How to get access to the high hash rate?

- 1 Why the demand for computing power is growing

- 1.1 1. The Rise of Artificial Intelligence and Machine Learning

- 1.2 2. Big Data Analytics

- 1.3 3. Cloud Computing

- 1.4 4. Internet of Things (IoT)

- 1.5 5. Virtual and Augmented Reality

- 1.6 6. Blockchain and Cryptocurrencies

- 1.7 7. Scientific Research and Simulations

- 1.8 8. Cybersecurity

- 1.9 9. Financial Services

- 2 Why use the hash market?

- 2.1 What is the Hash Market?

- 2.2 How Does the Hash Market Work?

- 2.2.1 For Buyers

- 2.2.2 For Providers

- 2.3 The Significance of the Hash Market in the Cryptocurrency Ecosystem

- 2.4 Challenges and Considerations

- 2.5 Future Outlook

- 3 Conclusion

Nowadays, more and more people are engaged in professions that involve processing large amounts of data. Big Data, Machine Learning, image processing, or blockchain technology are just some fields that require the user to have a high-speed computer. For this reason, knowing how to acquire the computing power necessary for such intricate and complex tasks is beneficial.

Why the demand for computing power is growing

In recent years, the demand for computing power has been escalating unprecedentedly. This surge can be attributed to several factors ranging from technological advancements and the proliferation of data to the increasing complexity of computational tasks. This article delves into the various reasons driving the growth in demand for computing power, exploring the role of artificial intelligence, big data, cloud computing, and other significant trends.

1. The Rise of Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront of technological innovation today. These technologies require immense computational resources to train sophisticated models, analyze vast datasets, and perform complex calculations.

- Training Deep Learning Models: Training deep learning models, especially those with multiple layers and parameters, is computationally intensive. For instance, training a model like GPT-4 involves processing terabytes of data and necessitates powerful GPUs and TPUs to reduce training times from years to weeks or days.

- Real-Time Inference: Deploying AI models for real-time applications, such as autonomous driving, natural language processing, and real-time video analysis, requires robust computational power to ensure quick and accurate responses.

2. Big Data Analytics

The explosion of data generated by digital activities has led to the era of Big Data. Analyzing this massive amount of data to extract meaningful insights requires substantial computing resources.

- Volume, Variety, Velocity: Big Data is characterized by its volume, variety, and velocity. Handling these aspects requires high-performance computing systems capable of processing and analyzing data at scale.

- Predictive Analytics and Business Intelligence: Organizations leverage big data analytics for predictive modeling, trend analysis, and business intelligence. These processes involve complex algorithms and computations that demand powerful hardware and software infrastructure.

3. Cloud Computing

Cloud computing has revolutionized how businesses and individuals access and utilize computing resources. The shift towards cloud services has contributed significantly to the growing demand for computing power.

- Scalability and Flexibility: Cloud platforms offer scalable computing resources that can be adjusted based on demand. This flexibility is crucial for businesses experiencing fluctuating workloads and startups needing to scale rapidly.

- Infrastructure as a Service (IaaS) and Platform as a Service (PaaS): Cloud providers offer IaaS and PaaS solutions, allowing organizations to build, deploy, and manage applications without significant upfront investment in hardware. These services rely on extensive computing power hosted in data centers.

4. Internet of Things (IoT)

The Internet of Things (IoT) connects billions of devices worldwide, generating vast amounts of data and requiring extensive computing power for processing and analysis.

- Edge Computing: IoT systems often employ edge computing to reduce latency and improve efficiency, where data is processed near the source rather than sent to centralized data centers. This approach demands robust edge devices capable of handling significant computational tasks.

- Data Processing and Storage: The sheer volume of data generated by IoT devices necessitates robust computing systems to store, manage, and analyze the information in real time.

5. Virtual and Augmented Reality

Virtual Reality (VR) and Augmented Reality (AR) technologies are becoming increasingly popular in various fields, including entertainment, education, healthcare, and retail. These technologies require significant computational power to deliver immersive and interactive experiences.

- Rendering and Graphics Processing: VR and AR applications rely heavily on high-quality rendering and graphics processing, which require powerful GPUs and CPUs to achieve the desired performance and realism.

- Real-Time Interaction: Ensuring smooth and real-time interaction in VR and AR environments involves complex computations and low-latency responses, necessitating advanced computing infrastructure.

6. Blockchain and Cryptocurrencies

Blockchain technology and cryptocurrencies have gained substantial traction, contributing to the growing demand for computing power.

- Mining and Validation: Cryptocurrency mining and blockchain validation involve solving complex mathematical problems requiring significant computational resources. The increasing difficulty of mining algorithms further drives the need for powerful hardware.

- Decentralized Applications (DApps): The development and deployment of DApps on blockchain platforms require robust computing resources to ensure security, efficiency, and scalability.

7. Scientific Research and Simulations

Scientific research in physics, chemistry, biology, and climate science relies heavily on computational power for simulations, modeling, and data analysis.

- High-Performance Computing (HPC): Research institutions and universities use HPC systems to conduct simulations that would be infeasible with conventional computing resources. These systems enable researchers to explore complex phenomena and accelerate scientific discoveries.

- Genomics and Bioinformatics: Analyzing genomic data and conducting bioinformatics research involves processing vast datasets and performing intricate computations, necessitating robust computational infrastructure.

8. Cybersecurity

The increasing prevalence of cyber threats and the need for robust cybersecurity measures have driven the demand for computing power.

- Threat Detection and Response: Advanced cybersecurity systems use machine learning and AI to detect and respond to threats in real time. These systems require significant computational resources to analyze network traffic, identify anomalies, and implement protective measures.

- Encryption and Decryption: Ensuring data security through encryption and decryption processes involves complex mathematical computations that demand powerful hardware.

9. Financial Services

The financial sector relies heavily on computational power for various applications, including algorithmic trading, risk management, and fraud detection.

- Algorithmic Trading: High-frequency trading algorithms require robust computing systems to execute trades within microseconds, analyzing market data and making decisions faster than human traders.

- Risk Management and Fraud Detection: Financial institutions use sophisticated models and machine learning techniques to assess risk and detect fraudulent activities. These processes involve extensive data analysis and computational tasks.

The demand for computing power is growing at an exponential rate due to a multitude of factors. Various industries and technological trends are driving this surge, from the rise of AI and big data analytics to the proliferation of IoT devices and the need for advanced cybersecurity measures. As we continue to innovate and develop more complex applications, the need for robust and scalable computing infrastructure will only intensify. Addressing this demand will require ongoing advancements in hardware, software, and networking technologies, ensuring we can keep pace with the ever-increasing computational requirements of the digital age.

Why use the hash market?

The hash market has gained significant attention in cryptocurrency and blockchain communities in recent years. This article aims to provide a comprehensive overview of the hash market, explaining what it is, why it is used, and its significance in the broader context of blockchain technology and cryptocurrency mining.

What is the Hash Market?

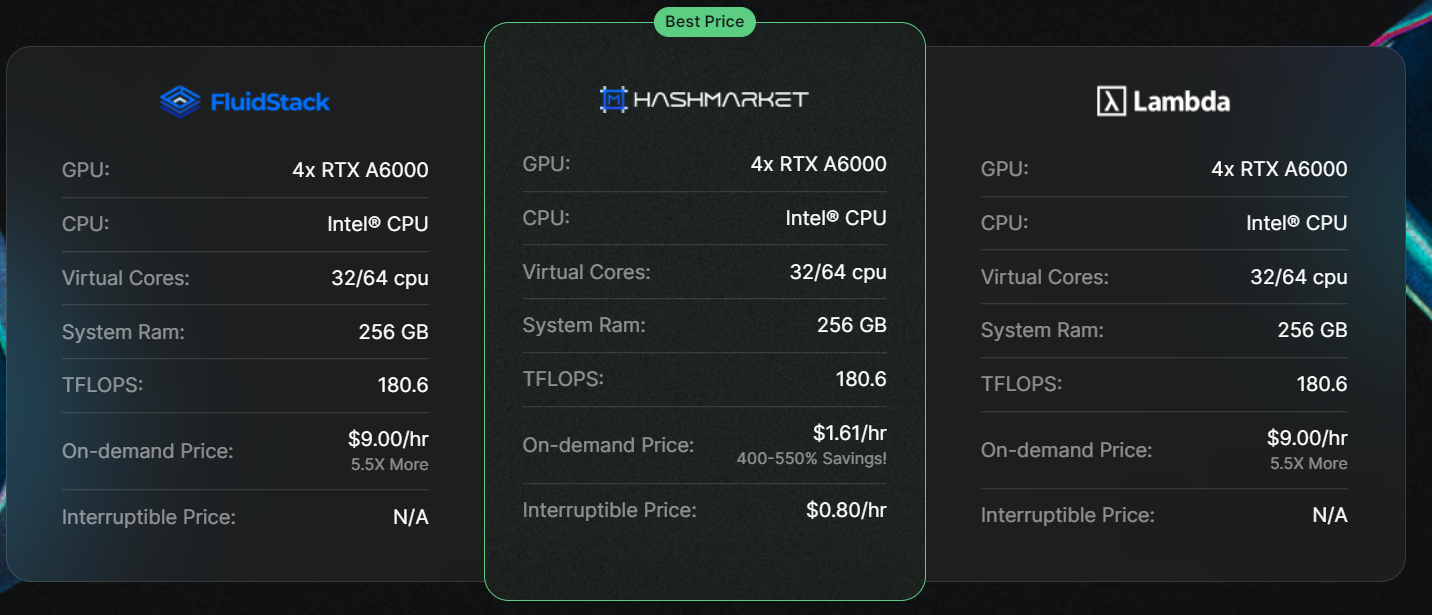

The hash market, the hashing power marketplace, is a digital platform where individuals and organizations can buy and sell computational power dedicated to cryptocurrency mining. Hashing power refers to the computational resources used to solve complex mathematical problems in validating transactions and securing blockchain networks.

How Does the Hash Market Work?

The hash market operates similarly to other online marketplaces, but it deals in computational power instead of physical goods or traditional services.

- Providers: These individuals or entities possess excess computational resources and wish to monetize them. They offer their hashing power for sale on the market.

- Buyers: These individuals or entities require additional computational resources for cryptocurrency mining but do not have the necessary hardware. They purchase hashing power from providers.

- Platform: The marketplace acts as an intermediary, facilitating the transactions between buyers and providers. It ensures transparency, security, and efficient matching of supply and demand.

There are several compelling reasons for using the hash market, both from the perspective of buyers and providers.

For Buyers

- Cost-Effective Mining:

- Reduced Initial Investment: Purchasing hashing power from the market allows buyers to engage in cryptocurrency mining without significant upfront investment in expensive hardware.

- Scalability: Buyers can scale their mining operations up or down based on their needs and market conditions without being constrained by their hardware capacity.

- Access to Advanced Technology:

- Cutting-Edge Hardware: Providers on the hash market often have access to the latest mining hardware. Buyers can leverage state-of-the-art technology without directly investing in it by purchasing hashing power.

- Efficiency: Advanced hardware often means more efficient mining, leading to higher returns on investment.

- Geographical Flexibility:

- Global Access: The hash market allows buyers to access computational power worldwide, taking advantage of regions with lower electricity costs or more favorable regulatory environments.

- Risk Diversification: By purchasing hashing power from multiple providers in different locations, buyers can mitigate risks associated with hardware failures or regional disruptions.

- Focus on Core Activities:

- Outsourcing Complexity: Cryptocurrency mining involves managing hardware, software, and energy consumption. Buyers can focus on strategic activities like trading or portfolio management by purchasing hashing power, leaving the technical aspects to the providers.

For Providers

- Monetization of Idle Resources:

- Extra Income: Providers can monetize their excess computational resources, generating additional income from otherwise idle or underutilized hardware.

- Return on Investment: By selling hashing power, providers can accelerate the return on their investment in mining hardware.

- Market Demand:

- High Demand: The increasing popularity of cryptocurrencies ensures a consistent demand for hashing power, providing providers with a steady resource market.

- Competitive Pricing: Providers can set competitive prices based on market conditions, optimizing their earnings.

- Simplified Management:

- Operational Ease: Instead of mining, providers can focus on maintaining and optimizing their hardware, reducing the complexity and risks associated with direct mining.

- Lower Overhead: Providers can avoid the costs and challenges of managing mining pools and payout structures by selling hashing power.

The Significance of the Hash Market in the Cryptocurrency Ecosystem

The hash market is crucial in the broader cryptocurrency ecosystem, contributing to its stability, security, and decentralization.

- Network Security:

- Increased Hashrate: By providing a platform for the sale of hashing power, the hash market helps improve the overall hash rate of blockchain networks, enhancing their security and resistance to attacks.

- Distributed Mining Power: The hash market encourages the distribution of mining power among more participants, reducing the risk of centralization and potential 51% attacks.

- Economic Accessibility:

- Lower Barrier to Entry: The hash market lowers the barrier to entry for individuals and small entities wishing to participate in cryptocurrency mining, fostering a more inclusive ecosystem.

- Economic Opportunities: The hash market creates economic opportunities for individuals and businesses worldwide by enabling anyone with computational resources to participate.

- Technological Advancements:

- Incentive for Innovation: The demand for efficient and powerful hashing power incentivizes hardware manufacturers and technology providers to innovate and develop more advanced mining solutions.

- Resource Optimization: The hash market promotes the efficient use of computational resources, as providers are motivated to optimize their hardware for maximum performance and profitability.

Challenges and Considerations

Despite its advantages, the hash market also faces several challenges and considerations that participants should be aware of.

- Market Volatility:

- Price Fluctuations: The price of hashing power can be volatile, influenced by factors such as cryptocurrency prices, mining difficulty, and regulatory changes. Buyers and providers must navigate this volatility to maximize their benefits.

- Demand and Supply Dynamics: The balance between hashing power demand and supply can shift rapidly, affecting the profitability of transactions on the hash market.

- Trust and Security:

- Trustworthiness of Providers: Buyers must ensure that they are purchasing hashing power from reputable and reliable providers to avoid fraud or subpar performance.

- Platform Security: The marketplace must implement robust security measures to protect users’ funds and data from cyber threats.

- Regulatory Environment:

- Regulatory Compliance: Participants in the hash market must be aware of and comply with the regulatory requirements in their respective jurisdictions. This includes tax obligations, licensing, anti-money laundering (AML adherence), and knowing your customer (KYC) regulations.

- Legal Risks: Regulatory changes can impact the operations of the hash market, potentially introducing legal risks for both buyers and providers.

Future Outlook

The hash market is poised for significant growth as the cryptocurrency and blockchain sectors expand. Several trends and developments are likely to shape its future.

- Integration with Decentralized Finance (DeFi):

- Financial Products: The hash market could integrate with DeFi platforms, enabling the creation of financial products like mining power derivatives and hash rate futures, which would provide new investment opportunities.

- Staking and Lending: Hashing power could be used as collateral for staking and lending in DeFi protocols, unlocking liquidity and enhancing capital efficiency.

- Advancements in Hardware and Technology:

- Next-Generation Hardware: Continued innovation in mining hardware, such as more efficient ASICs and GPUs, will drive the evolution of the hash market, offering higher performance and energy efficiency.

- AI and Machine Learning: Integrating AI and machine learning could optimize the allocation and pricing of hashing power, improving market efficiency and user experience.

- Sustainability and Green Mining:

- Renewable Energy: The shift towards renewable energy sources for mining operations will become increasingly important, promoting sustainability in the hash market.

- Energy Efficiency: Innovations in energy-efficient mining techniques will reduce the environmental impact of cryptocurrency mining, aligning the hash market with global sustainability goals.

Conclusion

The hash market is a dynamic and integral component of the cryptocurrency ecosystem, providing a platform for exchanging computational power essential for mining and securing blockchain networks. Its benefits, including cost-effectiveness, access to advanced technology, and economic opportunities, make it an attractive option for buyers and providers. As the cryptocurrency industry evolves, the hash market is expected to grow and adapt, driven by technological advancements, regulatory developments, and the increasing importance of sustainability. By understanding the hash market and its implications, participants can better navigate this emerging landscape and capitalize on its opportunities.