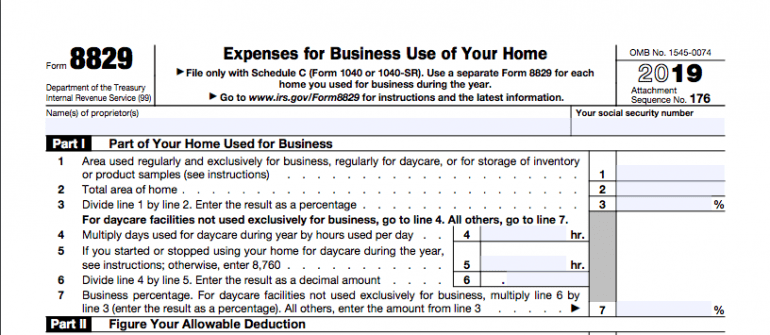

How To Fill Out Form 8829

- 1 Use Tax Deduction to Fill out Form 8829 Online

- 1.1 You can deduct no more than $10,000 per year for repairs

- 1.2 File Form 8829 Online

- 1.3 Use the Forms Provided

- 1.4 What is the 8829 form?

- 1.5 What is the 8829 form?

- 1.6 How to get an income tax refund

- 1.7 How to file your income tax return

- 1.8 How to fill out a tax return

- 1.9 How to make a tax return

- 2 Where can I find Form 8829?

To be eligible to fill out Form 8829 online, you must be an individual, an S-corporation, or a C-Corporation. An individual is considered an individual taxpayer, while an S-Corp and a C-Corp are considered corporations. The IRS will ask you to identify yourself using the information on your IRS W-2.

Use Tax Deduction to Fill out Form 8829 Online

The IRS allows you to deduct the expenses you incur using your home. For example, you can deduct the cost of your utilities, property taxes, and insurance costs. You can also deduct some repairs. However, these deductions are limited. You can deduct no more than $10,000 per year for repairs.

You can deduct no more than $10,000 per year for repairs

You also cannot deduct your living expenses. For example, if you rent your home to someone else for a profit, you cannot deduct the cost of your mortgage or rent.

If you have an LLC or a partnership, you can also deduct the amount of your rental income. However, you can only deduct the amount you report on your tax return. So, if you paid someone $5,000 to manage your LLC, you can only deduct $4,500.

File Form 8829 Online

You can file Form 8829 online. Just visit the IRS website. When you have finished filling out the form, you need to print it out and send it to the IRS.

Use the Forms Provided

You can also download a copy of Form 8829 and use it as a guide.

What is the 8829 form?

Form 8829 is used to calculate a taxpayer’s income tax withholding. The IRS requires businesses to use this form to calculate employee income tax withholding. They use this information to determine how much money they need to withhold from each employee’s paycheck. The IRS also uses this information to determine how much each employee should pay.

What is the 8829 form?

Form 8829 is used to calculate a taxpayer’s income tax withholding. It is used by employers who deduct taxes from their employee’s paychecks.

How to get an income tax refund

Income tax is the government’s way of making sure that everyone pays his or her fair share of the country’s expenses. Income tax is usually due when you file your tax return. You will get a refund if your total income is more than the total amount you owe in taxes. You will receive an income tax bill if your total income is less than what you owe.

When you file your income tax return, you must tell the IRS how much you earned. You will also have to list any deductions you have taken during the year. If you made more money than you owed in taxes, you would probably get a refund.

How to file your income tax return

The IRS requires that you file an income tax return every year.

To file an income tax return, you must be a U.S. citizen, a resident of the United States, a U.S. national, or a resident alien. If you are not a U.S. citizen or a U.S. national, you must be a resident of the United States. If you are a resident alien, you must have certain tax requirements.

How to fill out a tax return

You will probably owe some taxes if you make less than what you owe. But if you make more than the taxes you owe, you will probably receive a refund.

You need to fill out an income tax return to claim a refund. You will also have to attach any documentation you received during the year that shows you made a large amount of money. This documentation can include pay stubs, bank statements, or receipts.

How to make a tax return

- You will get a refund if you make more money than you owe in taxes.

- To receive a refund, you must complete a tax return. You can download a tax return from the IRS website.

- You must claim enough deductions to offset your income if you are self-employed.

- You must provide proof of wages and deductions if you work for someone else.

- When you make a tax return, you must include information about your income, deductions, and refunds.

Where can I find Form 8829?

There are a few different ways to get the IRS Form 8829, but the easiest way is to use a free download. Here are 3 of the best free downloads to help you get started.

TaxAct

TaxAct offers a free, downloadable PDF of IRS Form 8829.

This download is easy to access and includes helpful information on how to fill out the form.

TurboTax

TurboTax offers a free PDF of IRS Form 8829.

The TurboTax website includes helpful information on how to fill out the form.

Smart Tax Software

Smart Tax Software offers a free, downloadable PDF of IRS Form 8829.

They also include helpful information on how to fill out the form.

What is the simplified method for home office deduction

The IRS recently changed the rules regarding home office deductions. For the first time since 1997, taxpayers can now deduct any part of their home office space used exclusively for business purposes.

In addition, any expenses that you incur in your home office are no longer considered non-deductible home office expenses, meaning that these costs can now be deducted. However, if you can claim those expenses on Schedule A, they must be itemized, or you may lose the ability to deduct them.

To calculate your deduction, you need to determine what portion of your home is used for business purposes. For most taxpayers, the portion of the house that is used for business purposes is the entire home. However, there are exceptions to this rule. If you rent out rooms to tenants, then the portions of the home used exclusively for business purposes can include the rental income.

If you operate an active rental property, then your expenses relating to the property can also be deductible. These expenses include expenses such as property taxes, insurance, and repairs.

How do I deduct home office expenses?

Do you have a home office? You probably already have one if you’re running your own business from home.

But if you work for someone else, it can be a little tricky to figure out how to deduct the expenses associated with your home office.

You’ll need to know where to look and what information you’ll need to deduct them properly.

This is where Form 8829 can help. It’s designed to help you calculate and deduct your home office expenses.

Once you’ve figured out your home office percentage, you can determine how much to deduct.

There are several ways to determine how much to deduct. Some of the most popular are the following:

- The average annual cost of rent and utilities

- Home office expense percentage

- Number of square feet

- Square footage of your home office

- You can use any of these methods to determine the exact amount you should deduct.

- Then, you just need to multiply your home office percentage by the amount you figured out.

- For example, if your home office expense percentage was 25%, and you worked 3,000 hours in your home office last year, you would deduct $7,500.

- That’s the amount of money you should deduct from your gross income.

Does form 8829 need to be filed?

Form 8829 is a mandatory form you must file if you earn money from certain jobs. You can get that form from the IRS website, but there’s no reason why you have to fill out this form.

Here’s why: The IRS will not contact you if you do not meet the income requirements. If you qualify, you don’t have to file this form. But if you fail to qualify, there’s no penalty for filing the form.

So there you have it. There’s no reason why you have to file this form if you don’t make enough money.

Can I write off my Internet if I work from home

Well, the answer is yes, but there are a few things that you have to consider first.

First, you must determine what you mean when saying “write off.” For most taxpayers, this means that you can deduct the expense of your Internet service provider (ISP) against your income. But the tax laws also say that this deduction will only apply if you’re not using the Internet to make a profit.

You cannot write off the associated costs if you are making money using the Internet. So how do you know if you are making money with the Internet?

Many people use the Internet to make a profit by selling their products. If you are doing this, you are considered to be making money on the Internet. You can write off the expenses related to this, but if you are not making money, you cannot write off the expenses associated with your ISP.

Second, you must determine how much you paid for your Internet access. If you pay $100 per month for your Internet access, you can only deduct $25 against your taxes.

Third, you need to determine whether or not you have paid enough for your Internet access.

For example, if you have an unlimited data plan, you have paid for all of the usages that you have made. So if you have 10 GB of usage, you will have paid $100 for that usage. If you have 10 GB of usage, you cannot write off any of the $100 you paid.

If you have a limited data plan, you cannot write off any of the $100 you spent. But you can claim a tax credit for the amount that you spend.

Fourth, you must determine if you’re paying for broadband or a dial-up connection.

Broadband connections are much faster than dial-up connections. So if you’re paying for a broadband connection, you can write off a larger percentage of your expense.

Fifth, you have to determine if you’re paying for the services that you use or the equipment that you use.

If you’re paying for the equipment you use, you cannot write off the cost of the equipment.

But if you’re paying for the services you use, you can deduct the costs associated with those services.

So you can determine which type of Internet access you have and what you are paying for.

Conclusion

To make the best decision on your tax return, knowing what you’re taking in is important. On Form 8829, you’ll need to enter all of the business-related expenses that you paid or incurred during the year, which includes a list of all the types of business-related expenses that are allowable.

This list includes rent or lease payments for your business, the equipment you use to operate your business, and other related costs. Once you have your list of items, you’ll need to go through the list and figure out whether or not they qualify as deductible business expenses. If you have an active business, you’ll need to consider how much income the business brought in during the year. Deductible expenses are allowed for business losses, so they can reduce your taxable income.