Can You Get Loan Approval With Bad Credit via UKBadCreditLoans? – A 2024 Review

The first thing to note about UKBadCreditLoans is that the credit service is not a direct lender. Instead, the company represents a vast network of third-party lenders that are able to provide borrowers with online loans. And the main differentiator with using this platform is that their partner lenders are open to catering to individuals with a bad credit score.

In other words, if you find yourself unable to qualify for funding from traditional lenders like banks or credit unions, you can consider applying for UK loans with bad credit from UKBadCreditLoans.

However, if you are not familiar with the credit broker, here’s a breakdown of how the lending platform works, as well as the things you need to consider before applying for a loan.

UKBadCreditLoans – Loan Rates & Terms On Offer

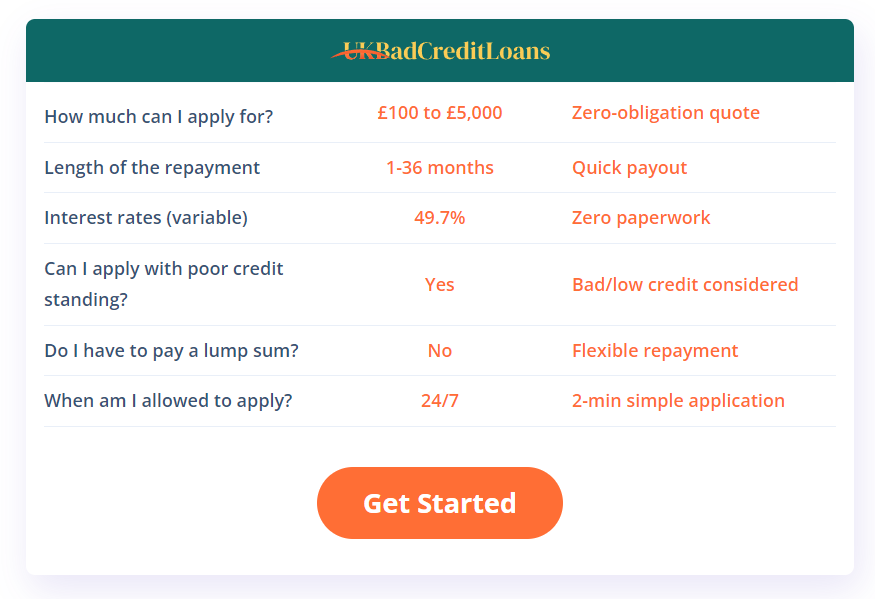

UKBadCreditLoans offers instant access to dozens of direct lenders that can provide you with unsecured online loans that typically range from as low as £100 to as high as £5,000. However, keep in mind that the loan amounts that you end up qualifying for will often depend on your credit score and your income level.

In terms of interest rates, they can typically go as high as 49.7%, but this also depends on your level of creditworthiness, as the lower your credit score, the higher you can expect your interest rates to be due to the increased level of risk to the lender.

In addition, the repayment periods offered will often vary between 1 and 36 months, so there’s a fair amount of flexibility available to you. You can also obtain short-term loans on this site and use them for a wide variety of purposes, as their lending network does not impose any restrictions on how you can use your funds.

This includes debt consolidation, home renovations, medical bills, car repairs, travel expenses, etc. There is also no minimum credit score requirement, so no matter what your credit rating may be, you can still find a lender who is open to working with you.

Is UKBadCreditLoans Right For You?

If you need a loan in a hurry or can’t seem to be approved for one anywhere, then UKBadCreditLoans is worth considering, and here are the reasons why.

Cost Value

The UKBadCreditLoans lending platform is completely free to use, which means that you never have to worry about having to pay any hidden fees to find loan providers. And while you may end up having to pay extra costs on your loan, like an origination fee, these charges are not imposed by the site itself but rather by the lender.

As such, you can feel free to browse the platform and explore what loan options are available to you without fear of having to make a financial commitment.

Ease of Use

With UKBadCreditLoans, the online process of finding a reliable lender and securing yourself a competitive loan is significantly easier than if you attempted to handle it yourself. All you need to get started is to input your relevant information in the online pre-approval form, and within minutes of submitting it, you will be presented with multiple loan offers to choose from.

Each one will usually come with its loan rates and terms to consider, but once you find the ideal offer that suits your budget and current needs, you only need to e-sign the loan agreement. The funds will then be processed and deposited into your account by the next business day.

Complete data protection and security

The benefit of UKBadCreditLoans is that the lending service takes data privacy and confidentiality very seriously. It is for this reason that the platform uses bank-level encryption software to protect your personal and financial data from any unauthorized access. Furthermore, they have a strict privacy policy in place that ensures your information will never be shared with any third parties.

What To Keep In Mind Before Using UKBadCreditLoans?

One of the main things to consider before you decide to take out a loan via UKBadCreditLoans’ lending network is that the APRs tend to be high. This is especially relevant if you have a low credit score, as the increased risk to the lender results in rates that can go as high as 49.7%.

In addition, these loans also tend to come with shorter repayment periods compared to traditional loans. It is for this reason that you should always be confident that you can afford to repay your debt on time before you sign any loan agreements.

In fact, you should also keep in mind that failure to make your loan repayments on time can significantly impact your credit score, as the lenders are likely to report you to the major credit bureaus. On top of that, you may also end up having to pay high late repayment fees that can raise your level of debt dramatically.

How Do I Repay The Loan Borrowed?

Once you secure a loan from their lending network, the funds will be deposited into your checking account. Most lenders will usually require you to set up automatic payments that electronically deduct the monthly payments from your account on the due date.

And even if the option to handle it manually is available, it is often recommended to use auto-pay, as it will reduce the risk of a potential default. However, always make sure that your checking account has enough money to cover the payments; otherwise, an unintended overdraft may be initiated.

What Happens if I Can’t Repay The Loan?

As mentioned before, failure to make your payments on time can result in being charged high late fees. However, given the fact that UKBadCreditLoans is not the actual lender, this means that the lending service cannot quantify how much you will be charged, as it usually varies by lender.

If you ever conclude that you may not be able to make your repayment on time, you should quickly reach out to the lender directly. Some of them may be willing to offer you a grace period that should help ease the problem and make the repayment a little easier to handle.

Are There Any Other Fees To Worry About?

Aside from late payment fees, some lenders may even charge you a prepayment fee for repaying your loan early. While this may sound strange, the reason a fair number of lenders often do this is that it reduces the profit they would have made had the interest continued to accrue.

However, this also varies from lender to lender, which is why you should take the time to carefully read through your loan agreements and their fine print to ensure that you don’t get blindsided.

Summary

Overall, UKBadCreditLoans can be absolutely relied upon to help you secure loan approval. It doesn’t matter how low your credit score may be; the platform makes it easy for borrowers of all credit types to find a lender. With such an extensive lending network to choose from, you are highly likely to find the right kind of loan offer that is well-suited to you and your financial situation.