AI and Pattern Recognition in Financial Markets

- 1 The Impact of Artificial Intelligence on Trading Strategies

- 2 Understanding Pattern Recognition in Trading

- 3 AI Applications in Pattern Recognition

- 4 Challenges and Opportunities in AI-Driven Financial Market Analysis

- 5 Conclusion:

- 5.1 FAQs:

- 5.1.1 How does AI revolutionize trading strategies?

- 5.1.2 What advantages does AI offer in trading?

- 5.1.3 What role does pattern recognition play in AI-driven trading?

- 5.1.4 What challenges do AI-driven trading strategies face?

- 5.1.5 How can traders optimize AI-driven trading strategies?

- 5.1.6 What applications does AI have beyond trading?

- 5.1.7 How can traders balance AI algorithms with their expertise?

- 5.1.8 What steps can traders take to overcome AI-driven trading challenges?

In Short:

- AI Revolutionizes Trading: Artificial intelligence transforms trading strategies by analyzing vast financial data, detecting patterns, and making accurate predictions, surpassing human capabilities.

- Enhanced Decision-Making: AI algorithms enable faster, more informed decisions by detecting market anomalies, adapting to real-time conditions, and incorporating diverse data points beyond historical price data.

- Pattern Recognition Advantage: AI excels in pattern recognition, uncovering hidden correlations and providing insights into market sentiment, enhancing trading accuracy and minimizing risks.

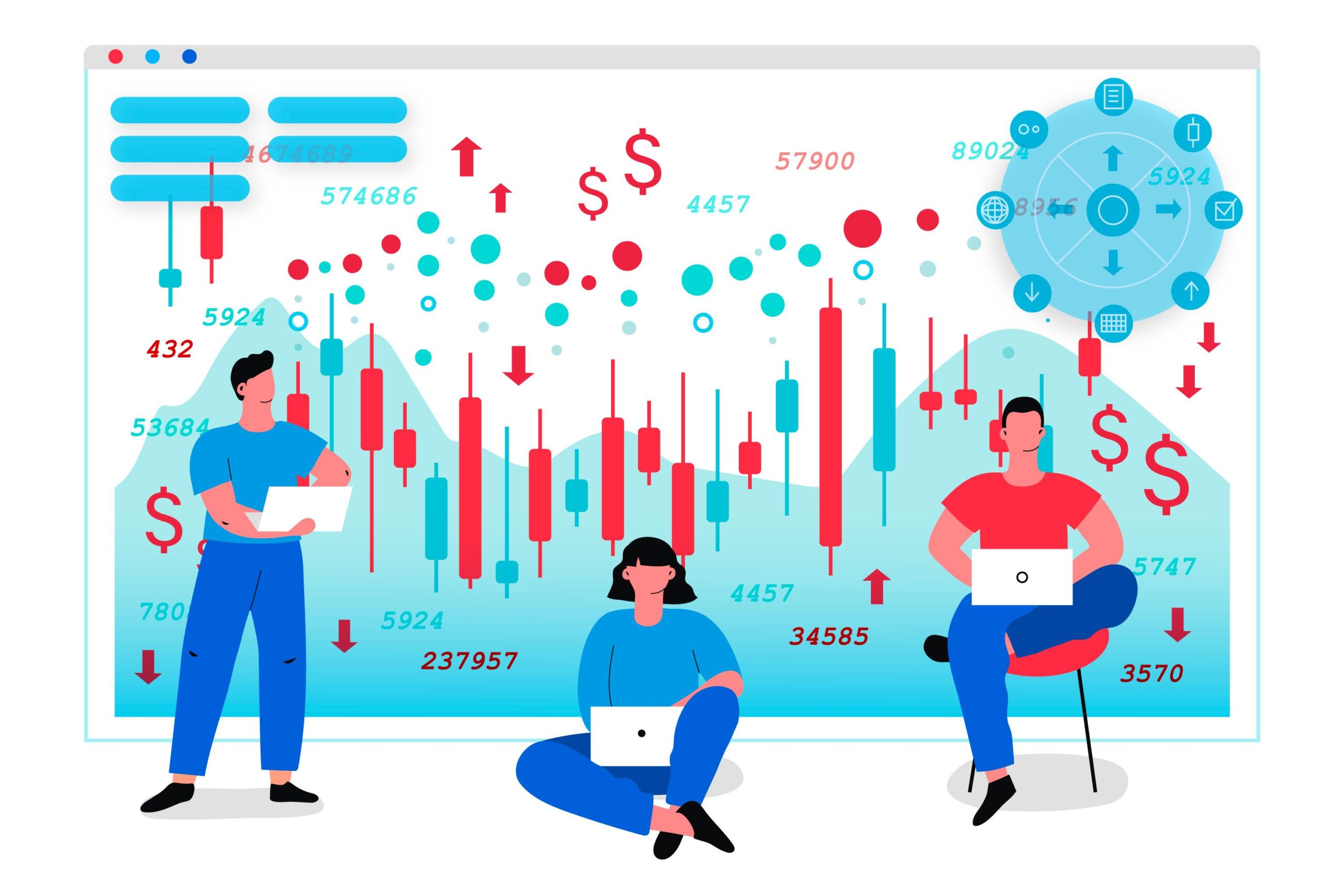

From content creation to the discovery of new elements, artificial intelligence has enabled us to reach a historic pace of technological advancement, surpassing even predictions. It was inevitable that the world of finance would benefit from this extraordinary potential. AI has revolutionized trading strategies by enabling faster, more informed decision-making through data analysis, pattern recognition, and forecasting algorithms. AI algorithms improve trading accuracy and reduce human biases by detecting market anomalies and patterns that humans may miss.

The Impact of Artificial Intelligence on Trading Strategies

Artificial intelligence has changed the way trading strategies are developed and implemented. Gone are the days of manual trading based solely on intuition and experience. AI-powered algorithms are now analyzing vast amounts of financial data, identifying patterns, and making predictions with remarkable accuracy. This allows traders to make faster, more informed decisions, reducing human biases and emotion-based errors.

One example of the impact of AI on trading strategies is the use of machine learning algorithms to detect market anomalies and predict price movements. By analyzing historical data, AI algorithms can detect subtle patterns that human traders might miss, giving them a competitive advantage in the market.

Imagine a scenario where a financial AI tool analyzes a particular stock. Not only does it consider historical price data, but it also takes into account various external factors such as news sentiment, social media trends, and even weather patterns. By combining these additional data points, the algorithm can provide a more comprehensive analysis of the stock’s potential performance. It may have already made up its mind in the time you would have lost scrolling through news sites.

AI algorithms can also adapt and learn from market conditions in real-time. They are constantly monitoring the market, adjusting their strategies based on new information and changing trends. This dynamic approach allows traders to stay ahead of the market and take advantage of emerging opportunities. The investor who takes the help of AI benefits tremendously in terms of time, not to mention the accuracy of the decision. In a field where making the right move at the right time is so crucial, this advantage may be one of the most critical factors in determining the winner.

Expert Tip: When developing a trading strategy, it is essential to strike a balance between relying on AI algorithms and incorporating your expertise. Remember that AI is a tool to help you; it cannot replace your knowledge and experience. Trust your instincts and use AI as a valuable resource.

Understanding Pattern Recognition in Trading

One of the most sensitive areas where AI touches the right investment decisions is pattern recognition in data analysis, which has dramatically improved our ability to detect and interpret patterns in financial data. By analyzing historical price data, volume patterns, and other relevant indicators, AI algorithms can identify recurring trends and patterns that signal potential opportunities or risks.

Moreover, AI algorithms can recognize complex patterns that are invisible to human traders. By finding correlations in massive datasets, these algorithms allow them to identify hidden relationships between different financial instruments and markets. This will enable traders to make more informed decisions and potentially maximize their profits.

Expert Advice: In data analysis, AI has indeed enabled great speed. But don’t forget to improve your basic financial literacy for manual checks. For example, being able to interpret price charts, recognize candlestick patterns, and anticipate the right move will increase your ability to act in the moment, making it easier to make the right decisions.

AI Applications in Pattern Recognition

AI and pattern recognition have a wide range of applications beyond trading and investment decisions. For example, AI can be used to detect fraudulent activity in financial transactions, helping companies improve security measures and protect against monetary losses.

In addition, AI algorithms can be used to analyze sentiment in financial news and social media, providing valuable insights into market sentiment and perception. By understanding how public sentiment influences market movements, traders and investors can adjust their strategies accordingly and potentially gain a competitive advantage.

Challenges and Opportunities in AI-Driven Financial Market Analysis

Artificial intelligence and pattern recognition hold great promise for financial markets, but they also bring some challenges. One of the most critical challenges is the need for high-quality data to train AI algorithms effectively effectively. Clean and reliable data is crucial for making accurate predictions and avoiding biases.

Another challenge is the constant evolution of markets and the need for AI algorithms to adapt. Markets are highly dynamic, and the factors affecting them change rapidly. AI algorithms need to evolve to remain effective and adaptive constantly.

Expert Advice: To overcome these challenges, it is essential to stay abreast of the latest developments in AI and continuously improve your knowledge and skills. Attend conferences, network with experts, and invest in further education to ensure you are using AI and pattern recognition effectively in financial markets.

Conclusion:

Artificial intelligence has revolutionized trading strategies, empowering traders with unprecedented speed, accuracy, and adaptability. Through pattern recognition and data analysis, AI algorithms enhance decision-making, detect market anomalies, and provide valuable insights, paving the way for a new era of financial market analysis.

FAQs:

How does AI revolutionize trading strategies?

AI analyzes vast financial data, detects patterns, and makes accurate predictions, enabling faster, more informed decisions.

What advantages does AI offer in trading?

AI reduces human biases, adapts to real-time market conditions, and enhances pattern recognition, improving trading accuracy and minimizing risks.

What role does pattern recognition play in AI-driven trading?

Pattern recognition allows AI to uncover hidden correlations, identify market anomalies, and provide insights into market sentiment, enhancing trading strategies.

What challenges do AI-driven trading strategies face?

Challenges include the need for high-quality data, constant adaptation to evolving markets, and ensuring effective training of AI algorithms.

How can traders optimize AI-driven trading strategies?

Traders can optimize strategies by staying updated on AI developments, improving financial literacy for manual checks, and continuously refining their knowledge and skills.

What applications does AI have beyond trading?

AI can detect fraudulent activity in financial transactions, analyze sentiment in financial news and social media, and improve security measures.

How can traders balance AI algorithms with their expertise?

Traders should trust their instincts and use AI as a valuable resource, striking a balance between relying on algorithms and incorporating their knowledge and experience.

What steps can traders take to overcome AI-driven trading challenges?

Traders can ensure access to high-quality data, stay informed about market developments, and invest in further education to optimize AI-driven strategies.