How to start White Label Forex Brokerage: Step-by-Step Guide

- 1 What is a White Label Forex Brokerage?

- 2 Types of white label arrangements:

- 3 Advantages of White Labelling

- 4 How to start white-label forex brokerage?

- 4.1 Research and choose a reputable white-label brokerage platform provider:

- 4.2 Register your forex brokerage company:

- 4.3 Obtain regulatory licences:

- 4.4 Connect to the white-label provider’s technology:

- 4.5 Integrate your own CRM and other internal systems:

- 4.6 Set up your office space and create a website:

- 4.7 Develop client acquisition strategy:

The forex market is one of the world’s biggest and most liquid markets. It began more than a century ago, but with the onset of the internet and the boom in online trading platforms, it has become even more accessible. Anyone worldwide can participate in forex trading and profit from the fluctuations in the exchange rates.

In recent years, daily forex trading volume has surpassed $6.6 billion. As the number of traders participating in daily forex trades has increased, it should be no surprise that the number of brokerage platforms through which forex transactions occur has also improved massively. However, starting a brokerage firm is not a walk in the park. Instead, it is a tricky endeavour that requires you to spend time, money, knowledge and effort to make it fruitful.

Building a forex brokerage firm from scratch entails a lot of difficulties and complexities. Therefore, this article is an attempt to inform you of everything you may need to start a white-label forex brokerage.

What is a White Label Forex Brokerage?

The forex market is a crowded sector for new brokers, and creating their brands in the forex industry and reaching success is quite challenging. This is why new entrants opt for white-label FX solutions to get themselves started in the forex industry as forex brokers.

White labelling in the forex industry refers to a partnership between a broker and a third-party company (aspiring brokerage firm), where the third-party company can use the broker’s technology and infrastructure to launch its own branded forex brokerage. The third-party company, known as the “forex white label partner,” can offer its clients the same trading platforms, pricing, and execution as the broker but with its branding and marketing. This allows the white-label partner to enter the forex market quickly and with minimal investment. At the same time, the primary broker can expand its reach and increase its revenue through the partnership.

Types of white label arrangements:

Partial

A partial white-label arrangement allows the partner to use the broker’s trading platform and infrastructure, but the partner is responsible for acquiring and servicing its clients. The broker provides support and liquidity, but the partner is responsible for its branding, marketing and compliance.

Full

A complete white-label arrangement allows the partner to use the broker’s trading platform, infrastructure, branding, and compliance. The broker is responsible for all aspects of the business, including acquiring and servicing clients, and the partner pays a fee for using the broker’s services.

Advantages of White Labelling

There are several White Label Forex benefits:

- White labelling can help a company increase brand recognition and establish customer loyalty.

- It can remove entry barriers and ensure easy and fast-track entry into the market.

- White-label brokerage can be less expensive than developing and maintaining in-house trading systems.

- White labelling removes the difficulties of dealing with the business’s technical complexities.

- A good white-label forex broker provider can also support you in branding, website design, marketing campaigns, etc.

- The white-label brokerage allows companies to launch new products and services quickly without extensive development and testing.

- Opting for a reputed white label gives you access to the top trading platforms like MT4 and MT5, which you can offer to your clients. They can choose the platform that they feel comfortable trading with.

- White-label brokerage can be customised to meet a company’s specific needs, including features such as educational resources and research tools, which help in trading.

How to start white-label forex brokerage?

Starting a white-label forex brokerage involves several steps:

Research and choose a reputable white-label brokerage platform provider:

The first and foremost concern for a company looking for a white-label solution is finding a provider that offers full-fledged service to equip them with a robust trading platform that’s up-to-date with industry standards. Besides being a reliable and user-friendly platform, it should offer competitive pricing and a wide range of trading instruments. Reviewing the provider’s regulatory compliance and ensuring they have the necessary licences is also essential.

Register your forex brokerage company:

Once you have found a WL provider, you should be ready to register your company. One of the first requirements that you must consider is the jurisdiction in which you plan to set up your company. There are several jurisdictions, and all have different requirements, which you should know beforehand to precisely determine whether or not they serve your company’s goals and aspirations. Ensure that your brokerage complies with all the norms and requirements of the particular jurisdiction.

Obtain regulatory licences:

Forex market is a decentralised market with no central regulatory authority. There are different regulatory obligations in other jurisdictions. Therefore, depending on the jurisdiction where your brokerage will operate, you may need to obtain one or more licences to offer forex trading services legally. This can include licences from regulatory bodies such as the Cyprus Securities and Exchange Commission (CySEC), National Futures Association (NFA) or the Financial Conduct Authority (FCA) etc.

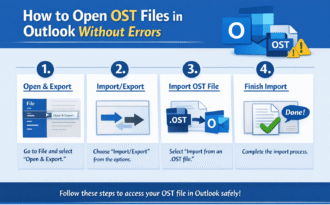

Connect to the white-label provider’s technology:

Once your legal and regulatory requirements have been met, you must connect to the white-label provider’s technology, including its trading platforms, pricing feeds, and back-office systems.

Integrate your own CRM and other internal systems:

You’ll need to integrate your own CRM and other internal systems, such as payment gateway, compliance checking, and risk management systems, to ensure the smooth operation of your brokerage.

Set up your office space and create a website:

After completing the paperwork, it’s time to build comfortable and reliable office space for your employees, set up fast-running computers with a high-speed internet connection, security systems, and everything else required. You should also develop a professional website to attract potential clients and establish your brand effectively. Before starting your brokerage firm, you should ensure enough capital to set up and run the business comfortably. It’s good to have at least enough money to incur the expenses of the first year of your business operation.

Develop client acquisition strategy:

Create a client acquisition strategy that will help you attract and retain clients. This can include online marketing, networking, and other methods.

These are general steps, and each country’s regulations and requirements might differ. It’s essential to check with the local regulatory bodies and consult with legal professionals before you start this process.