How To Sign In To Sddfcu And Create An Account?

Sddfcu is a company that gives short-term loans to people with bad credit. The loans don’t need anything as security because they are unsecured. Most Sddfcu loans are for less money than traditional loans and have a high interest rate.

People who wanted a place where people with bad credit could get short-term loans started Sddfcu in 2002.

People who started Sddfcu thought many people could repay a loan but couldn’t get one because of their credit history. Sddfcu will lend up to $500 to people with bad credit—most loans last between two weeks and one month. Most of the time, the interest rate on a Sddfcu loan is higher than the rate on a traditional loan.

Sddfcu is a bank in California that gives short-term loans to people with bad credit. The interest rates are high, but the loans don’t have to be paid back. Sddfcu was started in 2002 to help people get loans who couldn’t get traditional loans because of their credit history.

What Does Sddfcu Stand For?

Credit union members can get reasonable rates on loans, savings accounts, and other financial products with Sddfcu. Its main goal is to help its members save money and give them loans at fair rates. Sddfcu offers its members various financial services, such as savings accounts, loans, and investment products.

History

Since 1923, there has been a credit union called Sddfcu. Its main office is in the city of Sioux Falls, South Dakota. As of 2019, it is worth over $1.9 billion and has over 140,000 members. Sddfcu offers a variety of financial products and services, such as checking and savings accounts, loans, and credit cards. It also has an excellent online banking system that lets members manage their accounts from anywhere.

For a long time, credit unions have helped their members and the general public. It was started by a group of teachers who wanted to help their fellow teachers get financial products and services at affordable prices. Sddfcu has worked hard since the 1920s to help its members reach their financial goals. People have used it to start businesses, buy homes, and pay for college with the money.

The credit union also helps people in the area. It enables local schools and other organizations. If you want to work with a bank you can trust, Sddfcu is an excellent choice. It has been helping its members and the community for a long time and offers a wide range of goods and services.

Locations

Sddfcu, a credit union, has served the Denver area for over 70 years. They offer services like checking and savings accounts, loans, and credit cards. There are five of them around Denver.

- The first place is in downtown Denver on 17th Street.

- The second place is in Englewood, on South Broadway.

- The third place is on Lakewood’s Wadsworth Boulevard.

- The fourth place is in Thornton, on Washington Street.

- Sheridan Boulevard in Westminster is fifth and last.

Timings

The Santa Cruz Dawson Federal Credit Union is owned and run by those who use it. It is a bank that doesn’t make money for itself. The credit union offers many services, such as savings and checking accounts, loans, and credit cards. There are also many ways to learn about money at the credit union. Monday through Friday, 9 a.m. to 5 p.m., the Santa Cruz Dawson Federal Credit Union is open. The credit union is closed on Saturday and Sunday.

The Santa Cruz Dawson Federal Credit Union offers its members several services. There are also many ways to learn about money at the credit union. The Santa Cruz Dawson Federal Credit Union is owned and run by those who use it. It is a bank that doesn’t make money for itself.

How Sddfcu’s Different Accounts Work

Accounts for the money you save:

Sddfcu has a wide range of savings options, such as certificates of deposit and regular money market accounts (CDs). Interest is added to the amount left in these accounts.

Accounts to look at:

Each checking account Sddfcu offers has its perks and benefits.

Accounts to lend money:

Sddfcu has many ways to borrow money, such as auto, home equity, and personal loans.

Things That Are Good and Bad About Sddfcu

Pros

- Sddfcu offers a wide range of products and services related to money.

- The credit union has been helping people in the military for a long time, and its members can count on great rates and service.

- Since Sddfcu doesn’t make money, it doesn’t have to answer to shareholders. So, the credit union can focus more on helping its members than making money.

Cons

- Since Sddfcu isn’t a big credit union, it doesn’t have as many convenient services as larger banks.

- Since Sddfcu is mainly for people in the military, people who are not in the military may not feel as welcome there at times.

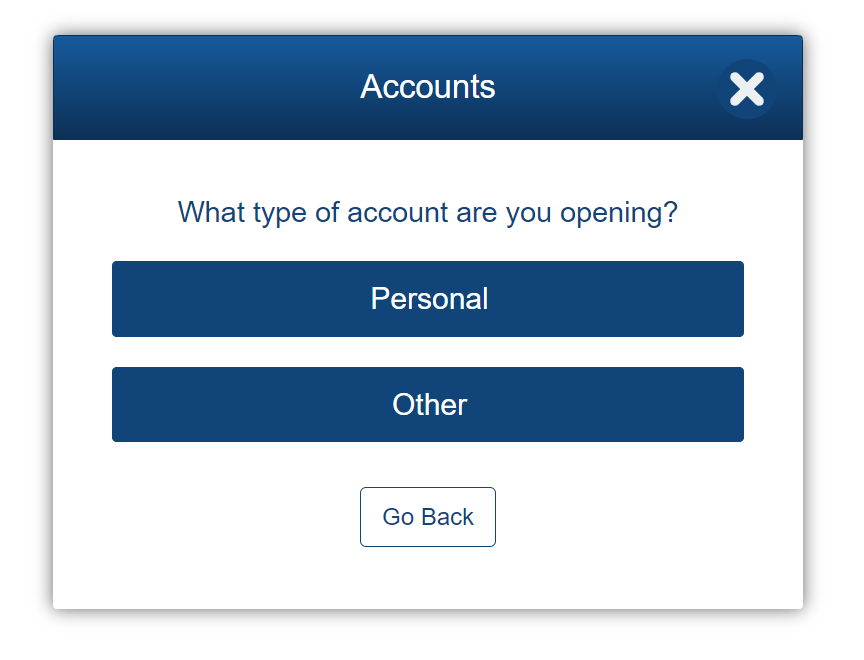

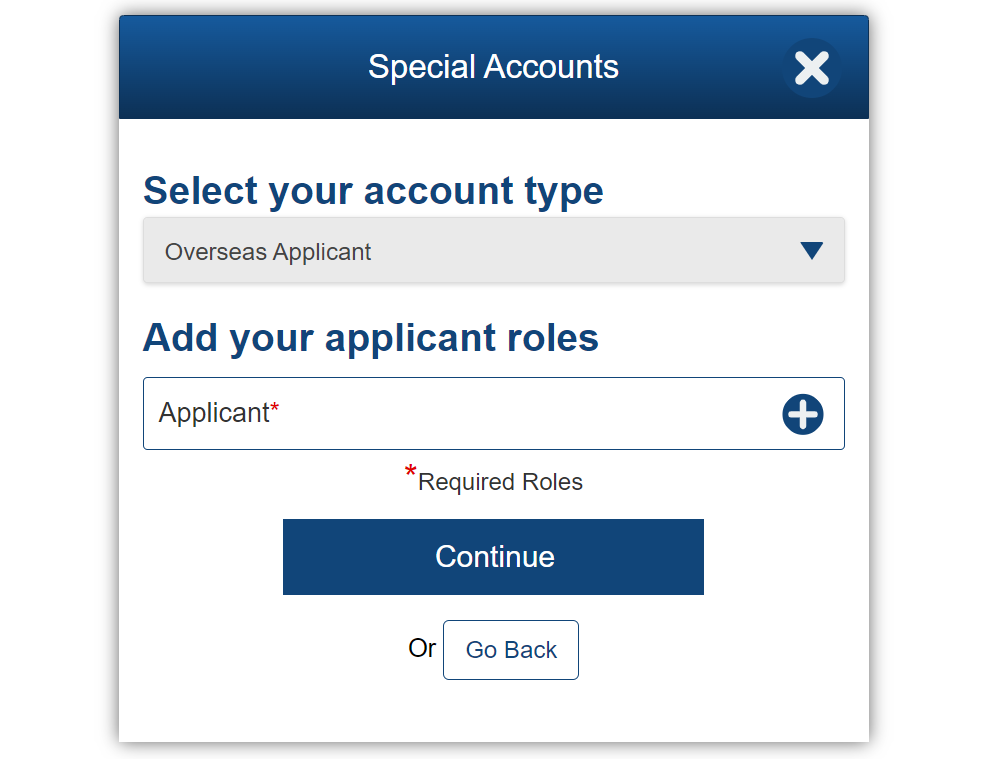

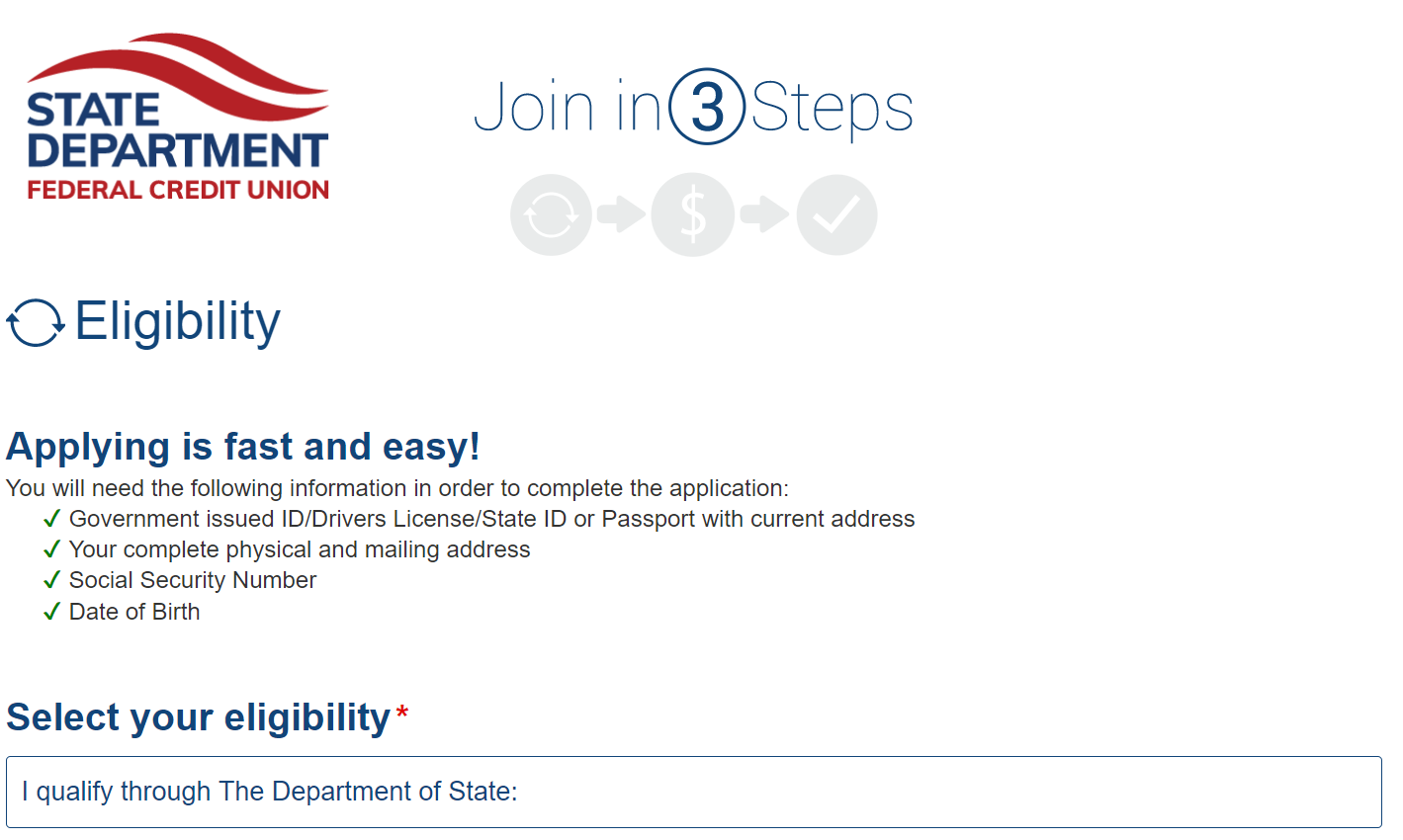

How Can I Sign Up For The Sddfcu?

If you want to join Sddfcu, you must know a few things about it. Joining the State Bar of Texas is the first step. Second, you must have an account at a credit union. Last, the account must always have at least $5 in it. If you meet these requirements, you can join Sddfcu by visiting their website or calling their customer service line.

Conclusion

Sddfcu has competitive rates and better customer service than many big banks. It’s a good option for people who don’t want to switch banks. However, it may be easier to use Sddfcu than online banking. Some people still like bank branches because they are easy to get to and have quick service.

FAQs

What does Sddfcu stand for?

Sddfcu is often a short form for San Diego County Credit Union. Despite what most people think, this cooperative bank does not make money for its customers. In 1938, teachers in the area started a group called Sddfcu.

How do credit unions help the people who belong to them?

Both credit unions and banks offer banking services, but they are not the same in important ways. Credit unions are owned by their members and are not-for-profit cooperatives. This means that the money they make is first used to help their customers. As a result, interest rates on savings accounts and loans go down, as do service fees. Second, people who live in the same area own and run credit unions.

How can I sign up for the Sddfcu?

Anyone who lives, works or attends church in San Diego County can.