What to choose between Ethereum or Bitcoin

- 1 A Comparative Study Of Bitcoin and Ethereum

- 1.1 Origins and Development

- 1.2 Underlying Technologies

- 1.2.1 Consensus Mechanisms

- 1.3 Smart Contracts and Turing Completeness

- 1.4 Use Cases

- 1.4.1 Bitcoin: Digital Gold

- 1.5 Ethereum: Decentralized Applications Platform

- 1.6 Scalability and Upgrades

- 1.7 Security and Decentralization

- 1.8 Future Prospects

- 2 Conclusion

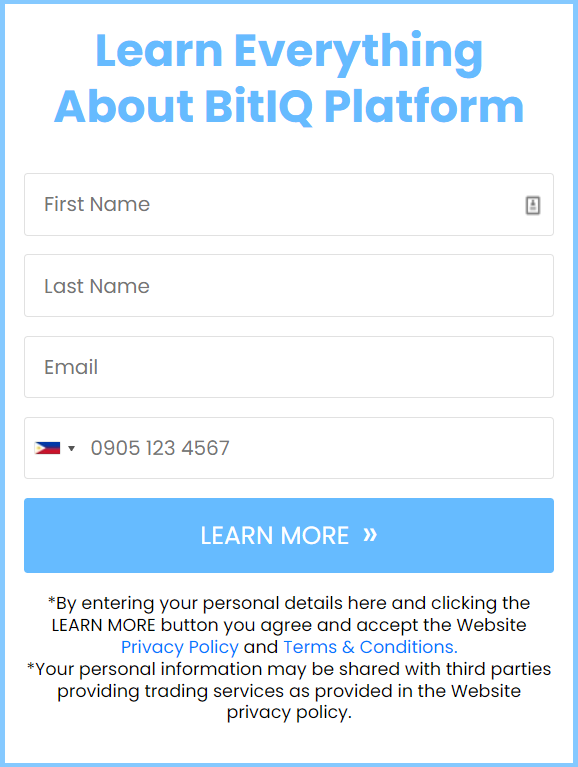

Ethereum and Bitcoin are nicknamed BTC and ETH. It should go without saying that Bitcoin and Ethereum are currently the two most popular cryptos in the world. Thanks to their leadership, these two companies have been the front-runners in the industry, contributing significantly to its overall expansion. Click the image below to begin trading bitcoins.

Bitcoin is often called “gold 2.0” due to its perceived value as a digital representation of physical gold. On the flip side, Ethereum is seen as a decentralized computer among investors worldwide. According to various criteria, Bitcoin and Ethereum are considered to be the two most valuable cryptocurrencies in the world. These metrics include market capitalization, the number of distinct wallet addresses, and the trade volume on cryptocurrency exchanges.

A Comparative Study Of Bitcoin and Ethereum

Origins and Development

Bitcoin: The Pioneer

Bitcoin, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, is the first and most well-known cryptocurrency. Nakamoto’s whitepaper, “Bitcoin: A Peer-to-Peer Electronic Cash System,” outlined a vision for a decentralized digital currency that operates without a central authority. Bitcoin was designed to enable secure, peer-to-peer online transactions, relying on a distributed ledger technology called blockchain.

Bitcoin’s blockchain is a public ledger that records all transactions in chronological order. This ensures transparency and prevents double-spending. Bitcoin’s supply is capped at 21 million coins, a feature intended to create scarcity and protect against inflation.

Ethereum: The Versatile Platform

Ethereum, proposed by Vitalik Buterin in late 2013 and launched in 2015, extended the concept of blockchain beyond digital currency. Buterin envisioned a platform where developers could build decentralized applications (dApps) using smart contracts—self-executing contracts with the terms directly written into code. Ethereum introduced the Ethereum Virtual Machine (EVM), which enables these smart contracts to run on its network.

Unlike Bitcoin, Ethereum does not have a fixed supply limit. Instead, it employs an inflationary model with periodic adjustments to its issuance rate. This flexibility ensures a balance between network security and economic sustainability.

Underlying Technologies

Consensus Mechanisms

Bitcoin and Ethereum use consensus mechanisms to validate transactions and secure their networks but employ different approaches.

- Bitcoin’s Proof of Work (PoW): Bitcoin relies on PoW, where miners compete to solve complex mathematical puzzles to add a new block to the blockchain. This process requires significant computational power and energy, contributing to its security and raising environmental concerns.

- Ethereum’s Transition to Proof of Stake (PoS): Originally, Ethereum also used PoW. However, with the Ethereum 2.0 (or ETH 2.0) upgrade, Ethereum is transitioning to PoS. In PoS, validators are chosen to create new blocks and validate transactions based on the number of coins they hold and are willing to “stake” as collateral. PoS is more energy-efficient than PoW and aims to enhance scalability and security.

Smart Contracts and Turing Completeness

One of the critical differentiators between Bitcoin and Ethereum is the support for smart contracts.

- Bitcoin: Bitcoin’s scripting language is intentionally limited and not Turing complete, meaning it cannot perform complex computations. This design choice prioritizes security and simplicity but limits programmability.

- Ethereum: Ethereum’s EVM supports a Turing complete language, enabling developers to create complex smart contracts. This flexibility has led to a vibrant ecosystem of dApps, decentralized finance (DeFi) projects, and non-fungible tokens (NFTs).

Use Cases

Bitcoin: Digital Gold

Bitcoin is often referred to as “digital gold” due to its store of value properties. Its primary use cases include:

- Store of Value: Many investors consider Bitcoin a hedge against inflation and economic uncertainty, similar to how gold is perceived.

- Medium of Exchange: While Bitcoin can be used for transactions, its scalability issues and high transaction fees often make it less practical for everyday use.

- Cross-Border Transactions: Bitcoin’s decentralized nature allows for relatively quick and low-cost international transfers compared to traditional banking systems.

Ethereum: Decentralized Applications Platform

Ethereum’s broader scope has led to a diverse range of use cases:

- Smart Contracts: Ethereum’s intelligent contracts facilitate automated, trustless agreements without intermediaries.

- Decentralized Finance (DeFi): Ethereum is the backbone of the DeFi movement, enabling lending, borrowing, trading, and earning interest without traditional financial institutions.

- Non-fungible tokens (NFTs): Ethereum’s ERC-721 standard has popularized NFTs, which represent unique digital assets such as art, collectibles, and virtual real estate.

- Decentralized Autonomous Organizations (DAOs): DAOs are organizations governed by code rather than traditional management, allowing decentralized decision-making and operations.

Scalability and Upgrades

Bitcoin

Bitcoin’s scalability is limited by its block size and the time it takes to confirm transactions. Several solutions have been proposed and implemented to address these issues:

- Segregated Witness (SegWit): SegWit is an upgrade that reduces the size of transactions, allowing more transactions to fit in a single block.

- Lightning Network: The Lightning Network is a second-layer solution that enables faster and cheaper transactions by creating off-chain payment channels.

Ethereum

Ethereum’s scalability challenges have been more pronounced due to its broader functionality. Ethereum 2.0 aims to address these issues through several upgrades:

- Sharding: Sharding involves splitting the Ethereum network into smaller, interconnected pieces called shards, allowing for parallel transaction processing.

- Proof of Stake (PoS): As mentioned earlier, the transition to PoS aims to improve scalability and energy efficiency.

- Layer 2 Solutions: Similar to Bitcoin’s Lightning Network, Ethereum’s layer two solutions, such as Optimistic Rollups and zk-Rollups, aim to increase transaction throughput and reduce costs.

Security and Decentralization

Bitcoin

Bitcoin’s long history and significant hash power make it one of the most secure blockchain networks. Its decentralization is a core feature, with thousands of nodes distributed globally. However, concerns about mining centralization exist, as large mining pools can exert significant influence.

Ethereum

Ethereum’s transition to PoS is designed to enhance security and decentralization. PoS reduces the risk of centralization associated with PoW mining by requiring validators to stake their own coins. However, Ethereum’s broader functionality and complexity can introduce additional attack vectors, necessitating robust security measures.

Future Prospects

Bitcoin

Bitcoin’s future largely hinges on its adoption as a store of value and its ability to address scalability issues. Institutional adoption, regulatory clarity, and advancements in second-layer solutions will play crucial roles in its evolution. As digital gold, Bitcoin’s primary value proposition remains its security, scarcity, and decentralization.

Ethereum

Ethereum’s future is closely tied to its success of Ethereum 2.0 and ability to maintain its position as the leading platform for dApps and DeFi. The ongoing development of layer two solutions and the expansion of its ecosystem will be critical. Ethereum’s flexibility and adaptability position it well for continued innovation in blockchain technology.

Conclusion

Bitcoin and Ethereum represent two distinct but complementary visions for the future of blockchain technology. With its focus on security, decentralization, and scarcity, Bitcoin serves as a digital store of value and a hedge against economic uncertainty. Ethereum, emphasizing programmability and versatility, has become the foundation for various decentralized applications and financial services.

Both cryptocurrencies face challenges, particularly regarding scalability and regulatory scrutiny, but their development communities are actively working on solutions. As the blockchain landscape continues to evolve, Bitcoin and Ethereum will likely remain central players, each contributing uniquely to decentralized technologies’ broader adoption and advancement.