Maximising Returns: Intelligent Choices in Asset Management

Effective asset management is crucial for individuals and organizations looking to grow their wealth and secure their financial futures. However, asset management is complex and requires insightful decision-making to maximize returns while minimizing risk. This article explores intelligent choices investors can make in asset management to optimize their portfolio’s performance.

Intelligent Choices in Asset Management To Maximize Returns

Diversifying Your Portfolio

One of the most important principles in investing is diversification across different asset classes. Rather than putting all your eggs in one basket, diversification allows you to spread risk and take advantage of different market conditions. For instance, a portfolio might include stocks, bonds, real estate, commodities, and cash.

Even within an asset class like stocks, further diversification can be achieved by investing across market sectors, geographies, market caps, and investment styles.

Proper diversification provides more stable returns, reduces volatility, and protects against events that may impact one particular security or asset class. Investors must find the right mix of asset classes that align with their risk tolerance, time horizon, and goals. However, a lack of diversification, such as concentrating solely in tech stocks, leaves investors overly exposed to sector declines.

Allocating to Alternative Investments

Alternative investments include assets outside of traditional stocks, bonds, and cash, such as venture capital, private equity, hedge funds, managed futures, real estate, commodities, and collectibles. Adding alternatives can enhance portfolio diversification and yield higher returns less correlated to mainstream markets. For example, when equity markets decline, investments in commodities like oil and gold may rise in value as safe-haven assets.

However, alternatives come with higher fees, lower liquidity, and lack of regulation compared to traditional securities. Investors must conduct due diligence to identify top-performing funds with experienced managers. Moderately allocating 10-20% of a portfolio to alternatives can provide outsized returns while limiting exposure to risks.

Rebalancing at Regular Intervals

As different assets within a portfolio grow at different rates, the weighting of holdings will shift over time. Rebalancing involves periodically buying and selling to restore the portfolio back to its original target asset allocation. Rebalancing forces investors to sell high and buy low, capturing profits from outperforming assets and reallocating capital to undervalued assets.

Studies show that rebalanced portfolios provide higher returns over the long run compared to portfolios left to drift. Investors should rebalance at sensible intervals, such as annually or semi-annually. Too frequent rebalancing leads to excessive trading fees that erode returns.

Tax-Efficient Investing

Taxes can diminish investment returns, so strategies to improve tax efficiency are critical. For example, holding investments for over a year allows profits to be taxed at lower long-term capital gains rates. Further tax savings can come from recognizing investment losses to offset capital gains, harvesting losses to offset income, donating appreciated shares to charity, and using retirement accounts like 401(k)s or IRAs to grow money tax-deferred.

Additionally, placing highly taxed assets, like bonds and real estate, into retirement accounts allows them to compound tax-free for decades. On the other hand, growth stocks are better suited for taxable accounts. Working closely with tax and financial advisors can unlock legal ways to minimize what you owe.

Utilizing Low-Cost Index Funds

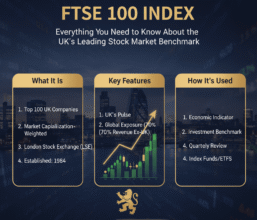

Actively managed mutual funds employ stock pickers aiming to beat the market but charge higher expense ratios that erode returns. Index funds simply track market benchmarks like the S&P 500, providing broadly diversified exposure at a minimal cost. Studies demonstrate most active managers fail to consistently outperform comparable index funds after fees.

Investors are better off building a portfolio around low-cost, passively managed index funds. Leading providers like Vanguard offer indexed funds charging less than 0.10% annually. Over decades, the cost savings from index funds compound into significantly higher wealth. Index investing also simplifies portfolio management compared to stock picking.

Conclusion

Intelligent asset management requires ongoing research, planning, and discipline, for all this, there is asset management software. Diversifying holdings across various asset classes, allocating to alternatives, rebalancing, minimizing taxes, and emphasizing low-cost index funds represent prudent choices investors should incorporate. Adhering to these best practices raises the probability of successfully maximizing investment returns over the long run. With thoughtful strategy, investors can work towards growing their wealth and securing their financial futures through effective asset management.