Leading Experts Outlined How To Invest In US Stocks In Nigeria In 2023

Investing in the stock market can help your money grow over time. The US stock market is the largest one globally, worth around $40.2 trillion, which is more than half of the total stock market value worldwide. It’s a good choice for both experienced investors and beginners looking to expand and improve their investment portfolios. In this article, Traders Union experts will explain how to invest in US stocks in Nigeria.

Unlocking Investment Opportunities

Can Nigerians Invest in US Stocks? Yes, they can, and you don’t need to be an expert to do it. Thanks to digital brokers, you can access the US stock market from Nigeria. The tricky part is choosing the right broker.

TU experts have determined two ways Nigerians can invest in US stocks:

With International Stock Brokers:

Nigerians can open accounts with global online brokers like Roboforex or IC Markets to trade global stocks. These brokers offer various international securities, including CFDs on international stocks, indices, ETFs, and more. It’s essential to check the licenses of these brokers, and the safest ones usually have licenses from respected regulators like the UK’s FCA or Australia’s ASIC. The advantage is you can invest in international securities, but keep in mind that some global brokers may not be regulated locally and might not have a presence in Nigeria.

With Local Brokers:

Nigerians can also trade global stocks through local online brokers. These brokers offer a limited selection of international stocks and a broader range of local stocks. They are regulated by authorities like the Nigerian Securities and Exchange Commission, ensuring a safe and transparent trading platform. To trade through the Nigerian Exchange (NGX), you need a stock trading account with a licensed broker. The advantage here is local regulation, making it a safer option, but you may have fewer international stock options.

So Nigerians can invest in US stocks through both international and local brokers, each with its pros and cons. Traders Union analysts recommend considering your investment goals and risk tolerance when choosing the right approach.

How Much Money Do You Need to Invest in US Stocks?

The minimum amount you need to start investing in US stocks can vary. Some brokers don’t ask for any specific minimum investment, while others might require at least $50 (about 36,500 naira) or more. The good news is, you don’t need to be super wealthy to invest in the US stock market. Almost anyone can do it.

It’s also important to know that while you can buy just a fraction of a stock, there could be rules about the smallest amount you can invest in one stock. To make the best choice, it’s a smart move to compare the fees and minimum investment requirements of different brokerage firms before you decide where to put your money.

Top Brokers To Buy US Stocks In Nigeria

If you’re looking to invest in financial markets, it’s essential to choose a reputable broker that offers a wide range of products and services. Here is a top choice for 2023 from TU analysts:

RoboForex

RoboForex offers a wide range of products and services for investors, including tight spreads starting at 0 pips and low commissions. They provide quick order execution through their RoboForex MetaTrader 4 and 5 platforms, offering 36 FX pairs, metals, and CFDs. RoboForex also offers CopyFX, allowing users to copy trades with a minimum deposit of $100, providing flexibility and control.

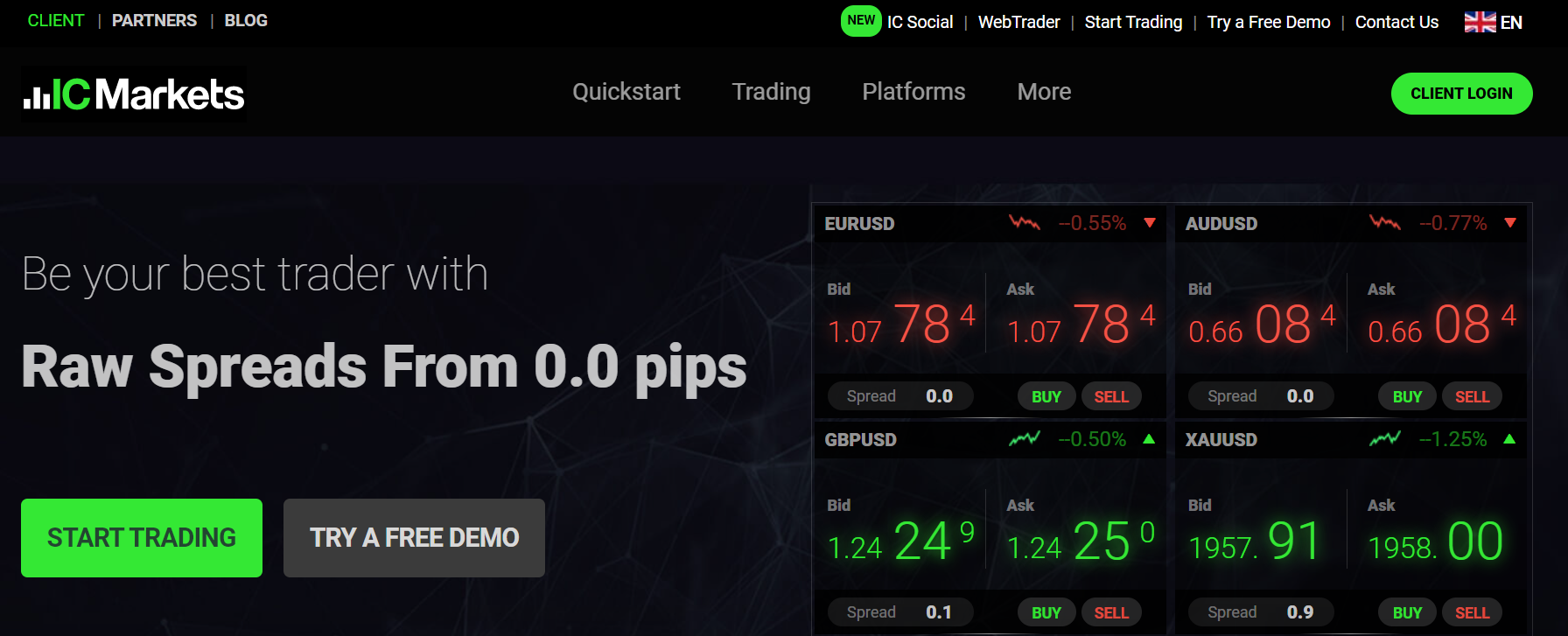

IC Markets

IC Markets is a regulated Australian-based Forex CFD broker popular among South African traders. They offer access to over 10,000 securities, including major companies. The minimum deposit is 888 MYR, and they offer various leverage options to suit different traders. Commission fees depend on the account type chosen.

Conclusion

Investing in the US stock market is a great way to grow your wealth, and it’s accessible to Nigerians. Experts at Traders Union have outlined two main approaches: using international stock brokers like RoboForex or IC Markets and local brokers regulated by Nigerian authorities. Each method has its advantages and disadvantages, so it’s essential to align your choice with your investment goals and risk tolerance.