Different Type Of Payment Methods [Detail Guide]

- 1 Different Types Of Payment Methods –

- 1.1 Cash payment – Widely Used Payment Method

- 1.2 Cash on delivery(Types Of Payment Method)

- 1.3 Payment by bank transfer

- 1.4 Acceptance of ERIP payments on the website

- 1.5 Acceptance of payments by bank cards

- 1.6 Acceptance of payments by electronic money

- 1.6.1 Advantages of accepting electronic money:

- 1.6.2 There are many more disadvantages:

- 1.6.3 The most popular electronic systems in Belarus and the world are:

- 1.7 How do we enable payment acceptance on the site?

Historically, in Belarusian online stores or web resources where it is possible to accept payments on the site, you can make payment in just a few ways—in cash, by bank transfer to an account, remotely through ERIP, bank cards, or electronic money on the site.

In this article, we will take a closer look at all the options for accepting payments and the advantages and disadvantages of each for business owners. But before that, it should be noted that most of the listed methods will be remote. This is due to the following factors, which are typical not only for Belarus:

An increase in the share of purchases “here and now” – impulsive purchases are straightforward to make if it is possible to make a payment right at the exact moment;

Expanding the geography of customer coverage – the more payment options, along with the possibility of prompt delivery, the more customers from different cities and countries;

Increase in customer loyalty – convenient payment and delivery have a positive effect on the dynamics of customer loyalty growth;

Legislative aspect – Belarusian legislation obliges all online stores to provide at least one remote payment option;

Legal security—Remote payment does not legally infringe on buyers’ rights because, in the legislation of the Republic of Belarus, rights and obligations are not delimited by the method of making a payment, and there is no significant difference between online and offline purchases.

Different Types Of Payment Methods –

Cash payment – Widely Used Payment Method

The most familiar and proven way of paying for goods or services is payable upon receipt. The main reasons are distrust of new technologies, the convenience of such a payment method, and there is no alternative in some instances.

Benefits of paying in cash:

Instant receipt of money – unlike remote methods, the seller receives money immediately, which can be immediately put into circulation. This has a positive effect on liquidity and reduces the possibility of a cash gap;

You cannot decline the payment – when you receive money, you recalculate and accept it. With cards, there may be problems with payment rejections for various reasons, ultimately leading to a client’s loss. There is no such problem when paying in cash;

Simplicity – no need to organize technical support or negotiate with payment services or banks;

No commissions – there are no losses for sellers that arise, for example, when paying with a bank card, using ERIP or electronic money, etc.

Disadvantages of this Cash Payment Method:

Low security – it is necessary to organize the transportation of funds by couriers, monitor its safe storage;

Increased control – you need constant control, recalculation of money upon receipt, verification of authenticity, etc.

Cash on delivery(Types Of Payment Method)

A reasonably popular option is chosen mainly in cases where it is challenging to deliver delivery to the buyer using a courier service. The buyer pays after the fact for the purchase that has already been delivered to a convenient Belfast office. Many online stores do not work with cash on delivery or work only on 100% prepayment, and BelPochta is used only as a delivery service for purchases. This is because there are certain inconveniences for business when dealing with cash on delivery – loss or damage to the goods during delivery, cases of non-payment by the buyer of the goods, and their return back to the seller (and this is extra time and money), the length of time waiting for the receipt of funds from the sale, etc., etc.

Payment by bank transfer

It is not the most common e-commerce payment method. It is characteristic only for companies and sellers who work in the b2b field, that is, they sell goods or services for another business.

Among the advantages it is worth noting:

High security – bank transfer is carried out as a direct payment from the buyer’s current account to the seller’s current account;

The complexity of the return of payment – if an erroneous payment was made or there were problems with the receipt of goods, then the payment can be revoked only with the consent of the seller, as well as through the court;

There is no commission for sellers and suppliers of goods or services.

Of the minuses, the following can be distinguished:

Payment terms – transfers between Belarusian banks take on average one day, between resident and non-resident banks 2-3 days;

The inconvenience of processing – if you transfer not through a current account, then you need to make a payment through a bank and fill out a payment order, which takes additional time;

Commission for the buyer—depending on the conditions, it can be 1% or more. This increases the cost of the purchased product and reduces the attractiveness of this payment method.

Acceptance of ERIP payments on the website

The ERIP system (AIS “Ratchet”) was developed by the National Bank of the Republic of Belarus in 2008 to solve the problem of prompt and reliable remote payment on the Internet for individuals and legal entities in Belarus. The service has developed dramatically during its existence. Now, through the ERIP system, you can pay for almost any goods and services (more than 58 thousand suppliers of services and goods), which can generally be paid remotely in Belarus.

ERIP system shortcomings:

Locality – ERIP is an excellent solution if you work only in Belarus. If you plan to accept payments from other countries, you need to connect additional payment methods;

The convenience of payment – the payment procedure in the ERIP system itself is not always clear for buyers, especially for those who rarely use the system;

No multicurrency – all payments are accepted only in the national currency of the Republic of Belarus.

Acceptance of payments by bank cards

Globally, bank card payments can be made in two ways. The first is when the buyer pays the courier through the terminal to deliver the goods after the fact. The second is direct payment on the website through a unique form called Internet acquisition.

Benefits of paying with cards:

The popularity of cards – bank cards are not an indicator of luxury. And the more cardholders there are, the more payments they make, including online;

The simplicity of payments – you only need to enter the payment card details and confirm the procedure using SMS verification. The whole process takes 1-2 minutes;

Speed of money transfer – online payments using bank cards are carried out and confirmed instantly;

Globality of payment – bank cards of international payment systems are accepted everywhere; by connecting online payment with cards on your website, the whole world becomes your potential customers;

Availability of recurring payments—You can easily set up recurring (repeated) payments and automatic debiting of funds from cards for services provided by the seller.

The disadvantages of paying with cards are:

Fight against fraudsters – serious measures are required to ensure security and combat various types of fraudulent transactions;

Distrust of buyers – your website should inspire the trust of potential customers; many are afraid to pay and be deceived;

The complexity of the connection – organizing the acceptance of payments on the site is not a one-day task and requires several technical improvements and further control;

Commission from payments – all commissions when paying with cards are borne exclusively by sellers (suppliers of goods and services). Each successful transaction is a commission in the region of 3%, which every business owner should take into account when selling goods;

Payment can be challenged—in case of deception, loss, or non-delivery of goods, discrepancies, and other force majeure situations, the buyer can initiate a refund procedure.

Acceptance of payments by electronic money

Although electronic money has existed in the Republic of Belarus for a long time, its use has not yet become widespread. This is mainly because although electronic money is legally equated to real money, legislative aspects limit the full-fledged operation of a business with this payment method.

Advantages of accepting electronic money:

Payment security – the buyer’s consent is required to make a payment. Ensuring security falls entirely on the electronic system itself;

Instant execution – instant transfer of electronic money to the seller’s account;

There is no chargeback—payments cannot be revoked. Returns for any reason are only possible with the permission of the service or product provider.

There are many more disadvantages:

Problems with accepting from non-residents – Belarusian electronic money systems are not popular abroad. Therefore, it is complex for foreign buyers to use them;

Limited use – a business can use electronic means of payment only to pay tax; you cannot even transfer them between legal entities;

Replenishment of the wallet is required – before paying by electronic means, it is necessary to replenish the wallet itself, and this is an additional action of the buyer;

Difficulty with conversion – legal entities cannot perform operations of converting some electronic money into others; this is available only to individuals;

Lack of anonymity – relatively recently, a ban was introduced on anonymous e-wallets in Belarus, which significantly reduced the scale of their use and attractiveness for individuals.

The most popular electronic systems in Belarus and the world are:

Electronic money Webmoney from the Russian system, which came to Belarus in 2005 and in partnership with TechnoBank, which acts as a guarantor in the territory of the Republic of Belarus, launched an analogue of Belarusian money WMB. At the moment, it is worth noting that none of the Belarusian payment aggregators work with WMB from WebMoney;

YuMoney –

Yandex has officially been present in Belarus since 2011. Offers Belarusian customers the opportunity to create a wallet for electronic money (the equivalent of the Belarusian ruble), which has not received much distribution in the country and is accepted for payment in a few online stores;

Qiwi –

Electronic money Qiwi, which the company of the same name from Russia tried to promote in Belarus in partnership with Priorbank, but this initiative did not receive much development;

Paypal –

Payment system Paypal is one of the leaders in payment systems worldwide. The PayPal system recently allowed Belarus users to use the service legally, but accepting payments for business through the system is not yet available. PayPal Stripe is one of the fastest-growing payment systems in the world, popular in IT and SaaS services. Works with 135 currencies and 40 countries, but, unfortunately, the Belarusian business is not yet available;

Payoneer –

The Payoneer payment system, like other world leaders of payment systems, is not officially represented in our country, therefore it is still impossible to legally accept payments in Belarus through it.

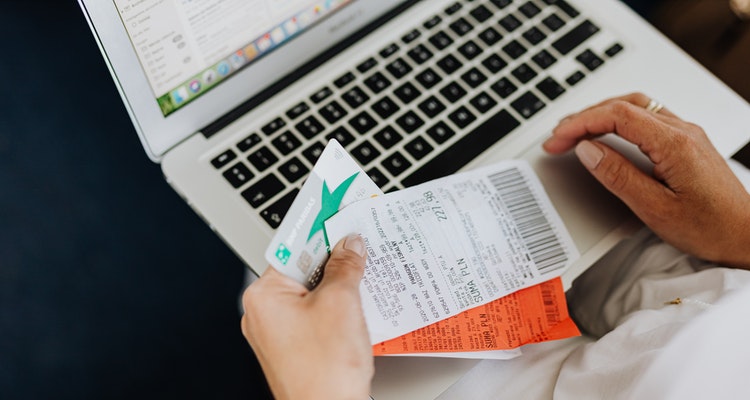

We briefly reviewed what methods of accepting payments in Belarus for business exist, as well as the advantages and disadvantages of each of them. Now, familiarize yourself with a short checklist of actions to connect online payments on your website in Belarus.

How do we enable payment acceptance on the site?

First of all, you should already have a working website. If it does not exist, you can quickly create it using the Staronka or Koshyk platforms. Website development requires no special programming skills, so it is easy to do it yourself. If you still have questions, check out the video tutorials on the channel or write to the online support chat;

Decide which payment methods on the site you want to connect—card payments or payment through ERIP. Both ways? Is there anything else extra?

Select a payment aggregator through which you will connect the selected payment methods – prepaid, WebPay, Hutki Grosh, and ExpressPay. Agree with him, send the necessary information and documents;

Put your site in order – by the requirements of payment systems and aggregates, reed requirements are simple and relatively quickly implemented on the website (the only exception can be registration in BelGIE, which can be waited for a long time, and only if the site has not yet been registered in the system);

After everything is put in order, the technical setup and the connection to receive payments on the site occur. In Staronka, this is done through particular extensions – select the one you want and fill in the required fields (literally 1-3 lines);

Check if everything was done correctly – make a test payment – and if everything is fine, connect to receive accurate payments and enjoy payments on your website!

![Different Type Of Payment Methods [Detail Guide] Different Type Of Payment Methods [Detail Guide]](https://techbehindit.com/wp-content/uploads/2021/03/1_Dq6kuyr13D2YIaF8nlXEaA.jpeg)