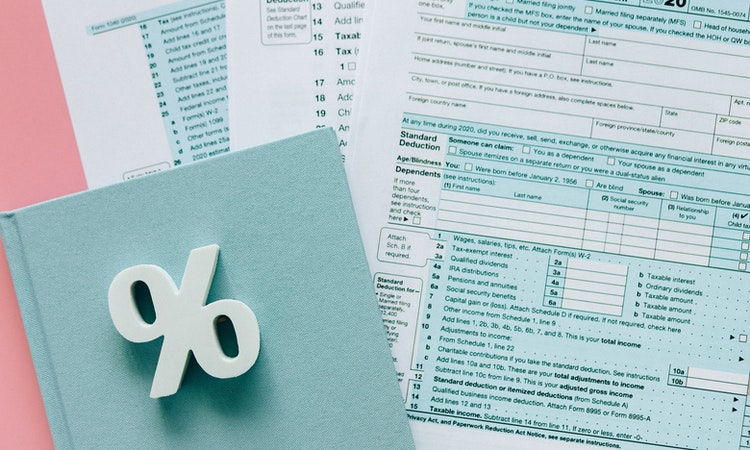

Top 7 Tax Filing Mistakes and How to Avoid Them

- 1 Top 7 Tax Filing Mistakes To Check In Income Tax Filing:

- 1.1 1st Tax Filing Mistake – Do not under-report income

- 1.2 2nd Tax Filing Mistake – What is the filing status?

- 1.3 3rd Tax Filing Mistake – Not knowing where you can save money

- 1.4 4th Tax Filing Mistake – Making baseless deductions

- 1.5 5th Tax Filing Mistake – Filling incorrect information

- 1.6 6th Tax Filing Mistake -Being in the target group

- 1.7 7th Tax Filing Mistake – Missing the deadline

With the consistent change in tax laws and day-to-day engagements, it is easy to lose track of things that can interrupt your tax filing. And when you do, common errors such as errors in the calculation, details of your spouse, or even minor spelling mistakes create problems. The number of citizens who receive a notice from the IRS for a faulty income tax filing is modest, but hardly anyone enjoys being on that list. Here, we are discussing the top 7 tax filing mistakes that you can avoid.

A wrong tax filing may delay your refund. That notification can also create problems if you receive tax benefits the IRS did not legally entitle you to.

Top 7 Tax Filing Mistakes To Check In Income Tax Filing:

1st Tax Filing Mistake – Do not under-report income

Basically, you pay tax for every income unless explicitly exempted, like some donations and inherited wealth. In most cases, declare your income to the government and yourself through information return forms, namely Form 1099.

Now, the problem arises when the income you declare does not match the IRS log. So, to avoid any further complications, make sure you include revenue from each of your sources. Also, note that there are specific forms for filing taxes for various sources. This is where you can get help from a competent tax accountant and minimize the risk of errors.

2nd Tax Filing Mistake – What is the filing status?

Knowing the exact filing status is one of the first complications when filing your tax return. What makes this step so confusing is the minute differences between several statuses. The qualifying conditions are often the deciding factor. They determine whether you’ll be eligible to file as the Head of Household, a relatively favourable taxing position, or you’ll be paying more tax as a singular entity.

To file tax as Head of Household, you must fulfil the following conditions:

- You live with a dependant

- You essentially pay for more than half of your household expenses

- You are neither married nor have been living with your partner for the last six months.

If you’re confused about your income tax filing status, consider talking to a tax expert and go through the rule of dependents mentioned on the IRS’s website.

3rd Tax Filing Mistake – Not knowing where you can save money

Since you are unaware of your filing rights, status, and potential for availing of various tax credits and exemptions, you waste many chances of saving a substantial amount of tax money.

Because the Internal Revenue Service will eventually uncover every missing 1099 earnings, or if you produce a false dependent in your name, there’s no point hiding it. Although they won’t correct your form if you fail to declare other exemptions, suppose you attempt income tax filing in Mesa, AZ, and you skip stating children and dependents benefit, even when you’re eligible. The IRS won’t add that to your account. This implies you are throwing away a lot of money because of a lack of proper information.

A foolproof solution is to have a tax accountant by your side who will inform you about every government scheme that saves you tax money.

4th Tax Filing Mistake – Making baseless deductions

The Internal Revenue Service keeps a close eye on several tax exemptions to prevent tax fraud, especially if the tax benefit is very significant or uncommon, such as an enormous charitable contribution.

Since the IRS can ask you to present documents supporting your claim, you must maintain detailed records to corroborate the tax benefits. Also, if it’s about a large donation, verify that the receiving group is government-approved.

Also, to validate a foundation’s tax-exempt status, visit the IRS’s “Exempt Organizations Checking” tool.

5th Tax Filing Mistake – Filling incorrect information

Often, even the slightest errors cause dire problems, especially with the IRS. This is the most common example: putting the incorrect Social Security, State ID, or Tax file number leads to peculiar issues with preparing your tax return.

To avoid such mishaps, take the following precautions:

- Check the accuracy of every figure on your income tax filing.

- Verify if you have accurately spelt every name in the form.

- Try comparing your current tax return with the previous years’ to check for any unjustified variances or things left out.

- Make sure there are proper signatures and dates on all necessary pages.

Many people employ tax-filing software to improve the overall correctness of their returns. It assists them in identifying many deduction opportunities for which they are eligible. However, the best tax software cannot identify fundamental errors and many benefits that a tax accountant could tell you about.

6th Tax Filing Mistake -Being in the target group

Ironically, if you are filing income tax as a self-employed person, you might be in a category intensely scrutinized by the Internal Revenue Service. For a self-employed person, it is simpler to overstate business costs and falsify earnings; the IRS pays special attention to such files. Claiming financial loss for over three consecutive years and seeking a dubious regular deduction can cause further background checks for the self-employed.

To avoid this, you must learn what makes for a valid exemption. The expenditure on necessary inventory required to carry on your business is often deductible.

Small businesses may try employing a professional accountant for proper functioning. If you think about it, one really cannot help being in the target group. Apart from self-employed individuals, those with either abnormally low or high incomes are a popular target.

7th Tax Filing Mistake – Missing the deadline

Like most people, if you like putting off tax filing for a long time, make sure it does not cross the limit. Since income tax filing is a tedious task for many, it requires a substantial amount of time.

If you miss the deadline, you still have a saviour like Form 4868. If you submit the paperwork on time, it will extend your filing deadline by six months. But nothing comes this easy. Here is the catch.

While submitting Form 4868, you must not have any outstanding taxes due in your name. So, it is quite uncertain whether you can fill out this form. However, you can use many accounting calculators on the web to check if you are eligible.