Mobisafar: Transforming India’s Access to Financial Services

- 1 Founding of Mobisafar

- 1.1 Strategic Partnerships

- 1.2 Vision and Leadership

- 1.3 Offerings Driving Financial Inclusion

- 1.4 Robust Technology Platforms

- 1.5 Financial Growth and Competitive Positioning

- 1.6 Vision for the Future

- 1.7 Mobisafar Agent Login Instructions

- 1.8 Business Model and Network

- 1.9 Technology Platforms

- 1.10 Financial Metrics

- 1.11 Expansion Plans

- 1.12 Competitive Landscape

- 2 Conclusion

- 3 Frequently Asked Questions

In Short

- In Ludhiana, Punjab, Abhishek Kumar Pandey established Mobisafar Services Private Limited on August 13, 2015.

- After establishing Tinku E-Services Private Limited, the firm changed its name to Mobisafar in 2017 to better represent its expanding financial services offerings.

- Abhishek Kumar Pandey, CEO of Mobisafar, has molded the company’s mission to make high-quality financial services available to all Indians through technology. Mobisafar owes a great deal to his direction and leadership.

Indian fintech startup Mobisafar’s mission is to increase people’s ability to use financial services in the country’s urban and rural areas. Since its inception in 2015, Mobisafar has been at the forefront of technological advancements to expand access to financial services. Mobisafar is a fintech startup from India that aims to make high-quality financial services available to people in all parts of the country. This case study delves into Mobisafar’s history, offerings, business strategy, expansion plans, and predictions for the future.

| Name of The Company | Mobisafar |

| Headquarters | Ludhiana, Punjab, India |

| Industry | Financial Services, E-Commerce |

| Founder | Abhishek Kumar Pandey |

| Year Of Establishment | 2015 |

| Website | https://www.mobisafar.com/ |

Founding of Mobisafar

Mobisafar Services Private Limited was founded on August 13, 2015, as Tinku E-Services Private Limited. The company is based in Ludhiana, Punjab, and provides e-commerce services.

In 2017, Tinku E-Services was rebranded as Mobisafar. The name change shifted the company’s focus on financial services.

Strategic Partnerships

- Mobisafar partnered with established institutions like YES Bank and NPCI to develop its fintech solutions early.

- In 2022, Mobisafar announced a collaboration with Suryoday Small Finance Bank to expand banking access through Mobisafar’s agent network.

- These partnerships with leading banks and financial institutions have provided credibility and enabled Mobisafar’s rapid growth.

A key driver of Mobisafar’s growth has been strategic partnerships. Mobisafar partnered with YES Bank and NPCI to develop its fintech solutions suite early on. In 2022, Mobisafar announced a collaboration with Suryoday Small Finance Bank. This partnership will allow Mobisafar to provide essential banking services through its network of franchisees and agents across India.

Vision and Leadership

Abhishek Kumar Pandey founded Mobisafar. As CEO, Pandey shaped the company’s vision to improve financial inclusion in India. Under his leadership, Mobisafar pioneered solutions like micro ATMs to bring banking access to remote areas. Pandey aims to make quality financial services available to all Indians, whether urban or rural.

Offerings Driving Financial Inclusion

Mobisafar provides a diverse suite of offerings aimed at promoting financial inclusion:

- Domestic Money Transfers

- Cash Withdrawals

- Micro ATMs

- Bill Payments

- Recharges

- Travel Bookings

- Insurance

- PAN Card Applications

- Mobisafar’s micro ATM network across 24 states significantly improves financial access in rural and remote areas.

- The company’s semi-closed wallet and vast agent network facilitate secure financial transactions.

Robust Technology Platforms

- Mobisafar utilizes advanced technology like APIs, UPI, wallets, and SMS Pay to power its financial platforms.

- Its neo-banking platform and mobile apps make digital payments seamless and convenient.

- eKYC and digital onboarding capabilities help rapidly expand Mobisafar’s customer base.

- The API infrastructure seamlessly connects Mobisafar’s network to banks and other institutions.

Financial Growth and Competitive Positioning

- Mobisafar has exhibited solid financial growth, with an estimated annual revenue of $5.7 million in 2021.

- The company has raised nearly $450 million over 82 funding rounds, displaying investors’ confidence.

- Mobisafar competes with other fintech apps and banks but focuses on financial inclusion.

- With over 1.5 lakh agents covering 13,000 pin codes, Mobisafar has unmatched rural reach and scale.

Vision for the Future

Mobisafar aims to accelerate the expansion of its agent network and offerings:

- It plans to have 250,000 active MITRAs by March 2023, increasing to 750,000 by March 2026.

- The collaboration with Suryoday Bank will drive growth by offering banking services through Mobisafar’s agents.

- New product introductions like micro pensions and micro-insurance will deepen financial access.

- Expanding services for merchants and SMEs also forms part of Mobisafar’s roadmap.

- International expansion to similar markets in Asia and Africa offers long-term potential.

In six short years, Mobisafar has disrupted India’s financial landscape by using technology to drive inclusive finance. Its innovative offerings, robust platforms, visionary leadership, and focus on rural reach have unlocked progress. Mobisafar is poised to continue transforming financial access for millions and cementing its position as a fintech leader.

Mobisafar Agent Login Instructions

You may log in whenever needed after completing the online registration process and receiving your Mobisafar login credentials. You may use Mobisafar’s services and features without hassle. You must keep your login credentials safe and accessible for future logins. If you forget your password or have login issues, follow the steps or contact Mobisafar customer support.

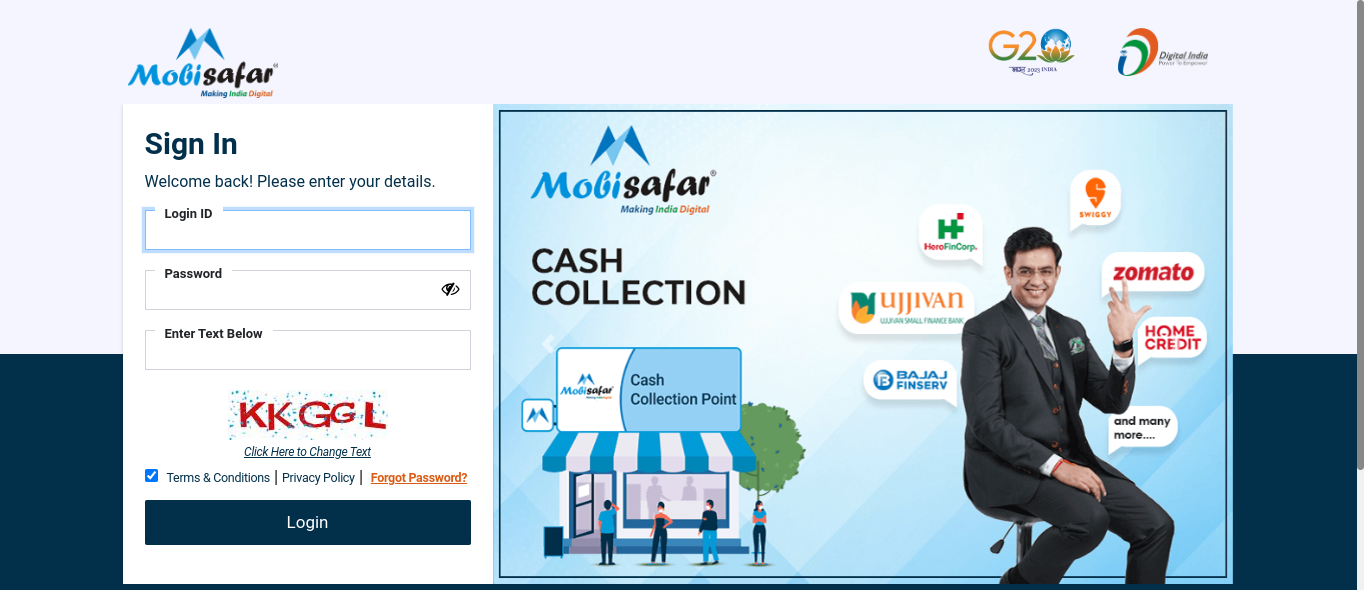

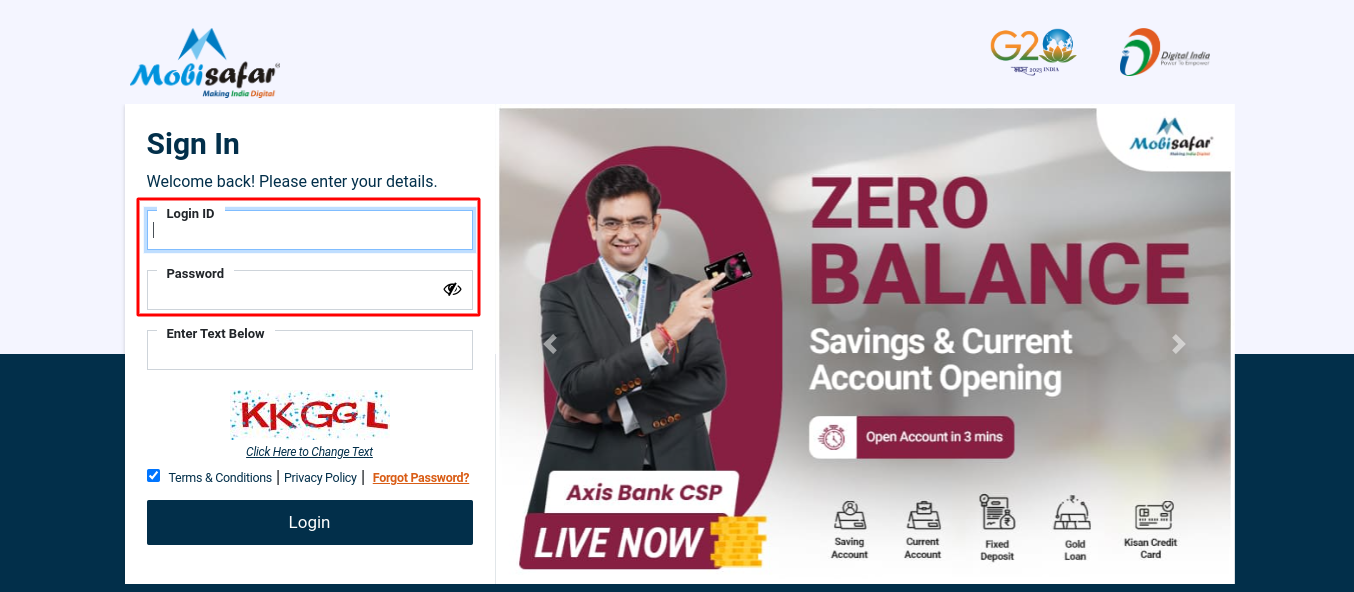

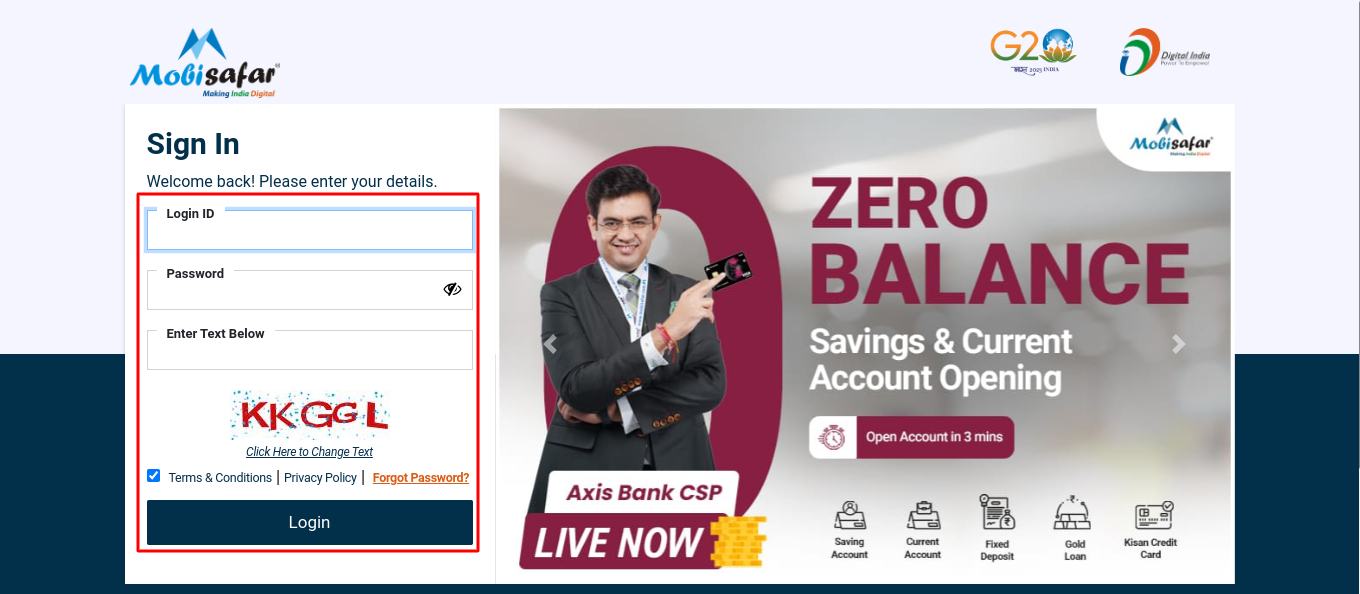

Please follow these simple Mobisafar login steps:

- Start at Mobisafar’s official website, http://www.mobisafar.com/.

- Just click “Partner Login” on the website homepage.

- Your screen will display the login page

- Enter your login ID and password here.

- Enter the captcha code and click Login.

To reset your Mobisafar login password, follow these steps:

- Visit Mobisafar’s official login page.

- Find “Forgot Password” on the login page and click it.

- A new page will appear where you must enter these details:

- Required fields: User Name, Email ID

- Page Captcha Code

- After entering the required information, click “Forgot Password” to recover your password.

- Recovering your login password should be easy. After receiving your new password, you may log in to Mobisafar immediately.

You may quickly contact Mobisafar Customer Support if you have any issues with the online platform. Their Contact Info: Customer Service: 0161-5015050, Email: You may also email them at Support@Mobisafar.Com with any questions or issues.

Business Model and Network

Mobisafar follows an aggregator model. It aggregates, distributes, and processes payments and financial services. The company has over 1.5 lac agents across 13,000 pin codes in India. This vast network allows Mobisafar to offer last-mile financial access.

Technology Platforms

Mobisafar utilizes technology to enable seamless financial transactions. Its neo-banking platform and suite of mobile apps make payments easy and user-friendly.

Features like UPI, wallets, SMS Pay, and API integration power Mobisafar’s technology infrastructure. The company prioritizes accessibility and convenience.

Financial Metrics

As a private company, Mobisafar’s financials are not public. However, available data suggests high growth. Mobisafar’s estimated annual revenue was $5.7 million in 2021. The company has raised nearly $450 million from investors over 82 funding rounds. The large investor interest indicates confidence in Mobisafar’s profitability and growth prospects.

Expansion Plans

Mobisafar aims to expand its network of agents and MITRAs rapidly. It plans to have 250,000 active MITRAs by March 2023, increasing to 750,000 by March 2026. The Suryoday Bank partnership will also drive growth. Mobisafar intends to offer banking services through all of its MITRAs.

Competitive Landscape

Mobisafar competes with other payment service providers like Paytm, PhonePe, Google Pay, and banks. However, its focus on financial inclusion and rural access provides strategic advantages.

Mobisafar’s partnerships, network depth, and micro ATM infrastructure are key differentiators in the fintech space. The company is well-positioned to gain market share.

Conclusion

Driven by the vision of founder Abhishek Kumar Pandey, Mobisafar has emerged as a leading fintech enabler of financial access in India. Its diverse services, vast network, innovative technology, and strategic partnerships provide a strong platform for future growth. As a pioneer in inclusive finance, Mobisafar is poised to transform how Indians bank.

Frequently Asked Questions

Bank international transfer fees?

Every bank is different. However, international transfers often cost 3-4% of the total. Fortunately, many banks aim to restrict client fees. This varies by institution.

Mobisafar firm profile?

The private company MOBISAFAR SERVICES PRIVATE LIMITED was founded on 13-08-2015. It is a non-governmental corporation incorporated at RoC-Chandigarh. The state of registration is Punjab. Paid-up and authorized share capital are 1000000.00.

What bank cooperated with Mobisafar?

Suryoday Small Finance Bank Ltd and Mobisafar Services Private Limited combine to provide pan-India banking services by Sharman Joshi.

How does Mobisafar drive financial inclusion?

Mobisafar drives financial inclusion through technology solutions like:

- Micro ATM network across 24 states

- Semi-closed wallet

- Payments via UPI and SMS

- eKYC digital onboarding

- Expansive agent network across India

What is Mobisafar’s future expansion plan?

Mobisafar aims to expand its agent network to 250,000 MITRAs by 2023 and 750,000 by 2026. It also plans to offer banking services through its agents via its partnership with Suryoday Bank.