the problem of bad medical debt. Healthcare providers prioritize improving and saving lives, but that should not be at the cost of their financial stability. However, the ethical implications bound them to treat patients and provide necessary medical services, regardless of their ability to pay.

- So, will medical professionals continue encountering bad debt challenges that can threaten their stability?

- Who is responsible for compensating the financial losses incurred from unpaid medical bills?

- How can they recover outstanding debt while maintaining patient-doctor relationships?

It’s time for a new approach: setting up payment plans and automated bad debt recovery processes can be the way.

What Ethical Implications Do Healthcare Providers Have?

Patient Well-being:

Medical professionals are confined to prioritizing patient care and well-being. However, while attempting to collect unpaid invoices, they risk compromising their relationships with the patients. This delicate balance raises concerns about potential harm to patients who may face additional stress or emotional turmoil due to financial pressures.

In March 2022, 63 percent of people in the US with medical debt had to reduce spending on basics like food and clothing.

Access to Healthcare:

The ethical principle of justice emphasizes equal access to healthcare services for all individuals. When medical professionals start recovering outstanding debt, it may result in limited access to necessary medical care for patients who can’t afford out-of-pocket care. It creates a potential conflict between financial viability and the ethical duty to provide equal treatment to all patients, regardless of their ability to pay.

Confidentiality and Privacy:

The process of bad debt recovery often involves sharing patients’ information with external debt collection agencies or pursuing legal action. Medical professionals must navigate this process while upholding patient confidentiality and privacy rights. The potential breach of trust raises ethical concerns, as patients expect their personal information to remain confidential within the healthcare setting.

Not only ethical implications, but medical professionals also face multiple challenges when recovering bad debts from patients.

What Challenges Do Healthcare Providers Face While Recovering Bad Debts?

Balancing Empathy and Economic Stability

Medical professionals face the challenge of balancing compassionately addressing patients’ healthcare needs without compromising finances. The pressure to collect bad debt while providing quality care can create moral distress, potentially affecting the professional’s financial well-being and the doctor-patient relationship.

Lack of Standardized Policies:

The absence of standardized policies and guidelines regarding bad debt collection in healthcare poses significant challenges. Medical professionals often need clarification on situations and decision-making difficulties when determining how aggressively to pursue outstanding bills. The lack of clear ethical frameworks makes it difficult to navigate this complex environment.

Socioeconomic Differences:

Bad debt collection affects individuals from lower socioeconomic backgrounds already facing financial hardships. Medical professionals may find themselves in a difficult position, torn between their ethical obligations and the financial realities of operating a healthcare facility. This challenge highlights the inherent tension between economic sustainability and equitable access to healthcare.

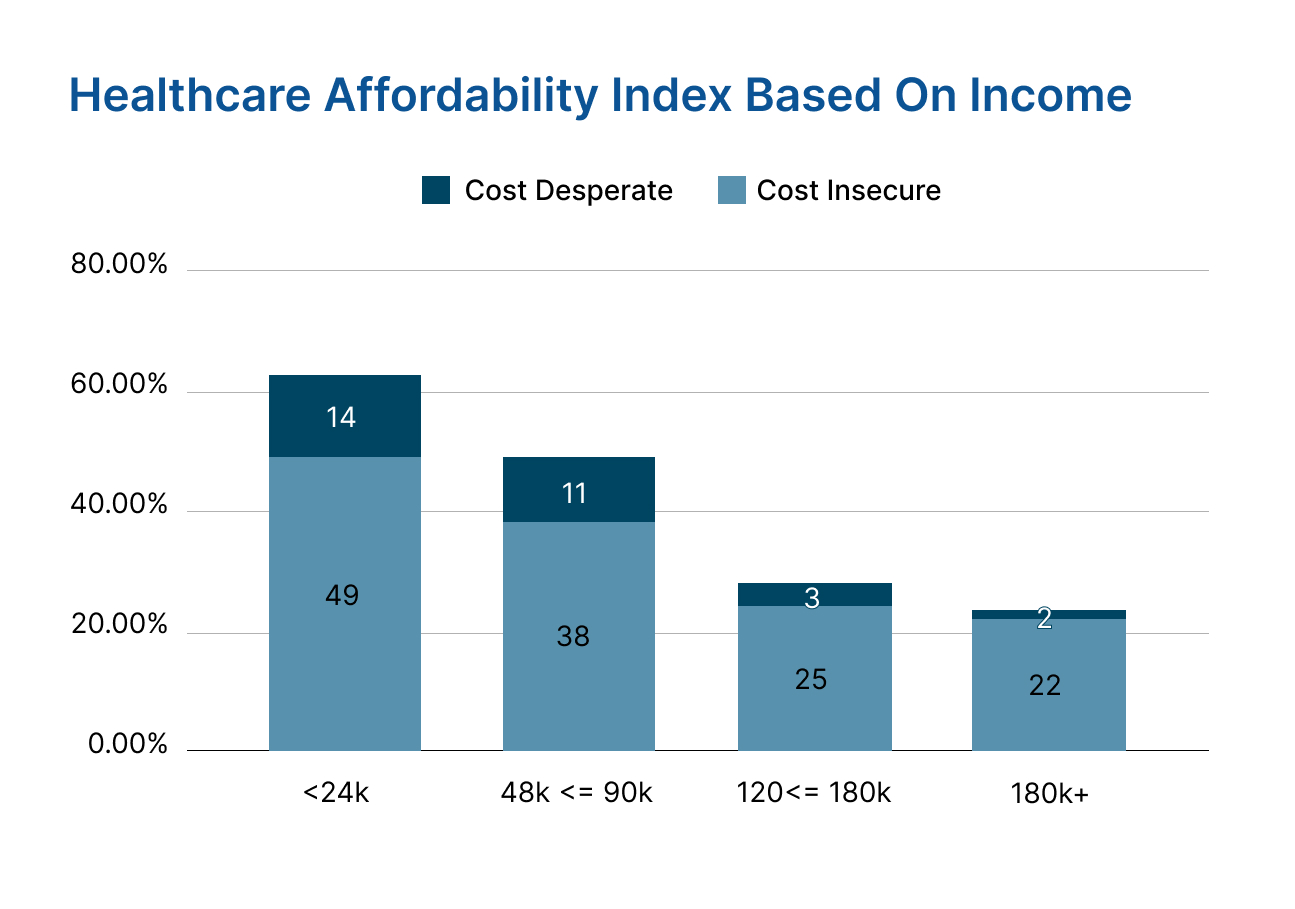

In the 2021 Healthcare Affordability Index survey, about half of the adults earning less than $24,000 a year said they couldn’t afford healthcare or medicine recently. Almost 14% struggled with paying for household care and medication and worried about accessing affordable quality care if needed the same day. Even 22% of Americans earning more than 180+k per annum reported their inability to afford healthcare or medicine recently. Also, 2% said they won’t be able to pay for household care and medication and worried about accessing affordable quality care if needed today. |

How Are Medical Professionals Trying To Recover Outstanding Balance?

Medical professionals use various strategies to recover bad debt. The specific approaches may vary depending on the healthcare facility and local regulations. Here are some popular methods used to address the issue of bad debt:

In-House Collection Efforts:

Healthcare practices may have dedicated staff or departments responsible for handling bad debt collections. These professionals work directly with patients to negotiate payment arrangements, answer questions, and resolve outstanding issues.

Third-Party Debt Collection Agencies:

Medical professionals may engage external debt collection agencies to recover unpaid bills. These agencies specialize in debt recovery and have the resources and expertise to pursue legal actions to collect the debt on behalf of the healthcare facility.

Legal Actions:

Healthcare professionals may initiate legal proceedings against patients with significant outstanding debt as their last resort. This typically involves filing lawsuits to obtain judgments and potentially placing liens on assets to recover the owed amount.

However, the traditional methods of medical debt recovery can place an excessive burden on healthcare providers and often have more negative consequences than benefits.

What’s The Impact Of Bad Debt Recovery On Medical Practices?

The impact of bad debt on medical practices can be significant and complex. Here are some ways in which bad debt affects healthcare providers:

Financial Strains

Unpaid bills and bad debt create a financial strain for medical practices, majorly independent practices. The loss of revenue can hinder the ability to invest in the necessary equipment, maintain quality staff, or expand services. Ultimately, it can impact the overall sustainability of the practice.

Increased Administrative Burden

Dealing with bad debt requires additional administrative work, such as sending repeated reminders, managing payment plans, and pursuing collections. This diverts resources and time that could be dedicated to patient care or other critical operational tasks.

Limited Resources for Patient Care

When healthcare providers focus on debt recovery, it can redirect resources away from patient care. The time and energy spent on pursuing bad debt may reduce the availability of appointments, prolong waiting times, or limit the ability to provide certain services or treatments.

Strained Patient-Provider Relationships

The debt collection process can strain the relationship between medical professionals and patients. Patients may feel harassed or stigmatized, leading to a breakdown in trust and potentially affecting the overall patient experience and quality of care.

Despite wasting multiple resources and hundreds of dollars on medical bad debt collection, healthcare professionals struggle. Therefore, medical practices should focus on making quality care affordable. This will automatically reduce the occurrence of medical debt.

Using reliable and effective debt recovery software is the most practical solution.

Solutions:

Quality healthcare in the US is becoming expensive each day. Even after spending trillions of dollars on public health, the system fails to address the affordability challenge and help healthcare providers with feasible solutions to recover bad debt from patients.

The Effective Solutions Are:

Offer Flexible Payment Plans:

Payment plans in healthcare provide patients with financial flexibility by allowing them to manage medical expenses more effectively. Instead of paying a large sum upfront, patients can spread out payments over an extended period, enabling them to budget and allocate funds accordingly. This increased affordability makes healthcare services more accessible to individuals facing financial constraints.

Patients who can make smaller, manageable payments over time are likely to fulfill their financial obligations than those who need to make a one-time payment. Hence, offering healthcare payment plans can act as a preventive measure, reducing the chances of medical debt accumulation.

However, traditional lenders approve patients with good credit scores only. Healthcare providers should choose a solution such as Denefits that has a No Credit Check policy. Thus, patients with unfavorable scores get instant approval and can pay off their medical bills in installments. By spreading out payments, patients can effectively manage their medical expenses while healthcare professionals ensure a positive patient experience and a higher likelihood of receiving full payment for services provided.

Use Automated Bad Debt Recovery System:

Implementing automated debt recovery software such as Denefits in healthcare practices offers numerous benefits. The medical professionals just need to upload a list of outstanding accounts, Denefits reaches debtors and sends reminders for monthly installment payments, streamlining the process. This automation improves efficiency, allowing medical professionals to save more lives and focus on other tasks.

Consistent and timely communication with debtors increases the chances of prompt payments. It enhances cash flow and revenue recovery rate, as the software generates personalized payment plans and tracks progress. The automated system reduces the administrative burden, freeing up staff time. It ensures compliance with legal and ethical requirements, promoting a strong reputation. It’s the optimal way for healthcare providers to optimize debt recovery and prioritize quality patient care.

Conclusion:

The harsh reality of bad medical debt in the United States and its profound impact on healthcare providers and patients is alarming. With millions of adults burdened by staggering debt, the ethical implications and challenges of medical professionals are undeniable. It is a tragic situation where financial stability clashes with the compassionate duty to provide essential care.

The stories of individuals forced to sacrifice basic necessities and the healthcare providers’ struggles in recovering debts evoke a sense of empathy and urgency. The healthcare system must adopt innovative solutions like flexible payment plans and automated debt recovery systems. They can alleviate the burden of patients and preserve the integrity of the patient-provider relationship. It is time for a paradigm shift that prioritizes affordable and accessible healthcare for all while ensuring the financial sustainability of medical practices.